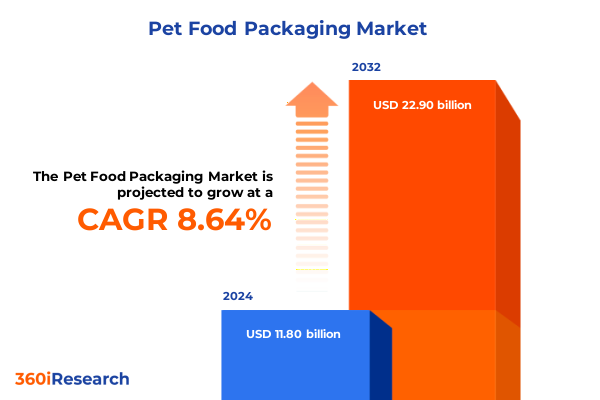

The Pet Food Packaging Market size was estimated at USD 12.60 billion in 2025 and expected to reach USD 13.47 billion in 2026, at a CAGR of 8.89% to reach USD 22.90 billion by 2032.

Discover How Evolving Consumer Expectations and Technological Innovations Are Redefining Pet Food Packaging to Enhance Brand Value and Drive Sustainability

The pet food packaging arena is experiencing unprecedented momentum as pet humanization accelerates consumer demand for higher quality, more nutritious products. Pet owners increasingly view their animal companions as family members, driving the need for packaging that not only preserves product integrity but also reinforces brand commitment to health, sustainability, and transparency. Concurrently, environmental stewardship has emerged as a core purchasing criterion, with eco-conscious materials and circular design principles shaping product differentiation and fostering long-term brand loyalty.

As busy lifestyles demand convenience, packaging formats have evolved to deliver resealable, portion-controlled, and lightweight solutions that ensure freshness and ease of use. These functional enhancements are complemented by digital engagement features such as QR codes and NFC tags, which offer access to nutritional information, feeding recommendations, and loyalty programs, transforming packaging into an interactive brand touchpoint. The convergence of these factors underscores packaging’s pivotal role as both a protective vessel and a strategic marketing asset, setting the stage for the comprehensive exploration that follows.

Uncover the Transformative Shifts in Sustainability, Convenience, and Digitalization That Are Driving the Next Wave of Pet Food Packaging Evolution

In the past year, sustainability has shifted from a voluntary brand initiative to an industry imperative, with leading manufacturers adopting recyclable mono-materials and bio-based alternatives to meet stringent regulatory standards and consumer expectations. This pivot toward green packaging is driving investments in advanced material science and life-cycle assessment tools, enabling companies to substantiate environmental claims and demonstrate genuine progress toward zero-waste objectives. These developments mark a fundamental transformation in value chain dynamics, as suppliers and converters collaborate to ensure seamless integration of recyclable solutions into existing production lines.

Simultaneously, digitalization is redefining packaging’s function, integrating smart technologies that enhance traceability, engage consumers, and optimize supply chain efficiency. Freshness indicators, interactive labels, and digital loyalty platforms are now standard expectations rather than novel concepts. This digital shift is complemented by innovative packaging structures-such as stand-up pouches with pinch-bottom stability and multi-layer laminates-that balance barrier performance with lightweight convenience. These converging trends underscore a holistic transformation in the pet food packaging landscape, blending environmental responsibility with technological sophistication.

Analyze the Cumulative Impact of the 2025 United States Import Tariffs on Packaging Materials and Their Implications for Pet Food Supply Chains

The 2025 United States tariff regime has introduced multiple layers of import duties that directly affect packaging materials vital to the pet food sector. Under the IEEPA framework, imports from China were initially subject to a 10% ad valorem rate, later increased to 20% on March 4, while goods from Canada and Mexico faced 25% duties effective March 4 due to deferred implementation dates. Concurrently, Section 232 tariffs reinstated a 25% levy on steel and aluminum imports as of March 3, raising costs for metal closures, aerosol cans, and related metal packaging components.

