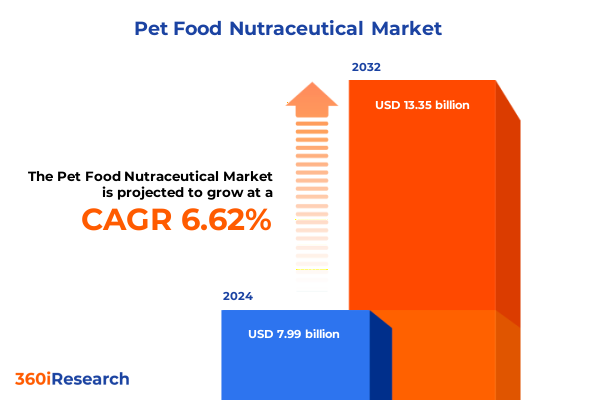

The Pet Food Nutraceutical Market size was estimated at USD 8.41 billion in 2025 and expected to reach USD 8.86 billion in 2026, at a CAGR of 6.82% to reach USD 13.35 billion by 2032.

How Rising Pet Wellness Priorities And Cutting Edge Nutraceutical Innovations Are Shaping The Evolving Landscape Of Functional Pet Food Products

The pet nutraceutical food sector has evolved into a critical frontier where the intersection of animal health, preventive care, and high-value nutrition creates unprecedented opportunities. Rising pet ownership rates, coupled with a growing humanization of animal companions, have elevated expectations for specialized dietary solutions that extend beyond basic nutrition. Pet guardians now seek functional foods enriched with vitamins, minerals, and bioactive compounds to support longevity and quality of life for their cats and dogs. This shift reflects a broader wellness movement in which proactive health management resonates across both human and animal populations.

In response to these developments, manufacturers and ingredient suppliers are intensifying their efforts in product innovation and scientific validation. Advanced delivery formats are emerging to ensure palatability, stability, and bioavailability of key nutrients, bridging the gap between clinical efficacy and consumer convenience. At the same time, regulatory agencies in major markets are refining guidelines for claims substantiation and labeling transparency, compelling industry participants to invest in rigorous research and compliance. As a result, the sector is witnessing a dynamic blend of technological advancement, shifting consumer expectations, and regulatory scrutiny that together define today’s pet nutraceutical landscape.

Understanding How The Digital Revolution And Demand For Transparency Are Fueling Transformative Evolutions In Pet Nutraceutical Food Formulation And Delivery

Digital transformation has redefined how pet owners discover and purchase nutraceutical products, creating an omnichannel environment that blends e-commerce platforms, telehealth consultations, and direct-to-consumer models. As consumers demand greater transparency, traceability, and personalized recommendations, brands are leveraging data analytics and digital diagnostics to tailor supplement regimens based on individual pet health profiles. This level of customization mirrors trends in human nutraceuticals and underscores the importance of integrated platforms that capture behavioral insights, dietary patterns, and veterinary feedback.

Meanwhile, sustainability imperatives are reshaping ingredient sourcing and packaging strategies. Ethical protein alternatives, such as insect-derived nutrients and plant-based analogues, are gaining traction among eco-savvy consumers seeking lower environmental impact options. Packaging innovations focus on recyclability and reduced material use without compromising product integrity, reinforcing brand commitments to social responsibility. Transitioning seamlessly from traditional supply chains to circular models requires strategic partnerships across the value chain, making collaboration a key driver of transformative change in the pet nutraceutical space.

Examining The Broad Impact Of 2025 United States Tariffs On Ingredient Sourcing Supply Chains And Cost Structures Within The Pet Nutraceutical Food Market

In early 2025, the United States implemented a new schedule of tariffs targeting a range of imported raw materials and botanical extracts commonly used in pet nutraceutical formulas. These levies have applied upward pressure on costs for key ingredients such as fish oil concentrates, exotic plant antioxidants, and specialized probiotic strains. The immediate consequence has been a recalibration of supplier relationships, with several manufacturers pivoting toward domestic sourcing arrangements and local cultivators to mitigate import exposure.

Over time, the reverberations of these tariffs have triggered broader adjustments across the supply chain. Ingredient distributors have consolidated offerings to optimize logistics and negotiate volume discounts, while some end-use brands have reformulated product lines to incorporate tariff-exempt or lower-duty substitutes. Concurrently, strategic nearshoring initiatives have emerged as a vital risk-management approach, aligning procurement strategies with evolving trade policies. These cumulative measures illustrate how regulatory shifts can catalyze operational resilience and supply chain agility within the pet nutraceutical industry.

