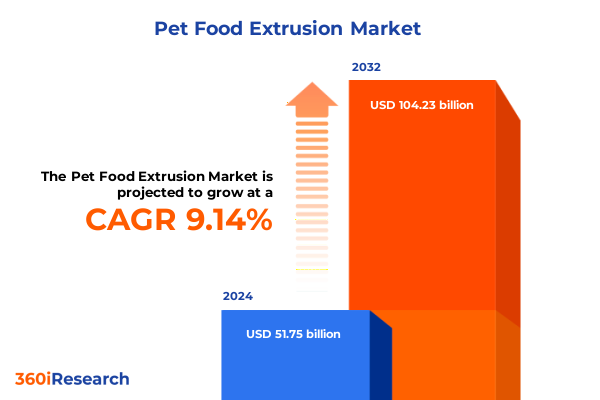

The Pet Food Extrusion Market size was estimated at USD 56.40 billion in 2025 and expected to reach USD 61.30 billion in 2026, at a CAGR of 9.16% to reach USD 104.23 billion by 2032.

An In-Depth Exploration of Pet Food Extrusion Fundamentals Illuminating Advanced Processing Principles Nutrition Priorities and Emerging Consumer Expectations

The pet food extrusion industry operates at the intersection of advanced engineering principles and nutritional science. In such a dynamic environment, manufacturers must balance complex processing parameters such as temperature profiles, screw configuration, and moisture content to ensure product quality, palatability, and safety. Recent innovations in extrusion equipment have introduced modular designs and intelligent process controls that enhance production flexibility and operational efficiency, enabling producers to respond swiftly to shifting consumer preferences.

Moreover, the growing emphasis on premiumization within the pet food sector has driven the integration of functional ingredients and alternative protein sources into extruded formats. As pet owners increasingly view their companion animals as integral family members, they demand foods that deliver both health benefits and gourmet experiences. Consequently, manufacturers are investing in co-rotating twin-screw extruders and localized ingredient sourcing to optimize nutrient retention and texture. In parallel, regulatory bodies continue to refine standards on labeling, ingredient traceability, and allergen management, underscoring the need for robust quality assurance systems across the extrusion value chain.

In summary, a thorough grasp of both technical and market trends is essential for stakeholders aiming to maintain competitive advantage. The interplay between process innovation, ingredient science, and consumer expectations lays the foundation for strategic decision-making in the pet food extrusion landscape.

Examining the Convergence of Sustainability Digitalization and Traceability That Is Reshaping Pet Food Extrusion Markets

Over the past year, several transformative shifts have redefined the pet food extrusion landscape. First, sustainability considerations have moved from niche dialogues to boardroom agendas, compelling stakeholders to reevaluate input materials and energy footprints. This shift has accelerated interest in upcycled raw materials and renewable energy integration, driving pilot projects that couple extrusion lines with solar or biomass power sources. Simultaneously, digitalization initiatives such as Industry 4.0 platforms are enabling real-time process monitoring and predictive maintenance, reducing downtime and optimizing throughput.

In addition, transparency and provenance have become critical differentiators. Blockchain-based traceability solutions are gaining traction, ensuring ingredient origins are verifiable from farm to bowl. This trend aligns with heightened consumer demand for ethically sourced proteins, particularly in grain-free formats, and supports claims around sustainability and animal welfare. Lastly, the COVID-19 pandemic’s legacy continues to influence supply chain resilience strategies, prompting a diversification of ingredient suppliers and a shift toward nearershore sourcing. Taken together, these dynamics underscore a market in flux, driven by the confluence of environmental stewardship, digital transformation, and supply chain agility.

Analyzing the Complex Competitive and Operational Consequences of the 2025 United States Tariff Adjustments on Pet Food Extrusion

In early 2025, the United States enacted revised tariff schedules targeting imported pet food ingredients and specialized extrusion machinery. These adjustments include increased duties on select cereal grains, novel protein isolates such as insect and pea proteins, and high-value extruder components from overseas suppliers. As a result, manufacturers reliant on imported inputs have faced margin pressures and rising input costs. In response, several leading producers have accelerated vertical integration initiatives or sought domestic alternative suppliers to circumvent heightened costs.

Moreover, the ripple effects extend beyond raw materials to capital expenditure planning. Projects slated for single-screw line expansions have been deferred or modified to include domestically manufactured components, even when this entails longer lead times or higher base equipment prices. Importantly, the tariff impact remains uneven across ingredient categories, with grain-based formulations experiencing moderate cost escalation while premium grain-free recipes have seen sharper increases due to their reliance on niche proteins. This cumulative tariff burden underscores the importance of scenario planning and cost-pass-through strategies within contractual arrangements. Ultimately, businesses that proactively adapt sourcing and production footprints will be best positioned to mitigate the long-term effects of these policy changes.

