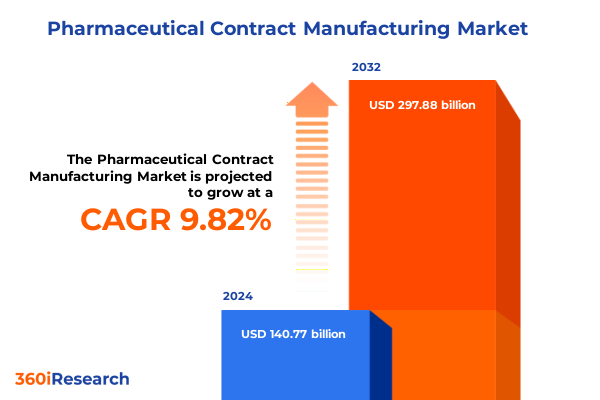

The Pharmaceutical Contract Manufacturing Market size was estimated at USD 152.27 billion in 2025 and expected to reach USD 164.71 billion in 2026, at a CAGR of 10.06% to reach USD 297.88 billion by 2032.

Comprehensive exploration of the strategic evolution and core role of contract manufacturing in the modern pharmaceutical industry’s innovation framework

The pharmaceutical contract manufacturing landscape has undergone a profound transformation over the past decade, evolving from a cost–containment measure into a cornerstone of strategic innovation and capacity optimization. Leading pharmaceutical companies have increasingly partnered with specialized contract development and manufacturing organizations (CDMOs) to streamline their operations, leveraging outsourced services to accelerate product pipelines while mitigating capital expenditures and regulatory complexities. This shift reflects a broader industry imperative to decouple manufacturing from core research functions, enabling biopharma firms to focus on discovery and commercialization while entrusting sophisticated production processes to expert service providers.

Insightful analysis of technological breakthroughs, sustainability mandates, and supply chain resilience reshaping the contract manufacturing landscape worldwide

In recent years, advanced digitalization and AI-driven process engineering have redefined how CDMOs approach quality control, process scale–up, and regulatory compliance. Tools such as digital twins and predictive analytics now enable organizations to model entire production workflows in silico, identifying process bottlenecks and deviations long before physical batches are produced, reducing development timelines by significant margins and minimizing costly reworks. Concurrently, continuous manufacturing technologies are shifting the industry away from traditional batch processes, delivering higher throughput, improved consistency, and leaner material usage-capabilities that align with regulatory agencies’ growing preference for real–time quality assurance.

In-depth review of how new U.S. tariff policies in 2025 are influencing pharmaceutical supply chains, reshoring trends, and global production strategies

The uncertainty surrounding proposed United States tariff policies in 2025 has catalyzed a wave of strategic reshoring and domestic capacity expansion by global pharmaceutical firms. Major companies have publicly committed to record investment packages in U.S. manufacturing, a direct response to potential import duties aimed at reducing eastern dependency-an approach dubbed the TOFU strategy by industry commentators. Leading CDMOs and innovators are actively reconfiguring global supply chains to mitigate tariff exposures, prioritizing facilities in the Americas while maintaining diverse international footprints to ensure cost competitiveness and supply security.

Deep dive into pivotal market segmentation insights spanning service portfolios, molecule types, dosage categories, customer segments, and process models

A nuanced understanding of market segmentation reveals critical inflection points for service optimization and client engagement. Within service portfolios, demand for advanced analytical capabilities-such as stability studies and bioanalytical method development-has surged alongside the complexity of next–generation therapies. Simultaneously, formulation and process development services are evolving to integrate continuous chemistry and high–potency handling, while fill–finish expertise across syringes, vials, and unit–dose formats continues to underpin commercial supply chain agility. Differentiation between biologics and small molecule programs has also intensified, as CDMOs invest in specialized cell culture and fermentation technologies to support monoclonal antibodies and emerging modalities alongside traditional oral solids and parenteral dosage forms.

This comprehensive research report categorizes the Pharmaceutical Contract Manufacturing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Molecule Type

- Dosage Form

- Therapeutic Area

- Contract Type

- Production Scale

- Process Type

Comprehensive exploration of regional market dynamics and drivers across the Americas, EMEA, and Asia-Pacific contract manufacturing environments

Regional dynamics present distinct competitive contours that shape strategic expansion decisions and partnership models. In the Americas, supportive policy frameworks and patient access imperatives have elevated domestic manufacturing to a core tenet of national health security, prompting biotechs and big pharma alike to seek CDMO collaborations that ensure uninterrupted supply for critical therapies. Over in EMEA, harmonized regulatory standards and incentivized green manufacturing initiatives are driving CDMOs to adopt eco–efficient processes and circular–economy practices, positioning European sites as hubs for sustainable production and high–value API synthesis. Meanwhile, the Asia–Pacific region continues to serve as both a cost–effective manufacturing base and an emerging innovation corridor, where local service providers leverage integrated networks and skilled talent pools to deliver competitive offerings in development, clinical manufacturing, and commercial–scale supply.

