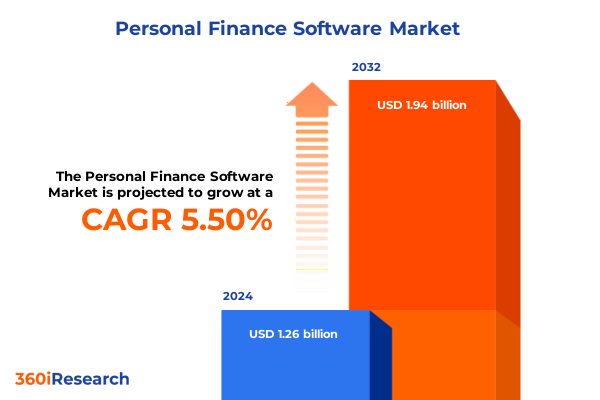

The Personal Finance Software Market size was estimated at USD 1.34 billion in 2025 and expected to reach USD 1.41 billion in 2026, at a CAGR of 5.48% to reach USD 1.94 billion by 2032.

Opening the Doors to Modern Financial Agility by Harnessing Disruptive Technologies and Seamless Integration Within Personal Finance Software Solutions

As organizations and individuals increasingly navigate complex financial landscapes, the role of personal finance software has become critically important. Consumers demand intuitive tools that streamline budgeting, tax planning, retirement forecasting, and investment tracking into a cohesive experience. Meanwhile, industry stakeholders are racing to integrate cutting-edge technologies-such as artificial intelligence, machine learning, and predictive analytics-to deliver personalized recommendations and automation that reduce manual effort and enhance financial outcomes. According to McKinsey, 92 percent of U.S. consumers made some form of digital payment over the past year, signaling deep comfort and trust in digital financial channels.

At the forefront of this evolution, leading providers have demonstrated the tangible benefits of an AI-enabled approach. For instance, Intuit forecasted fiscal 2025 revenue to exceed Wall Street expectations, attributing its success to AI-driven enhancements across TurboTax, QuickBooks, and Credit Karma. This trend underscores a broader market imperative: software must not only aggregate data but also drive insights and outcomes that align with individual goals and regulatory requirements. As consumers become more sophisticated, providers must balance robust security and compliance with seamless user experiences, ensuring trust remains paramount. This report sets the stage for an in-depth exploration of transformative market drivers, segmentation insights, regional dynamics, and strategic recommendations shaping the future of personal finance software.

Navigating the Transformative Waves of AI, Open Banking, and Security Innovations Reshaping Personal Finance Software Dynamics Across Markets

The personal finance software landscape is being reshaped by a confluence of technological advances and regulatory shifts. Artificial intelligence and machine learning are empowering systems to analyze transactional data, anticipate cash flow needs, and offer tailored recommendations, elevating the user experience from passive tracking to proactive financial management. Recent benchmarking research highlights that leading digital banks across the United States and Europe are prioritizing AI-powered customer service, mobile payments, and embedded personal financial management tools to deepen engagement and strengthen customer loyalty.

Concurrently, open banking regulations are unlocking secure data-sharing opportunities, allowing fintechs to integrate banking, investment, and wealth management services within unified applications. Security innovations, including biometric authentication and advanced encryption standards, are alleviating consumer concerns around data privacy and cyber threats, which remain high on the agenda for both regulators and end users. Moreover, the mobile-first approach has accelerated with 60 percent of Americans increasingly relying on in-app payments and digital wallets, reflecting a fundamental shift toward always-on, accessible financial services. Through these transformative forces, the market is converging on a paradigm where agility, personalization, and security coalesce to define competitive differentiation, establishing the foundation for future innovations and new business models.

Examining the Far-Reaching Consequences of Recent United States Tariff Adjustments on Cost Structures and Deployment Strategies in Personal Finance Software

In 2025, U.S. trade policy introduced significant tariff adjustments that are reverberating across technology supply chains and impacting the economics of personal finance software deployment. Notably, tariffs on semiconductors and related components imported from China were scheduled to rise from 25 percent to 50 percent as part of broader measures to protect domestic chip manufacturing under the CHIPS Act. This escalation has increased the costs of critical hardware used in data centers, servers, and end-user devices, compelling software providers and enterprise customers to reassess infrastructure strategies.

Earlier in the year, U.S. leadership signaled a willingness to impose tariffs of up to 100 percent on overseas semiconductor production to incentivize onshore manufacturing, a pledge that has introduced uncertainty for suppliers and development roadmaps. As a result, providers of on-premise personal finance solutions have faced higher capital expenditures and extended lead times for hardware procurement. This environment has reinforced the strategic appeal of cloud-based deployments, where providers can absorb procurement risk and leverage scale efficiencies, and has accelerated the shift toward hybrid architectures that balance control with cost predictability.

Looking ahead, navigating these tariff-driven cost pressures will require agile sourcing strategies, deeper collaboration with hardware manufacturers, and continued investment in cloud-native services. By proactively addressing supply chain volatility and cost pass-through concerns, software vendors can maintain competitive pricing and service reliability, ultimately safeguarding end-user value and fostering market resilience.

