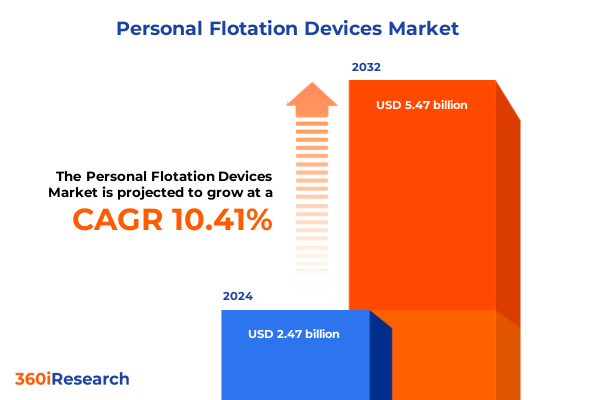

The Personal Flotation Devices Market size was estimated at USD 2.73 billion in 2025 and expected to reach USD 3.03 billion in 2026, at a CAGR of 10.41% to reach USD 5.47 billion by 2032.

Establishing the Critical Role of Personal Flotation Devices in Enhancing Maritime Safety Under Evolving Regulatory and Consumer Demands

Personal flotation devices serve as indispensable safety equipment for recreational boaters, commercial mariners, military personnel, and rescue professionals alike. Under Title 33 of the Code of Federal Regulations, recreational vessels are mandated to carry at least one wearable PFD per person, with additional throwable devices required on larger craft, ensuring alignment with U.S. Coast Guard standards that have been refined through decades of maritime safety experience. These regulations reflect a broader commitment to reducing drowning fatalities, particularly among children under 13 years of age, who must wear an approved PFD at all times while on deck.

Against this regulatory backdrop, personal flotation devices have evolved far beyond simple buoyant aids. Modern designs integrate inherent buoyancy materials, hybrid inflatable chambers, and rigorous testing protocols governed by ANSI/CAN/UL 12402 standards for lifejackets, underlining a rigorous approval process that balances performance and user comfort. As these devices become more sophisticated, understanding the latest standards and compliance requirements is essential for stakeholders seeking to develop, distribute, or procure cutting-edge safety solutions.

Examining the Technological, Regulatory, and Material Innovations Driving Transformative Shifts in Personal Flotation Device Development

Innovation and technological integration are reshaping the personal flotation device landscape at an unprecedented pace. The proliferation of smart PFDs equipped with GPS tracking and emergency beacon functionality enables real-time location sharing with rescue services, a capability that has proven vital in remote or offshore environments where cellular coverage is unreliable. These connected devices can now trigger alerts to multiple recipients, transmit vital information such as body temperature or submersion status, and interface with mobile applications to provide maintenance reminders and usage analytics.

Material science advancements are also transforming performance and sustainability outcomes. High-strength neoprene blends and hybrid materials offer enhanced durability while reducing weight and bulk, catering to both professional rescue teams and recreational water sports enthusiasts. Concurrently, the adoption of eco-friendly materials-including recycled ocean plastics and biodegradable foams-reflects growing environmental consciousness among manufacturers and consumers alike. This convergence of technology, performance, and environmental stewardship signifies a pivotal shift in PFD development, with industry players racing to embed sensors, improve buoyancy profiles, and minimize their ecological footprint.

Analyzing the Cumulative Effects of Multifaceted United States Tariffs on Raw Materials and Finished Personal Flotation Device Imports in 2025

The United States’ multifaceted tariff regime in 2025 exerts significant pressure on both upstream raw materials and finished personal flotation devices imported from key manufacturing hubs. Section 232 tariffs escalated duties on steel and aluminum articles from 25 percent to 50 percent, effective June 4, 2025, impacting metal hardware components and fasteners critical to PFD construction. Simultaneously, under the International Emergency Economic Powers Act (IEEPA), a 20 percent tariff applies to all Chinese-origin goods, compounding existing Section 301 duties ranging from 7.5 percent to 25 percent on polymeric materials, including nylon and PVC, which form the structural basis of many buoyant aids.

This layered tariff structure, which can exceed 70 percent on certain imports, compels manufacturers to reassess global supply chains, source alternative materials, or absorb increased costs, ultimately influencing pricing strategies and procurement decisions for safety equipment providers. The cumulative effect is a heightened emphasis on domestic manufacturing, regional sourcing partnerships, and innovative material substitutions to mitigate tariff exposure while maintaining stringent performance and compliance requirements.

