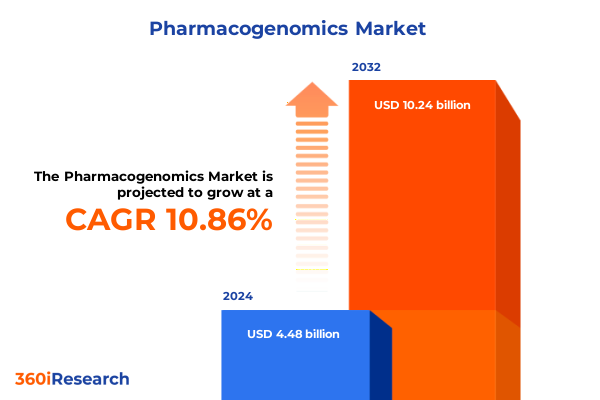

The Pharmacogenomics Market size was estimated at USD 4.98 billion in 2025 and expected to reach USD 5.47 billion in 2026, at a CAGR of 10.85% to reach USD 10.24 billion by 2032.

Exploring the Emergence of Pharmacogenomics as a Cornerstone in Personalized Medicine Through Genomic Insights and Data-Driven Therapeutic Optimization

Exploring the Emergence of Pharmacogenomics as a Cornerstone in Personalized Medicine Through Genomic Insights and Data-Driven Therapeutic Optimization

Pharmacogenomics has rapidly evolved into a cornerstone of personalized medicine, offering the promise of tailoring drug therapies to an individual’s genetic profile. This transformative field transcends traditional one-size-fits-all approaches by integrating genomic variants, metabolic pathways, and biomarker profiling. The convergence of next-generation sequencing, high-throughput genotyping, and advanced bioinformatics has catalyzed a paradigm shift, enabling clinicians to predict therapeutic efficacy and mitigate adverse reactions with unprecedented precision.

In recent years, collaborations between academic institutions, biotechnology innovators, and healthcare systems have accelerated the translation of pharmacogenomic discoveries into clinical decision support tools. Regulatory bodies are increasingly recognizing the importance of gene–drug interactions, establishing guidance to streamline diagnostic approvals and reimbursement frameworks. These developments have paved the way for broader adoption within clinical trials and real-world practice, elevating patient outcomes and cost-effectiveness. Consequently, pharmacogenomics stands at the intersection of molecular science, data analytics, and patient-centric care, poised to redefine therapeutic strategies across diverse disease areas.

Identifying Key Technological and Collaborative Transformative Shifts Redefining Pharmacogenomics Research and Clinical Application Ecosystems

Identifying Key Technological and Collaborative Transformative Shifts Redefining Pharmacogenomics Research and Clinical Application Ecosystems

Over the past decade, the pharmacogenomics landscape has experienced several transformative inflection points. The maturation of sequencing technologies, including both next-generation platforms and precise digital PCR techniques, has dramatically lowered per-sample costs while elevating sensitivity for rare variant detection. Beyond hardware advancements, the integration of artificial intelligence and machine learning into data analysis pipelines has unlocked deeper insights from multiomic datasets, facilitating predictive modeling of patient responses and enabling real-time interpretation of complex genomic profiles.

Concurrently, public–private partnerships have played a pivotal role in driving standardization and interoperability. Initiatives that unite diagnostic laboratories, pharmaceutical developers, and research organizations foster the creation of shared databases and biobanks, expediting biomarker validation and clinical trial enrollment. Regulatory agencies have responded with adaptive frameworks that encourage the co-development of companion diagnostics alongside novel therapeutics, ensuring alignment between molecular tests and drug labels. In parallel, patient advocacy groups have amplified the voice of end users by championing transparency, data privacy, and equitable access to emerging therapies. Together, these catalytic shifts in technology, collaboration, and policy are forging a new era where pharmacogenomics moves from the periphery of research into the mainstream of patient care.

