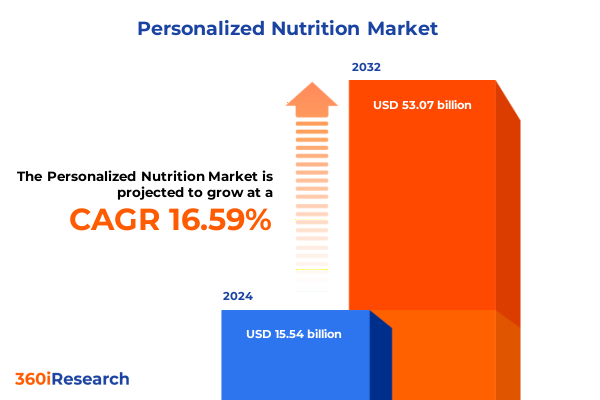

The Personalized Nutrition Market size was estimated at USD 18.21 billion in 2025 and expected to reach USD 20.06 billion in 2026, at a CAGR of 13.01% to reach USD 42.89 billion by 2032.

Unveiling the Horizon of Personalized Nutrition as Consumer Demands and Technological Advances Coalesce to Redefine Health and Wellness Experiences

The personalized nutrition sector is at a pivotal juncture where the convergence of scientific innovation, consumer empowerment, and digital technologies is reshaping how individuals approach their health and wellness choices. As personalized health strategies evolve beyond one-size-fits-all recommendations, there is a growing expectation for nutrition solutions that align with an individual’s unique genetic makeup, lifestyle demands, and health goals. In this dynamic environment, the interplay between advanced data analytics and emerging biotechnologies is unlocking new possibilities for tailored dietary interventions.

In this context, personalized nutrition is gaining traction as a transformative force that addresses the increasing consumer demand for targeted solutions. The rise of wearable nutrition trackers and mobile applications has elevated the accessibility of real-time dietary monitoring, while genetic testing kits are empowering consumers with actionable insights into their metabolic predispositions. Together, these innovations are catalyzing a paradigm shift toward proactive health management and continuous optimization of nutritional intake.

Given this evolving landscape, decision-makers must stay informed on the latest industry drivers, regulatory considerations, and consumer trends that define the personalized nutrition journey. This introduction sets the stage for a deep dive into the transformational shifts, tariff impacts, segmentation nuances, regional dynamics, competitive intelligence, actionable recommendations, and methodological rigor that underpin the future of personalized nutrition.

Exploring the Evolution of Personal Health Strategies Driven by Data, Science, and Consumer Empowerment Transforming How Nutrition Adapts to Individual Needs

Over the past decade, the personalized nutrition landscape has undergone sweeping transformations driven by the maturation of data science, the democratization of health information, and the heightened focus on preventive care. Initially rooted in early adopters of nutrigenomics research, the sector has advanced from theoretical promise to tangible consumer offerings. Today, personalized meal plans, custom supplement regimens, and AI-driven dietary coaching are mainstream, reflecting the profound influence of technology on consumer health behaviors.

Data interoperability and integrative platforms have become central to these shifts, enabling seamless connections between genetic kits, mobile applications, and wearable nutrition trackers. As consumers increasingly engage with multifaceted health ecosystems, brands are compelled to deliver cohesive experiences that harmonize real-time dietary feedback with long-term wellness guidance. This integration not only enhances user engagement but also generates robust datasets that inform continuous product innovation.

Simultaneously, consumer empowerment has redefined traditional relationships between individuals and health professionals. Personalized nutrition services are no longer limited to clinical settings; rather, they are accessible through apps that deliver instant dietary recommendations and virtual consultations. This democratization of expertise ensures that personalized guidance is available at scale, laying the groundwork for a future in which nutrition decisions are informed by holistic insights.

Assessing the Broad Consequences of 2025 Tariff Adjustments on Ingredient Access, Pricing Dynamics, and Value Chain Resilience in Personalized Nutrition

In 2025, the United States government implemented a series of tariff adjustments on imported ingredients commonly used in personalized nutrition products. These policy changes were aimed at protecting domestic agricultural producers and promoting local supply chains. Ingredients ranging from specialty grains to botanical extracts experienced increased import duties, prompting immediate cost pressures throughout the value chain. Manufacturers faced the challenge of reconciling consumer expectations for affordability with the rising procurement expenses.

