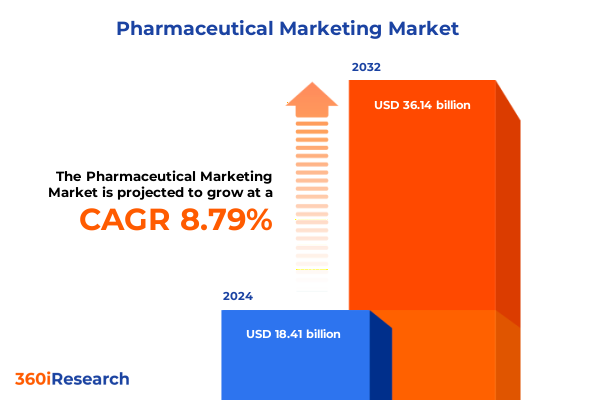

The Pharmaceutical Marketing Market size was estimated at USD 31.10 billion in 2025 and expected to reach USD 33.81 billion in 2026, at a CAGR of 8.86% to reach USD 56.37 billion by 2032.

Discover the Critical Forces Reshaping the Pharmaceutical Marketing Environment and How an Executive Synopsis Unlocks Strategic Leadership Opportunities

In an era marked by rapid technological advancements and shifting regulatory landscapes, understanding the strategic imperatives behind pharmaceutical marketing has never been more critical. The confluence of digital transformation, precision medicine, and evolving patient expectations demands an executive-level perspective that synthesizes key trends into a cohesive narrative. This introduction lays the groundwork for an in-depth exploration of the forces reshaping marketing strategies across therapeutic segments, channels, and geographies.

As competitive pressures intensify, pharmaceutical organizations must navigate complex stakeholder ecosystems encompassing healthcare providers, payers, and patients. The proliferation of digital touchpoints-from telehealth platforms to social media communities-requires marketers to integrate data-driven insights with compelling content that resonates at every stage of the patient journey. Moreover, heightened scrutiny on pricing and access compels leaders to balance commercial objectives with ethical considerations and regulatory compliance.

Against this dynamic backdrop, an executive summary serves as a strategic compass, distilling multifaceted research into clear, actionable conclusions. By synthesizing high-level analysis of market shifts, tariff impacts, segmentation intelligence, regional nuances, and competitor positioning, this summary equips decision-makers with the perspective needed to steer their organizations toward sustainable growth and competitive advantage.

Unveiling the Pivotal Transformations in Pharma Marketing Dynamics That Will Define Competitive Advantage Across Channels and Patient Engagement Models

Pharmaceutical marketing is undergoing a transformational shift driven by emerging technologies, novel therapeutic modalities, and changes in stakeholder engagement models. Artificial intelligence and machine learning are now integral tools for predictive analytics in campaign optimization, enabling marketers to tailor messaging with unprecedented precision. Simultaneously, real-world evidence has emerged as a cornerstone for demonstrating product value to payers and providers, creating opportunities for more personalized and outcome-focused narratives.

Patient centricity has evolved beyond tokenism into fully integrated engagement strategies that leverage digital health platforms, remote monitoring, and patient support programs. This shift toward patient-empowered ecosystems mandates that marketing teams align commercial goals with improved health outcomes, reinforcing trust and adherence. In parallel, the growing emphasis on value-based care contracts and risk-sharing agreements is reshaping how brands communicate their efficacy and cost-effectiveness throughout the healthcare delivery continuum.

Furthermore, the rise of precision medicine is redefining therapeutic positioning, with biomarkers and genetic profiling requiring bespoke educational campaigns for both providers and patients. As digital channels proliferate, omnichannel orchestration has become a non-negotiable capability, demanding seamless integration across email, mobile, webinars, and in-person engagements. This convergence of technological innovation, patient empowerment, and data-driven decision-making represents a pivotal transformation in how pharmaceutical marketing drives brand differentiation and market access.

