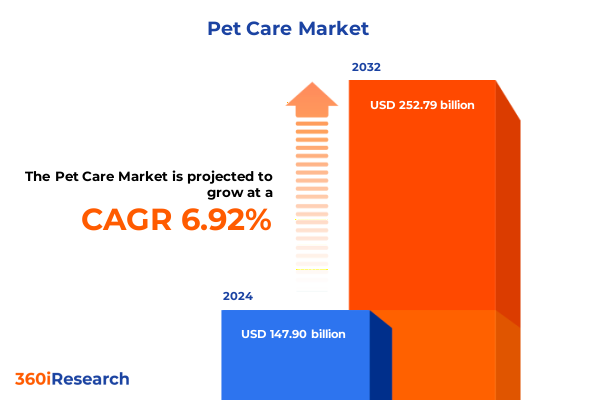

The Pet Care Market size was estimated at USD 157.68 billion in 2025 and expected to reach USD 168.20 billion in 2026, at a CAGR of 6.97% to reach USD 252.79 billion by 2032.

Understanding the Rapid Evolution of the Pet Care Sector Driven by Humanization Sustainability and Technological Innovation

The pet care sector has undergone a rapid transformation in recent years, propelled by consumers treating pets as cherished family members and seeking products that mirror human-grade quality and innovation. This evolution has fueled a premiumization trend where high-end formulations and curated wellness solutions have become mainstream, reshaping product development and retail strategies across the industry. Companies are responding by elevating standards for nutrition, safety, and efficacy to meet the expectations of discerning pet parents who demand transparency and science-backed claims.

Concurrently, sustainability and technology are converging to redefine pet care experiences and operational footprints. A growing majority of pet owners prioritize eco-friendly packaging, upcycled ingredients, and carbon-conscious supply chains, driving manufacturers to adopt renewable energy and biodegradable materials. Meanwhile, the integration of digital health platforms and telemedicine services is enhancing preventive care, enabling real-time monitoring of biometrics and early intervention. This dual focus on environmental stewardship and technological advancement underscores the complexity of the modern pet care landscape and the critical need for data-driven strategic decision-making.

Identifying the Fundamental Trends Shaping Pet Care through Premiumization Sustainability and Digital Disruption in 2025

Four major forces are reshaping the pet care industry’s trajectory, each demanding agile responses and strategic foresight. First, the humanization of pets continues to intensify as owners view animals as integral family members, driving demand for premiumized products that parallel human wellness trends. From gourmet formulations to bespoke supplements, manufacturers are harnessing scientific research to deliver tailored nutrition solutions that promise functional benefits and nutritional transparency.

Second, sustainability has emerged as a non-negotiable criterion, with consumers actively seeking brands that demonstrate environmental responsibility. This has spurred innovation in recyclable and compostable packaging, alternative protein sources, and circular supply chain initiatives, compelling organizations to embed ecological considerations into every stage of product lifecycle management. Third, digital disruption through AI-driven tools, telehealth services, and connected devices is redefining customer engagement and care delivery. E-commerce platforms and subscription models are leveraging data analytics and machine learning to offer personalized recommendations and predictive replenishment, elevating convenience and loyalty. Together, these transformative shifts underscore the multidimensional nature of today’s pet care ecosystem, where consumer values, regulatory mandates, and technological possibilities converge.

Examining How the 2025 U S Tariff Overhaul Has Reshaped Cost Structures Supply Chains and Consumer Dynamics in the Pet Care Industry

In early April 2025, the United States implemented a comprehensive tariff overhaul that significantly altered cost dynamics for pet care companies relying on global supply chains. The revised measures introduced baseline duties on imports from traditional partners and imposed elevated rates on goods sourced from key manufacturing hubs, with Chinese-sourced pet food ingredients and packaging materials now subject to rates exceeding 100 percent. This policy shift has placed considerable pressure on profit margins and compelled stakeholders to reassess sourcing strategies and pricing models.

The immediate effect has been a sharp increase in procurement expenses for raw materials such as non-woven fabrics, superabsorbent resins, and specialty grains used in functional foods. Many companies have faced escalating research and development costs as they explore alternative inputs and reformulated recipes to maintain product quality. At the same time, transportation and logistics expenses have risen, prompting organizations to optimize inventory levels and renegotiate freight contracts to mitigate the added burdens imposed by elevated duties.