Across ingredient sourcing, formulators encountered disruptions that extended beyond higher landed costs. The imposition of tariffs stimulated shifts in supplier negotiations, with many brands exploring alternative domestic ingredients or diversifying vendor portfolios to mitigate exposure. However, the limited availability of some niche ingredients at scale created bottlenecks, compelling companies to adjust formulations and reevaluate vendor partnerships to ensure continuity of supply.

Consequently, end-consumers began noticing incremental price adjustments on customized nutrition products. While premium segments absorbed some of the increases, mainstream offerings saw greater sensitivity, leading to a reevaluation of value propositions and packaging formats. As the market adapts, stakeholders are investing in supply chain resilience initiatives, including vertical integration and strategic alliances with domestic producers, to buffer against future policy fluctuations.

Deciphering the Multifaceted Segmentation of Personalized Nutrition to Illuminate Consumer Preferences and Unlock Strategic Product and Service Pathways

The personalized nutrition market encompasses an intricate tapestry of product types, beginning with functional foods such as energy bars, fortified foods, and probiotic foods, which cater to day-to-day performance and digestive wellness. Complementing these are herbal products, including aromatherapy and botanical formulations that emphasize holistic balance and stress relief. Supplements form the third pillar, comprising minerals that support essential physiological processes, protein supplements targeted at muscle recovery and growth, and vitamins calibrated to fill dietary gaps. This multifaceted product taxonomy underscores the diverse pathways through which personalized nutrition delivers tailored health solutions.

From an application standpoint, personalized nutrition extends across general health and wellness with a focus on bone health and immune support, while sports nutrition addresses both post-workout and pre-workout supplementation to optimize athletic performance. Weight management applications are also central, featuring appetite suppressants that aid in hunger regulation and meal replacements designed to support controlled caloric intake. These application domains reveal the breadth of use cases driving consumer engagement and innovation in customized dietary offerings.

Segmentation by consumer demographics uncovers distinct usage patterns across age groups-adults seeking preventive care, seniors prioritizing mobility and longevity, and teenagers navigating nutritional education-along with gender nuances among female, male, and non-binary users, and lifestyle-driven segments that range from athletes to busy professionals and sedentary individuals desiring improved energy and metabolic support. Variations in nutritional preferences further diversify the landscape, with gluten-free solutions leveraging grain-based alternatives and innovative flours; keto and low-carb options tapping into almond flour-based products and collagen-based formulations; and vegan and vegetarian offerings featuring plant-based proteins and seaweed products.

Delivery methods also shape the user experience, with chewable and slow-release tablets providing convenience, concentrated drops and ready-to-drink beverages enabling on-the-go intake, and powders tailored to mix with juice or water for flexible consumption. Engagement through dietary concern lenses reveals verticals targeting diabetes management with low glycemic index and sugar-free innovations, digestive health enhanced by fiber-rich and probiotic enriched foods, and heart health supported by high omega-3 and low-sodium products. Technological integration, finally, spans genetic testing kits offering customized reports and DNA-based analysis, mobile applications facilitating calorie counting and meal planning, and wearable nutrition trackers embedded in fitness devices and smart bracelets to deliver continuous feedback.

Together, these layers of segmentation illustrate the complexity and depth of personalized nutrition, demonstrating how brands can craft precise offerings for specific consumer profiles and use cases.

This comprehensive research report categorizes the Personalized Nutrition market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- Consumer Demographics

- Nutritional Preferences

- Delivery Method

- Dietary Concerns

- Technological Integration

Analyzing Regional Divergence in Personalized Nutrition Adoption Patterns Across the Americas, Europe, Middle East, Africa, and Asia Pacific to Uncover Growth Frontiers

Regional nuances profoundly shape the trajectory of personalized nutrition adoption. In the Americas, robust infrastructure and high consumer awareness have fostered a thriving ecosystem of digital nutrition platforms and direct-to-consumer brands. North American consumers, in particular, seek seamless integration of genetic insights and mobile apps, driving partnerships between technology providers and food manufacturers. In Latin America, rising disposable incomes are enabling greater experimentation with functional foods and supplements, supported by localized supply chains and regional ingredient innovations.