Analyzing the Compounding Effects of 2025 United States Tariff Policy on Pharmaceutical Supply Chains Costs and Strategic Sourcing Decisions

The introduction of new tariff measures by the United States in 2025 has exerted a cumulative effect on pharmaceutical supply chains, compelling companies to re-evaluate sourcing and manufacturing strategies. Higher duties on active pharmaceutical ingredients imported from traditional low-cost regions have increased production costs, particularly for generics and biosimilars that rely on cost-sensitive supply models. As a result, organizations are accelerating efforts to diversify their supplier base, shifting production toward nearshore facilities and strategic partnerships with domestic chemical and biologics manufacturers.

These tariff-induced cost pressures extend beyond raw materials to impact ancillary components such as packaging materials and specialized excipients. Consequently, logistics and procurement functions are adopting advanced analytics to forecast duty exposures and mitigate financial risks through hedging strategies and tariff classification optimizations. Cross-functional collaboration between procurement, regulatory affairs, and commercial teams has become essential to navigate complex compliance requirements while safeguarding margin performance.

Looking ahead, the ripple effects of the 2025 tariff regime are driving companies to invest in greater supply chain transparency and resilience. End-to-end digital traceability platforms, underpinned by blockchain and IoT sensors, are gaining traction as tools to monitor origin, duty status, and quality control in near real time. These transformational adaptations underscore the strategic imperative of aligning commercial and operational functions to manage the long-term impacts of evolving trade policy.

Unlocking Segmentation Intelligence Across Therapeutic Areas Drug Modalities Administration Routes Distribution Channels and End Users to Pinpoint High-Value Growth Drivers

Segmentation intelligence reveals that therapeutic areas such as cardiovascular, oncology, and central nervous system disorders continue to drive targeted marketing initiatives, while emerging focus on rare disease portfolios demands specialized patient outreach and education programs. Within cardiovascular, marketers are refining messages around anticoagulant therapies and heart failure management, tailoring content to address payer concerns on outcomes and long-term adherence. In oncology, the distinction between hematologic malignancies and solid tumors has led to differentiated communication strategies that emphasize both clinical trial data and real-world patient experiences to support treatment adoption.

Drug type segmentation highlights the evolving roles of branded therapies versus generics and biosimilars in portfolio planning, as competition intensifies in small molecule spaces while biosimilars expand access in immunology and oncology. Meanwhile, advanced mechanism of action categories such as gene therapies and cell treatments necessitate educational campaigns that simplify complex science for both prescribers and patient communities. Monoclonal antibodies and therapeutic vaccines are particularly reliant on targeted digital engagement to overcome clinical inertia and reinforce brand authority.

Administration route and distribution channel analysis indicates that injectable therapies demand robust cold-chain logistics communications, whereas oral and inhalation products benefit from patient adherence support tools. The rise of online pharmacies and direct-to-consumer channels underscores the importance of seamless digital experiences, while traditional hospital and retail pharmacy access points remain critical for complex therapies. Across all segments, end user insights reinforce the need for tailored messaging that aligns with clinic workflows, homecare realities, and evolving telehealth adoption patterns.

This comprehensive research report categorizes the Pharmaceutical Marketing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Channel

- Therapeutic Area

- Data Source

- Audience Type

Deciphering Regional Market Nuances across the Americas Europe Middle East Africa and Asia Pacific to Tailor Actionable Commercial Strategies for Diverse Healthcare Ecosystems

Regional analysis uncovers distinct commercial imperatives across the global pharmaceutical landscape. In the Americas, advanced healthcare infrastructure and digital health adoption have created fertile ground for omnichannel marketing and real-world evidence platforms that support reimbursement dialogues. Markets in Latin America, while growing, still require innovative patient assistance programs and cost-access models to bridge affordability gaps. Regulatory harmonization efforts within North American free trade agreements are easing clinical data exchanges but continue to present navigation challenges for market entry strategies.

In Europe, Middle East, and Africa, the fragmentation of payer systems and varying price controls necessitate region-specific value propositions that articulate both health economic benefits and clinical differentiators. The push toward centralized procurement in some Gulf Cooperation Council countries contrasts with national pricing negotiations in European Union member states, compelling marketers to develop flexible pricing frameworks. Across Africa, access remains constrained by infrastructure limitations, driving partnerships with local distributors and NGOs to bolster patient support initiatives.