Deep Dive into Ingredient Product Animal Technology and Distribution Segmentation Reveals Strategic Imperatives for Pet Food Extrusion Growth

Insights into ingredient type segmentation reveal that grain-based formulas maintain strong footholds owing to their familiarity, cost-effectiveness, and diverse carbohydrate sources such as corn, rice, and wheat. However, the grain-free category is gaining momentum as consumers seek novel protein sources. Insect protein, pea protein, and potato protein have emerged as viable alternatives, each bringing unique functional and nutritional characteristics to extruded diets. For example, insect protein delivers high digestibility and favorable amino acid profiles, whereas pea protein offers allergen-free appeal.

Turning to product type, dry food remains the dominant application for extrusion technology due to its long shelf life and streamlined logistics. Nonetheless, there is a growing niche for extruded treats that incorporate textures and flavors tailored to training and enrichment segments. Wet food extrusion, although technically more complex, is undergoing experimentation with dual-extrusion lines that can combine moist fillings with crispy outer layers, enhancing palatability and consumer engagement.

Exploring animal type segmentation, dogs represent the largest volume segment given their broader dietary versatility, yet cat owners are increasingly drawn to specialized extruded formulas designed to meet feline-specific nutritional requirements. This shift has spurred R&D into kibble size, hardness, and flavor profiles that cater to feline preferences.

From a technology standpoint, single-screw extruders remain widespread for their simplicity and ease of maintenance, with belt drive and direct drive variants each offering trade-offs in terms of throughput and energy efficiency. However, co-rotating twin-screw extruders, prized for their superior mixing capabilities and adaptability to high-protein formulations, are gaining traction, particularly in premium segments. Counter-rotating twin-screw systems, while less common, serve specialized applications requiring gentle ingredient handling.

Finally, distribution channels are evolving as online retailers capitalize on subscription models and direct-to-consumer innovations. Pet specialty stores continue to serve as hubs for premium and personalized nutrition solutions, while supermarket and hypermarket channels leverage scale and private-label offerings. Each channel presents distinct opportunities and challenges in terms of inventory management, brand positioning, and consumer engagement.

This comprehensive research report categorizes the Pet Food Extrusion market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ingredient Type

- Product Type

- Animal Type

- Extrusion Technology

- Distribution Channel

Uncovering the Diverse Regional Drivers and Regulatory Environments Shaping Pet Food Extrusion Trends Across the Globe

Regional dynamics in the Americas reflect a mature market landscape characterized by established supply chains and a broad base of both global and regional extruded pet food brands. In North America specifically, a heightened focus on sustainability and sourcing transparency has spurred investments in domestic ingredient partnerships and eco-friendly packaging innovations. Latin American markets, while more price-sensitive, are benefiting from low-cost grain supplies and expanding middle-class pet ownership, presenting opportunities for volume growth in grain-based extruded feeds.

In Europe, Middle East, & Africa, regulatory frameworks around animal nutrition and feed safety are among the strictest globally, driving high barriers to entry and incentivizing advanced extrusion equipment adoption to meet stringent quality standards. Premium pet food categories are flourishing in Western Europe, with consumers willing to pay a premium for functional health claims. Conversely, emerging markets within the region, such as parts of the Middle East and Africa, are in the nascent stages of premiumization, relying predominantly on cost-driven grain-based formulations while gradually adopting grain-free alternatives as incomes rise.

Across Asia-Pacific, rapid urbanization, rising disposable incomes, and growing awareness of pet health are accelerating demand for specialized extruded diets. China, Japan, and Australia lead this surge, with local manufacturers partnering with technology providers to scale twin-screw extrusion lines. Southeast Asian nations are also witnessing steady growth, supported by government initiatives to modernize agricultural supply chains and improve ingredient traceability. Collectively, these regional insights highlight the necessity for tailored strategies that account for regulatory environments, consumer preferences, and supply chain capabilities.

This comprehensive research report examines key regions that drive the evolution of the Pet Food Extrusion market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Industry Leaders and Specialized Innovators Are Collaborating and Competing to Advance Pet Food Extrusion Technology

The competitive landscape of pet food extrusion features both multinational corporations and agile regional specialists. Global agribusiness firms leverage expansive R&D resources to pioneer extrusion innovations and ingredient development partnerships. Their broad portfolios span grain-based and novel protein lines, supported by robust supply chain networks that enable rapid scaling of new product launches.

Meanwhile, specialized extrusion equipment manufacturers are forging deeper collaborations with lead users to co-develop next-generation extruder configurations designed for enhanced energy efficiency and modular scalability. These partnerships often extend to joint trial facilities, allowing pet food producers to pilot novel recipes under real-world conditions.