To navigate these challenges, leading companies are diversifying supply chains and exploring localized manufacturing options to reduce exposure to import levies. Some are establishing regional plants or forging partnerships with domestic ingredient suppliers, while others are implementing advanced risk management protocols to forecast tariff fluctuations and secure more favorable terms. Despite these adjustments, consumer price sensitivity remains a central concern, as ongoing inflationary pressures and duty pass-throughs risk eroding purchasing power and altering demand patterns. Yet, the inelastic nature of pet essentials has thus far sustained baseline consumption levels, reaffirming the importance of resilience and supply chain fluidity in this new era of trade policy uncertainty.

Revealing Key Market Segmentation Insights across Product Pet Type Distribution Channels and Customer Profiles to Illuminate Strategic Priorities

A nuanced understanding of market segments reveals distinct opportunities and strategic imperatives. Analyzing product types uncovers a multi-layered landscape where accessories, grooming services, and healthcare solutions complement a robust food segment that spans dry kibble, treats and snacks, and wet formulations. Insights into pet types highlight divergent needs across dogs, cats, birds, fish, horses, reptiles, and small mammals, each category demanding bespoke nutritional profiles, enrichment tools, and healthcare protocols. This level of granularity empowers manufacturers to refine innovation pipelines and target investments in high-growth niches.

Equally important, distribution channels frame the consumer journey from initial awareness to repeat engagement. Specialty pet stores, supermarkets, hypermarkets, and veterinary clinics remain essential touchpoints for vet-recommended products and hands-on service experiences, while direct-to-consumer online platforms and third-party e-commerce players facilitate subscription-based models and personalized marketing. Lastly, customer type segmentation-spanning animal shelters, pet owners, and veterinary professionals-elicits distinct purchasing rationales and loyalty drivers. Tailoring communication and product design to these audiences fosters deeper connections and unlocks additional revenue streams.

This comprehensive research report categorizes the Pet Care market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Pet Type

- Distribution Channel

- Customer Type

Uncovering Regional Variations in Pet Care Demand Infrastructure and Consumer Behavior across Americas EMEA and Asia Pacific Markets

Regional nuances continue to shape competitive dynamics and growth trajectories. In the Americas, the United States and Canada exhibit advanced e-commerce infrastructures, high pet insurance penetration, and widespread adoption of telehealth services, fostering accelerated digital sales and subscription offerings. Stakeholders in this region are investing heavily in data-driven personalization and omnichannel integration to meet the sophisticated expectations of tech-savvy consumers.

In Europe, the Middle East, and Africa, evolving regulatory frameworks and stringent nutritional standards are driving reformulation and sustainability mandates. European markets lead in eco-certification and animal welfare claims, while Middle Eastern and African markets are rapidly expanding pet ownership and premium service adoption. This mosaic of regulatory and cultural contexts underscores the need for adaptable strategies that align product portfolios with localized requirements.

Across Asia-Pacific, urbanization, rising disposable incomes, and shifting cultural attitudes toward companion animals are fueling a surge in pet adoption rates. China and India have emerged as pivotal battlegrounds for premium dry foods and specialized healthcare products, supported by robust platforms for digital engagement and influencer-driven marketing. Local brands are leveraging regional insights to challenge global players, emphasizing authenticity and heritage in their value propositions.

This comprehensive research report examines key regions that drive the evolution of the Pet Care market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategic Movements Innovations and Collaborative Initiatives of Leading Pet Care Corporations Driving the Industry Forward

Leading corporations are deploying bold initiatives to secure competitive advantages. One global pet care giant has announced a multibillion-dollar commitment to digital innovation, launching artificial intelligence-powered health monitoring tools that empower pet parents to track dental and gastrointestinal wellness via smartphone imagery. This digital transformation is supported by the creation of a cross-disciplinary advisory board, ensuring rapid adoption of emerging technologies and data analytics to refine product recommendations and preventive care interventions.

Another industry frontrunner has leveraged corporate venturing and incubator programs to seed breakthrough startups across veterinary diagnostics, precision fermentation for novel proteins, and conversational commerce solutions. By awarding competitive grants and offering strategic mentorship, this organization is expanding its innovation ecosystem and accelerating commercialization of disruptive pet care concepts. Parallel investments in category management and metaverse-driven retailer engagement demonstrate a holistic approach to market access, optimizing in-store layouts and virtual shopping experiences to drive omnichannel growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pet Care market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABP Food Group

- Affinity Petcare S.A

- Aller Petfood Group

- Alphia, Inc.

- Ancol Pet Products Limited

- Blue Buffalo Company, Ltd. by General Mills Inc.

- Cargill, Incorporated

- Carhartt, Inc.

