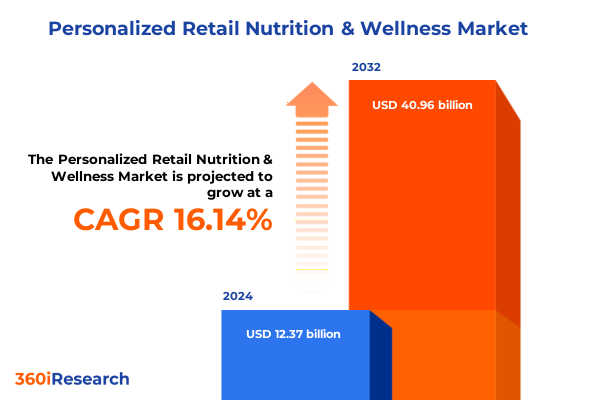

The Personalized Retail Nutrition & Wellness Market size was estimated at USD 14.29 billion in 2025 and expected to reach USD 16.52 billion in 2026, at a CAGR of 16.22% to reach USD 40.96 billion by 2032.

Unveiling the Convergence of Personalized Nutrition and Retail Wellness Amidst Evolving Consumer Expectations and Digital Innovation

The personalized retail nutrition and wellness sector stands at a pivotal crossroads where consumer empowerment, scientific advancement, and digital transformation converge to redefine traditional health and lifestyle paradigms. Contemporary consumers are no longer willing to settle for one-size-fits-all solutions; instead, they demand customized plans that integrate dietary guidance, fitness support, genetic insights, and seamless retail experiences. This shift has imparted unprecedented urgency for industry stakeholders to reevaluate longstanding operational frameworks and forge data-driven strategies that resonate with individual preferences.

Against a backdrop of heightened health awareness and rapid technological progression, the retail environment has evolved from a transactional space into a holistic wellness ecosystem. Innovations in mobile health applications and wearable sensors now facilitate real-time monitoring of biometric data, translating complex physiological metrics into actionable recommendations. At the same time, advances in nutrigenomics are unlocking the ability to craft dietary protocols aligned with an individual’s genetic profile, yielding more precise and efficacious nutrition interventions.

As digital and scientific innovations intersect with shifting consumer expectations, retailers and wellness providers must adopt an integrative approach that fuses personalized insights with engaging omnichannel experiences. The road ahead requires a clear understanding of how these dynamics coalesce to shape consumer decision-making, loyalty drivers, and long-term health outcomes. This report offers a comprehensive examination of those forces to equip decision-makers with the knowledge needed to navigate an increasingly competitive landscape.

Charting the Technological and Regulatory Forces Reshaping the Future of Retail Nutrition and Consumer Wellbeing with Precision

Over the past few years, the retail nutrition and wellness landscape has undergone transformative shifts driven by breakthroughs in digital health technology, evolving regulatory frameworks, and the drive toward consumer-centric service models. Premier among these developments is the proliferation of AI-driven platforms capable of analyzing multifaceted health data, enabling predictive insights that preemptively address nutritional deficiencies and lifestyle risks. At the same time, telehealth adoption has extended the reach of nutritional counseling, transforming what was once a brick-and-mortar service into an accessible, on-demand offering.

Regulatory agencies have also responded to increased scrutiny over product claims, safety standards, and data privacy by introducing more robust guidelines for supplement labeling, genetic testing disclosures, and consumer data management. These new requirements impose operational complexities but also serve to raise industry standards and bolster consumer trust, which is fundamental to sustained engagement in personalized offerings. Meanwhile, direct-to-consumer meal services have embraced blockchain for supply chain transparency, reinforcing provenance assurances and tackling concerns around food authenticity.

Together, these shifts define an environment in which competitive advantage is no longer solely predicated on product quality but on the seamless integration of technology, compliance, and consumer experience. Forward-looking organizations are those that can synchronize their operational capabilities with a deep understanding of evolving legal frameworks and emerging digital tools to deliver truly personalized, end-to-end wellness journeys.

Analyzing the Complex Effects of New United States Tariff Measures on Supply Chains and Innovation in Personalized Nutrition

In 2025, cumulative adjustments to United States tariff policies have exerted significant pressure on the personalized nutrition and wellness supply chain, driving up costs and redirecting sourcing strategies. The continuation of Section 301 duties on imported nutraceutical ingredients from key manufacturing hubs has elevated raw material expenses, prompting brands to explore nearshoring alternatives or strategic partnerships with domestic growers. Such cost pressures ripple through pricing structures, affecting everything from customized supplement capsules to liquid blends formulated for specific metabolic profiles.