Analyzing the Compound Consequences of United States Tariff Measures in 2025 on Supply Chains, Research Workflows, and Reagent Accessibility in Pharmacogenomics

Analyzing the Compound Consequences of United States Tariff Measures in 2025 on Supply Chains, Research Workflows, and Reagent Accessibility in Pharmacogenomics

Beginning January 1, 2025, the United States implemented additional tariff measures on imported laboratory consumables and sequencing reagents, resulting in a ripple effect across the pharmacogenomics sector. Although these duties target a broad range of biotechnological imports, the most pronounced impact has been felt in the procurement of kits, reagents, and specialized instrumentation primarily sourced from key overseas suppliers. As these incremental costs are absorbed by diagnostic laboratories and research services providers, budgets have shifted from exploratory research toward essential procurement, leading to elongated timelines for project initiation and completion.

Strategic responses across the ecosystem have included the diversification of supplier portfolios, the expansion of domestic manufacturing capacities, and the consolidation of reagent inventories to mitigate price volatility. Several clinical services organizations have renegotiated long-term supply agreements to secure volume discounts, while software and platforms providers have emphasized cloud-based data analysis solutions that reduce reliance on physical reagents. Furthermore, pharmaceutical companies have reevaluated their outsourcing models, shifting certain assay development and sample processing workflows to regions less exposed to US tariff pressures. As a result, laboratories and research organizations continue to adapt operating models to preserve research momentum despite rising input costs, signaling a measured but persistent recalibration of the pharmacogenomics supply chain.

Unveiling Critical Pharmacogenomic Market Segmentation Dynamics Across Therapeutic Areas, Product Categories, Technologies, End Users, Test Types, and Biomarkers

Unveiling Critical Pharmacogenomic Market Segmentation Dynamics Across Therapeutic Areas, Product Categories, Technologies, End Users, Test Types, and Biomarkers

The pharmacogenomics market unfolds across a diverse array of therapeutic areas, each presenting unique challenges and opportunities. In cardiology, genomic markers inform anticoagulant dosing and mitigate bleeding risks, whereas in infectious diseases, pathogen resistance profiling accelerates targeted antimicrobial regimens. Neurology benefits from genotype-guided mood disorder management, and oncology leverages somatic mutation panels to tailor chemotherapeutic interventions.

Product diversity further shapes market dynamics, as consumables such as kits and reagents underpin laboratory workflows, while services spanning clinical trial support and research assay development add layers of specialized expertise. Complementary software and platforms for data analysis, electronic clinical trial management, and result interpretation integrate these components into seamless analytical pipelines. Technological segmentation reveals a spectrum from microarray-based expression and SNP detection to PCR modalities-both real-time and digital-as well as high-throughput sequencing techniques encompassing next-generation and Sanger platforms.

Key end users include diagnostic laboratories-spanning hospital-based facilities and reference labs-hospitals administering point-of-care testing, pharmaceutical firms engaged in drug development, and academic or corporate research organizations. Testing approaches bifurcate into genotyping assays that identify single-nucleotide polymorphisms and phenotyping methods that assess metabolic or protein expression profiles. Underlying biomarker classifications distinguish inherited germline variations from acquired somatic mutations, delineating pathways for chronic disease management and oncology applications, respectively. Recognizing these interconnected segmentation layers is essential for stakeholders aiming to navigate the complexities of the pharmacogenomics ecosystem.

This comprehensive research report categorizes the Pharmacogenomics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapeutic Area

- Product

- Technology

- Test Type

- Biomarker Type

- End User

Deciphering Regional Pharmacogenomics Landscape Variations and Strategic Imperatives Across Americas, EMEA, and Asia-Pacific Jurisdictions

Deciphering Regional Pharmacogenomics Landscape Variations and Strategic Imperatives Across Americas, EMEA, and Asia-Pacific Jurisdictions

The Americas continue to lead in clinical adoption and investment, buoyed by robust healthcare infrastructure, supportive reimbursement policies, and a high concentration of research laboratories. The United States, in particular, drives demand through extensive pharmacogenomic consortia and regulatory incentives for companion diagnostic development. Meanwhile, Canada shows growing interest in integrating genomics into national healthcare programs, though reimbursement models vary by province.