- Central Garden & Pet Company

- Colgate-Palmolive Company

- Fabri-Tech, Inc.

- Freshpet, Inc.

- Heristo AG

- Majestic Pet

- Mammoth Pet Products

- Mars, Incorporated

- Monge & C. S.p.a.

- Nestlé S.A.

- Nippon Pet Food Co.,Ltd.

- Petco Animal Supplies Stores, Inc.

- Petmate

- ROOKCRAN Co., Ltd.

- Rosewood Pet Products Ltd.

- Sam Yu AquaPets CO.,LTD.

- Schell & Kampeter, Inc.

- Simmons Foods, Inc.

- Spectrum Brands Holdings, Inc.

- Sumitomo Corporation

- Taiwan Pet Comb Enterprises Co., Ltd.

- The J.M. Smucker Company

- The KONG Company, LLC

- Tiernahrung Deuerer GmbH

- Unicharm Corporation

- Wellness Pet Company, Inc.

- West Paw Inc.

Crafting Actionable Strategic Recommendations to Enhance Resilience Agility and Growth Opportunities for Pet Care Industry Leaders

Industry leaders must embrace strategic imperatives that enhance both operational resilience and market responsiveness. Prioritizing supply chain diversification will mitigate tariff risks and logistical disruptions, while fostering closer partnerships with regional ingredient suppliers supports cost containment and sustainability objectives. Simultaneously, accelerating digital channel expansion-through branded e-commerce sites, mobile apps, and AI-powered personalization-will solidify customer engagement and drive higher lifetime value.

Moreover, integrating environmental stewardship into core product development is essential for meeting consumer expectations and regulatory mandates. Investing in circular packaging solutions and alternative proteins not only addresses ecological concerns but also differentiates brands in a crowded marketplace. In parallel, the deployment of telehealth platforms and virtual care services will enhance preventive health outcomes and create new revenue streams. Finally, cultivating robust corporate venturing programs and cross-sector alliances will unlock external innovation, enabling organizations to stay at the forefront of emerging trends and technologies.

Detailing the Rigorous Multimethod Research Methodology Employed to Ensure Data Integrity Validity and Comprehensive Market Insights

This research draws upon a multimethod approach to ensure comprehensive and reliable insights. Secondary research encompassed analysis of industry publications, regulatory documents, and corporate filings to map macroeconomic drivers, policy changes, and competitive strategies. Complementing this, primary interviews were conducted with senior executives from manufacturing, retail, and veterinary services, alongside qualitative discussions with consumer focus groups to validate shifting preferences and unmet needs.

Quantitative data were sourced through structured surveys of pet owners and professionals, capturing purchase behaviors, channel preferences, and willingness to adopt emerging products. The findings were triangulated using advanced statistical techniques and cross-verified against syndicated databases and trade association reports. Throughout the study, rigorous quality control protocols- including methodological audits and peer reviews-were applied to uphold data integrity, validity, and actionable relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pet Care market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pet Care Market, by Product Type

- Pet Care Market, by Pet Type

- Pet Care Market, by Distribution Channel

- Pet Care Market, by Customer Type

- Pet Care Market, by Region

- Pet Care Market, by Group

- Pet Care Market, by Country

- United States Pet Care Market

- China Pet Care Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing the Core Findings Implications and Strategic Considerations Emerging from the Comprehensive Pet Care Market Analysis

The analysis confirms that pet humanization, sustainability, and digitalization are the primary catalysts shaping the industry’s evolution. Tariff-induced cost pressures have heightened the imperative for supply chain agility, while regional dynamics underscore the importance of localized strategies that resonate with diverse regulatory landscapes and cultural contexts. Leading organizations are responding through targeted investments in technology, corporate venturing, and collaborative partnerships to drive innovation and secure market share.

Looking forward, the companies that succeed will be those that integrate environmental and social governance principles into their core value propositions, harness data-driven personalization to deepen customer loyalty, and maintain operational flexibility to navigate geopolitical uncertainties. By aligning strategic initiatives with these imperatives, industry participants can unlock sustainable growth and deliver enhanced value to both pets and their human companions.

Engage with Ketan Rohom to Unlock the Full Potential of the Pet Care Research Report and Drive Strategic Value for Your Organization

To explore how these insights can be tailored to your organization’s unique challenges and unlock actionable strategies, please connect with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in translating comprehensive research into impactful business decisions will ensure your team capitalizes on emerging opportunities, strengthens resilience, and drives sustainable growth in the dynamic pet care market.

- How big is the Pet Care Market?

- What is the Pet Care Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?