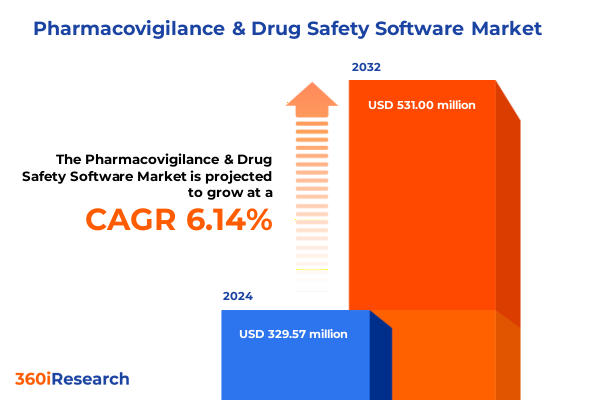

The Pharmacovigilance & Drug Safety Software Market size was estimated at USD 346.83 million in 2025 and expected to reach USD 371.02 million in 2026, at a CAGR of 6.28% to reach USD 531.33 million by 2032.

Introduction Establishing the Critical Imperatives and Evolving Complexities Shaping Pharmacovigilance and Drug Safety Software

In an era marked by rapid technological advances, mounting safety expectations, and an increasingly intricate regulatory environment, the discipline of pharmacovigilance has never been more critical. Stakeholders across the pharmaceutical ecosystem-from regulatory bodies to contract research organizations-are grappling with the imperative of ensuring drug safety while expediting time to market. This dynamic has given rise to a complex tapestry of challenges, including the need to process massive volumes of adverse event data, adhere to evolving global compliance mandates, and extract meaningful insights from diverse real-world evidence sources.

Against this backdrop, drug safety software solutions have evolved from basic adverse event tracking tools to sophisticated platforms that integrate advanced analytics, automation, and cloud architectures. Enterprise safety database management systems now serve as centralized repositories for case intake, processing, and reporting, while AI-driven signal detection modules promise earlier identification of emerging risks. Regulatory reporting engines are being fortified to meet stringent requirements in the United States, Europe, and Asia, where agencies are issuing new guidance on data transparency, real-world evidence, and artificial intelligence in decision-making.

As companies recalibrate their pharmacovigilance strategies to navigate these pressures, it is imperative to develop a clear understanding of the transformative forces at play. This executive summary sets the stage by defining the core challenges, highlighting the advent of new technological paradigms, and underscoring the need for strategic agility. By painting a comprehensive portrait of the current landscape, this introduction lays the groundwork for the insights and recommendations that follow, ensuring that decision-makers are equipped with the context and perspective necessary for informed action.

Embracing Disruption Through Technological Innovations and Data-Driven Approaches Redefining Pharmacovigilance Operations and Compliance

The landscape of pharmacovigilance is undergoing seismic change as organizations embark on ambitious digital transformation journeys. Traditional reactive approaches-rooted in manual case review and statistical disproportionality analysis-are giving way to predictive models and automated workflows. AI and machine learning algorithms are now harnessed to sift through terabytes of structured and unstructured data, including clinical reports, electronic health records, social media feeds, and patient registries. These capabilities reduce signal detection timelines and improve the accuracy of safety signal validation by filtering out noise and prioritizing clinically relevant patterns.

Beyond analytics, cloud-native architectures are revolutionizing how pharmacovigilance functions are deployed and scaled. Public and private cloud offerings enable organizations to shift from capital-intensive on-premise infrastructure to more flexible consumption-based models. This transformation fosters global collaboration among safety and regulatory teams, facilitating real-time data sharing and version control while reducing operational overhead. Additionally, the integration of AI-powered reporting engines is streamlining regulatory submissions, ensuring compliance with Good Pharmacovigilance Practices and aligning with new directives on AI transparency issued by major agencies in 2025.

