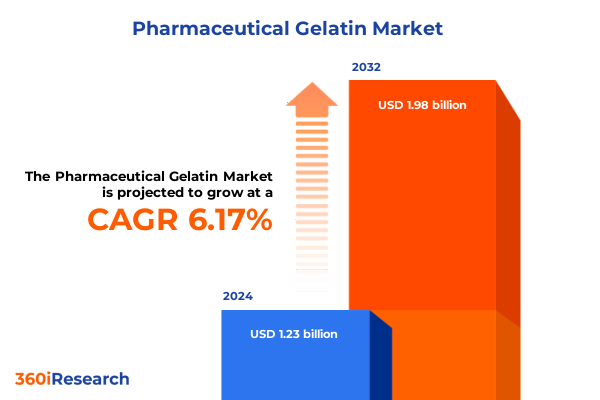

The Pharmaceutical Gelatin Market size was estimated at USD 1.30 billion in 2025 and expected to reach USD 1.38 billion in 2026, at a CAGR of 6.18% to reach USD 1.98 billion by 2032.

Industry Overview and Foundational Insights into Pharmaceutical Gelatin Highlighting Core Drivers and Emerging Dynamics Impacting Global Healthcare Formulations

The pharmaceutical gelatin sector represents a cornerstone of contemporary drug delivery systems offering a biocompatible and versatile excipient that underpins a wide range of oral dosage forms. Gelatin derived from animal collagen undergoes precise extraction and purification processes to yield a polymer that meets stringent pharmaceutical standards. Its molecular properties facilitate controlled drug release and ensure capsule integrity safety and patient acceptability. Against this backdrop stakeholders from raw material suppliers to finished dosage manufacturers rely on gelatin’s unique functional attributes to enhance product stability and performance.

The following executive summary distills pivotal trends and developments shaping the industry at present. It contextualizes technological breakthroughs regulatory shifts and macroeconomic factors that collectively redefine value chains. Readers will gain clarity on the transformative forces influencing sourcing strategies cost structures and commercialization pathways. Furthermore this document elucidates segmentation and regional dynamics pinpointing where growth vectors and competitive advantages converge. Finally actionable recommendations and methodological rigor underscore the strategic narrative ensuring that decisions are informed by validated evidence.

Evolving Market Dynamics Driven by Technological Innovations Regulatory Reforms and Sustainability Imperatives Reshaping the Pharmaceutical Gelatin Sector

In recent years the pharmaceutical gelatin landscape has undergone rapid evolution propelled by innovation driven quality initiatives and an intensified focus on sustainability. Advanced extraction techniques employing enzymatic hydrolysis and membrane filtration have improved yield consistency and functional properties enabling manufacturers to offer specialty grades tailored to high-performance applications. Simultaneously regulatory bodies worldwide have tightened quality requirements for residual solvents microbial limits and heavy metal thresholds fostering greater transparency across supply chains.

Moreover consumer and stakeholder demand for environmentally responsible sourcing has spawned interest in alternative feedstocks and greener processing pathways. Fish gelatin has emerged as a viable complement to traditional bovine and porcine sources particularly in regions where religious or cultural considerations influence raw material selection. These sustainability imperatives are further amplified by circular economy models that seek to valorize byproducts from food processing industries. As a result the gelatin sector is experiencing a paradigm shift in which technological sophistication and ethical sourcing coalesce to redefine competitive differentiation and market resilience.

Assessing How Recent United States Tariff Measures Have Altered Supply Chains Procurement Strategies and Cost Structures in Gelatin Sourcing

United States tariff policies have exerted significant pressure on gelatin supply chains altering procurement paradigms and cost structures across the industry. Section 301 duties levied on imports from specific origins have remained in effect into 2025 maintaining an additional 25 percent ad valorem charge on traditional gelatin shipments. As a consequence manufacturers and distributors have been compelled to re-evaluate supplier portfolios seeking sources less exposed to incremental levies.

This shift has accelerated the diversification of raw material origins toward South American bovine producers and European operations that benefit from favorable trade agreements. The cumulative tariff burden has also spurred negotiations for long-term contracts incorporating risk-sharing mechanisms and value-added services to offset elevated landed costs. Ultimately the persistence of elevated duties underscores the importance of dynamic sourcing frameworks and proactive engagement with policy developments to safeguard profitability and product continuity.