The combined Europe, Middle East, and Africa region presents a tapestry of regulatory frameworks and cultural preferences. In Western Europe, stringent health regulations and well-established nutraceutical markets emphasize clinical validation and quality assurance, guiding personalized nutrition brands toward rigorous scientific substantiation. Meanwhile, Middle Eastern markets display a strong appetite for traditional botanical products blended with modern delivery methods, reflecting a harmony between heritage and innovation. Across Africa, nascent digital infrastructure and growing interest in preventive healthcare are catalyzing pilot programs that leverage mobile applications to extend personalized dietary guidance to underserved communities.

In the Asia-Pacific region, rapid urbanization and digital penetration underpin a surge in health-conscious consumption. East Asia, led by technologically advanced markets, embraces AI-driven meal planning and wearable nutrition trackers as standard wellness tools, while Southeast Asia experiences burgeoning demand for affordable functional foods tailored to local tastes. Australia and New Zealand, with their robust regulatory environments and synthetic biology capabilities, are at the forefront of developing novel probiotic strains and plant-based protein alternatives. This regional mosaic underscores the importance of adaptive strategies that account for regulatory, cultural, and technological dynamics.

This comprehensive research report examines key regions that drive the evolution of the Personalized Nutrition market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Moves and Innovations from Leading Industry Players Driving Growth and Competitive Differentiation in Personalized Nutrition

Leading players in personalized nutrition are deploying distinct strategies to differentiate their offerings and capture market share. Biotech innovators are leveraging advanced genomic research to deliver hyper-personalized meal plans, often integrating cloud-based analytics to synthesize user data across multiple touchpoints. Traditional supplement companies are transitioning toward digital ecosystems, acquiring health tech startups to embed mobile coaching and genetic insights into their product portfolios.

In the functional foods segment, emerging brands are forming partnerships with ingredient suppliers to co-develop fortified products that target specific health outcomes. These collaborations often include joint investments in clinical trials to validate efficacy, reinforcing consumer trust through transparent science. Herbal product companies are expanding their footprints by blending ancient botanical knowledge with modern encapsulation techniques, delivering stress-relief and cognitive-support solutions in convenient formats.

Across geographies, multinational corporations are pursuing a dual approach: customizing global platforms for regional preferences while building local manufacturing capabilities to streamline distribution and ensure regulatory compliance. Meanwhile, innovators in the direct-to-consumer space are refining subscription models that combine regular product deliveries with ongoing virtual support, bolstering retention and lifetime value. Strategic mergers and acquisitions continue to reshape the competitive landscape, as incumbents and new entrants alike seek to assemble end-to-end capabilities spanning ingredient sourcing, formulation, and digital engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Personalized Nutrition market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amway Corporation

- Archer Daniels Midland Company

- Arla Foods amba

- Atlas Biomed Group Limited

- Balchem Corporation

- BASF SE

- Bayer AG

- Baze Labs, Inc.

- DayTwo Inc

- DNAlysis Biotechnology

- Elo Health, Inc.

- Floré by Sun Genomics

- Fonterra Co-Operative Group Limited

- Gainful Inc.

- Glanbia PLC

- Habit LLC

- Herbalife Nutrition Ltd.

- Ingredion Incorporated

- Kerry Group PLC

- Koninklijke DSM N.V.

- Nestlé S.A.

- Nutrigenomix Inc.

- Nutrisense, Inc.

- Perfood GmbH

- Salvo Health

- Suggestic Inc.

- Viome Life Sciences, Inc.

- Zinzino AB

Delivering Targeted Recommendations to Navigate Emerging Opportunities and Overcome Challenges in the Personalized Nutrition Sector for Industry Leadership

Industry leaders should prioritize the development of interoperable platforms that seamlessly integrate genetic, biometric, and lifestyle data to deliver cohesive personalized nutrition experiences. Establishing partnerships with technology firms and academic institutions can accelerate product validation and market readiness. By investing in robust clinical research and transparent communication of efficacy, brands can enhance credibility and foster consumer trust.

