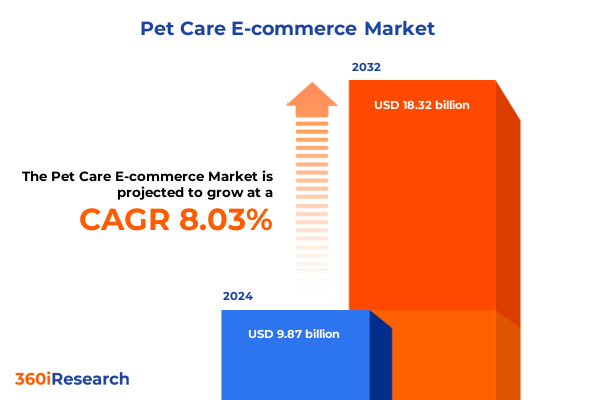

The Pet Care E-commerce Market size was estimated at USD 10.58 billion in 2025 and expected to reach USD 11.34 billion in 2026, at a CAGR of 8.15% to reach USD 18.32 billion by 2032.

Exploring the Dynamic Growth of the Pet Care E-commerce Sector Fueled by Digital Innovation Personalization and Shifting Consumer Preferences

The pet care e-commerce sector has undergone a remarkable transformation over recent years spurred by rapid technological innovation and shifting consumer lifestyles As more households embrace digital channels for everyday purchases the market has expanded beyond basic necessities to encompass a wide array of offerings designed to cater to personalized pet care needs Moreover the convergence of mobile commerce platforms and data analytics has enabled retailers to deliver targeted promotions and seamless shopping experiences that resonate with today’s informed consumer At the same time social media communities and influencer partnerships have amplified brand visibility fostering deeper emotional connections between pet owners and leading e-commerce brands Consequently this dynamic environment has heightened competition and compelled retailers to innovate in service delivery subscription models and omnichannel integration

Identifying Transformative Shifts in the Pet Care Landscape Driven by Technological Integration and Consumer Behavior Evolution

The landscape of pet care retail has been redefined by several transformative shifts that underscore the importance of agility and strategic foresight Firstly the proliferation of smart home technologies has catalyzed demand for connected devices such as automated feeders and health monitoring wearables These advancements not only empower pet owners with real-time insights but also create cross selling opportunities for retailers who integrate hardware with consumable products Furthermore evolving consumer expectations around convenience and sustainability have elevated the prominence of eco-friendly packaging and ethically sourced ingredients As a result brands that prioritize transparent supply chains and sustainable practices have strengthened customer loyalty and differentiated themselves in a crowded market Additionally the emergence of direct-to-consumer models has disrupted traditional distribution channels enabling brands to foster deeper customer relationships and refine product offerings through direct feedback loops Collectively these shifts highlight the imperative for industry participants to embrace innovation invest in digital infrastructure and remain attuned to consumer values

Assessing the Far reaching Effects of 2025 United States Trade Tariffs on Pet Care E-commerce Pricing and Supply Chain Dynamics

Recent adjustments to United States trade policy have introduced significant tariffs on imported consumer goods including key components for pet care products These levies have contributed to rising input costs for manufacturers relying on overseas raw materials such as specialized plastics for toys or premium protein sources for pet food As a consequence many e-commerce retailers have experienced margin compression and have been compelled to absorb a portion of these additional expenses to maintain competitive pricing While some businesses have responded by diversifying supplier networks and nearshoring select production activities others have leveraged strategic inventory management and dynamic pricing algorithms to mitigate cost pressures Moreover the broader impacts of these tariffs extend to supply chain volatility as lead times have lengthened and shipping costs have escalated highlighting the critical need for robust logistics strategies Going forward industry participants must continue to refine their procurement processes and collaborate with partners who can offer greater supply chain resilience under evolving trade regulations

Uncovering Critical Segmentation Insights Across Product Variety Animal Preferences and Evolving Distribution Pathways for Pet Care E-commerce Success

