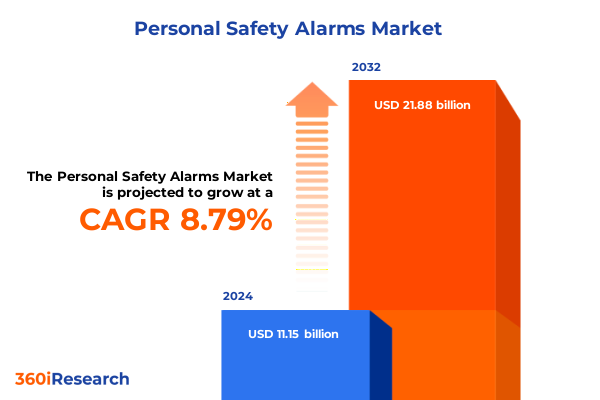

The Personal Safety Alarms Market size was estimated at USD 12.15 billion in 2025 and expected to reach USD 13.25 billion in 2026, at a CAGR of 8.76% to reach USD 21.88 billion by 2032.

Navigating the Rapidly Evolving Personal Safety Alarm Industry Amid Rising Security Concerns, Regulatory Shifts, and Technological Advancements

The global landscape for personal safety alarms has witnessed a remarkable transformation amid growing concerns over public security and individual well-being. From urban centers grappling with rising crime rates to rural and suburban regions embracing community policing, demand for portable alert devices has surged across demographics. This evolution is underpinned by heightened awareness of personal vulnerability in everyday environments, driving consumers and institutions alike to seek quick and reliable means of summoning assistance. The result is a dynamic industry where adaptability and innovation have become paramount for market leaders and new entrants alike.

Within this context, the proliferation of Internet of Things (IoT) platforms and the increasing ubiquity of smartphones have played a pivotal role in steering product roadmaps toward seamless connectivity. Manufacturers have responded by embedding wireless communication modules, designing user-friendly mobile applications, and prioritizing interoperability with smart home ecosystems. As a consequence, the traditional fixed alarm systems of the past are giving way to a new generation of wearable, vehicle-mounted, and pendant-style devices that can deliver location-based alerts in real time and integrate with broader security networks.

Setting the stage for the subsequent analysis, it is critical to recognize how both external pressures-such as evolving trade policies-and internal drivers-like consumer expectations for miniaturization and autonomy-have converged to redefine competitive benchmarks. With this foundation established, the following exploration will examine the transformative technological shifts reshaping the market.

Revolutionary Technology Integrations and Consumer Behavior Shifts Driving Innovation in Personal Safety Alarm Solutions

In recent years, personal safety alarm solutions have transitioned from basic standalone panic buttons to sophisticated systems enriched by artificial intelligence and cloud-based analytics. Next-generation devices now incorporate machine learning algorithms capable of distinguishing between false alarms and actual emergencies, thereby enhancing response accuracy and reducing operational costs for monitoring entities. The integration of geofencing technology further empowers both end users and security providers by offering proactive alerts when individuals enter predefined risk zones, ushering in a proactive stance toward personal protection.

Simultaneously, consumer behavior has undergone a noticeable shift toward preference for wearable form factors that harmonize style and functionality. Wristbands and pendant alarms featuring minimalist designs have gained traction among women, senior citizens, and outdoor enthusiasts who value discreet yet dependable safety tools. Voice-activated triggers and one-touch SOS functionalities are increasingly becoming standard, catering to users who require hands-free operation. This convergence of wearability and intuitive design has opened new avenues for product differentiation, compelling manufacturers to embed biometric monitoring such as heart rate and fall detection into alarm devices.

These technological and behavioral dynamics are also intersecting with evolving trade policies, particularly in the United States, where recent tariff adjustments have impacted component sourcing and manufacturing decisions. The next section will delve into the cumulative effects of the 2025 tariff landscape on production costs, supply chain diversification, and competitive positioning within the global personal safety alarm market.

Analyzing the Far-Reaching Effects of 2025 United States Tariffs on Import Costs, Supply Chains, and Industry Competitiveness

The implementation of additional United States tariffs in 2025 on select consumer electronics items has introduced a complex set of challenges for personal safety alarm manufacturers and distributors. With a 10 to 15 percent levy imposed on imported wireless modules, batteries, and printed circuit boards, production costs have risen significantly. As component costs are passed through to OEMs and finally to end users, margin pressures have intensified across the value chain. The tariff burden has been particularly acute for companies reliant on Asian low-cost production hubs, compelling many to reevaluate their sourcing strategies and cost structures.