Simultaneously, modifications to Section 232 steel and aluminum tariffs have increased the expense of manufacturing precision fitness trackers and health-monitoring devices, leading technology providers to optimize component designs and negotiate long-term supplier contracts. These pressures have spurred a wave of innovation in sustainable packaging and materials science, as companies seek to mitigate import duties while maintaining the quality and reliability consumers expect.

Despite these challenges, the tariff environment has also catalyzed a diversification of supply sources, with firms increasingly investing in regional manufacturing ecosystems across North America. This strategic pivot not only curbs exposure to future tariff fluctuations but also shortens lead times for product customization. In turn, the enhanced agility of supply networks strengthens the ability of brands to respond to shifting consumer demands and regulatory requirements without compromising on delivery speed or product integrity.

Illuminating the Multifaceted Segmentation of the Personalized Nutrition and Wellness Market to Drive Targeted Product and Service Innovation

The personalized retail nutrition and wellness market exhibits multifaceted segmentation that informs how products and services are tailored to specific consumer needs. Product type segmentation reveals that wearable fitness trackers have evolved from basic step counters into advanced devices that integrate with digital platforms to deliver holistic health feedback. Meal services have transcended meal-kit models, offering chef-curated menus underpinned by dietary DNA analysis, whereas nutrigenomics tests bridge the gap between genetics and nutrition by interpreting the impact of gene variants on metabolic pathways. Nutritional counseling has moved beyond generic diet plans to include immersive virtual coaching experiences, and supplement categories now reflect increased demand for precision dosing, with capsules optimized for timed release, liquids engineered for rapid absorption, and powders designed for biotherapeutic delivery.

Distribution channel segmentation underscores the growing symbiosis between digital and physical retail environments. Online retailers remain a primary access point for personalized nutrition solutions, leveraging subscription and one-time purchase models to cultivate direct customer relationships and recurring revenue. Pharmacies and drug stores have responded by hosting in-store genetic testing kiosks and virtual nutrition consultations, while specialty stores focus on experiential engagement through in-person sampling events and workshops. Supermarkets and hypermarkets are adapting by carving out dedicated wellness aisles that feature interactive displays explaining personalized plan offerings and smart packaging that syncs with smartphone apps.

Sales model segmentation highlights the importance of flexibility in consumer payment preferences. One-time purchases appeal to trial-driven users who seek immediate, ad hoc solutions, while pay-per-use structures enable access to individualized meal or coaching sessions without committing to long-term contracts. Subscription models have witnessed the fastest adoption curve, offering tiered services that deliver curated supplement bundles, monthly health reports, and ongoing program adjustments. Each sales model influences customer loyalty dynamics, lifetime value calculations, and the depth of personalized data that companies can leverage to refine their offerings.

End-user segmentation provides critical insights into where value is created across different audience cohorts. Fitness centers incorporate personalized supplementation and DNA-based meal programs into their membership packages to augment performance tracking, while healthcare and wellness centers integrate genetic assessments and digital monitoring into patient care plans, enabling clinicians to prescribe nutrition interventions with clinical precision. Individual consumers represent the broadest demographic, with subgroups focused on general wellness seeking baseline health maintenance solutions, sports nutrition enthusiasts prioritizing performance optimization, and weight management individuals requiring targeted macronutrient profiles. Tailoring engagement strategies to these distinct end-user groups ensures that messaging resonates and adoption barriers are minimized.

This comprehensive research report categorizes the Personalized Retail Nutrition & Wellness market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Sales Model

- Distribution Channel

- End-user

Exploring the Distinct Drivers Shaping Personalized Nutrition and Wellness Adoption across Key Global Regions

Regional dynamics play a defining role in shaping the evolution of personalized retail nutrition and wellness offerings. In the Americas, elevated health awareness and well-established e-commerce infrastructure have accelerated the adoption of integrated digital platforms, enabling brands to leverage robust consumer data ecosystems and sophisticated fulfillment networks. Innovative partnerships between meal service providers and fitness tech companies have emerged, fostering seamless interoperability between personalized diet plans and wearable performance tracking.