Uncovering Strategic Insights Through Device Type, End Use, Distribution, Material, Design, and Age Group Segmentation Frameworks

Understanding market segmentation is pivotal for tailoring product innovation and distribution strategies. By categorizing offerings based on device type-ranging from infant devices and inflatable jackets to ring buoys and throwable aids-manufacturers can calibrate design specifications and approval labels to specific safety requirements and user capabilities. End use segmentation further refines this approach, distinguishing between commercial applications on cruise ships, maritime transport, and offshore oil and gas platforms; military deployment across army, coast guard, and navy units; recreational pursuits in boating, fishing, and water sports; and rescue operations in fire safety and lifeguard services.

Distribution channel segmentation underscores the importance of direct sales through bulk orders and corporate partnerships, general retail via department stores and supermarkets, online platforms operated by e-commerce marketplaces and manufacturer websites, and specialty outlets such as marine-focused stores and sporting goods retailers. Material type segmentation spans hybrid composites, neoprene, nylon, PE foam, and PVC, each offering distinct performance attributes in buoyancy, durability, and environmental resistance. Design-based segmentation highlights foam-based, hybrid, and inflatable constructions, while age group segmentation ensures that adult, infant, and youth users receive appropriately sized and performance-rated devices. This holistic segmentation framework enables stakeholders to identify areas for product differentiation and targeted market penetration.

This comprehensive research report categorizes the Personal Flotation Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- End Use

- Distribution Channel

- Material Type

- Design

- Age Group

Highlighting Region-Specific Dynamics and Market Drivers Across the Americas Europe Middle East Africa and Asia Pacific Regions

Regional dynamics play a crucial role in shaping demand and innovation trajectories for personal flotation devices. In the Americas, the United States reported the fewest recreational boating fatalities in over 50 years in its 2024 Recreational Boating Statistics Report, even as registered vessels surpassed 11.6 million and incidents edged higher by 1.1 percent, underscoring sustained demand for safety gear alongside growing participation in water-based activities. Latin American markets, buoyed by expanding tourism and coastal infrastructure investments, are similarly exhibiting rising adoption of PFD mandates.

In Europe, the Middle East, and Africa, regulatory frameworks under SOLAS and ISO directives drive uniform approval standards, while growing emphasis on sustainability spurs the development of eco-friendly PFD materials. Military and offshore oil and gas sectors in the North Sea and Persian Gulf are investing in high-specification lifejackets designed to meet harsh environmental conditions. Across Asia Pacific, China leads global flotation device exports with over 739 shipments in 2024, leveraging extensive manufacturing capacity, while emerging markets in India, Southeast Asia, and Japan reflect heightened water sports participation and coastal safety campaigns, creating fertile ground for both traditional buoyant aids and smart wearable technologies.

This comprehensive research report examines key regions that drive the evolution of the Personal Flotation Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Delving into Key Competitive Dynamics and Strategic Positioning of Leading Manufacturers in the Personal Flotation Device Industry

The competitive landscape in the personal flotation device sector is anchored by established safety equipment manufacturers and emerging innovators. Mustang Survival, under Johnson Outdoors, leverages advanced Hydrostatic Inflatable Technology and modular designs to meet the exacting requirements of professional marine users, while Baltic Safety Products emphasizes sustainability by incorporating recycled materials into its lifejackets, aligning with broader environmental mandates. UK-based Spinlock distinguishes itself with ergonomic, offshore sailing lifejackets that integrate customizable harness systems, reflecting deep engagement with competitive sailing communities.

Emerging players such as Colligo Marine and Stearns capture value through competitive pricing and product accessibility while expanding portfolios to include inflatable and foam-based designs tailored for recreational users. Survitec Group, with a heritage dating back to the 1950s, commands a global footprint in survival equipment, spanning liferafts and marine evacuation systems under rigorous military and SOLAS certifications. Collectively, these manufacturers navigate a complex matrix of performance standards, technological integration, and cost considerations, shaping a dynamic market where innovation, brand reputation, and regulatory compliance drive strategic differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Personal Flotation Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Astral Designs, LLC

- Balden Technologies Pty Ltd

- Dongtai Jianghai Wear-Resistant Material Co., Ltd.

- Eyson Ltd.

- Harmony Gear LLC

- International Safety Products Ltd.

- Kent Sporting Goods Co.

- LALIZAS Life-Saving Equipment

- MTI Lifejackets

- Mustang Survival Corp.

- Northwest River Supplies, Inc.

- O'Neill, Inc.

- Onyx Outdoor Inc.

- Salus Marine Wear Inc.

- Secumar Bernhardt Apparatebau GmbH

- Stormy Lifejackets

- The Coleman Company, Inc.