Regulatory frameworks themselves are evolving to accommodate these technological innovations. Agencies such as the FDA and EMA have published guidance on the use of AI in regulatory decision-making, emphasizing explainability, data provenance, and risk mitigation. These developments are prompting companies to adopt robust governance models, invest in algorithm validation processes, and build cross-functional teams combining pharmacovigilance, data science, and regulatory affairs expertise. As a result, the industry is moving toward a more proactive risk management posture, leveraging predictive analytics to forecast potential safety concerns before they escalate into public health issues.

Assessing How United States Tariffs Introduced in 2025 Are Reshaping Cost Structures and Deployment Strategies in Drug Safety Software

In April 2025, the United States implemented a sweeping 10% global tariff on all imported goods, encompassing data-center equipment, networking hardware, and critical IT infrastructure components. These measures have significant downstream implications for pharmacovigilance software deployments, particularly for large enterprises maintaining on-premise hardware environments. Higher import duties on servers, storage arrays, and telecom equipment have increased capital expenditure and elongated procurement timelines, forcing many organizations to reassess their technology roadmaps.

Moreover, the imposition of up to 25% duties on pharmaceutical machinery and APIs sourced from China and India has extended cost pressures to the broader healthcare technology landscape. Although software delivered digitally remains untaxed, the hardware dependencies of on-premise solutions mean that life sciences companies must weigh the total cost of ownership more carefully. As a result, there is a marked pivot toward cloud and hybrid architectures, where software-as-a-service models allow pharmacovigilance teams to avoid steep hardware outlays and benefit from rapid scalability.

This tariff regime has also spurred organizations to diversify their supplier base and explore near-shoring options for critical system components. Some life sciences firms have accelerated partnerships with domestic data centers and private cloud providers to mitigate exposure to future trade disruptions. At the same time, the increased cost of on-premise upgrades is driving small and medium enterprises to lean heavily on public cloud instances, where multi-tenant environments help distribute infrastructure expenses across a wider customer base. Collectively, these shifts underscore the pivotal role of tariff-induced economic factors in shaping deployment strategies and the adoption of emerging pharmacovigilance technologies.

Generating Deep Segment-Level Perspectives Across Components Organization Sizes End Users Deployment Modes and Application Areas Driving Market Dynamics

Deep analysis across component layers reveals that demand for signal detection and risk management modules is surging as companies seek more proactive pharmacovigilance frameworks. Safety database management systems remain foundational, yet the appetite for adjacent analytics and regulatory reporting capabilities is intensifying, creating a spectrum of solution bundles tailored to specific operational needs.

Organizational scale also plays a pivotal role. Large enterprises often favor comprehensive, integrated platforms that support complex workflows and global compliance requirements. In contrast, small and medium enterprises gravitate toward modular offerings that minimize initial expenditure and allow incremental capability enhancement as safety programs mature. This divergence is mirrored in deployment preferences, with larger organizations deploying private cloud or hybrid environments to maintain control over sensitive data, while smaller entities rely on public cloud models to access enterprise-grade functionality with minimal internal IT investment.

From an end-user perspective, contract research organizations are driving demand for scalable pharmacovigilance case management and regulatory reporting services on behalf of multiple sponsors. Meanwhile, biopharmaceutical companies are focusing on end-to-end safety database solutions with embedded analytics to streamline in-house workflows. Application-level insights further highlight that adverse event case management continues to command significant attention, but aggregate reporting and risk communication tools are rapidly gaining traction as regulatory agencies demand richer narrative and data disclosures in periodic safety update reports and risk management plans.

This comprehensive research report categorizes the Pharmacovigilance & Drug Safety Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Organization Size

- End User

- Deployment Mode

- Application

Examining Regional Dynamics Driving Adoption of Pharmacovigilance and Drug Safety Solutions Across the Americas Europe Middle East Africa and Asia-Pacific

In the Americas, the United States remains the epicenter of pharmacovigilance investment, driven by stringent FDA regulations and the country’s leadership in biopharmaceutical innovation. The U.S. market’s maturity is evidenced by widespread cloud adoption, with many organizations leveraging private cloud instances to balance agility and data sovereignty. Canada and Latin America are also witnessing gradual uptake, as regional regulatory authorities harmonize reporting requirements and promote digital safety frameworks across border alliances.