In early April, a baseline 10% reciprocal tariff came into effect for nearly all imported goods, with country-specific surcharges rolled back to this level after a temporary escalation period. Notably, a high-profile U.S.-China agreement on May 12 suspended 24 percentage points of additional duties, reducing reciprocal U.S. tariffs on Chinese imports to 30% for an initial 90-day window and signaling potential relief for supply chains, albeit amid continuing uncertainty over long-term arrangements. These cumulative measures have compelled pet food manufacturers and packaging suppliers to intensify cost mitigation strategies and diversify sourcing channels to preserve margin stability.

Gain Deep Insights into Key Market Segmentation Based on Material, Type, Format, Technology, Animal Demographics, and Sales Channels Shaping Packaging Strategies

The pet food packaging market’s complexity can be better understood through multiple thematic lenses. Packaging material preferences are distinguished across glass, metal, paper and paperboard-including corrugated board and paperboard boxes-and various plastic formulations, each selected for barrier properties, weight considerations, and recyclability objectives. In parallel, the relative adoption of flexible, rigid, and semi-rigid structural formats underscores the need for tailored consumer experiences and logistical efficiencies. Packaging formats span an array of shapes and sizes-from bags and bottles to pouches, trays, tubs, and cans-where product type, shelf presentation, and distribution modality dictate design choices.

Advances in packaging technology further segment the market, with active, aseptic, modified atmosphere, and vacuum packaging innovations extending freshness and safety parameters. Equally important is the categorization by animal type-encompassing birds, cats, dogs, fish & aquatic species, reptiles, and small animals-which informs portion size, moisture requirements, and barrier specifications. Finally, distribution channels ranging from convenience outlets and hypermarkets to online platforms, specialty pet stores, and veterinary clinics influence packaging robustness, label compliance, and consumer engagement strategies.

This comprehensive research report categorizes the Pet Food Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Material

- Packaging Type

- Packaging Format

- Packaging Technology

- Animal Type

- Sales Channel

Explore Regional Dynamics in the Pet Food Packaging Market Highlighting Unique Trends in the Americas, Europe Middle East & Africa, and Asia-Pacific Territories

Regional dynamics play a pivotal role in shaping packaging innovation and adoption. The Americas command a leading share of global activity, bolstered by robust pet ownership and premiumization trends that drive demand for high-performance flexible pouches and resealable bags. North America alone accounts for over 40% of market engagement, with sustainability initiatives propelling paper-based and mono-polyethylene solutions into mainstream use. E-commerce penetration in the region further catalyzes investment in protective, lightweight structures suited for parcel delivery.

In the Europe, Middle East & Africa cluster, regulatory stringency and environmental consciousness are paramount, leading to a 25% market presence that favors recyclable paperboard and mono-material pouches. Notably, directives such as the Packaging and Packaging Waste Regulation drive innovation in bio-based and compostable films, while consumer preference for transparency underpins growth in clear, informative packaging formats. Meanwhile, Asia-Pacific-representing over 30% of global market growth-benefits from rising disposable incomes, urbanization, and digital-first retail channels. Rapid pet adoption in China and India fuels demand for cost-effective yet premium-appearing packaging, with local converters advancing barrier-coated mono-material films to satisfy both performance and sustainability goals.

This comprehensive research report examines key regions that drive the evolution of the Pet Food Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examine Key Industry Players Driving Innovation Through Strategic Acquisitions, Sustainable R&D Initiatives, and Value Chain Collaborations in Pet Food Packaging

Industry leaders are investing heavily in strategic consolidation and sustainable innovation to maintain competitive advantage. Amcor’s landmark all-stock acquisition of Berry Global for $8.4 billion in late 2024 has created a combined enterprise with $24 billion in annual revenue and a commitment to inject $180 million annually into sustainable packaging research and development, targeting recyclable and reusable solutions by 2025. This consolidation is enabling accelerated rollout of mono-material films designed for curbside recyclability and advanced barrier performance.

Mondi has similarly strengthened its footprint through targeted partnerships, exemplified by its June 2025 collaboration with Saga Nutrition to launch recyclable re/cycle FlexiBag mono-material packaging for dry pet food. This high-barrier pouch, compliant with CEFLEX guidelines, reflects Mondi’s broader investment in scalable circular solutions and underscores the importance of private-sector alliances in driving systemic sustainability shifts. Elsewhere, Berry Global’s recognition for certified-circular plastic innovations-highlighted by a Gold Award for sustainability with Hill’s Pet Nutrition-demonstrates how advanced recycling technologies are being commercialized to meet rising consumer and regulatory demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pet Food Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor plc

- Berry Global Group, Inc.

