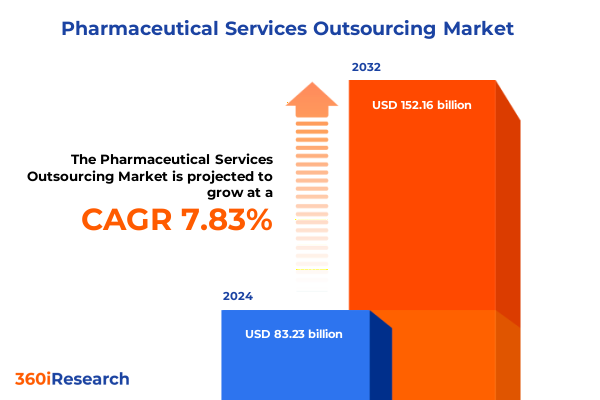

The Pharmaceutical Services Outsourcing Market size was estimated at USD 89.83 billion in 2025 and expected to reach USD 95.47 billion in 2026, at a CAGR of 7.82% to reach USD 152.16 billion by 2032.

Exploring the Expanding Horizon of Outsourced Pharmaceutical Services Fueled by Innovation Imperatives and Cost Optimization Strategies

The pharmaceutical industry is navigating an era of unprecedented complexity, driven by escalating research and development costs, stringent regulatory demands, and an urgent need to accelerate time to market. In response, organizations are increasingly turning to specialized outsourcing partners to leverage external expertise, advanced technological platforms, and scalable resources. This shift is underpinned by a quest for enhanced operational efficiency and the desire to de-risk critical programs by distributing responsibilities across external networks.

As novel therapeutic modalities such as gene and cell therapies gain prominence, the requirement for specialized services has intensified. Outsourcing providers are now expected to deliver not only routine support but also deep scientific and regulatory acumen. Moreover, cost containment pressures within commercial markets are compelling companies to reassess traditional in-house models. Consequently, strategic alliances have emerged as a cornerstone for innovation, enabling fragmentary functions-ranging from data management to late-stage clinical operations-to be seamlessly integrated into cohesive, end-to-end development pathways.

Through collaborative frameworks, stakeholders are capitalizing on the convergence of cutting-edge analytics, cloud-enabled platforms, and cross-functional operating models. This foundational landscape sets the stage for an exploration of the transformative shifts, tariff dynamics, segmentation intricacies, and regional differentiators that define the current outsourcing paradigm.

Tracing Fundamental Transformations in Pharmaceutical Outsourcing Driven by Digital Integration, Advanced Analytics, and Collaborations

The outsourcing landscape has undergone a profound metamorphosis as digital technologies and data analytics reshape service delivery. Advanced real-world evidence platforms, artificial intelligence-driven trial design, and decentralized trial models are no longer nascent concepts but integral components of modern drug development. Service providers are evolving into digital orchestrators, harnessing predictive modeling and machine learning to optimize patient recruitment, monitor safety signals in real time, and improve overall trial efficiency.

Parallel to these technological strides, strategic partnerships have transcended traditional transactional arrangements. Leading pharmaceutical companies and emerging biotech firms are formalizing longer-term alliances that prioritize value co-creation over vendor selection. This collaborative ethos emphasizes shared risk-reward structures, with performance-based contracting emerging as a preferred model. Furthermore, the growing adoption of modular, functional service engagements allows for granular customization, enabling sponsors to access specialized capabilities-such as medical writing or biostatistics-without relinquishing overarching program oversight.

Taken together, these shifts underscore a strategic inflection point: service providers are transforming into integral partners, co-innovating at every stage of the development continuum. As digital integration deepens and collaborative frameworks proliferate, the outsourcing ecosystem is poised to deliver unparalleled flexibility and resilience.

Assessing the Cumulative Effects of United States Tariff Measures in 2025 on Outsourced Drug Development and Global Supply Chain Dynamics

In 2025, the implementation of targeted U.S. tariffs on active pharmaceutical ingredients and ancillary raw materials has reverberated across the outsourcing sector, catalyzing a reevaluation of global supply chain strategies. Heightened import costs have prompted sponsors and service providers to explore nearshore and onshore manufacturing partnerships, as well as to diversify sourcing channels. Consequently, contract research and manufacturing organizations are recalibrating their footprints, expanding domestic capabilities while nurturing relationships with alternative international suppliers to mitigate exposure to tariff volatility.

Moreover, the tariff landscape has underscored the critical importance of supply chain visibility and agility. Service providers are investing in end-to-end digital track-and-trace systems, enabling real-time monitoring of material movements and facilitating rapid rerouting when pricing or regulatory incentives shift. This enhanced transparency not only buffers against cost fluctuations but also strengthens compliance with evolving U.S. customs and regulatory requirements.

Looking ahead, organizations that proactively integrate tariff resilience into their outsourcing strategies will gain a competitive edge. By embedding flexibility within sourcing agreements and adopting adaptive contracting structures, stakeholders can navigate the tariff environment with confidence. This strategic recalibration, while born of necessity, ultimately reinforces a broader drive toward streamlined, risk-intelligent supply networks.