The pet care e-commerce arena comprises an intricate tapestry of offerings that can be understood through a detailed examination of product type animal preferences and purchasing channels By evaluating Pet Accessories including items ranging from bedding and furniture to durable leashes and interactive toys alongside Pet Food varieties such as nutrient rich dry formulas specialized treats and moisture rich wet options the market reveals distinct consumer spending patterns Pet Grooming Products also play a pivotal role with an emphasis on ergonomic brushes innovative nail care solutions and gentle cleansing shampoos that cater to breed specific needs while the growing demand for Pet Healthcare Products underscores the importance of preventive Dental Care alongside prescription and over the counter Medications as well as targeted nutritional Supplements Insights into Animal Type preferences highlight the enduring loyalty of dog owners who frequently adopt subscription models complemented by specialist nutrition solutions whereas cat enthusiasts demonstrate a keen interest in premium grooming tools and interactive enrichment items Birds and small animals follow unique consumption cycles with an emphasis on health oriented products and customized habitat accessories Fish keepers increasingly seek advanced filtration and nutrition kits that align with sustainable practices Distribution Channel analysis further enriches the segmentation narrative as Manufacturer Direct to Consumer channels build meaningful brand communities while Online Retailers both general and specialist offer scale and convenience Subscription Services whether delivered monthly or quarterly present an effective mechanism for fostering recurring revenue and customer loyalty and Third Party Marketplaces continue to serve as discovery hubs that introduce shoppers to emerging brands collectively affirming the need for tailored engagement strategies across each segment

This comprehensive research report categorizes the Pet Care E-commerce market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Animal Type

- Distribution Channel

Evaluating Regional Variations in Pet Care E-commerce Trends across the Americas Europe Middle East Africa and Asia Pacific Markets

An exploration of regional trends reveals nuanced distinctions that must inform global pet care e-commerce strategies In the Americas rapid urbanization and high smartphone penetration have accelerated the adoption of mobile commerce and facilitated the expansion of scalable subscription services that cater to busy pet owners Meanwhile at the same time innovations in logistics infrastructure across Latin America are opening new corridors for cross border distribution fostering increased competition and driving price sensitivity In Europe Middle East and Africa the diversity of regulatory frameworks and consumer attitudes underscores the importance of localized approaches Brands operating in Western European markets benefit from established e-payment ecosystems and strong consumer protections whereas emerging economies in the Middle East and Africa present opportunities for growth through targeted educational initiatives and partnerships with local distributors Conversely the Asia Pacific region exemplifies perhaps the fastest evolving landscape propelled by rising middle class populations and a growing pet humanization trend As a result regional leaders have introduced advanced digital wallets and integrated social commerce functionalities that resonate with tech savvy consumers while simultaneously emphasizing premium wellness and beauty oriented offerings tailored to local culinary and cultural preferences

This comprehensive research report examines key regions that drive the evolution of the Pet Care E-commerce market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovative Initiatives from Leading Players Shaping the Pet Care E-commerce Market Landscape

Leading players in the pet care e-commerce domain have demonstrated remarkable agility in response to shifting market dynamics Each of these companies leverages a unique blend of technology investments and customer centric strategies to secure competitive advantages One prominent retailer has capitalized on an extensive network of strategic fulfillment centers paired with an advanced AI driven recommendation engine to personalize product suggestions and expedite final mile delivery Another global marketplace has deepened its service ecosystem by offering integrated telehealth vet consultations alongside a curated selection of premium pet supplies thereby forging an end to end wellness platform Furthermore innovative direct to consumer brands continue to disrupt traditional hierarchies by nurturing tight knit online communities that drive organic referrals and high customer lifetime value Simultaneously, subscription focused enterprises are refining their tiered membership models to deliver enhanced value through loyalty rewards exclusive content and early access to new launches Collectively these diverse approaches illustrate the spectrum of strategic pathways available to companies seeking to achieve sustainable growth in a highly competitive environment

This comprehensive research report delivers an in-depth overview of the principal market players in the Pet Care E-commerce market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon.com Inc.

- BarkBox Inc.

- Chewy Inc.

- Fressnapf Group

- JustFoodForDogs LLC

- Mars Petcare US Inc.

- MyPet Inc.

- Nestlé Purina PetCare Company

- Only Natural Pet Inc.

- Petco Health and Wellness Company Inc.

- PetFlow LLC

- PetMed Express Inc.

