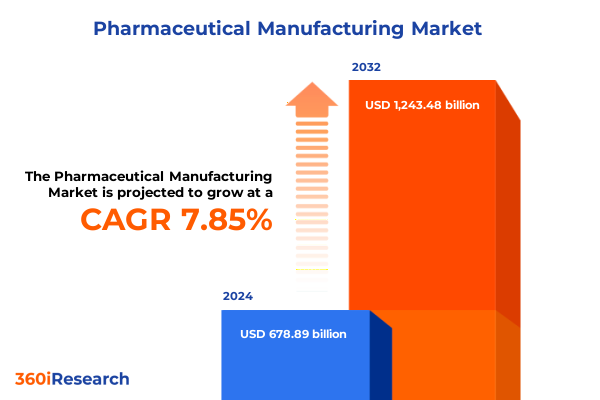

The Pharmaceutical Manufacturing Market size was estimated at USD 729.80 billion in 2025 and expected to reach USD 785.42 billion in 2026, at a CAGR of 7.90% to reach USD 1,243.48 billion by 2032.

Unveiling the Billion-Dollar Complexity and Growth Drivers Shaping Pharmaceutical Manufacturing Ecosystem’s Global Future

The pharmaceutical manufacturing industry lies at the nexus of scientific innovation and global health imperatives, demanding a synthesis of precision engineering, regulatory compliance, and robust supply chain orchestration. Against this backdrop, stakeholders encounter a landscape defined by escalating complexity-from the molecular intricacies of drug formulation to the integration of advanced manufacturing technologies. The convergence of digitalization, heightened quality standards, and dynamic market demands underscores the critical importance of a comprehensive understanding of manufacturing processes across diverse segments and regions.

As companies strive to optimize efficiency, mitigate risk, and maintain the highest levels of product integrity, the ability to anticipate and adapt to transformative shifts becomes a strategic imperative. This report synthesizes key insights into emerging trends, tariff impacts, segmentation dynamics, regional nuances, and competitive strategies to equip decision-makers with the intelligence needed to navigate uncertainties and capitalize on growth opportunities. The following sections offer a structured examination of these dimensions, providing a clear roadmap for leaders seeking to reinforce resilience and drive innovation within their organizations.

Exploring Pivotal Transformations Driving Innovation Efficiency and Resilience Across Pharmaceutical Manufacturing Processes Worldwide

Across pharmaceutical manufacturing, a wave of transformative shifts is redefining traditional paradigms and enabling unprecedented levels of agility and scalability. The adoption of single-use technologies has surged as organizations prioritize contamination control, rapid changeover, and reduced capital expenditures. Concurrently, continuous manufacturing platforms are gaining traction for their ability to streamline production workflows, minimize variability, and accelerate time to market. These advances are further catalyzed by the integration of Industry 4.0 technologies-including real-time data analytics, IoT-enabled process monitoring, and machine learning algorithms-that facilitate proactive quality assurance and performance optimization.

In tandem with technological innovation, the landscape is being reshaped by an increased emphasis on sustainability and environmental stewardship, driving investment in energy-efficient operations and waste reduction initiatives. Regulatory bodies are also evolving their frameworks to accommodate novel manufacturing modalities, issuing guidance that endorses process analytical technology and data-driven validation approaches. As a result, manufacturers that embrace these shifts can achieve competitive differentiation through enhanced product quality, operational resilience, and the agility to respond swiftly to changing patient needs and market dynamics.

Assessing the Nuanced Consequences of United States Tariff Policies in 2025 on Pharmaceutical Supply Chains and Production Economics

The introduction of new tariff measures by the United States in early 2025 has had a cumulative impact on pharmaceutical manufacturing cost structures, supply chain resiliency, and strategic sourcing decisions. With tariffs affecting a broad spectrum of imported inputs-from active pharmaceutical ingredients to specialized packaging materials-manufacturers are grappling with the need to re-evaluate established procurement strategies. These policy shifts have led organizations to explore near-shoring and reshoring options, as operational leaders seek to mitigate exposure to trade volatility while ensuring uninterrupted production continuity.