Unveiling Critical Service, Phase, Customer, Contract, and Therapeutic Segmentation Dynamics Shaping the Pharmaceutical Outsourcing Ecosystem

An examination of service type segmentation reveals nuanced demand patterns across clinical development, data management, manufacturing services, pharmacovigilance, and regulatory affairs. Clinical development remains foundational, with early-phase engagements driving sponsorship decisions in light of complex biologic and cell therapy pipelines. Concurrently, advanced data management solutions-spanning data integration platforms and cloud-based EDC-are increasingly sought to harness the accelerating volumes of decentralized trial data.

Clinical phase segmentation further accentuates differentiated priorities; Phase I programs emphasize rapid dose escalation designs while Phase II engagements focus on nuanced efficacy assessments, each requiring specialized operational frameworks. Customer archetypes ranging from nimble biotechnology firms to large multispecialty pharmaceutical corporations exhibit distinct outsourcing preferences, with biotech sponsors often gravitating toward flexible functional service models and established pharma enterprises favoring full-service integrations.

Contractual segmentation likewise informs engagement structures, as full-service providers deliver end-to-end program management while functional providers cater to discrete needs in biostatistics or medical writing. Meanwhile, therapeutic area focus, particularly in oncology, drives high-complexity trials across both hematological malignancies and solid tumors, leveraging tailored regulatory and pharmacovigilance capabilities. These segmentation insights underscore the importance of constructing fluid engagement paradigms calibrated to sponsor needs and therapeutic intricacies.

This comprehensive research report categorizes the Pharmaceutical Services Outsourcing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Clinical Phase

- Customer Type

- Contract Model

- Therapeutic Area

Analyzing Regional Variations in Outsourced Pharmaceutical Services Across Americas, EMEA, and Asia Pacific Highlighting Distinct Market Drivers

Across the Americas, the outsourcing market is characterized by mature infrastructure, integrated service platforms, and robust regulatory support. Sponsors benefit from deep pools of experienced investigators and advanced laboratory networks, catalyzing swift study startup and accelerated enrollment timelines. Moreover, the region’s emphasis on value-based healthcare models drives demand for outcomes-oriented trial designs and real-world data assessments.

In Europe, Middle East & Africa, heterogeneous regulatory frameworks coexist alongside concerted harmonization efforts, such as the Clinical Trials Regulation in the European Union. This mix necessitates region-specific compliance expertise and localized project teams. Simultaneously, digital maturity varies widely, prompting service providers to tailor decentralized trial solutions that consider connectivity limitations and patient access challenges. Emerging hubs in the Middle East are investing heavily in research infrastructure, while African nations present untapped opportunities for infectious disease and vaccine development collaborations.

The Asia-Pacific region stands out for its cost-competitive landscapes and rapidly evolving regulatory environments. Robust patient populations and expanding clinical capacity in countries such as China, India, and emerging Southeast Asian markets drive significant outsourcing activity. Service providers are enhancing regional capabilities, forging alliances with local contract research organizations to navigate country-specific requirements and cultural dynamics. Together, these regional insights illustrate the imperative for differentiated geographic strategies aligned with localized market drivers.

This comprehensive research report examines key regions that drive the evolution of the Pharmaceutical Services Outsourcing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Contract Service Providers Accelerating Growth Through Innovation, Strategic Partnerships, and Expanded Service Portfolios

Leading service providers have doubled down on technology investments and strategic alliances to fortify their market positions. One global contract research organization has integrated artificial intelligence-enabled trial design modules with cloud-native data management platforms, enhancing cross-functional collaboration and reducing cycle times. Another key player has expanded its manufacturing footprint by acquiring specialized biologic fill-finish facilities, addressing sponsor demands for end-to-end biologics supply chain solutions.

Simultaneously, mid-tier organizations are carving out niche leadership in areas such as decentralized clinical trials and risk-based monitoring. By aligning service offerings with emerging therapeutic modalities, these providers are attracting partnerships with agile biotech firms seeking focused expertise. Strategic mergers and acquisitions have also reshaped competitive dynamics, with select players securing regional partnerships to bolster local trial execution and manufacturing capacity in high-growth markets.

Taken together, these developments underscore a competitive environment defined by scale-driven innovation and targeted specialization. Organizations that harmonize digital excellence with therapeutic domain expertise are emerging as preferred partners for sponsors aiming to navigate increasing complexity and drive program success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pharmaceutical Services Outsourcing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aurobindo Pharma Ltd.

- Biocon Limited

- Cadila Healthcare Ltd.

- Catalent, Inc.

- Charles River Laboratories International, Inc.

- Cipla Limited

- Covance Inc.

- Divis Laboratories Limited

- Dr. Reddy's Laboratories Ltd.

- Gland Pharma Limited

- Hetero Drugs Limited

- ICON plc

- IQVIA Holdings Inc.

- Jubilant Pharmova Limited

- Laboratory Corporation of America Holdings

- Laurus Labs Limited

- Lonza Group Ltd.

- Parexel International Corporation

- Pharmaceutical Product Development, LLC

- Samsung Biologics Co., Ltd.

