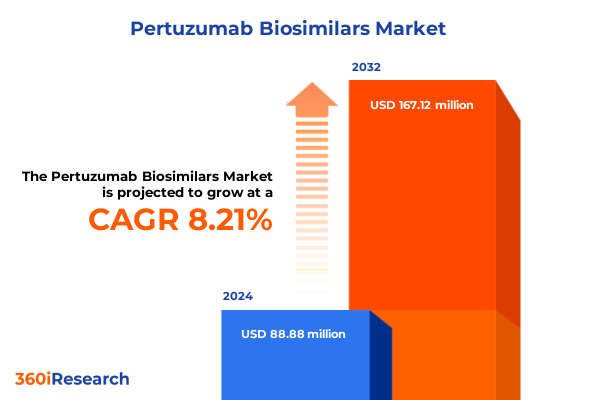

The Pertuzumab Biosimilars Market size was estimated at USD 95.61 million in 2025 and expected to reach USD 103.03 million in 2026, at a CAGR of 8.30% to reach USD 167.12 million by 2032.

Unveiling the Strategic Emergence of Pertuzumab Biosimilars as a Catalyst for Enhanced Access and Competitive Oncology Treatment Dynamics

Pertuzumab, marketed as Perjeta, is a humanized monoclonal antibody designed to inhibit HER2 receptor dimerization, thereby preventing signal transduction pathways that drive tumor growth. Since its initial approval by the Food and Drug Administration and subsequent authorization by the European Medicines Agency in 2012 and 2013 respectively, pertuzumab has become a cornerstone in the treatment regimen for HER2-positive breast cancer in both metastatic and early-stage settings. Its mechanism of action complements trastuzumab by binding to a distinct extracellular domain of HER2, resulting in synergistic blockade of oncogenic signaling and potentiation of antibody-dependent cell cytotoxicity.

Key Drivers Powering the Transformational Shift Toward Next Generation Biosimilar Integration in HER2-Positive Cancer Care Worldwide

Recent years have witnessed a paradigm shift in regulatory and clinical acceptance of biosimilars as viable, cost-effective alternatives to originator biologics. The approval of Phesgo, a subcutaneous fixed-dose combination of pertuzumab and trastuzumab, for at-home administration underscores a broader trend toward patient-centric delivery models, which seek to alleviate clinic capacity constraints and enhance patient convenience without compromising safety or efficacy. Parallelly, major health authorities have introduced streamlined pathways for biosimilar approvals, emphasizing rigorous analytical and clinical comparability assessments that have strengthened clinician confidence across oncology specialties.

Assessing the Complex Ripple Effects of United States 2025 Tariff Enhancements on Biosimilar Oncology Supply Chains and Market Viability

The United States’ implementation of expanded Section 301 tariffs on pharmaceutical ingredients and packaging materials has introduced unprecedented cost pressures across the biosimilar supply chain. With duties ranging from 20–25% on active pharmaceutical ingredients sourced from China and India and 15% on critical packaging components, the inflationary impact on production and distribution workflows has been profound, forcing manufacturers to reconsider sourcing strategies and pursue strategic onshoring of key operations.

Discerning Critical Market Segmentation Insights Shaping Pertuzumab Biosimilar Adoption Across Dosages Indications Channels Types and End Users

Market segmentation reveals intricate dynamics shaping the adoption of pertuzumab biosimilars across multiple dimensions. Dosage strength preferences are emerging around the two primary presentations of 340 mg and 420 mg, with 340 mg favored in neoadjuvant protocols and 420 mg optimized for metastatic regimens. Indication-based demand varies between breast cancer, which remains the predominant application, and gastroesophageal cancer, where uptake is rapidly growing in select regions. Distribution channels are diversifying as hospital pharmacies maintain high-volume procurement, while online and retail pharmacies are gaining traction through patient convenience and decentralized dispensing models. Decisions between liquid and lyophilized formulations hinge on cold chain logistics and reconstitution requirements, with liquid formats streamlining administration in outpatient settings. Finally, end users-from specialized cancer treatment centers to community clinics and large hospital systems-exhibit distinct procurement cycles, budget constraints, and formulary evaluation processes that collectively influence market entry and competitive dynamics.

This comprehensive research report categorizes the Pertuzumab Biosimilars market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Formulation

- Application

- Distribution Channel

- End User

Uncovering Strategic Regional Nuances in the Pertuzumab Biosimilar Landscape Across the Americas EMEA and Asia-Pacific Markets

In the Americas, the U.S. regulatory landscape has been pivotal, with the FDA’s acceptance of the first pertuzumab biosimilar BLA catalyzing competitive interest and supplier readiness for potential U.S. commercialization upon approval. Europe, Middle East & Africa markets benefit from the European Medicines Agency’s validation of the marketing authorization application for HLX11, signaling robust regulatory alignment with global comparability standards and reinforcing confidence among payers and providers. In the Asia-Pacific region, regulatory momentum has been significant, with China’s National Medical Products Administration accepting a pertuzumab biosimilar application as early as December 2024, creating a foundation for accelerated uptake across high-burden oncology markets in the region.