Moreover, the tariff environment has accelerated collaborations between manufacturers and domestic suppliers, fostering investments in local capabilities and capacity expansions. At the same time, companies are assessing the trade-off between the initial capital outlay for domestic integration and the long-term benefits of reduced supply chain complexity and lower geopolitical risk. As regulatory authorities continue to refine tariff classifications and exemptions for critical healthcare products, manufacturers that maintain proactive engagement with trade experts and policy influencers are better positioned to navigate the evolving landscape with minimal operational disruption.

Deriving Profound Insights from Diverse Market Segmentation Criteria That Illuminate Every Tier of the Pharmaceutical Manufacturing Value Chain

When viewed through the prism of Drug Type segmentation-encompassing Biosimilars, Branded Drugs, and Generic Drugs-the manufacturing landscape reflects distinct operational imperatives and cost dynamics. For example, high-value biologics production demands sophisticated facilities and stringent quality controls, whereas generic small molecule drugs often rely on established batch processes optimized for cost efficiency. Shifting focus to Dosage Form, manufacturers encounter a spectrum of challenges: Liquid Dosage Forms such as emulsions, solutions, and suspensions require specialized mixing and sterilization workflows; Parenteral Dosage Forms introduce additional layers of complexity through the integration of infusion systems and injectable formats, including prefilled syringes and vials; and Solid Dosage Forms traverse capsule, powder, and tablet manufacturing lines that hinge on precise granulation and compression technologies.

Analyzing the Manufacturing Stage perspective further clarifies the value chain: API Manufacturing emerges as a high-margin, capital-intensive domain, whereas Formulation Manufacturing and Packaging and Labelling carry distinct regulatory and operational considerations. Equally pivotal is Molecule Type differentiation, where Large Molecule Drugs necessitate bioreactor capabilities and cold chain logistics, contrasted with the relative simplicity of Small Molecule Drugs. Furthermore, Manufacturing Technology segmentation underscores divergent pathways: Batch Manufacturing remains prevalent for its flexibility, Continuous Manufacturing is prized for consistency and throughput, and Single-Use Technology offers rapid scalability with reduced cleaning validation burdens. Finally, End-User segmentation highlights the varying demands placed by Biotechnology Companies, Contract Research Organizations, Government and Public Health Bodies, Pharmaceutical Companies, and Research Organizations and Academic Institutes. Overlaying these criteria with Therapeutic Area segmentation-spanning Cardiovascular, Endocrinology, Gastroenterology, Immunology, Infectious Diseases, Neurology, Oncology, Rare Diseases, and Respiratory-reveals unique therapeutic-driven process requirements that influence capacity planning, specialized equipment investments, and tailored quality assurance protocols.

This comprehensive research report categorizes the Pharmaceutical Manufacturing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Type

- Molecule Type

- Dosage Form

- Manufacturing Stage

- Manufacturing Technology

- Therapeutic Area

- Age Group

- Distribution

Comparative Analysis of Regional Market Characteristics and Strategic Imperatives across the Americas Europe Middle East Africa and Asia-Pacific

Regional dynamics within pharmaceutical manufacturing reveal a mosaic of regulatory frameworks, infrastructure capabilities, and market priorities across the Americas, Europe Middle East and Africa, and Asia-Pacific. In the Americas, the regulatory environment is characterized by stringent FDA oversight, robust supply chain infrastructure, and a mature contract manufacturing sector that supports both small molecule and biologic production. Investment in manufacturing modernization is particularly pronounced in key hubs such as the United States and Canada, where incentives for advanced process technologies have catalyzed facility upgrades.