In Europe, Middle East & Africa (EMEA), regulatory harmonization across the European Union has facilitated cross-border clinical trials, while individual nations maintain distinct guidelines for diagnostic validation. The United Kingdom’s continued focus on precision medicine through the NHS Genomic Medicine Service underscores regional momentum, yet Middle Eastern markets exhibit a nascent but rapidly maturing interest in genomic literacy and infrastructure, supported by government-led genomics initiatives.

Asia-Pacific presents a dual narrative of advanced markets and emerging economies. Japan and South Korea have institutionalized pharmacogenomics within national healthcare protocols, driving demand for local production of reagents and platforms. In contrast, emerging markets in Southeast Asia and India navigate challenges around skilled workforce development and regulatory alignment, leading to increased partnerships with global companies to bridge expertise gaps. These regional nuances influence strategic entry considerations, collaborative models, and long-term investment trajectories for industry stakeholders.

This comprehensive research report examines key regions that drive the evolution of the Pharmacogenomics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing Leading Global Players Driving Innovation, Partnerships, and Competitive Strategies Within the Evolving Pharmacogenomics Sector

Assessing Leading Global Players Driving Innovation, Partnerships, and Competitive Strategies Within the Evolving Pharmacogenomics Sector

Global leadership in pharmacogenomics is defined by a blend of technological prowess, strategic partnerships, and integrated service offerings. Established life science companies continue to expand their portfolios through acquisitions of niche diagnostics firms, embedding high-throughput sequencing capabilities alongside comprehensive bioinformatics solutions. Conversely, agile specialist players leverage focused expertise in digital PCR or microarray platforms to address targeted segments such as oncology panels or rare disease assays.

Collaborative networks between pharmaceutical giants and diagnostic innovators have generated co-development programs for companion tests that align regulatory approval pathways with label expansions. Similarly, partnerships with research organizations and academic consortia facilitate early access to validated biomarkers and cutting-edge assay methodologies. In parallel, software vendors specializing in data analytics and interpretation services have differentiated themselves by embedding AI-driven algorithms into clinical decision support tools, enhancing predictive accuracy and facilitating clinician adoption. By monitoring these strategic maneuvers-spanning acquisitions, alliances, and internal R&D investments-stakeholders can anticipate competitive dynamics and identify opportunities for co-innovation across the pharmacogenomics landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pharmacogenomics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 23andMe, Inc.

- Abbott Laboratories

- Admera Health, Inc.

- Agilent Technologies, Inc.

- Biogen Inc.

- Centogene N.V.

- Color Health, Inc.

- F. Hoffmann-La Roche Ltd.

- Genomic Health, Inc.

- Genomind, Inc.

- Illumina, Inc.

- Invitae Corporation

- Laboratory Corporation of America Holdings

- Myriad Genetics, Inc.

- OneOme, LLC

- Pathway Genomics Corporation

- Qiagen N.V.

- Quest Diagnostics Incorporated

- SOPHiA GENETICS SA

- Thermo Fisher Scientific Inc.

Formulating Actionable Strategic Recommendations to Guide Industry Leaders in Leveraging Pharmacogenomics Advances for Sustainable Competitive Advantage

Formulating Actionable Strategic Recommendations to Guide Industry Leaders in Leveraging Pharmacogenomics Advances for Sustainable Competitive Advantage

To harness the full potential of pharmacogenomics, organizations should prioritize the integration of next-generation sequencing with robust bioinformatics frameworks that enable scalable interpretation and reporting. Aligning internal R&D roadmaps with evolving regulatory pathways for companion diagnostics will streamline co-development efforts and accelerate market entry. Engaging early with payers and health technology assessment bodies ensures that evidence generation strategies align with reimbursement criteria, mitigating commercialization risks.

Industry leaders must also cultivate diversified supply chains by fostering domestic partnerships for consumables manufacturing and identifying regional distributors capable of maintaining quality while managing cost pressures. Investing in workforce development through collaborative programs with academic institutions will strengthen capabilities in genomic data analysis, interpretation, and clinical implementation. Finally, fostering open innovation ecosystems-comprising diagnostic laboratories, software developers, and pharmaceutical companies-will drive cross-sector synergies, facilitate data sharing, and unlock new therapeutic insights. By operationalizing these recommendations, stakeholders can build resilient and agile business models that stay ahead of emerging market trends.