Unveiling Critical Segmentation Patterns Unraveling Diverse User Groups and Deployment Modalities in the Evolving Personal Finance Software Ecosystem

Market segmentation reveals a nuanced ecosystem defined by software functionality, deployment preferences, platform accessibility, and user demographics. When examining solutions based on type, tools range from simple budgeting applications to sophisticated wealth management platforms, encompassing portfolio management, retirement planning, and tax optimization capabilities. This classification underscores the diversity of user needs, from individuals seeking basic expense tracking to advisors managing comprehensive asset portfolios.

Deployment mode further differentiates offerings, as cloud solutions continue to expand across public, private, and hybrid environments, while on-premise options remain viable for customers prioritizing direct control and data sovereignty. Within the cloud, public clouds deliver rapid scalability, private clouds reinforce security for compliance-sensitive applications, and hybrid models blend these strengths. On-premise installations are similarly bifurcated between self-hosted environments and customer-hosted private data centers, each attracting organizations with specific governance and customization requirements.

Platform segmentation indicates that desktop clients-whether on Windows, Mac, or Linux-still support power users requiring offline access and advanced analytics, while web-based portals offer universal accessibility. Mobile apps on iOS and Android, meanwhile, cater to on-the-go banking, notifications, and instant payments, reflecting the growing imperative for anytime, anywhere financial oversight.

Finally, user segmentation highlights distinct demands from individual consumers, whether managing family accounts or maintaining personal budgets, and from small businesses, which encompass both microbusinesses and small enterprises. Each of these segments exhibits unique expectations for automation, collaboration, and scalability, shaping product roadmaps and go-to-market strategies.

This comprehensive research report categorizes the Personal Finance Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Deployment Mode

- Platform

- End User

Highlighting Distinct Regional Variations and Growth Drivers Shaping the Future Trajectory of Personal Finance Software Adoption Worldwide

Regional insights illustrate that adoption drivers, regulatory considerations, and innovation priorities vary dramatically across global markets. In the Americas, robust smartphone penetration and a mature banking infrastructure have accelerated uptake of integrated digital finance platforms. U.S. consumers demonstrate a growing appetite for full-service apps that couple budgeting, tax filing, and investment tools under one interface, while Latin American markets are witnessing rapid growth in digital wallet solutions as traditional banking access remains limited in rural areas.

Europe, the Middle East, and Africa present a landscape where open banking regulations and GDPR compliance shape product offerings. Financial institutions in these regions are investing heavily in secure APIs, biometric authentication, and AI-driven risk monitoring to meet stringent data protection standards. Cross-border transaction capabilities and currency conversion features are particularly salient for users navigating the Eurozone and emerging markets with disparate financial systems.

Asia-Pacific stands out for its mobile-first orientation and the proliferation of super-app models embedding financial services alongside e-commerce and social media. Nations like China, India, and Southeast Asian economies lead in QR-based payments and micro-investment features that democratize wealth-building. Strategic partnerships between fintech startups and telecommunications providers are expanding reach to unbanked and underbanked populations, driving innovation in micro-lending and savings products.

These regional dynamics underscore the importance of tailoring solutions to local preferences, regulatory frameworks, and technology infrastructures while leveraging global capabilities to scale efficiently and maintain competitive differentiation.

This comprehensive research report examines key regions that drive the evolution of the Personal Finance Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Corporate Movements and Innovations Driving Competitive Advantage in the Personal Finance Software Market Landscape

Competitive dynamics in the personal finance software market are defined by a blend of established incumbents and agile challengers harnessing AI and seamless user experiences. Intuit leads the charge with its integrated ecosystem of TurboTax, QuickBooks, and Credit Karma, leveraging AI-powered recommendations and automated workflows to deepen customer engagement and drive revenue growth. This broad portfolio allows Intuit to cross-sell services across tax preparation, bookkeeping, and consumer finance, reinforcing its dominant position.

On the budgeting front, You Need A Budget (YNAB) has cultivated a loyal user base through its zero-based budgeting methodology and community-driven support model, while Quicken remains a stalwart desktop solution offering comprehensive expense tracking and bill payment features. Newer entrants such as Moneydance and PocketGuard differentiate through intuitive mobile interfaces, subscription management, and lightweight onboarding processes, capturing segments that prioritize simplicity and real-time insights.

Beyond pure-play software, embedded finance offerings from large banks and neobanks have emerged as formidable competitors by integrating personal financial management capabilities directly within mobile banking apps. These players leverage extensive customer data and brand trust to offer in-app spending analysis, savings challenges, and microinvestment options, raising the bar for standalone vendors and further intensifying market competition.

This comprehensive research report delivers an in-depth overview of the principal market players in the Personal Finance Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albert Corporation

- Dayspring Technologies, Inc.

- Empower Personal Wealth, LLC

- Expensify, Inc.

- GnuCash Project

- HomeBank Project

- Honeydue, Inc.

- Monefy App

- NerdWallet, Inc.

- PocketGuard Inc.

- PocketSmith Ltd.

- Quicken Inc.