Exploring How Product Formats Pet Types Ingredient Categories Age Groups Sales Channels And Applications Uncover Opportunities In Nutraceutical Pet Food

Nutraceutical pet food manufacturers are honing product development strategies by evaluating consumption patterns across various delivery mediums. Liquid formats appeal to pet guardians seeking dosage flexibility and rapid absorption, whereas powder formulations enable customizable blends that integrate seamlessly with existing diets. Meanwhile, soft chews capitalize on the demand for palatable, treat-like applications, and tablet or pill presentations remain integral for precision dosing and veterinary prescription models.

Equally important is the distinction between cat and dog markets, each characterized by unique physiological requirements and taste preferences. Brands tailor ingredient portfolios to satisfy species-specific health goals, deploying targeted blends that address feline susceptibility to urinary issues and canine predisposition toward joint and digestive wellness. Ingredient innovation spans multiple categories, from antioxidants that counteract oxidative stress to minerals that support skeletal health, Omega-3 fatty acids renowned for anti-inflammatory benefits, probiotics that promote gut balance, and essential vitamins that reinforce overall vitality.

Age segmentation further refines product positioning, highlighting formulations designed to meet the metabolic demands of adult animals, the growth needs of puppies and kittens, and the mobility concerns of senior pets. Distribution channels play a pivotal role in accessibility, with clinics and pharmacies offering professional endorsements, online retail platforms-both general e-commerce outlets and pet-specific sites-delivering convenience, and pet specialty stores-encompassing both chain and independent retailers-providing curated assortments. Supermarkets and hypermarkets complement the landscape by integrating wellness supplements into mass-market offerings. Beyond channel considerations, application-focused positioning in areas such as dental health, digestive support, immune enhancement, joint mobility, skin and coat condition, and weight management underscores the multifunctional appeal of nutraceutical solutions.

This comprehensive research report categorizes the Pet Food Nutraceutical market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Pet Type

- Ingredient Type

- Age Group

- Sales Channel

- Application

Regional Dynamics Showing How The Americas Europe Middle East Africa And Asia Pacific Are Driving Pet Nutraceutical Food Trends And Growth

Regional variations continue to shape strategic priorities for industry participants. In the Americas, premiumization remains a dominant theme, as discerning consumers invest in high-quality, science-backed products that emphasize transparency and traceability. Brands that articulate clear sourcing narratives and support third-party certifications gain competitive advantage in establishing trust among pet communities seeking optimal wellness outcomes.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts are fostering an environment in which unified labeling standards and safety evaluations streamline market entry. Manufacturers in EMEA are capitalizing on robust veterinary networks and emerging digital health platforms to educate pet owners on the benefits of functional nutrition, thereby driving incremental adoption of nutraceutical supplements.

Meanwhile, the Asia-Pacific region is experiencing rapid growth fueled by rising disposable incomes, expanding pet ownership rates, and the proliferation of e-commerce infrastructure. Local brands are innovating by blending traditional herbal remedies with modern delivery formats, while global players are forging partnerships to address demand for both established and emerging wellness applications. The confluence of cultural preferences, digital engagement, and evolving regulatory frameworks positions APAC as a dynamic cornerstone of global market expansion.

This comprehensive research report examines key regions that drive the evolution of the Pet Food Nutraceutical market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industry Players Strategic Partnerships And Product Innovations That Are Defining Competitive Advantage In The Pet Nutraceutical Food Arena

Leading players in the pet nutraceutical arena are distinguished by their commitment to research-driven product pipelines and strategic collaborations that amplify market presence. One global pet care conglomerate has established dedicated innovation centers focused on nutrigenomics and tailored supplement development, enabling rapid translation of scientific discoveries into commercial offerings. Another multi-national food and beverage entity has leveraged its distribution network to accelerate penetration of premium pet supplements across diverse retail environments.

Strategic acquisitions and licensing agreements are also reshaping competitive dynamics. Companies are acquiring niche startups with proprietary ingredient technologies, such as next-generation probiotic strains and marine-derived bioactives, to catalyze portfolio diversification. Meanwhile, cross-sector partnerships-encompassing veterinary clinics, digital health startups, and ingredient manufacturers-are facilitating integrated solutions that blend product efficacy with digital monitoring tools. These moves underscore the fact that leadership in the nutraceutical pet food space stems from a synergistic approach uniting innovation, supply chain integration, and collaborative ecosystem engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pet Food Nutraceutical market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company (ADM)

- Blue Buffalo Company, Ltd

- Boehringer Ingelheim International GmbH

- Darling Ingredients Inc.

- Elanco Animal Health Incorporated

- Hill’s Pet Nutrition, Inc.

- INECTA, LLC

- Kemin Industries, Inc.