Examination of Source Form Type Application and Distribution Channel Insights Revealing Diverse Trajectories within the Pharmaceutical Gelatin Ecosystem

Analysis of gelatin sources reveals a well-established dominance of bovine-derived collagen owing to its consistent gel strength and broad acceptance in global pharmaceutical markets. Fish-origin gelatin however is gaining traction for its lower gel strength profile and attractive sustainability credentials while porcine-derived options maintain relevance in regions where religious or cultural norms favor that feedstock. Transitioning to the molecular classification gelatins into Type A and Type B grades further differentiates performance characteristics enabling formulators to tailor dissolution profiles and mechanical properties to specific dosage forms.

The physical state of gelatin likewise informs its utility in various manufacturing processes with powder formats preferred for high-throughput encapsulation lines while sheet grades remain essential for specialty applications demanding exact mass control. Applications such as hard capsules sustain the highest volume given consumer familiarity and regulatory precedence whereas soft capsule formats benefit from continuous innovation in plasticizer systems enhancing flexibility and drug loading. Pellet-based delivery systems have carved out a niche in targeted release offerings and tablet coating applications leverage gelatin’s film-forming capacity to mask taste and control moisture ingress. Distribution channels span direct engagement with end users for custom projects through traditional distributor networks offering standardized grades and evolving online procurement platforms facilitating rapid access and order visibility.

This comprehensive research report categorizes the Pharmaceutical Gelatin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Raw Material

- Application

- Distribution Channel

Comparative Analysis of Regional Demand Patterns Regulatory Environments and Supply Chain Nuances across Americas EMEA and AsiaPacific Gelatin Markets

The Americas region exhibits strong demand anchored by a mature regulatory environment and a robust generics industry that continues to innovate around established excipients. In the United States biopharmaceutical sponsors and contract manufacturers collaborate closely to integrate gelatin in novel oral dosage platforms while Canadian stakeholders frequently emphasize adherence to rigorous Health Canada standards which drive quality enhancement initiatives. Transitioning supply chains toward North and South American producers has become a strategic priority in order to mitigate import duty impacts and secure nearshoring advantages.

Europe Middle East and Africa presents a complex tapestry of regulatory jurisdictions where the European Medicines Agency enforces harmonized GMP guidelines complemented by national agencies with variable requirements. Sustainability and traceability imperatives in Europe are intensifying efforts around eco-friendly gelatin production with fish-derived and halalanalyzed grades finding receptive markets in the Middle East. Africa’s pharmaceutical manufacturing sector is gradually adopting standardized gelatin applications coinciding with regional initiatives to improve access to essential medicines.

Asia-Pacific has evolved into a pivotal hub for both gelatin supply and consumption. China and India contribute significant volumes of bovine and fish gelatin supported by large livestock industries and cost-competitive manufacturing. Regulatory heterogeneity across APAC underscores the importance of adaptive compliance strategies covering certification accreditation and sampling protocols. Moreover intra-regional trade agreements continue to reshape sourcing dynamics promoting diversification and collaborative partnerships.

This comprehensive research report examines key regions that drive the evolution of the Pharmaceutical Gelatin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning Technological Competencies and Collaborative Initiatives of Leading Organizations Driving Innovation in Pharmaceutical Gelatin Production

Leading gelatin producers have sharpened their strategic positioning through targeted investments in high-value product lines and research collaborations. Companies with vertically integrated operations capitalize on end-to-end traceability ensuring that raw collagen sources meet stringent safety specifications. R&D investments have concentrated on developing specialty gelatins with defined molecular weights viscosity profiles and gelling characteristics tailored to advanced drug delivery technologies.

Several major organizations have pursued partnerships with biotech firms to explore enzymatic crosslinking technologies and functionalized gelatin derivatives enhancing therapeutic performance. Capacity expansions in both established and emerging markets reflect efforts to align production footprints with shifting demand centers and tariff-induced sourcing realignments. Meanwhile service-oriented providers differentiate through integrated technical support services and regulatory consulting enabling clients to navigate complex approval landscapes efficiently.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pharmaceutical Gelatin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Danish Crown Protein A/S

- Darling Ingredients Inc.