In response, a pronounced shift toward nearshoring and regional manufacturing has emerged. Producers are increasingly establishing assembly operations in Mexico and the United States, benefiting from preferential trade agreements and reduced shipping lead times. Concurrently, some stakeholders have diversified supply bases by engaging contract manufacturers in Vietnam and Eastern Europe, balancing cost efficiency against geopolitical risk. While these adjustments have mitigated certain tariff impacts, they have also introduced new complexities, including the need for robust quality control protocols and calibrated inventory management to avoid stockouts.

Looking ahead, industry participants will need to navigate this tariff environment strategically by leveraging digital sales channels, pursuing value-added service offerings, and forging partnerships that spread risk. By aligning their operational models with shifting trade regulations, companies can maintain competitive pricing and continue to invest in product innovation despite the headwinds presented by the 2025 tariff framework.

Unpacking Critical Market Segments Across Alarm Types, End Users, Distribution Channels, Technology Platforms, Applications, and Price Ranges

Insight into market segmentation reveals that alarm type holds significant implications for both user experience and cost considerations. Fixed alarms remain prevalent in commercial and healthcare settings where wired installations provide reliable infrastructure integration. However, keychain alarms have achieved popularity among urban dwellers seeking portability and discretion, while pendant alarms continue to resonate with seniors due to their ergonomic design. Vehicle alarms are gaining traction in ride-hail and logistics applications, offering location-based safety monitoring on the go. Wristband alarms, by virtue of their wearable form factor, are increasingly adopted in fitness, recreational, and personal security contexts, signaling a shift toward devices that seamlessly blend with daily activities.

When examining end user categories, the commercial segment-which encompasses hospitality and retail verticals-drives substantial institutional uptake. Within hospitality, hotels leverage panic buttons and discreet pendant devices to bolster guest safety, while restaurants implement visible alarms for front-of-house staff. In retail environments such as electronics stores and supermarkets, devices are utilized to protect employees and deter theft. The healthcare domain spans elderly care, featuring fall detection and GPS tracking to support at-risk populations, and patient monitoring scenarios where emergency call buttons and vital sign alert systems integrate directly with clinical workflows. Additionally, individual consumers seek personal protection, and law enforcement agencies employ specialized alarms for officer safety and field coordination.

Distribution channel analysis points to a duality between direct sales models-where professional integrators and security service providers offer end-to-end solutions-and online channels, including company websites and third-party e-commerce platforms, which cater to tech-savvy consumers. Pharmacy, specialty store, and supermarket outlets also serve as critical touchpoints, with electronic retailers and security dealers playing a pivotal role in product demonstration and after-sales support. Price range segmentation, spanning low-, mid-, and premium-tier offerings, reflects a balanced market strategy where value models target cost-conscious buyers and feature-rich products address advanced requirements.

By further considering the technology dimension, the dichotomy between mechanical and electronic alarms illuminates divergent R&D priorities. Wired electronic systems-employing cellular or hardwired connectivity-offer stability for fixed installations, whereas wireless variants leveraging Bluetooth and RF communication are central to portable and wearable devices. This intricate tapestry of segmentation underscores the importance of tailored product roadmaps and go-to-market strategies that align with the distinct needs of each user group, channel partner, and application scenario.

This comprehensive research report categorizes the Personal Safety Alarms market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Alarm Type

- Technology

- Application

- End User

- Distribution Channel

Identifying Growth Drivers and Regulatory Dynamics Shaping the Personal Safety Alarm Market Across the Americas, EMEA, and Asia-Pacific Regions

The Americas region stands as a mature market characterized by high urbanization rates, advanced telecommunications infrastructure, and robust regulatory frameworks that promote public safety initiatives. In North America, widespread adoption of wireless cellular and Bluetooth-enabled alarms is driven by consumer demand for instant connectivity and integration with home automation platforms. Latin America, while exhibiting pockets of high crime rates that fuel interest in personal security solutions, contends with variable enforcement policies that influence procurement and distribution dynamics. Cross-border trade agreements such as USMCA have guided supply chain decisions, enabling manufacturers to optimize production footprints and respond to regional demand fluctuations with greater agility.