Conversely, the Europe, Middle East and Africa region presents a heterogeneous landscape: Western Europe upholds some of the world’s most rigorous GMP standards and drives innovation in continuous and single-use manufacturing, while emerging markets in Eastern Europe and parts of the Middle East are prioritizing capacity expansion and export-oriented production. In Africa, nascent pharmaceutical clusters are supported by public-private partnerships aimed at addressing local healthcare needs. Meanwhile, the Asia-Pacific region continues to expand its manufacturing prowess, particularly in India and China, where cost-effective API manufacturing and formulation services dominate global outsourcing patterns. Yet, this growth is accompanied by increasing regulatory harmonization efforts and quality oversight, reflecting the region’s ambition to ascend the value chain into more specialized biologics and high-value dosage forms.

This comprehensive research report examines key regions that drive the evolution of the Pharmaceutical Manufacturing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Moves and Technological Advancements of Leading Players Shaping the Pharmaceutical Manufacturing Arena

Leading pharmaceutical manufacturers and contract development and manufacturing organizations are driving industry evolution through strategic investments, technology partnerships, and capacity expansions. Global incumbents are prioritizing advanced bioprocessing platforms and continuous manufacturing lines to maintain competitive differentiation in biologics and high-potency small molecule production. Meanwhile, specialty manufacturers are carving out niches by offering integrated end-to-end services that span API development, formulation, and clinical trial manufacturing.

Collaborations between technology vendors and contract manufacturers are facilitating the deployment of smart factories equipped with real-time monitoring, predictive maintenance, and digital twin capabilities. At the same time, strategic consolidations and joint ventures are reshaping the competitive landscape, enabling organizations to achieve scale without forgoing flexibility. New entrants are also leveraging single-use systems and modular facility designs to enter the market with lower capital requirements and accelerated timelines. This competitive tapestry underscores the necessity for incumbents and challengers alike to cultivate agile operating models, prioritize technology adoption, and forge alliances that align with evolving regulatory expectations and customer demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pharmaceutical Manufacturing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AbbVie Inc.

- Alkem Laboratories Ltd.

- Amgen Inc.

- Astellas Pharma Inc.

- AstraZeneca plc

- Aurobindo Pharma Ltd.

- Baxter International Inc.

- Bayer AG

- Biogen Inc.

- Boehringer Ingelheim GmbH

- Bristol‑Myers Squibb Company

- Cipla Ltd.

- Croda International Plc

- CSL Limited

- Divi’s Laboratories Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

- Gilead Sciences, Inc.

- GlaxoSmithKline plc

- Johnson & Johnson Services, inc.

- Lupin Ltd.

- Mankind Pharma Ltd.

- Merck KGaA

- Novartis AG

- Novo Nordisk A/S

- Pfizer Inc.

- Sanofi S.A.

- Sun Pharmaceutical Industries Limited

- Takeda Pharmaceutical Company Ltd.

- Teva Pharmaceutical Industries Ltd.

- Thermo Fisher Scientific Inc.

- Torrent Pharmaceuticals Ltd.

- Viatris Inc.

- Zydus Lifesciences Ltd.

Practical and Forward-Looking Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Critical Risks

To capitalize on emerging opportunities and mitigate evolving risks, industry leaders should prioritize investments in next-generation manufacturing platforms that support continuous production and single-use implementations. By integrating advanced analytics and process control systems, organizations can transition from reactionary quality checks to predictive, data-driven decision making, thereby enhancing throughput and reducing operational variability.

In parallel, companies must diversify their supplier networks and consider near-shoring critical feedstocks to buffer against tariff disruptions and geopolitical uncertainties. Establishing regional centers of excellence for both API and formulation manufacturing can bolster supply chain resilience while optimizing logistics. Furthermore, forming strategic alliances with technology providers, academic institutions, and public health agencies will accelerate innovation and facilitate regulatory alignment. Finally, upskilling the workforce through targeted training programs in digital operations, regulatory standards, and quality assurance will empower talent to navigate increasingly sophisticated manufacturing environments.

Outlining a Comprehensive and Transparent Research Approach That Validates Insights across Segmentation Criteria and Regional Dynamics

This report is underpinned by a robust, multi-tiered research methodology combining primary and secondary intelligence to ensure comprehensive coverage and verifiable insights. The secondary framework entailed systematic reviews of peer-reviewed journals, regulatory publications, and industry white papers to map technological trends, tariff changes, and regional developments. Concurrently, primary research was conducted through in-depth interviews with senior executives across pharmaceutical manufacturers, contract manufacturing organizations, technology vendors, and regulatory bodies to validate assumptions and capture emerging practices.