- Crown Holdings, Inc.

- DS Smith plc

- Huhtamaki Oyj

- Mondi plc

- Sealed Air Corporation

- Smurfit Kappa Group plc

- Sonoco Products Company

- Winpak Ltd.

Implement Actionable Strategies for Industry Leaders to Navigate Regulatory Challenges, Optimize Packaging Solutions, and Strengthen Supply Chain Resilience

To navigate the evolving regulatory and market landscape, industry leaders should prioritize the integration of recyclable mono-material packaging formats that meet or exceed circularity benchmarks. Embracing life-cycle assessment tools and certifications can substantiate sustainability claims and reduce exposure to future policy risks affecting multi-layer laminates. Additionally, integrating smart packaging features-such as freshness indicators and interactive digital interfaces-can deepen consumer engagement and reinforce brand differentiation in crowded retail environments.

Supply chain resilience must be bolstered through diversified sourcing strategies that balance domestic and global material procurement, mitigating tariff-related cost pressures and logistical disruptions. Collaborating with strategic partners to localize production and foster transparent raw-material traceability will further strengthen operational agility. Finally, aligning packaging formats to regional nuances-ranging from e-commerce-focused pouch designs in Asia-Pacific to paperboard solutions compliant with EMEA waste directives-will optimize market penetration and consumer resonance.

Understand the Rigorous Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Robust Validation Techniques That Underpin This Report

This report’s findings are underpinned by a rigorous mixed-methods research framework. Primary data was collected through targeted interviews with senior executives, R&D leaders, and supply chain specialists across leading packaging firms and pet food brands. These insights were complemented by quantitative surveys administered to distributors, retailers, and consumers to capture breadth and depth of market preferences.

Secondary research incorporated industry publications, trade association data, and regulatory filings to contextualize macroeconomic and policy drivers. A bottom-up approach was leveraged to assess segment-level dynamics, triangulating findings against company disclosures, import-export statistics, and patent filings. Validation exercises, including expert panel workshops and iterative peer reviews, ensured the robustness and relevance of the conclusions presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pet Food Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pet Food Packaging Market, by Packaging Material

- Pet Food Packaging Market, by Packaging Type

- Pet Food Packaging Market, by Packaging Format

- Pet Food Packaging Market, by Packaging Technology

- Pet Food Packaging Market, by Animal Type

- Pet Food Packaging Market, by Sales Channel

- Pet Food Packaging Market, by Region

- Pet Food Packaging Market, by Group

- Pet Food Packaging Market, by Country

- United States Pet Food Packaging Market

- China Pet Food Packaging Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesize Core Findings on Pet Food Packaging Trends to Provide a Cohesive Perspective That Guides Strategic Decision-Making in the Evolving Market

In summary, the pet food packaging sector stands at the nexus of sustainability, technological innovation, and consumer-centric design. The convergence of circular economy imperatives, smart packaging capabilities, and dynamic regulatory environments is reshaping value chains and brand strategies. As tariffs introduce new cost considerations, strategic supply chain planning and materials innovation emerge as critical levers for maintaining competitiveness.

Looking ahead, the successful brands will be those that seamlessly integrate eco-friendly materials, embrace digital engagement, and tailor solutions to regional market dynamics. This report offers the actionable intelligence needed to anticipate shifts, optimize packaging portfolios, and drive transformative growth in the pet food industry.

Take Immediate Action on Transformative Packaging Insights by Contacting Associate Director of Sales & Marketing Ketan Rohom to Secure Your Comprehensive Market Research Report

To unlock the full depth of our market research insights, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, who can guide you through tailored solutions and answer any questions on report customization. Secure your organization’s competitive edge today by engaging with an expert who understands the intricacies of the pet food packaging landscape. Let Ketan connect you with the comprehensive data, actionable analysis, and strategic guidance necessary to drive innovation and growth in your business.

- How big is the Pet Food Packaging Market?

- What is the Pet Food Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?