In Europe, the Middle East, and Africa (EMEA), regulatory compliance and data privacy concerns are shaping product specifications and go-to-market approaches. The European Union’s stringent General Data Protection Regulation (GDPR) requirements mandate secure handling of location and biometric data, prompting vendors to implement enhanced encryption and consent management features. Meanwhile, Middle East markets driven by urban development projects are integrating personal safety alarms into smart city frameworks, focusing on large-scale deployments in hospitality and public transit environments. Across sub-Saharan Africa, limited infrastructure and distribution challenges have spurred growth in low-cost mechanical alarm systems that rely less on cellular networks and more on localized radio frequency technologies.

The Asia-Pacific landscape displays a heterogeneous mix of high-growth and emerging markets with diverse regulatory, cultural, and technological contexts. In developed markets such as Japan, South Korea, and Australia, consumer preference favors compact wearables featuring advanced sensors and AI-driven analytics. Conversely, in Southeast Asia and South Asia, affordability and battery longevity are paramount, resulting in a robust demand for mid-range keychain and pendants with basic GPS tracking. Government initiatives to protect vulnerable populations, such as elderly citizen programs in China and fall-detection pilot schemes in India, are also catalyzing broader acceptance of personal alarm solutions across both urban and rural communities.

This comprehensive research report examines key regions that drive the evolution of the Personal Safety Alarms market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Players Driving Innovation, Strategic Partnerships, and Competitive Positioning in the Global Personal Safety Alarm Arena

Leading global corporations leverage expansive R&D budgets and established distribution networks to innovate across multiple dimensions of the personal safety alarm ecosystem. Major security conglomerates have integrated alarm offerings into their broader portfolio of surveillance cameras, access control systems, and cloud-based monitoring services, creating bundled packages that appeal to both B2B and B2C segments. Strategic partnerships with telecommunications providers have enabled these incumbents to offer turnkey cellular connectivity and real-time monitoring subscriptions, fostering recurring revenue models.

Emerging specialized vendors focus on niche applications, such as fall detection for the elderly and incident reporting solutions with deep integration into emergency response centers. These players drive differentiation through user-centric design, intuitive interfaces, and strong mobile app experiences. Their agility allows them to rapidly pilot new technologies-such as AI-enabled activity recognition and ultra-low-power sensor networks-and to refine offerings based on direct customer feedback. Many have forged alliances with healthcare providers, senior living communities, and ride-hail companies to tailor device capabilities to precise use cases.

Mid-tier enterprises and start-ups are reshaping competitive dynamics by exploring adjacent verticals, including personal wellness, environmental monitoring, and lone-worker safety. Through a combination of venture capital funding, strategic acquisitions, and joint-development agreements, these organizations are consolidating complementary technologies-ranging from biometric authentication to advanced RF‐based localization-into cohesive solutions. This collaborative approach not only accelerates time-to-market but also mitigates the investment risk associated with singular product bets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Personal Safety Alarms market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Birdie Personal Safety, Inc.

- GEESECAM USA Inc.

- JNE Security, Ltd.

- Jolt Technology, Inc.

- Mace Security International, Inc.

- Mighty Loud Entertainment, LLC

- SABRE Security Equipment Corporation

- She's Birdie, Inc.

- Shenzhen Huayi Century Technology Co., Ltd.

- Shenzhen Jingshunfeng Technology Co., Ltd.

- Shenzhen Suntech Company Limited

- Streetwise Security, Inc.

- Stunster.com, Inc.

- Ungo Security Systems, Inc.

- Vigilant Personal Safety, Inc.

Strategic Actions for Industry Leaders to Capitalize on Market Trends, Enhance Product Portfolios, and Strengthen Customer Engagement

To maintain a competitive edge, industry leaders should prioritize the integration of advanced sensor fusion and machine learning capabilities into their next-generation alarm products. By harnessing real-time data streams from multiple inputs-such as accelerometers, GPS, and biometric monitors-companies can deliver predictive safety alerts that preempt emergent threats. Concurrently, expanding cross-industry alliances, particularly with smart home and telehealth service providers, will unlock bundled offerings that enhance customer value and foster stickier subscription models.

Supply chain agility must remain a central strategic pillar in light of ongoing tariff volatility. Organizations can mitigate cost pressures by implementing dual-sourcing strategies for critical components and deepening partnerships with regional contract manufacturers. Investing in advanced inventory management systems, underpinned by AI-driven demand forecasting, will further reduce lead‐time uncertainty and minimize overstocking. Such measures will ensure rapid responsiveness to market fluctuations and support continuity of shipments to key distribution channels.