- Gelco International

- Gelita AG

- Italgelatin SpA

- Lonza Group AG

- MV Protein Inc.

- Nippi Inc.

- Nitta Gelatin Inc.

- Norland Products Inc.

- PB Leiner NV

- Tessenderlo Group NV

- Weishardt International SAS

Strategic Roadmap for Enhancing Supply Chain Resilience Compliance Agility and Opportunity Capture within the Pharmaceutical Gelatin Value Chain

Industry leaders should prioritize diversification of raw material sources to hedge against geopolitical and policy-driven disruptions. Establishing strategic alliances with suppliers in underutilized regions can unlock cost efficiencies and reinforce supply assurance. Concurrently rigorous implementation of quality assurance frameworks encompassing real-time analytics and digital traceability will enhance compliance readiness and reduce batch release timelines.

To capitalize on sustainability trends organizations must explore the integration of alternative feedstocks such as marine-derived gelatin and invest in green chemistry approaches for extraction and purification. Collaboration with academic institutions and cross-industry consortia can accelerate the adoption of next-generation gelatin derivatives with enhanced functional properties. Additionally developing agile procurement models that leverage online platforms will optimize inventory management and improve responsiveness to evolving customer demands.

Rigorous MultiSource Data Acquisition Analytical Framework and Validation Procedures Underpinning the Credibility of Pharmaceutical Gelatin Research Insights

The insights presented herein are grounded in a methodological approach combining primary interviews with industry experts including formulation scientists contract manufacturers and quality assurance professionals. Secondary research entailed a thorough review of regulatory databases clinical trial registries and industry publications. Triangulation techniques were employed to validate data points across multiple independent sources ensuring robustness and mitigating bias.

Quantitative measures such as production capacity and trade flow data were supplemented with qualitative assessments of emerging technological advancements and policy trajectories. All findings underwent rigorous internal peer review with cross-functional stakeholders vetting assumptions and interpretations. This integrated framework ensures that the analysis accurately captures current realities and provides a reliable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pharmaceutical Gelatin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pharmaceutical Gelatin Market, by Type

- Pharmaceutical Gelatin Market, by Form

- Pharmaceutical Gelatin Market, by Raw Material

- Pharmaceutical Gelatin Market, by Application

- Pharmaceutical Gelatin Market, by Distribution Channel

- Pharmaceutical Gelatin Market, by Region

- Pharmaceutical Gelatin Market, by Group

- Pharmaceutical Gelatin Market, by Country

- United States Pharmaceutical Gelatin Market

- China Pharmaceutical Gelatin Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesis of Core Insights Emphasizing Strategic Imperatives Collaborative Advantages and Growth Catalysts for Stakeholders in the Gelatin Value Ecosystem

Synthesizing the foregoing analysis underscores a pharmaceutical gelatin sector at a crossroads driven by technological innovation regulatory evolution and macroeconomic headwinds. Stakeholders equipped with nuanced understanding of source differentiation and application-specific requirements are best positioned to navigate competitive pressures. Regional complexities demand adaptive strategies aligning production footprints with local compliance landscapes and trade paradigms.

Forward-looking organizations will leverage the strategic recommendations to bolster supply chain resilience embrace sustainability imperatives and harness digital transformation in procurement and quality assurance. By doing so they can convert emerging challenges into opportunities for differentiation and value creation. Ultimately the gelatin value ecosystem will reward those who balance operational excellence with visionary investments in next-generation functionalities.

Unlock Actionable Gelatin Market Intelligence Engage Directly with Ketan Rohom Associate Director of Sales & Marketing to Elevate Your Strategic Decisions

The comprehensive insights in this report await your exploration eager to translate data into strategic action and innovation Collaborate directly with Ketan Rohom Associate Director of Sales & Marketing to secure your full copy of the gelatin market intelligence and unlock the detailed analysis that will guide your next critical decisions

- How big is the Pharmaceutical Gelatin Market?

- What is the Pharmaceutical Gelatin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?