- Ramsey Solutions, LLC

- Rocket Money, Inc.

- The Infinite Kind Ltd.

- Tiller, LLC

- Times Internet Limited

- Wave Financial Inc.

- Whizdm Innovations Pvt. Ltd.

- You Need A Budget LLC

Empowering Industry Leaders with Actionable Strategic Pathways to Navigate Technology Disruption and Elevate Personal Finance Software Offerings

Industry leaders must proactively align their strategies with evolving market dynamics to secure sustainable growth. First, companies should prioritize the development of AI-driven features that transition applications from passive record-keeping to proactive financial coaching. By delivering hyper-personalized recommendations based on real-time behavioral data, software providers can significantly elevate user engagement and perceived value.

Second, to mitigate the cost uncertainties introduced by recent tariff adjustments, vendors should diversify deployment models. Embracing hybrid and cloud-native architectures allows for flexible capacity management, rapid feature rollout, and cost optimization through economies of scale. This agility will be crucial in maintaining competitive pricing and ensuring service reliability, regardless of hardware cost fluctuations.

Third, as regional regulations and consumer expectations diverge, strategic partnerships with local financial institutions and technology platforms will be essential. Collaborations can expedite compliance, enable localized feature sets, and unlock new distribution channels, especially in markets where digital banking ecosystems are still maturing.

Finally, fostering a culture of continuous innovation through dedicated R&D investments and collaboration with fintech accelerators will help organizations stay ahead of emerging trends. This includes exploring blockchain for secure transaction settlements, open APIs for ecosystem expansion, and advanced analytics for deeper user insights. By adopting a forward-looking mindset, industry leaders can transform disruption into opportunity and reinforce their position in a rapidly evolving market.

Outlining a Rigorous Research Framework Leveraging Primary Interviews and Data Synthesis to Validate Personal Finance Software Market Insights

This report was compiled using a rigorous, multi-pronged research methodology designed to deliver reliable, actionable insights. Secondary research included review of public financial filings, regulatory documents, industry white papers, and press releases to establish a foundational understanding of market drivers and competitive landscapes.

Primary research comprised in-depth interviews with senior executives from leading software providers, banking institutions, and technology integrators, ensuring that expert perspectives informed our analysis. These discussions provided qualitative context around strategic priorities, deployment challenges, and emerging opportunities that may not be captured in published data.

Additionally, a series of surveys targeting end users across individual consumers and small business segments were conducted to gauge satisfaction drivers, feature adoption rates, and willingness to pay for advanced functionalities. This user-centric approach enabled us to validate assumptions and triangulate quantitative findings.

All data points were cross-verified through a process of data triangulation, comparing internal proprietary databases with third-party sources to identify and rectify discrepancies. Insights were further refined through a validation workshop with independent industry advisors, ensuring that conclusions accurately reflect real-world market conditions and evolving stakeholder needs.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Personal Finance Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Personal Finance Software Market, by Type

- Personal Finance Software Market, by Deployment Mode

- Personal Finance Software Market, by Platform

- Personal Finance Software Market, by End User

- Personal Finance Software Market, by Region

- Personal Finance Software Market, by Group

- Personal Finance Software Market, by Country

- United States Personal Finance Software Market

- China Personal Finance Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Key Takeaways to Chart a Strategic Course for Maximizing the Impact of Personal Finance Software Solutions on Financial Well-Being

This analysis highlights several strategic imperatives for stakeholders in the personal finance software ecosystem. Embracing advanced AI capabilities enables providers to shift from descriptive analytics to predictive and prescriptive models, solidifying their role as indispensable financial advisors. Simultaneously, the recalibration of supply chain and deployment strategies in response to tariff dynamics underscores the importance of flexible infrastructure planning and cost management.

Segmentation insights reveal that no single solution can address the full spectrum of user needs, reinforcing the value of modular architectures and service bundles that cater to distinct customer profiles. Regionally, success hinges on the ability to balance global best practices with localized compliance and user experience nuances.

Competitive analysis affirms that incumbents benefit from scale and integrated ecosystems, while niche innovators thrive on streamlined user journeys and targeted feature sets. Moving forward, strategic partnerships-whether for technology integration, distribution channels, or regulatory alignment-will prove decisive in unlocking new growth trajectories.

Ultimately, the market rewards agility, customer-centric innovation, and rigorous execution. Organizations that align product roadmaps with emerging consumer behaviors and regulatory developments will be best positioned to lead in an era defined by digital transformation and heightened demand for personalized financial empowerment.

Inspiring Decisive Action to Secure the Comprehensive Personal Finance Software Intelligence Required for Strategic Competitive Edge and Market Mastery

Ready to elevate your strategic positioning with unparalleled insights into the personal finance software market? As Associate Director of Sales & Marketing, Ketan Rohom invites you to secure your competitive advantage through our comprehensive research report. Empower your decision-makers with data-driven analysis and actionable intelligence tailored to the evolving demands of digital finance. Contact Ketan Rohom to obtain your copy and unlock the full potential of market trends and strategic imperatives today

- How big is the Personal Finance Software Market?

- What is the Personal Finance Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?