In Europe, Middle East & Africa, regulatory harmonization around data privacy and health claims is propelling cautious yet steady market expansion. Countries with advanced genetic research capabilities are witnessing higher demand for nutrigenomics tests, while specialty health retailers in metropolitan hubs are pioneering experiential retail formats that combine live demonstrations with interactive health assessments. Investment in local supply chains has gained traction to offset potential disruptions associated with import tariffs and to adhere to region-specific agricultural standards.

Asia-Pacific presents a vibrant tapestry of opportunity driven by rapid urbanization, rising disposable incomes, and an ingrained cultural emphasis on preventive health. Markets in East Asia have displayed a keen interest in tech-enabled supplements, including personalized nutraceutical blends informed by traditional medicine practices. Subscription-based meal solutions have gained popularity in metropolitan centers, where time-constrained professionals seek balanced nutrition optimized for cognitive and stress management benefits. Across the region, cross-border collaborations are fostering knowledge exchange and accelerating the localization of product innovation.

This comprehensive research report examines key regions that drive the evolution of the Personalized Retail Nutrition & Wellness market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Pioneering Companies Setting New Standards in Technology, Collaboration, and Sustainability within Personalized Nutrition

Industry leaders in personalized retail nutrition and wellness are redefining competitive benchmarks through strategic investments in technology, partnerships, and scientific research. Major consumer electronics firms have expanded their wellness portfolios by incorporating advanced biosensor algorithms into next-generation wearable devices, elevating the granularity of health data capture. Leading nutrigenomics providers have formed alliances with academic institutions to validate gene-diet interactions, bolstering credibility and accelerating the translation of research findings into accessible consumer offerings.

Forward-thinking meal service platforms have differentiated themselves by securing exclusive culinary partnerships and leveraging AI-driven menu personalization, which continuously refines dietary recommendations based on user feedback loops. Top supplement manufacturers are shifting from mass production to agile, small-batch formulations that cater to emerging health trends and enable rapid prototyping of novel ingredients. Retail pharmacy chains have integrated virtual nutrition consults with prescription fulfillment, creating a unified consumer journey that bridges medical oversight and lifestyle support.

These companies are also pioneering sustainability initiatives, from carbon-neutral packaging for personalized supplement kits to responsibly sourced botanical ingredients. By prioritizing transparency in supply chains and proactively addressing environmental and ethical considerations, these leaders are cultivating brand trust and aligning their value propositions with broader consumer priorities around social responsibility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Personalized Retail Nutrition & Wellness market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Advanced Orthomolecular Research

- Amway Corporation

- Archer Daniels Midland Company

- Bactolac Pharmaceuticals, Inc.

- Bayer AG

- Cargill, Incorporated

- Danone S.A.

- Dymatize Enterprises LLC

- FANCL Corporation

- General Mills, Inc.

- Glanbia PLC

- GlaxoSmithKline PLC

- Herbalife Nutrition Ltd.

- Himalaya Wellness Company

- International Flavors & Fragrances Inc.

- Koninklijke DSM N.V.

- Matsun Nutrition

- Nestlé S.A.

- Otsuka Holdings Co. Ltd.

- Pfizer, Inc.

- Reckitt Benckiser Group plc

- Suntory Holdings Limited

- The Procter & Gamble Company

Crafting a Holistic Growth Blueprint That Integrates Innovation, Omnichannel Engagement, and Sustainable Practices for Market Leadership

To capitalize on the accelerating momentum of personalized retail nutrition and wellness, industry leaders must adopt a multidimensional strategy that balances technological innovation with operational agility. Initiating cross-functional teams that integrate R&D, digital analytics, and regulatory compliance will ensure swift adaptation to evolving data privacy regulations and health authority requirements. Additionally, forging strategic partnerships with biotech startups and academic research centers can expedite the development of proprietary algorithms and unique personalization methodologies.

Expanding omnichannel engagement is critical to meeting consumers where they are most receptive. Embedding interactive health assessments within physical retail environments, while simultaneously nurturing robust digital communities, will enable brands to cultivate deeper loyalty and capture richer behavioral data. In parallel, balancing pay-per-use and subscription pricing frameworks can optimize accessibility for first-time users while securing reliable revenue streams from committed customers.