- Viking Life-Saving Equipment A/S

- Yakwear, Inc.

- Z & S Technical Sales, Inc.

Presenting Actionable Strategic Recommendations for Industry Leaders to Navigate Innovation, Regulation, and Supply Chain Resilience

Industry leaders are advised to prioritize multipronged strategies that harmonize innovation with regulatory compliance and supply chain agility. Investing in smart technology integration, such as embedding IoT sensors for real-time location tracking and biometric monitoring, can establish first-mover advantages and align product portfolios with high-growth segments in offshore professional and remote recreational applications. Concurrently, diversifying material sourcing to include domestic and nearshoring partners mitigates exposure to escalating tariff burdens on steel, aluminum, and polymer imports, preserving margin stability amidst evolving trade policies.

Sustainability initiatives, including the adoption of recycled and biodegradable materials, should be coupled with transparent eco-certifications to appeal to environmentally conscious end users and meet emerging ESG requirements. Robust collaborations with standards bodies and participation in maritime safety advocacy campaigns can reinforce brand credibility and influence regulatory developments. Finally, leveraging segmentation insights to tailor marketing and distribution strategies-whether through targeted online retail platforms or specialized direct sales channels-will optimize resource allocation and accelerate market penetration across diverse end use scenarios.

Detailing the Research Methodology Incorporating Primary Stakeholder Engagement Regulatory Analysis and Secondary Industry Data Sources

This analysis integrates a rigorous mixed-method research approach. Primary research consisted of in-depth interviews with industry stakeholders-including equipment manufacturers, standards organizations, and maritime safety agencies-to capture firsthand insights into emerging technologies, regulatory impacts, and supply chain adaptations. Secondary research involved comprehensive reviews of U.S. Coast Guard Recreational Boating Statistics, White House proclamations on Section 232 and IEEPA tariffs, academic publications on PFD materials and IoT integration, and proprietary export data spanning global flotation device shipments.

The research methodology emphasizes data triangulation, cross-validating quantitative trade and safety statistics with qualitative expert perspectives. Regulatory analysis drew upon federal rulings and e-CFR documentation to map compliance requirements, while competitive assessments leveraged company filings, patent databases, and peer-reviewed innovation reports. This integrative framework ensures a holistic understanding of market dynamics, facilitating actionable insights for stakeholders across the PFD ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Personal Flotation Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Personal Flotation Devices Market, by Device Type

- Personal Flotation Devices Market, by End Use

- Personal Flotation Devices Market, by Distribution Channel

- Personal Flotation Devices Market, by Material Type

- Personal Flotation Devices Market, by Design

- Personal Flotation Devices Market, by Age Group

- Personal Flotation Devices Market, by Region

- Personal Flotation Devices Market, by Group

- Personal Flotation Devices Market, by Country

- United States Personal Flotation Devices Market

- China Personal Flotation Devices Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Consolidating Key Findings on Market Dynamics Regulatory Impacts Technological Advancements and Strategic Imperatives for PFD Stakeholders

In conclusion, the personal flotation device market is undergoing rapid transformation, driven by technological innovation, evolving regulatory mandates, and complex trade environments. Smart PFDs with GPS and biometric sensors are redefining expectations for user safety and situational awareness, while material advancements in neoprene, hybrid composites, and eco-friendly foams are responding to demands for performance and sustainability. Heightened U.S. tariffs on steel, aluminum, and Chinese-origin polymers are reshaping supply chain strategies, prompting a shift toward domestic and nearshoring sources to maintain cost competitiveness and regulatory compliance.

Segmentation insights across device types, end uses, distribution channels, materials, designs, and age groups reveal nuanced pathways for targeted product development and market entry. Regional variances-from robust boating safety initiatives in the Americas to standardized SOLAS requirements in EMEA and manufacturing leadership in APAC-underscore the importance of adaptive strategies that align with local dynamics. Leading companies that effectively balance innovation investment, tariff mitigation measures, and sustainability commitments will be best positioned to achieve long-term growth and resilience in a safety-critical industry.

Engaging with Associate Director of Sales and Marketing to Secure Comprehensive Personal Flotation Device Market Analysis and Insights

To gain an in-depth understanding of the personal flotation device market, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore bespoke research tailored to your strategic needs. His expertise can guide you through the nuances of safety equipment innovation, tariff impacts, and regional dynamics. Reach out to arrange a personalized consultation that will empower your organization with actionable intelligence and competitive advantage. Secure your comprehensive market analysis report today and make informed decisions that drive growth and resilience in an evolving global safety landscape.

- How big is the Personal Flotation Devices Market?

- What is the Personal Flotation Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?