To navigate evolving regulatory landscapes, companies must adopt agile compliance frameworks that anticipate policy shifts and enable rapid formulation adjustments. Collaborating with regional stakeholders and participating in standard-setting bodies will ensure that product innovation aligns with emerging guidelines. Additionally, diversifying supply chains by securing multiple ingredient sources and exploring in-region manufacturing can buffer against tariff volatility and logistical disruptions.

Lastly, brands should cultivate consumer engagement through dynamic digital ecosystems that encompass mobile coaching, wearable integration, and virtual community platforms. By leveraging data-driven insights to personalize communication and recommendations, companies can deepen customer relationships and drive recurring revenue through subscription-based models. Embracing these strategic imperatives will position industry leaders at the forefront of personalized nutrition’s next growth wave.

Outlining the Comprehensive Research Framework Combining Qualitative Expertise, Quantitative Analysis, and Secondary and Primary Data Sources for Rigorous Insights

This research employs a multi-layered methodology to ensure rigor and relevance. Secondary research sources include peer-reviewed journals, industry white papers, and regulatory publications to establish a comprehensive understanding of personalized nutrition’s scientific foundations. Proprietary databases and market intelligence repositories were analyzed to identify emerging trends and competitor activities, while policy documents provided insights into tariff impacts and regional regulatory variations.

Primary research was conducted through in-depth interviews with industry experts, including nutritionists, biotechnologists, and supply chain executives, to validate secondary findings and explore forward-looking perspectives. Quantitative surveys of end-consumers across key regions supplemented qualitative inputs, revealing authentic usage patterns and unmet needs. Data triangulation techniques were applied to reconcile insights from diverse sources, ensuring both depth and breadth of coverage.

Analytical frameworks such as SWOT analysis, value chain mapping, and segmentation modeling were utilized to dissect market dynamics and identify strategic inflection points. The resulting insights deliver actionable intelligence on product innovation, regulatory adaptation, and regional expansion strategies. Throughout the study, strict adherence to data confidentiality and ethical research standards was maintained, guaranteeing the integrity of findings and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Personalized Nutrition market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Personalized Nutrition Market, by Product Type

- Personalized Nutrition Market, by Application

- Personalized Nutrition Market, by Consumer Demographics

- Personalized Nutrition Market, by Nutritional Preferences

- Personalized Nutrition Market, by Delivery Method

- Personalized Nutrition Market, by Dietary Concerns

- Personalized Nutrition Market, by Technological Integration

- Personalized Nutrition Market, by Region

- Personalized Nutrition Market, by Group

- Personalized Nutrition Market, by Country

- United States Personalized Nutrition Market

- China Personalized Nutrition Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 4611 ]

Synthesizing Key Findings and Strategic Imperatives to Illuminate the Path Forward for Stakeholders in the Personalized Nutrition Landscape

The personalized nutrition industry stands at an inflection point, propelled by technological breakthroughs and shifting consumer expectations. Through a detailed examination of transformative shifts, tariff implications, segmentation layers, regional dynamics, and competitive strategies, several critical imperatives emerge. Brands must harness integrative platforms to deliver truly personalized experiences, ensuring that scientific rigor underpins product efficacy and safety.

Regulatory agility and supply chain resilience will be paramount as tariff environments fluctuate and regional policies diverge. Concurrently, the ability to interpret and leverage consumer data across demographic, application, and nutritional preference segments will define market differentiation. Leaders who prioritize transparent communication of benefits, coupled with subscription-based digital ecosystems, will capture and retain a loyal consumer base.

Ultimately, the convergence of biotech innovation, digital engagement, and strategic partnerships will chart the course for sustained growth. By aligning product development with emerging scientific insights and regional market nuances, stakeholders can unlock the full potential of personalized nutrition, driving improved health outcomes and capturing new revenue streams.

Engage with Associate Director of Sales and Marketing to Secure Access to the Comprehensive Personalized Nutrition Industry Research Report Today

Contact Ketan Rohom,Associate Director of Sales and Marketing,to secure your copy of this comprehensive personalized nutrition industry research report and gain strategic advantage in health innovation

- How big is the Personalized Nutrition Market?

- What is the Personalized Nutrition Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?