The Asia-Pacific region presents a dual narrative of maturity and rapid growth. Established markets in Japan and South Korea are embracing digital therapeutics and AI-driven patient support, while China’s evolving regulatory regime is accelerating approvals for innovative biologics and cell therapies. Emerging Southeast Asian markets are witnessing an uptick in public-private collaborations and e-pharmacy expansion, creating new channels for patient engagement. These regional distinctions underscore the necessity of customized market entry and scaling plans that leverage local insights and partnerships.

This comprehensive research report examines key regions that drive the evolution of the Pharmaceutical Marketing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Benchmarking Leading Pharmaceutical Innovators and Strategic Competitors to Reveal Differentiated Approaches in R D Commercialization and Partnerships

Leading pharmaceutical companies are adopting distinctive commercialization approaches to secure market leadership. Global innovator organizations are leveraging integrated data ecosystems that unify clinical trial insights, real-world patient data, and payer analytics to inform dynamic marketing strategies. These industry frontrunners are forging strategic alliances with digital health platforms and academic institutions to co-develop patient support solutions and demonstrate long-term therapy value.

At the same time, mid-sized and niche players are capitalizing on agile marketing teams and focused therapeutic portfolios to outmaneuver larger competitors. By concentrating on orphan drug segments and rare disease communities, these companies deploy highly personalized outreach initiatives, including virtual patient education forums and mobile adherence apps. Their lean structures facilitate rapid pivoting in response to emerging scientific data and regulatory opportunities.

Emerging biotech firms are also reshaping the competitive landscape through disruptive modalities such as gene editing and cell therapies. Their commercialization playbooks emphasize thought leadership and stakeholder engagement across scientific societies, KOL networks, and digital patient advocates. This collaborative ethos extends to payer negotiations, where innovative pricing models and outcome-based contracts are increasingly tabled to secure formulary inclusion. Collectively, these differentiated strategies highlight how companies of varied size and focus are redefining best practices in pharmaceutical marketing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pharmaceutical Marketing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Publicis Groupe

- Omnicom Group Inc.

- WPP plc

- Inizio Group Limited

- Real Chemistry

- Klick Inc.

- Supreme Optimization, LLC

- Fingerpaint Marketing, Inc.

- AbelsonTaylor Group

- Viseven Europe OÜ

- Syneos Health Communications

- Doceree Inc.

- Healthcare Success, LLC

- Digitalis Medical

- AXPIRA

- Amra & Elma

- CMDS Online Inc.

- Cobalt Communications

- Forma Life Science Marketing

- inBeat Agency

- NoGood by Berma LLC

- Stramasa

Crafting Targeted Strategic Initiatives and Optimization Roadmaps that Industry Leaders Can Implement to Accelerate Market Penetration and Maximize ROI

To thrive amid intensifying competition and dynamic policy environments, industry leaders should prioritize the development of integrated omnichannel frameworks that unify customer data across marketing, medical, and commercial functions. This entails investing in AI-driven analytics platforms that can segment audiences in real time, tailor messaging based on predictive behavior models, and optimize resource allocation across digital and field activities. In parallel, embedding real-world evidence generation into post-launch strategies will bolster health economic narratives, enabling stronger payer dialogues and reinforcing clinical credibility.

Supply chain resilience must also become a strategic focus, with procurement teams collaborating closely with regulatory affairs to anticipate tariff impacts and ensure uninterrupted access to critical APIs and biologics components. Diversification of manufacturing footprints, including nearshoring and strategic copacking partnerships, will mitigate cost volatility and safeguard commercial continuity. Additionally, cross-functional war rooms can be activated to rapidly address global policy changes, ensuring swift alignment of compliance, logistics, and marketing communications.

Finally, leaders should champion a culture of continuous innovation by forging alliances with digital health startups, patient advocacy groups, and academic research centers. These partnerships can accelerate the co-creation of patient support tools, enable data-driven pilot programs, and foster thought leadership that resonates across stakeholder communities. By implementing these strategic initiatives, organizations will be well positioned to capture emerging opportunities, navigate evolving regulations, and deliver sustainable value to patients and business stakeholders alike.