This comprehensive research report examines key regions that drive the evolution of the Pertuzumab Biosimilars market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategic Imperatives and Competitive Positioning of Leading Biopharma Entities Driving Pertuzumab Biosimilar Innovation Globally

Several biopharmaceutical players are at the forefront of pertuzumab biosimilar development and commercialization. Shanghai Henlius Biotech, in collaboration with Organon, has secured global commercialization rights for HLX11, positioning the candidate for entry across key markets outside China under an agreement established in 2022. In parallel, domestic innovators such as Qilu Pharmaceutical have advanced QL1209 into phase 3 clinical trials, while Zydus Cadila and Dr. Reddy’s Laboratories have forged licensing partnerships to co-market their pertuzumab biosimilar, underscoring the competitive momentum in Asia’s manufacturing hubs. Meanwhile, Roche’s strategic development of Phesgo and ongoing lifecycle management efforts for Perjeta demonstrate the originator’s commitment to defending market share through differentiated administration formats and broader label enhancements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pertuzumab Biosimilars market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amgen Inc.

- Apotex Inc.

- Aurobindo Pharma Limited

- BIOCAD

- Biocon Biologics Limited

- Celltrion, Inc.

- CinnaGen

- Coherus BioSciences, Inc.

- Dr. Reddy’s Laboratories Ltd.

- Eden Biologics, Inc. by Bora Pharmaceuticals

- EirGenix, Inc

- Eli Lilly and Company

- F. Hoffmann-La Roche AG

- Fresenius Kabi AG

- Hikma Pharmaceuticals PLC

- Lupin Limited

- Merck KGaA

- NeuClone Pharmaceuticals Ltd.

- Nippon Kayaku Co., Ltd.

- Novartis AG

- Organon LLC

- Pfizer Inc.

- Qilu Pharmaceutical Co. Ltd.

- Samsung Bioepis Co., Ltd.

- Sandoz International GmbH

- Sanofi S.A.

- Shanghai Henlius Biotech, Inc.

- Teva Pharmaceutical Industries Ltd.

- Thermo Fisher Scientific, Inc.

- Zydus Lifesciences Limited

Formulating Actionable Strategic Directives for Industry Leaders to Navigate and Capitalize on Emerging Pertuzumab Biosimilar Developments

Industry leaders must adopt multifaceted strategies to capitalize on the evolving pertuzumab biosimilar landscape. First, optimizing supply chain resilience through regional manufacturing hubs and diversified API sourcing will mitigate tariff-induced cost fluctuations. Second, engaging payers with robust health-economic models and real-world evidence can accelerate formulary inclusion and reimbursement alignment. Third, forging strategic partnerships for co-development, licensing, or commercialization will enhance geographic reach and share distribution risk. Finally, investing in digital patient support programs and decentralized dispensing channels can improve adherence and broaden market access beyond traditional hospital settings.

Detailing the Rigorous Research Methodology Underpinning Comprehensive Analysis of Pertuzumab Biosimilar Market Trends and Insights

This report synthesizes findings from an exhaustive research framework combining primary interviews with key stakeholders-ranging from regulatory officials and payers to clinicians and distribution executives-with secondary data analyses of company disclosures, peer-reviewed publications, and public regulatory filings. Quantitative datasets were triangulated to ensure accuracy, while robust validation protocols, including cross-referencing regulatory databases and clinical trial registries, were employed. Qualitative insights were substantiated through expert panel reviews, ensuring that conclusions reflect real-world operational considerations and emergent trends.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pertuzumab Biosimilars market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pertuzumab Biosimilars Market, by Formulation

- Pertuzumab Biosimilars Market, by Application

- Pertuzumab Biosimilars Market, by Distribution Channel

- Pertuzumab Biosimilars Market, by End User

- Pertuzumab Biosimilars Market, by Region

- Pertuzumab Biosimilars Market, by Group

- Pertuzumab Biosimilars Market, by Country

- United States Pertuzumab Biosimilars Market

- China Pertuzumab Biosimilars Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Consolidating Key Insights and Forecasting the Evolutionary Trajectory of the Pertuzumab Biosimilar Ecosystem in Oncology Care

The advent of pertuzumab biosimilars marks a pivotal inflection point in oncology treatment paradigms, poised to enhance therapeutic accessibility while intensifying competitive pressures on originator biologics. Regional regulatory harmonization and evolving tariff landscapes necessitate agile strategic responses, as segmentation nuances and company initiatives continue to shape market trajectories. Industry stakeholders who integrate these insights with proactive resource allocation and partnership strategies will be best positioned to drive value creation and sustain long-term growth in the dynamic biosimilar ecosystem.

Engage with Ketan Rohom Today to Secure Comprehensive Pertuzumab Biosimilar Insights and Propel Your Strategic Market Positioning Forward

For tailored guidance and in-depth clarification on any aspects of this research, engage directly with Ketan Rohom, Associate Director, Sales & Marketing. His expertise will ensure your organization can swiftly leverage these insights, align strategic initiatives with emerging market dynamics, and secure a competitive edge. Connect today to discuss bespoke solutions that will propel your business forward and maximize the value of your investment in this comprehensive pertuzumab biosimilar market report.

- How big is the Pertuzumab Biosimilars Market?

- What is the Pertuzumab Biosimilars Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?