Regional players, particularly in emerging markets, differentiate themselves through localized ingredient sourcing and swift response to domestic regulatory changes. Their lean organizational structures and focused product lines facilitate quick turnarounds on market feedback, enabling them to capture niche segments such as insect-protein treats and wet food innovations. As a result, larger multinationals are increasingly monitoring local startups for acquisition or joint-venture opportunities, underscoring the strategic importance of agility and innovation in this space.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pet Food Extrusion market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anderson International

- Baker Perkins

- Blue Buffalo

- Bühler Group

- Clextral

- Coperion

- Diamond Pet Foods

- General Mills

- Hill's Pet Nutrition

- JM Smucker Company

- Mars Incorporated

- Nestlé Purina PetCare

- Nisshin Pet Food

- Partner in Pet Food

- Schell & Kampeter

- Tiernahrung Deuerer

- Total Alimentos

- Unicharm Corporation

- WellPet

- Wenger Manufacturing

Strategic Pathways for Leaders to Embed Sustainability Digitalization and Consumer Intelligence into Pet Food Extrusion Operations

Industry leaders must prioritize the integration of sustainable practices throughout the extrusion value chain, beginning with a comprehensive review of ingredient sourcing and energy usage. By establishing cross-functional teams that include procurement, manufacturing, and R&D, organizations can identify opportunities to incorporate upcycled materials and renewable energy without sacrificing product quality.

Furthermore, embracing digital transformation should extend beyond isolated pilot projects. Executives can drive greater impact by embedding predictive analytics into maintenance schedules, process controls, and supply chain forecasting. These capabilities enhance operational resilience and free up capital for strategic investments in premium grain-free and functional ingredient lines.

In addition, companies should adopt a consumer-centric approach to product development by leveraging data from direct channels to refine extruded formats. Tailoring kibble texture, size, and nutrient profiles based on real-time feedback will deepen brand loyalty and unlock opportunities in premium segments. Finally, proactive engagement with policymakers and industry associations can ensure that tariff scenarios and regulatory evolutions are anticipated well in advance, enabling smoother adaptation to policy shifts.

Detailing the Rigorous Mixed Method Research Framework Employed to Uncover Technical Operational and Market Intelligence in Pet Food Extrusion

This research employed a multi-pronged approach rooted in primary and secondary data collection. Primary insights were garnered through structured interviews with equipment manufacturers, ingredient suppliers, and senior R&D executives at leading pet food companies. In addition, technical site visits to extrusion facilities provided first-hand observations of process parameters, equipment setups, and quality assurance protocols.

Secondary research included exhaustive reviews of industry publications, peer-reviewed journals on food processing technologies, and regulatory filings pertaining to feed safety standards. Trade association reports and patent databases were also analyzed to map the competitive landscape of extrusion innovations. Quantitative data on ingredient import and tariff schedules were sourced from public trade databases, ensuring accuracy in the assessment of policy impacts.

Finally, the research team synthesized these insights through a triangulation process, cross-validating qualitative feedback with quantitative data to construct a holistic view of the market. This methodology underpins the strategic conclusions and recommendations presented herein, offering stakeholders a robust foundation for informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pet Food Extrusion market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pet Food Extrusion Market, by Ingredient Type

- Pet Food Extrusion Market, by Product Type

- Pet Food Extrusion Market, by Animal Type

- Pet Food Extrusion Market, by Extrusion Technology

- Pet Food Extrusion Market, by Distribution Channel

- Pet Food Extrusion Market, by Region

- Pet Food Extrusion Market, by Group

- Pet Food Extrusion Market, by Country

- United States Pet Food Extrusion Market

- China Pet Food Extrusion Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Core Insights on Technological Innovation Sustainability and Consumer Evolution to Define the Future of Pet Food Extrusion

In conclusion, the pet food extrusion sector stands at a pivotal juncture where technological innovation, sustainability imperatives, and evolving consumer expectations converge. As premiumization accelerates and novel protein sources gain acceptance, manufacturers must balance complexity and cost through agile sourcing strategies and advanced process controls. Concurrently, the 2025 tariff adjustments underscore the necessity of proactive policy engagement and adaptive supply chain design.

Across segments and regions, opportunities abound for firms that can seamlessly integrate digital transformation with purpose-driven product development. Whether scaling twin-screw extruders for high-protein formulas or leveraging blockchain for end-to-end traceability, the path forward hinges on collaboration between R&D, operations, and commercial teams. Ultimately, those organizations that embrace holistic sustainability frameworks, invest in consumer insights, and refine their extrusion capabilities will emerge as market leaders in a landscape defined by rapid change and heightened expectations.

Unlock Comprehensive Insights on Pet Food Extrusion Markets and Transform Your Strategic Roadmap by Connecting with Our Sales and Marketing Leadership

For a detailed understanding of how evolving extrusion technologies and shifting tariff landscapes will impact your organization’s competitive positioning, contact Ketan Rohom, Associate Director of Sales & Marketing, to access the full market research report and unlock tailored strategic guidance.

- How big is the Pet Food Extrusion Market?

- What is the Pet Food Extrusion Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?