Detailing the Rigorous Research Framework Combining Qualitative Expert Interviews Quantitative Data Triangulation and Advanced Analytical Techniques

This research employs a robust mixed-methods framework, integrating qualitative and quantitative approaches to ensure comprehensive market insights. Primary research involved in-depth interviews with senior executives across pharmaceutical commercial operations, procurement, and market access functions. These conversations provided nuanced perspectives on tariff management, segmentation priorities, and digital transformation initiatives. Concurrently, expert panels convened thought leaders in regulatory affairs, patient advocacy, and emerging biotech, contributing experiential knowledge to interpret data patterns and validate hypothesis assumptions.

Secondary research sources included peer-reviewed journals, regulatory filings, and proprietary databases tracking clinical trial outcomes, reimbursement policies, and trade agreements. Data triangulation procedures were implemented to cross-verify findings, leveraging statistical correlation techniques and scenario modeling to assess the robustness of thematic insights. Advanced analytical tools, such as cluster analysis and sentiment mining, were utilized to uncover hidden patterns within stakeholder feedback and digital engagement metrics.

To uphold methodological rigor, standardized data quality protocols and bias mitigation strategies were applied throughout the research process. Documentation of research instruments, coding frameworks, and audit trails ensures transparency and replicability of findings. The combination of primary expert input and high-fidelity secondary data sources underpins the reliability of the conclusions drawn in this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pharmaceutical Marketing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pharmaceutical Marketing Market, by Service Type

- Pharmaceutical Marketing Market, by Channel

- Pharmaceutical Marketing Market, by Therapeutic Area

- Pharmaceutical Marketing Market, by Data Source

- Pharmaceutical Marketing Market, by Audience Type

- Pharmaceutical Marketing Market, by Region

- Pharmaceutical Marketing Market, by Group

- Pharmaceutical Marketing Market, by Country

- United States Pharmaceutical Marketing Market

- China Pharmaceutical Marketing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 4293 ]

Synthesizing Strategic Takeaways to Empower Decision Makers with a Clear Path Forward Amid Evolving Pharmaceutical Marketing Landscapes

This executive summary synthesizes the essential strategic considerations shaping the future of pharmaceutical marketing. By examining transformative shifts such as AI-driven personalization, patient-centric engagement models, and the growing influence of precision medicine, decision-makers gain clarity on high-impact trends. The analysis of 2025 tariff policies underscores the need for agile supply chain strategies and cross-functional collaboration to mitigate cost pressures and secure product accessibility.

Segmentation and regional insights highlight the value of tailored marketing approaches across therapeutic areas, drug types, administration routes, and end-user channels, while benchmarking of leading companies reveals how different-sized organizations are leveraging innovation to gain competitive advantage. Actionable recommendations present a clear roadmap for leaders to implement integrated omnichannel frameworks, enhance real-world evidence capabilities, and diversify supply chains through strategic partnerships.

As the pharmaceutical landscape continues to evolve, this summary provides a concise yet comprehensive foundation for informed decision-making. It equips commercial, medical, and executive stakeholders with the insights required to navigate policy shifts, capitalize on market segmentation opportunities, and drive sustainable growth in an increasingly complex environment.

Connect with Associate Director Ketan Rohom to Access the In-Depth Pharmaceutical Market Research Report That Drives Confident Commercial Decisions

For tailored insights and in-depth analysis of the evolving pharmaceutical marketing ecosystem, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Ketan Rohom brings deep expertise in market intelligence and strategic consulting focused on pharmaceutical and life sciences sectors. By partnering with him, you’ll gain priority access to the most comprehensive market research report available, designed to deliver actionable insights and drive confident decision-making. Connect today to discuss how this report can be customized to address your unique challenges and inform your next critical strategic initiative.

- How big is the Pharmaceutical Marketing Market?

- What is the Pharmaceutical Marketing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?