- PetSmart LLC

- VetSource LLC

- Zoetis Inc.

Proposing Strategic Actionable Recommendations to Enhance Market Positioning and Cater to Evolving Consumer Demands in Pet Care E-commerce

To capture emerging opportunities and fortify market presence industry leaders should cultivate a culture of continuous innovation that prioritizes seamless customer experiences and operational efficiency As a first measure brands must harness advanced analytics to anticipate shifting consumer preferences and tailor offerings from grooming essentials to specialized supplements with pinpoint accuracy Furthermore forging strategic alliances with logistics providers can unlock expedited shipping capabilities and flexible fulfillment solutions that enhance overall satisfaction Secondly incorporating sustainable practices throughout product development and packaging will resonate with eco conscious consumers and strengthen brand equity in a market where values align closely with purchasing choices Moreover expanding omnichannel touchpoints-including integration with live social commerce events and immersive virtual experiences-will enable retailers to foster deeper brand engagement and unlock new revenue streams Finally establishing formal feedback loops through community forums and targeted surveys will facilitate product innovation cycles and bolster customer loyalty by ensuring that evolving demands are met promptly and authentically

Detailing the Comprehensive Research Methodology Incorporating Primary Interviews Secondary Analysis and Data Triangulation Techniques

The foundation of this research is a meticulous combination of primary and secondary data collection methodologies designed to ensure robust, triangulated insights and comprehensive coverage Initially, in depth interviews were conducted with industry executives spanning retail, veterinary services and logistics to capture nuanced perspectives on emerging trends and operational challenges These qualitative discussions were complemented by structured surveys administered to a diverse panel of pet owners across demographic cohorts to quantify preferences in product type, breed specific needs and distribution channel priorities In parallel, secondary research encompassed an extensive review of publicly available company filings, industry publications, trade association reports, and regulatory filings to map the competitive environment and regulatory landscape Data synthesis was achieved through rigorous triangulation protocols whereby findings from primary sources were cross validated against secondary benchmarks and refined through expert workshops Additionally advanced data analytics techniques, including cluster analysis for segmentation validation and scenario modeling for tariff impact assessments, were employed to surface actionable insights with high confidence levels

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pet Care E-commerce market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pet Care E-commerce Market, by Product Type

- Pet Care E-commerce Market, by Animal Type

- Pet Care E-commerce Market, by Distribution Channel

- Pet Care E-commerce Market, by Region

- Pet Care E-commerce Market, by Group

- Pet Care E-commerce Market, by Country

- United States Pet Care E-commerce Market

- China Pet Care E-commerce Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Consolidating Key Takeaways and Strategic Imperatives to Navigate the Fast Evolving Pet Care E-commerce Ecosystem with Confidence

The evolving pet care e-commerce ecosystem presents both exciting opportunities and complex challenges for businesses seeking growth By synthesizing trends across technological innovation, consumer behavior shifts, regulatory developments and regional nuances this report underscores the multifaceted nature of the market Participants who embrace agile supply chain strategies, data driven personalization, and community centric engagement models are best positioned to forge sustainable competitive advantages Moreover the ongoing interplay between tariff pressures and logistical complexities highlights the necessity of proactive planning and strategic diversification As companies navigate these dynamics, the ability to translate rich market intelligence into swift, customer aligned action will be critical to driving long term success Ultimately, stakeholders that integrate nuanced segmentation insights with localized regional approaches will unlock the full potential of the pet care e-commerce sector and thrive in this vibrant commercial landscape

Engage with Ketan Rohom to Unlock Exclusive Access to In depth Pet Care E-commerce Insights and Propel Your Business Forward with Expert Analysis

Ready to elevate your strategic position in the rapidly evolving pet care e-commerce landscape Engage directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to obtain exclusive access to comprehensive insights and tactical guidance designed to drive your business growth Bridging the gap between market intelligence and actionable strategies this tailored consultation will empower your team to make data-driven decisions and unlock untapped opportunities in product innovation and customer engagement Reach out today to secure your personalized briefing and transform market intelligence into tangible competitive advantage

- How big is the Pet Care E-commerce Market?

- What is the Pet Care E-commerce Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?