This comprehensive research report examines key regions that drive the evolution of the Pharmaceutical Contract Manufacturing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insightful summary of leading contract manufacturing organizations’ strategies, partnerships, and innovations driving competitive differentiation in 2025

Leading contract manufacturing organizations are distinguishing themselves through bold strategic realignments, capacity expansions, and integrated service platforms. Lonza’s refocus on its CDMO core, including the acquisition of a large–scale biologics facility in Vacaville, California, exemplifies a deliberate pivot toward high–value modalities and end–to–end solutions, with investments in perfusion bioreactor technologies and dedicated bioconjugation suites set to reinforce its mammalian manufacturing leadership. Catalent’s recent divestiture of its New Jersey oral solids site to Ardena, coupled with planned $45 million investments in U.S. biologics capacity in Wisconsin, underscores an adaptive portfolio strategy aimed at balancing scale with nimble clinical supply services. Thermo Fisher’s acquisition of Sanofi’s Ridgefield, New Jersey, sterile fill–finish facility further amplifies its U.S. footprint, reinforcing a pragmatic approach to tariff risk management and client co–development partnerships. Meanwhile, Fujifilm Diosynth’s multi–billion–dollar investment in large–scale cell culture capacity in North Carolina and Denmark signals a commitment to modular network design and collaborative supply agreements, such as its $3 billion deal with Regeneron, that secure long–term demand and operational agility. Even amid geopolitical friction between the U.S. and China, leading Asian CDMOs are recalibrating their sourcing strategies to mitigate tariff exposures, stockpile critical reagents, and localize key operations to sustain global client service levels.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pharmaceutical Contract Manufacturing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cambrex Corporation

- Catalent, Inc.

- Fujifilm Diosynth Biotechnologies US, LLC

- Lonza Group AG

- PCI Pharma Services, Inc.

- Recipharm AB

- Samsung Biologics Co., Ltd.

- Siegfried Holding AG

- Thermo Fisher Scientific Inc.

- Wuxi AppTec Co., Ltd.

Strategic recommendations for industry leaders to strengthen operational efficiency, supply chain resilience, and leverage emerging manufacturing opportunities

Industry leaders must proactively align their manufacturing strategies with evolving regulatory and market imperatives to future–proof operations. Embracing digital quality platforms and AI–enabled predictive maintenance can significantly reduce downtime and ensure real–time compliance. Investing in continuous manufacturing infrastructure, alongside dual–use batch systems, offers the agility to scale from clinical to commercial volumes while optimizing resource utilization. Cultivating strategic relationships with CDMOs that demonstrate robust ESG credentials will be essential, as environmental performance scores increasingly inform sourcing decisions and long–term contracting. To address talent shortages and safeguard critical knowledge, organizations should develop talent pipelines through targeted partnerships with academic institutions, workforce retraining initiatives, and internal upskilling programs. Lastly, diversifying the manufacturing network across geographies and modality experts will fortify supply chain resilience against tariff fluctuations, geopolitical shifts, and demand surges.

Transparent overview of the research methodology integrating primary and secondary data collection, expert interviews, and rigorous analytical approaches

This report’s methodology integrates rigorous primary and secondary research processes to deliver a holistic market perspective. Primary inputs were gathered through structured interviews with senior executives across leading pharmaceutical companies and CDMOs, complemented by expert roundtables that distilled firsthand insights on operational challenges and strategic priorities. Secondary research encompassed a comprehensive review of company disclosures, regulatory filings, and reputable industry publications to ensure data integrity. Triangulation of quantitative and qualitative inputs, supported by cross–validation with financial reports and official agency guidelines, underpins the report’s analytical framework. The segmentation schema and regional evaluations were further stress–tested through scenario analysis and peer benchmarks, ensuring robustness and relevance for decision–makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pharmaceutical Contract Manufacturing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pharmaceutical Contract Manufacturing Market, by Service Type

- Pharmaceutical Contract Manufacturing Market, by Molecule Type

- Pharmaceutical Contract Manufacturing Market, by Dosage Form

- Pharmaceutical Contract Manufacturing Market, by Therapeutic Area

- Pharmaceutical Contract Manufacturing Market, by Contract Type

- Pharmaceutical Contract Manufacturing Market, by Production Scale

- Pharmaceutical Contract Manufacturing Market, by Process Type

- Pharmaceutical Contract Manufacturing Market, by Region

- Pharmaceutical Contract Manufacturing Market, by Group

- Pharmaceutical Contract Manufacturing Market, by Country

- United States Pharmaceutical Contract Manufacturing Market

- China Pharmaceutical Contract Manufacturing Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2703 ]

Concise concluding perspective highlighting the critical takeaways and future outlook for pharmaceutical contract manufacturing decision-makers

In conclusion, the pharmaceutical contract manufacturing sector stands at the nexus of innovation, strategic realignment, and regulatory transformation. Organizations that strategically embrace technological advancements, ESG imperatives, and diversified capacity networks will be best positioned to navigate the complexities of modern supply chains. By adopting the actionable insights and recommendations presented herein, decision–makers can enhance their competitive posture, accelerate time–to–market, and deliver critical therapies with confidence. As market dynamics continue to evolve, sustained collaboration between sponsors and CDMOs-anchored in transparency, agility, and shared commitment to quality-will drive the next frontier of pharmaceutical manufacturing excellence.

Compelling call-to-action urging engagement with Ketan Rohom to acquire in-depth pharmaceutical contract manufacturing insights for strategic market advantage

To explore the full breadth of insights, expert analysis, and tailored recommendations that can propel your organization’s contract manufacturing strategy ahead of the competition, reach out to Associate Director, Sales & Marketing, Ketan Rohom, and secure your copy of this comprehensive market research report.

By partnering with Ketan Rohom, you will gain direct access to actionable intelligence, exclusive data sets, and personalized guidance designed to inform your strategic decision-making and investment planning. Don’t let critical market trends and emerging opportunities go untouched-engage with our team today to acquire the definitive resource for pharmaceutical contract manufacturing excellence.

- How big is the Pharmaceutical Contract Manufacturing Market?

- What is the Pharmaceutical Contract Manufacturing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?