Europe, the Middle East, and Africa exhibit a heterogeneous landscape shaped by diverse regulatory regimes and data protection laws. The European Union’s General Data Protection Regulation has catalyzed a preference for private cloud and on-premise deployments, particularly among companies handling sensitive patient information. Meanwhile, the Middle East is investing in building local regulatory infrastructure, and Africa’s nascent pharmacovigilance networks are increasingly adopting cost-effective cloud-native platforms to bridge capability gaps.

Asia-Pacific stands out for its robust growth trajectory, fueled by expanding pharmaceutical R&D operations in countries such as China, India, Japan, and South Korea. Regulators in these markets are progressively aligning with international safety reporting norms, prompting global and local players to deploy advanced signal detection and analytics solutions. Cost sensitivity in this region underscores a penchant for public cloud consumption models, which offer rapid deployment and flexible pay-as-you-go pricing that accommodate evolving safety program budgets.

This comprehensive research report examines key regions that drive the evolution of the Pharmacovigilance & Drug Safety Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Core Competencies of Leading Players Shaping the Pharmacovigilance and Drug Safety Software Ecosystem in 2025

Leading technology vendors are consolidating their positions through strategic partnerships, continuous product innovation, and targeted acquisitions. ArisGlobal, known for its end-to-end safety and regulatory suite, has deepened its AI capabilities by integrating advanced natural language processing engines for case triage. Veeva Systems continues to expand its unified cloud platform, enhancing real-world data ingestion and offering new visualization tools for safety professionals.

Oracle’s Argus Safety solution remains a cornerstone for large enterprises, supported by decades of regulatory compliance validation and robust global support networks. IQVIA has leveraged its vast healthcare data assets and analytics expertise to deliver AI-augmented signal detection modules that connect pharmacovigilance insights to commercial performance metrics. Meanwhile, Dassault Systèmes’ Medidata platform is integrating predictive risk models to optimize safety surveillance in clinical trial settings.

Consulting and IT services providers such as Accenture and Cognizant are also playing critical roles by offering tailored implementation and managed services for pharmacovigilance systems. These integrators help translate complex regulatory requirements into scalable technology blueprints, ensuring that organizations can deploy high-impact safety solutions without overburdening internal teams.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pharmacovigilance & Drug Safety Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ArisGlobal LLC

- Clarivate Plc

- Dassault Systèmes SE

- Ennov Solutions SA

- EXTEDO GmbH

- Genpact Ltd.

- Lorenz Life Sciences Group GmbH

- Oracle Corporation

- RELX PLC

- Veeva Systems Inc.

Crafting Pragmatic and Forward-Looking Strategies to Guide Industry Leaders Navigating Evolving Regulatory Technological and Market Landscapes

To thrive amid accelerating regulatory expectations and technological complexity, industry leaders should first prioritize the development of a coherent AI governance framework. By establishing transparent model validation processes, organizations can ensure regulatory compliance and build trust in algorithm-driven decision support. Equally important is the migration of core safety workloads to cloud-native environments that offer elasticity, built-in security controls, and continuous software updates.

Leaders must also invest in cross-disciplinary talent, combining pharmacovigilance expertise with data science and software engineering skills. Building such teams enables more rapid customization of signal detection algorithms and accelerates the development of tailored reporting workflows. Moreover, organizations should cultivate strategic partnerships with specialized providers to augment internal capabilities, particularly in emerging areas such as real-world evidence integration and blockchain-enabled audit trails.

Finally, companies must adopt a dynamic supplier diversification strategy to mitigate supply chain risks exacerbated by escalating tariffs. Engaging multiple cloud and infrastructure vendors, exploring near-shoring options, and proactively negotiating service-level agreements will safeguard operational continuity and control costs. Collectively, these actionable steps will empower industry leaders to maintain regulatory alignment, harness innovation, and deliver superior patient safety outcomes.