Lastly, companies should refine their go-to-market playbooks with targeted engagement strategies for segmented audiences. Tailoring marketing messages to reflect the distinct needs of individual consumers, law enforcement agencies, hospitality groups, and healthcare providers will improve conversion rates and customer loyalty. Investing in digital customer experience platforms-featuring interactive product demonstrations, AI chat support, and community forums-will cultivate brand advocates and accelerate adoption across diverse user groups.

Comprehensive Research Approach Combining Primary, Secondary, and Analytic Techniques to Deliver Robust Insights and Unbiased Market Perspectives

This research employs a multi-pronged methodology to ensure robustness and impartiality. Primary research efforts included in-depth interviews with over 50 industry stakeholders, spanning senior executives at manufacturing firms, security service providers, channel distributors, and end-user organizations across multiple regions. These interviews informed qualitative insights into technology adoption patterns, pricing dynamics, and competitive strategies. Complementary surveys were conducted with more than 500 individual consumers and institutional buyers to quantify preferences related to form factor, connectivity, and feature prioritization.

Secondary research sources encompassed regulatory filings, patent databases, trade association publications, and press releases. These materials provided a foundational understanding of evolving policy landscapes, intellectual property trends, and M&A activities. Rigorous cross-verification was achieved through data triangulation, where insights from primary interviews were benchmarked against publicly available financial reports and market bulletins. In addition, a proprietary database of tariff schedules and import/export records was analyzed to quantify the impact of the 2025 United States tariff measures on component pricing.

Analytical frameworks such as Porter’s Five Forces and SWOT analysis guided the competitive assessment, while segmentation and regional models were calibrated using discrete choice experiments and scenario planning. Expert reviews by a panel of academic researchers and industry practitioners further validated key findings, ensuring the final report reflects a balanced perspective and actionable intelligence for decision makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Personal Safety Alarms market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Personal Safety Alarms Market, by Alarm Type

- Personal Safety Alarms Market, by Technology

- Personal Safety Alarms Market, by Application

- Personal Safety Alarms Market, by End User

- Personal Safety Alarms Market, by Distribution Channel

- Personal Safety Alarms Market, by Region

- Personal Safety Alarms Market, by Group

- Personal Safety Alarms Market, by Country

- United States Personal Safety Alarms Market

- China Personal Safety Alarms Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Summarizing the Critical Imperatives, Emerging Opportunities, and Strategic Imperatives for Success in the Personal Safety Alarm Industry Landscape

The personal safety alarm industry stands at the intersection of technological innovation, regulatory complexity, and evolving consumer expectations. As advancements in AI, connectivity, and miniaturization continue to accelerate, product offerings will become increasingly sophisticated, enabling proactive threat detection and seamless integration into broader security ecosystems. At the same time, ongoing trade policy developments and tariff frameworks require agile supply chain strategies to preserve cost competitiveness and ensure uninterrupted market access.

Opportunities abound for companies that can successfully harmonize software and hardware capabilities, leveraging strategic partnerships to create end-to-end safety solutions. By tailoring offerings to specialized end-user segments-such as law enforcement, healthcare providers, and hospitality operators-organizations can differentiate themselves in a crowded market. Moreover, targeted regional approaches that address local regulatory requirements and cultural preferences will prove critical in capturing growth in high-potential markets across the Americas, EMEA, and Asia-Pacific.

Ultimately, success in this dynamic landscape will hinge on a company’s ability to anticipate emerging security trends, harness data-driven insights, and deliver user-centric experiences that resonate across diverse demographic and professional cohorts. Firms that embrace innovation, operational resilience, and customer collaboration will be best positioned to thrive in the next wave of personal safety alarm adoption.

Engage with Ketan Rohom to Unlock Comprehensive Insights, Tailored Strategies, and Exclusive Access to the Full Personal Safety Alarm Market Research Report

For decision makers seeking to delve deeper into the strategic insights and nuanced analysis provided in this report, Ketan Rohom is your direct point of contact. As the Associate Director of Sales & Marketing, he possesses an in-depth understanding of the personal safety alarm landscape and can guide you through the process of securing full access to the comprehensive findings. By reaching out to Ketan, you will receive tailored guidance on report customization options, licensing arrangements, and supplementary advisory services designed to accelerate your strategic initiatives. Don’t miss the opportunity to leverage these exclusive insights to inform product development, streamline market entry tactics, and strengthen your competitive positioning. Contact Ketan Rohom today to discuss how this research can be adapted to your organization’s unique objectives and to begin your journey toward enhanced market intelligence and actionable growth strategies.

- How big is the Personal Safety Alarms Market?

- What is the Personal Safety Alarms Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?