- Kerry Group PLC

- Mars Petcare

- MIAVIT Stefan Niemeyer GmbH

- Nestlé S.A.

- Nutramax Laboratories Veterinary Sciences, Inc.

- Purina Pro Plan Veterinary Diets

- Rain Nutrience Ltd.

- Roquette Frères

- Royal Canin SAS

- Symrise AG

- Virbac S.A.

- WellPet LLC

Strategic Recommendations For Industry Leaders To Leverage Nutraceutical Trends Enhance Supply Chains And Strengthen Market Position In The Pet Food Landscape

To capitalize on emerging trends, decision-makers should prioritize investment in research initiatives that explore alternative protein sources and sustainable ingredient pathways. Strengthening alliances with ingredient innovators can unlock access to novel bioactive compounds and differentiate product offerings. At the same time, companies must enhance their digital engagement capabilities by deploying advanced analytics platforms that deliver personalized nutrition recommendations based on individual pet health data.

Optimizing supply chain resilience remains essential in light of evolving trade policies. Industry stakeholders should diversify sourcing portfolios, engage in nearshoring partnerships, and explore tariff-exempt ingredient categories to mitigate cost volatility. In parallel, tightening collaboration with veterinary professionals through continuing education programs and co-development projects will foster product credibility and drive professional endorsement. Finally, commitment to eco-friendly packaging design and transparent sustainability reporting will resonate with environmentally conscious consumers and reinforce brand integrity throughout the value chain.

Defining The Rigorous Research Approach Combining Primary Interviews Comprehensive Secondary Sources And Robust Data Triangulation Methods For In Depth Analysis

This analysis synthesizes insights drawn from a dual-track research framework. Quantitative data was collected through targeted surveys of veterinarians, pet owners, and retail distributors, ensuring a comprehensive understanding of consumption behaviors and purchasing motivations. Complementing this, in-depth interviews with ingredient suppliers, regulatory experts, and R&D leaders provided qualitative context around formulation challenges, compliance considerations, and technology adoption.

The secondary research phase entailed a rigorous review of peer-reviewed scientific literature, patent filings, and regulatory filings to validate ingredient efficacy claims and trace historical tariff developments. Market intelligence platforms and company disclosures offered supplemental data on product launches, M&A activity, and strategic partnerships. Throughout the process, data triangulation techniques were applied to reconcile disparate sources, strengthen reliability, and surface critical market themes that inform the strategic imperatives outlined in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pet Food Nutraceutical market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pet Food Nutraceutical Market, by Product Type

- Pet Food Nutraceutical Market, by Pet Type

- Pet Food Nutraceutical Market, by Ingredient Type

- Pet Food Nutraceutical Market, by Age Group

- Pet Food Nutraceutical Market, by Sales Channel

- Pet Food Nutraceutical Market, by Application

- Pet Food Nutraceutical Market, by Region

- Pet Food Nutraceutical Market, by Group

- Pet Food Nutraceutical Market, by Country

- United States Pet Food Nutraceutical Market

- China Pet Food Nutraceutical Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Summarizing Core Insights And The Path Forward Highlighting Key Drivers Innovations And Strategic Imperatives Within The Pet Nutraceutical Food Ecosystem

The pet nutraceutical food market stands at an inflection point, where escalating consumer demand for health-focused formulations converges with technological innovation and supply chain realignment. Key drivers include the maturation of digital channels, heightened regulatory scrutiny, and proactive tariff mitigation strategies that collectively influence cost dynamics and market accessibility. Segmentation insights highlight the importance of tailored solutions across product formats, species, life stages, and applications, while regional analyses underscore nuanced growth drivers in the Americas, EMEA, and APAC regions.

Industry leaders who embrace strategic collaboration, invest in science-backed ingredient innovation, and refine their digital engagement models will secure competitive advantage. Moreover, resilience in sourcing and packaging sustainability will determine long-term brand equity in an increasingly conscientious marketplace. As the sector continues to evolve, participants must remain agile in responding to policy shifts, consumer expectations, and emerging wellness paradigms to shape the future of pet health and nutrition.

Engage With Ketan Rohom To Unlock Comprehensive Pet Nutraceutical Market Intelligence And Drive Strategic Decisions With A Tailored Research Report Purchase Offer

To access detailed competitive landscapes and uncover nuanced consumer behaviors shaping the pet food nutraceutical market, reach out to Ketan Rohom, whose expertise in sales and marketing ensures tailored guidance and personalized support throughout your purchasing journey. Engage directly to explore customized package options, discuss how the insights align with your strategic needs, and secure prompt delivery of the market research report designed to inform pivotal business decisions and drive growth.

- How big is the Pet Food Nutraceutical Market?

- What is the Pet Food Nutraceutical Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?