Quantitative data points were triangulated by cross-referencing multiple sources to maintain accuracy and consistency. Segmentation assumptions were rigorously tested through workshops with domain experts, ensuring that Drug Type, Dosage Form, Manufacturing Stage, Molecule Type, Manufacturing Technology, End-User, and Therapeutic Area criteria accurately reflect operational realities. Regional insights were enriched by consultations with local regulatory specialists and trade analysts. Finally, a quality assurance process involving peer review and editorial vetting was applied to guarantee the report’s integrity, relevance, and actionable value.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pharmaceutical Manufacturing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pharmaceutical Manufacturing Market, by Drug Type

- Pharmaceutical Manufacturing Market, by Molecule Type

- Pharmaceutical Manufacturing Market, by Dosage Form

- Pharmaceutical Manufacturing Market, by Manufacturing Stage

- Pharmaceutical Manufacturing Market, by Manufacturing Technology

- Pharmaceutical Manufacturing Market, by Therapeutic Area

- Pharmaceutical Manufacturing Market, by Age Group

- Pharmaceutical Manufacturing Market, by Distribution

- Pharmaceutical Manufacturing Market, by Region

- Pharmaceutical Manufacturing Market, by Group

- Pharmaceutical Manufacturing Market, by Country

- United States Pharmaceutical Manufacturing Market

- China Pharmaceutical Manufacturing Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2067 ]

Synthesizing Critical Themes to Illuminate the Strategic Imperatives Guiding Next-Generation Pharmaceutical Manufacturing Evolution

In summary, the pharmaceutical manufacturing landscape is experiencing a convergence of technological innovation, regulatory evolution, and supply chain realignment, driven by factors ranging from single-use technologies to shifting tariff policies. Navigating this environment demands an integrative strategy that aligns advanced manufacturing capabilities with risk-mitigation measures and region-specific imperatives. Leaders must harness data analytics, cultivate strategic partnerships, and develop agile operational models to stay ahead of the curve.

The segmentation lens-from Drug Type through Therapeutic Area-illustrates how diverse process requirements shape capital investments and quality frameworks. Regional analyses highlight distinct regulatory and infrastructure landscapes, while competitive profiling underscores the strategic maneuvers of incumbents and new entrants. Together, these perspectives form a holistic blueprint for decision-makers to refine their manufacturing footprint, optimize resource allocation, and deliver high-quality therapies efficiently to patients worldwide. The future of pharmaceutical manufacturing belongs to organizations that proactively embrace change, foster collaboration, and invest in the technologies that will define the next era of biopharmaceutical production.

Partner with the Associate Director of Sales & Marketing to Secure Exclusive Pharmaceutical Manufacturing Research and Propel Strategic Growth

We invite you to partner with Ketan Rohom, Associate Director of Sales & Marketing, to unlock proprietary insights that will inform and empower your strategic initiatives within pharmaceutical manufacturing. By collaborating directly with Ketan, you gain privileged access to a comprehensive market research report that distills in-depth analyses of transformative trends, regulatory impacts, segment dynamics, regional nuances, and competitor strategies. Your organization will benefit from tailored guidance that aligns with your objectives, leveraging best-in-class data and expert interpretations.

Engaging with Ketan ensures a seamless purchasing experience and direct support throughout the deployment of these findings, enabling your teams to translate critical intelligence into actionable roadmaps. Don’t miss the opportunity to equip your leadership with the clarity and foresight necessary to navigate evolving challenges and harness emerging opportunities. Reach out to Ketan Rohom today to discuss how this definitive report can drive sustainable growth and operational excellence within your pharmaceutical manufacturing operations.

- How big is the Pharmaceutical Manufacturing Market?

- What is the Pharmaceutical Manufacturing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?