Detailing Rigorous Research Methodologies Integrating Qualitative Expert Interviews Data Triangulation and Secondary Information Validation for Robust Insights

This analysis synthesizes insights derived from a multi-pronged research approach. Secondary research encompassed a thorough review of industry publications, regulatory guidance documents, and publicly available corporate materials to establish a foundational understanding of market dynamics. To validate these findings, dozens of in-depth interviews were conducted with senior pharmacovigilance and regulatory affairs executives, data scientists, and technology solution architects across diverse geographies.

Quantitative data was corroborated through rigorous data triangulation, leveraging cross-verification of vendor announcements, regulatory filings, and third-party market intelligence repositories. A proprietary database of pharmacovigilance software implementations provided a granular view of adoption patterns across solution types and deployment models. Throughout the process, quality assurance protocols were enforced to ensure data integrity, including double-coding of qualitative interview transcripts and statistical validation of key numeric insights.

To enhance analytical rigor, scenario planning workshops were held with internal experts to stress-test emerging trends under varying macroeconomic and regulatory conditions. These collaborative sessions refined interpretative frameworks and shaped the actionable recommendations presented herein. The resulting methodology offers a transparent audit trail from data collection to insight generation, ensuring that stakeholders can trust the robustness and relevance of the conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pharmacovigilance & Drug Safety Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pharmacovigilance & Drug Safety Software Market, by Component

- Pharmacovigilance & Drug Safety Software Market, by Organization Size

- Pharmacovigilance & Drug Safety Software Market, by End User

- Pharmacovigilance & Drug Safety Software Market, by Deployment Mode

- Pharmacovigilance & Drug Safety Software Market, by Application

- Pharmacovigilance & Drug Safety Software Market, by Region

- Pharmacovigilance & Drug Safety Software Market, by Group

- Pharmacovigilance & Drug Safety Software Market, by Country

- United States Pharmacovigilance & Drug Safety Software Market

- China Pharmacovigilance & Drug Safety Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings to Reflect on Market Transformations and Implications for Stakeholders Engaged in Pharmacovigilance and Drug Safety Technologies

The evolution of pharmacovigilance and drug safety software reflects the broader digital transformation of the life sciences industry. Novel AI algorithms and cloud-native platforms are redefining how organizations detect, analyze, and respond to safety signals, shifting from reactive compliance to predictive risk management. At the same time, geopolitical and economic factors-most notably U.S. tariffs-are reshaping deployment strategies and accelerating the adoption of SaaS models.

Segment-level dynamics underscore that while safety database management remains a foundational requirement, adjacent analytics, regulatory reporting, and risk communication capabilities are driving new waves of investment. Regional insights highlight nuanced adoption patterns, with mature markets in North America and Europe prioritizing governance and data sovereignty, while Asia-Pacific emerges as a high-growth frontier seeking cost-effective cloud solutions.

The strategic moves of leading vendors and service providers demonstrate a clear emphasis on integrating advanced analytics, reinforcing regulatory compliance, and fostering ecosystem partnerships. For industry leaders, the imperative is to build adaptive architectures, cultivate multidisciplinary talent, and establish resilient supply chains that can withstand future disruptions. By embracing these imperatives, organizations can ensure both compliance and operational excellence, ultimately safeguarding patient health in an increasingly complex global environment.

Engage with Ketan Rohom to Unlock In-Depth Drug Safety Software Market Intelligence and Secure Your Comprehensive Pharmacovigilance Report Today

To access a comprehensive and meticulously researched pharmacovigilance and drug safety software market report, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise will ensure you receive tailored guidance on unlocking in-depth industry intelligence, navigating report features, and securing the subscription that best aligns with your strategic objectives. Reach out to Ketan Rohom today and fortify your organization’s ability to stay ahead in an increasingly complex regulatory and technological landscape.

- How big is the Pharmacovigilance & Drug Safety Software Market?

- What is the Pharmacovigilance & Drug Safety Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?