Outlining Rigorous Multi-Phase Research Methodology Integrating Data Sources, Analytic Frameworks, and Validation Approaches in Pharmacogenomics Investigation

Outlining Rigorous Multi-Phase Research Methodology Integrating Data Sources, Analytic Frameworks, and Validation Approaches in Pharmacogenomics Investigation

This research approach commences with comprehensive secondary data gathering, encompassing scientific literature, patent filings, regulatory databases, and public company disclosures to establish foundational knowledge. The second phase involves primary qualitative interviews with subject matter experts across diagnostic laboratories, pharmaceutical R&D teams, clinical services providers, and academic institutions to validate hypotheses and capture nuanced insights on emerging technologies and market shifts.

Subsequent analysis applies a combination of strategic frameworks to dissect industry dynamics: Porter’s Five Forces identifies competitive pressures; PESTLE analysis contextualizes external influences from political and regulatory factors to socio-economic trends; and SWOT analysis synthesizes organizational strengths, weaknesses, opportunities, and threats. Data triangulation ensures consistency across sources, while expert validation workshops confirm the accuracy of key findings and refine interpretive narratives. This multi-phase methodology ensures that conclusions are robust, action oriented, and reflective of the rapidly evolving pharmacogenomics ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pharmacogenomics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pharmacogenomics Market, by Therapeutic Area

- Pharmacogenomics Market, by Product

- Pharmacogenomics Market, by Technology

- Pharmacogenomics Market, by Test Type

- Pharmacogenomics Market, by Biomarker Type

- Pharmacogenomics Market, by End User

- Pharmacogenomics Market, by Region

- Pharmacogenomics Market, by Group

- Pharmacogenomics Market, by Country

- United States Pharmacogenomics Market

- China Pharmacogenomics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Concluding Synthesis of Pharmacogenomics Sector Evolution Highlighting Clinical, Technological, and Strategic Trajectories Shaping the Future

Concluding Synthesis of Pharmacogenomics Sector Evolution Highlighting Clinical, Technological, and Strategic Trajectories Shaping the Future

The pharmacogenomics sector stands at an inflection point where scientific innovation, policy evolution, and commercial strategy converge. Clinically, genomic insights are reshaping drug development pipelines and enabling precision dosing that enhances patient safety and therapeutic efficacy. Technologically, the relentless advancement of sequencing and PCR platforms-augmented by machine learning-driven analytics-continues to expand the boundaries of what is possible in variant detection and interpretation.

Strategically, cross-sector collaborations and adaptive regulatory frameworks have laid the groundwork for seamless integration of diagnostics into clinical trials and routine care. Nevertheless, persistent challenges around supply chain resilience, reimbursement alignment, and workforce readiness require concerted action. By embracing agile operational models, strategic partnerships, and a data-centric mindset, stakeholders can navigate complexity and drive sustained growth. The synthesis of these clinical, technological, and strategic trajectories will determine who leads the next chapter of pharmacogenomics, underscoring the imperative for informed decision-making and collaborative innovation.

Engaging with Ketan Rohom to Secure Comprehensive Pharmacogenomics Market Research Insights and Drive Informed Decision-Making for Strategic Growth

To explore the depths of pharmacogenomics and how its strategic insights can transform decision-making across scientific, clinical, and commercial domains, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in guiding organizations through complex market landscapes will equip your team with targeted guidance and bespoke strategies. By securing a comprehensive market research report, you gain access to data-driven perspectives, competitive benchmarking, and practical roadmaps tailored to your unique priorities.

Reach out to schedule a consultation with Ketan Rohom to unlock unparalleled visibility into emerging trends, regulatory influences, and innovation pipelines. Whether you are optimizing portfolio investments, advancing clinical programs, or strengthening supply chains, his consultative approach will ensure you harness the full potential of pharmacogenomics intelligence. Begin your journey towards informed strategic growth and operational excellence by partnering with a recognized thought leader in the field. Take the next step today to acquire the indispensable insights necessary to stay ahead in this dynamic industry.

- How big is the Pharmacogenomics Market?

- What is the Pharmacogenomics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?