- Strides Pharma Science Limited

- Sun Pharmaceutical Industries Ltd.

- Syneos Health, Inc.

- Thermo Fisher Scientific Inc.

- WuXi AppTec Co., Ltd.

Strategic Roadmap for Executive Decision Makers to Enhance Resilience, Drive Efficiency, and Foster Innovation in Outsourced Pharma Services

To thrive in an evolving outsourcing landscape, executive teams should prioritize the deployment of integrated digital platforms that unify clinical data, operational workflows, and supply chain logistics. Embedding advanced analytics capabilities at the outset of trial planning will enable predictive modeling for recruitment optimization and risk mitigation. Concurrently, diversifying manufacturing and clinical operations across multiple geographies will reduce tariff exposure and enhance supply chain resilience.

Leadership should also explore performance-based contracting models to align incentives and foster shared accountability. Establishing long-term alliance frameworks with tier-one service providers can drive continuous process improvement and cost efficiencies. At the same time, investing in strategic alliances with emerging niche providers will grant access to specialized expertise in areas such as cell and gene therapy or decentralized trial management.

Finally, cultivating talent through collaborative training programs and cross-organizational knowledge sharing will ensure operational excellence. By fostering a culture of innovation and agility, organizations can swiftly adapt to regulatory shifts, technological breakthroughs, and evolving therapeutic demands. These measures collectively will position companies to lead the next wave of transformation in outsourced pharmaceutical services.

Comprehensive Research Approach Combining Primary Engagements, Secondary Data Analysis, and Rigorous Quality Controls to Deliver Actionable Insights

This research employs a rigorous, multi-stage methodology combining primary and secondary data sources to ensure depth and reliability. Initial insights were garnered through structured interviews with senior leaders across pharmaceutical sponsors, contract research organizations, and regulatory bodies. These engagements provided firsthand perspectives on evolving outsourcing paradigms, technology adoption, and geopolitical influences.

Complementing primary inputs, exhaustive secondary research encompassed regulatory guidelines, industry white papers, and peer-reviewed journals. Historical case studies of major outsourcing initiatives were analyzed to identify best practices and emerging patterns. Data triangulation methods were applied throughout to reconcile divergent viewpoints and validate key findings, while statistical techniques ensured consistency and reduced bias in qualitative interpretations.

The analytical framework integrated both thematic analysis for qualitative data and trend mapping for operational metrics. An expert advisory panel reviewed preliminary conclusions, offering critical feedback that refined the final report structure. Stringent editorial controls governed the documentation process, guaranteeing clarity, accuracy, and actionable relevance for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pharmaceutical Services Outsourcing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pharmaceutical Services Outsourcing Market, by Service Type

- Pharmaceutical Services Outsourcing Market, by Clinical Phase

- Pharmaceutical Services Outsourcing Market, by Customer Type

- Pharmaceutical Services Outsourcing Market, by Contract Model

- Pharmaceutical Services Outsourcing Market, by Therapeutic Area

- Pharmaceutical Services Outsourcing Market, by Region

- Pharmaceutical Services Outsourcing Market, by Group

- Pharmaceutical Services Outsourcing Market, by Country

- United States Pharmaceutical Services Outsourcing Market

- China Pharmaceutical Services Outsourcing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Converging Insights on the Evolving Outsourcing Landscape Underscoring Strategic Imperatives for Stakeholders in Pharmaceutical Services

The convergence of technological innovation, strategic alliances, and evolving regulatory landscapes is reshaping the contours of pharmaceutical services outsourcing. Digital integration and advanced analytics have elevated the role of service providers from tactical vendors to strategic partners, while tariff dynamics underscore the necessity of supply chain agility. Segmentation insights illuminate the bespoke needs of different service types, clinical phases, and customer archetypes, whereas regional analysis reveals diverse market drivers and growth pockets.

Forward-looking organizations will harness these insights to construct resilient, adaptive outsourcing strategies that align with emerging therapeutic trends and regulatory imperatives. By embracing collaborative contracting, diversifying geographies, and embedding data-driven decision-making, stakeholders can navigate complexity and accelerate program timelines. Ultimately, the most successful players will be those that blend specialized expertise with a holistic, ecosystem-oriented mindset, ensuring sustained innovation and competitive advantage in a rapidly transforming environment.

Engage with Ketan Rohom to Unlock In-Depth Analysis of Pharmaceutical Service Outsourcing Trends and Secure Your Customized Market Intelligence

To explore these comprehensive insights in greater depth and secure tailored intelligence for your strategic initiatives, connect with Ketan Rohom, Associate Director of Sales & Marketing. By engaging directly, you will gain personalized access to premium research deliverables, including in-depth analyses, bespoke advisory sessions, and interactive data workshops. Ketan’s expertise and collaborative approach ensure that your organization can translate actionable findings into immediate strategic value. Reach out today to schedule a confidential consultation and discover how this market research report will empower your decision-making and position your business at the forefront of pharmaceutical services outsourcing.

- How big is the Pharmaceutical Services Outsourcing Market?

- What is the Pharmaceutical Services Outsourcing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?