Lastly, prioritizing sustainability and ethical sourcing will resonate with increasingly values-driven consumers. Implementing transparent traceability platforms and investing in eco-friendly packaging solutions will reduce supply chain risks associated with tariff volatility and environmental regulations. By executing these recommendations, industry players can position themselves at the forefront of personalized wellness and drive long-term brand differentiation.

Detailing the Integrated Secondary and Primary Research Framework That Underpins Comprehensive Market Analysis

This research synthesizes insights derived from rigorous secondary and primary methodologies to deliver an accurate, nuanced understanding of the personalized retail nutrition and wellness sector. The secondary phase involved systematic analysis of peer-reviewed journals, regulatory publications, and industry white papers to establish a contextual framework and benchmark technological and regulatory trends. Concurrently, company filings, investor presentations, and reputable digital analytics platforms were examined to map competitive landscapes and identify strategic imperatives.

The primary phase comprised in-depth interviews with senior executives across consumer electronics firms, nutritional genomics laboratories, meal service startups, and retail pharmacy chains. These interviews were complemented by consultations with regulatory experts and supply chain specialists to elucidate the operational impacts of recent tariff measures. In addition, consumer focus groups and online surveys were conducted to capture evolving preferences and adoption barriers across different demographic segments.

Data triangulation techniques were applied to reconcile findings across sources and validate emerging themes. Qualitative insights were mapped against quantitative data to ensure consistency and reliability. This robust methodological approach underpins a well-rounded view of market dynamics while providing actionable intelligence for stakeholders across the value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Personalized Retail Nutrition & Wellness market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Personalized Retail Nutrition & Wellness Market, by Product Type

- Personalized Retail Nutrition & Wellness Market, by Sales Model

- Personalized Retail Nutrition & Wellness Market, by Distribution Channel

- Personalized Retail Nutrition & Wellness Market, by End-user

- Personalized Retail Nutrition & Wellness Market, by Region

- Personalized Retail Nutrition & Wellness Market, by Group

- Personalized Retail Nutrition & Wellness Market, by Country

- United States Personalized Retail Nutrition & Wellness Market

- China Personalized Retail Nutrition & Wellness Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Summarizing Critical Insights on Consumer-Centric Innovation and Operational Agility as Pillars of Future Success in Retail Wellness

The personalized retail nutrition and wellness market is at the threshold of a new era defined by the interplay of advanced analytics, consumer-centric design, and regulatory evolution. Stakeholders that embrace the convergence of genetic insights, digital health platforms, and omnichannel distribution will unlock differentiated value propositions that resonate with diverse consumer needs. Despite headwinds from evolving tariff policies and stringent compliance requirements, the sector’s trajectory remains upward as innovation continues to drive product and service enhancements.

By synthesizing the transformative shifts, segmentation nuances, and regional dynamics outlined in this report, decision-makers gain clarity on where to channel investments and strategic focus. The profiles of market-leading companies illustrate that competitive advantage no longer rests solely on core product quality, but equally on the ability to orchestrate seamless consumer experiences and foster sustainable supply chain partnerships.

In this environment of rapid change, only those organizations that operationalize insights through cross-functional collaboration, agile supply strategies, and value-driven consumer engagement will secure enduring growth and market differentiation. The time to act is now, as personalized wellness becomes a central pillar of modern retail healthcare ecosystems.

Unlock Strategic Growth Opportunities in Personalized Retail Nutrition and Wellness by Partnering with Our Expert Sales and Marketing Leadership

Are you ready to harness the full potential of personalized retail nutrition and wellness for strategic growth? Secure your competitive advantage today by engaging with Ketan Rohom, the Associate Director of Sales & Marketing at 360iResearch. With deep expertise in nutrition science, consumer analytics, and market strategy, Ketan can guide you through an in-depth exploration of actionable insights tailored to your organization’s goals.

Reach out to unlock exclusive access to proprietary intelligence on transformative technology integrations, evolving consumer behaviors, and regulatory considerations that will shape the next wave of innovation in the personalized nutrition and wellness sector. Don’t miss the opportunity to translate in-depth research into informed decision-making, drive product differentiation, and accelerate your market leadership. Connect with Ketan Rohom to learn more about our comprehensive market research report and take the first step toward realizing new growth horizons.

- How big is the Personalized Retail Nutrition & Wellness Market?

- What is the Personalized Retail Nutrition & Wellness Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?