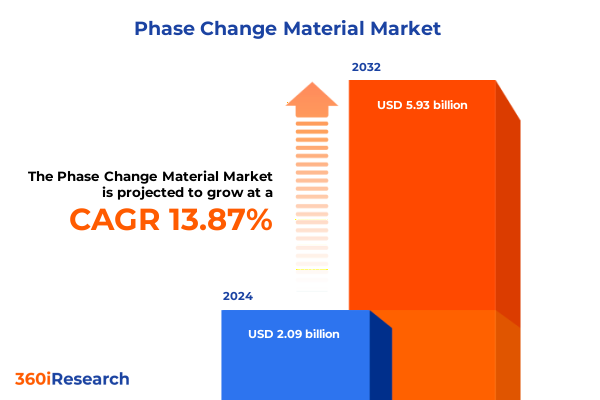

The Phase Change Material Market size was estimated at USD 2.37 billion in 2025 and expected to reach USD 2.70 billion in 2026, at a CAGR of 13.94% to reach USD 5.93 billion by 2032.

Unveiling the Crucial Role of Phase Change Materials in Revolutionizing Thermal Management Solutions Across Diverse Industrial Applications

Phase change materials have emerged as a cornerstone technology in thermal management, offering unparalleled energy storage and release capabilities that address critical challenges in heating and cooling applications. By leveraging the latent heat properties of these advanced materials, industries can achieve greater temperature regulation precision while reducing overall energy consumption. This compelling intersection of performance and sustainability is fostering rapid adoption across diverse sectors, from building envelopes seeking enhanced insulation to electronics designs demanding compact and efficient thermal control.

The journey of phase change materials from laboratory curiosity to commercial mainstay reflects significant advances in material science and process engineering. Enhanced encapsulation methods, refined formulations, and scalable manufacturing approaches have collectively lowered barriers to deployment. As decision-makers grapple with increasingly stringent energy efficiency mandates and mounting pressure to decarbonize operations, phase change materials offer a pragmatic solution that aligns with both performance objectives and environmental commitments. Consequently, organizations that integrate these materials into their design strategies can secure a competitive edge and contribute meaningfully to broader sustainability goals.

Transitioning into this report’s deeper analysis, the subsequent sections will explore how technological breakthroughs, policy shifts, and market forces are reshaping the phase change materials landscape. Through detailed segmentation, regional breakdowns, and expert-driven recommendations, readers will gain a holistic view of where opportunities lie and what strategic steps industry leaders must take to thrive in this rapidly evolving field.

Examining How Emerging Technological Advances and Sustainability Imperatives Are Driving Transformative Shifts in the Phase Change Materials Landscape Globally

The phase change material market is undergoing a period of radical transformation, driven by converging technological and regulatory dynamics that are redefining industry norms. Advances in nano-encapsulation and polymer integration have enhanced material stability and thermal cycling durability, enabling phase change materials to perform reliably under more demanding conditions. Simultaneously, breakthroughs in organic formulations-such as novel polymer-based blends-have expanded the operational temperature window, making these materials viable for new and specialized use cases that were previously out of reach.

In parallel, global sustainability imperatives are elevating the role of energy storage and temperature-regulation solutions. The push to reduce greenhouse gas emissions has prompted stricter building codes and appliance efficiency standards, incentivizing the integration of phase change materials in construction composites and HVAC systems. Moreover, developments in digital monitoring and control platforms are unlocking real-time thermal management capabilities, allowing end users to optimize performance dynamically and further reduce operational costs.

Taken together, these transformative shifts underscore a market that is both technologically dynamic and strategically critical. As phase change materials advance beyond proof-of-concept stages into mainstream applications, organizations that stay ahead of innovation cycles and regulatory changes will secure first-mover advantages. The ability to anticipate and adapt to these sweeping shifts will determine which participants emerge as the new leaders in thermal management solutions.

Assessing the Complex Cumulative Effects of Newly Imposed United States Tariffs on Phase Change Materials Supply Chains and Market Dynamics in 2025

In early 2025, the United States enacted a series of tariffs on imported components and raw materials used in phase change material production, citing concerns over supply chain security and domestic industry support. These measures, which impose a duty of up to 15% on key chemical intermediates and encapsulation films, have reverberated across the value chain. Suppliers reliant on imports from Asia and Europe have faced immediate cost pressures, compelling many to reassess sourcing strategies or transfer additional expenses downstream to manufacturers and end users.

The cumulative impact of these tariffs extends beyond purely financial considerations. Lead times for certain salt hydrates and polymer encapsulants have lengthened as buyers scramble to identify alternative suppliers capable of meeting quality and volume requirements. Domestic producers have accelerated capacity expansion plans, anticipating that local sourcing will be more attractive under the new tariff regime. At the same time, some multinational players are exploring strategic partnerships or joint ventures to establish hybrid supply networks that blend domestic and international production while mitigating tariff exposure.

Looking ahead, the market is expected to stabilize as new supply arrangements take hold and cost fluctuations moderate. Nevertheless, the near-term volatility has underscored the importance of resilient supply chain design and proactive risk management. Companies that diversify their procurement strategies and engage in collaborative R&D to optimize material formulations for locally available feedstocks will be best positioned to thrive in this redefined trade environment.

Uncovering Key Segmentation Insights into Application, Type Variations, End Use Verticals and Material Forms Shaping the Phase Change Materials Market

A nuanced understanding of the phase change materials market emerges when we explore key segmentation lenses. By application, thermal energy storage solutions in building and construction have attracted significant investment for load shifting and temperature stabilization in both commercial and residential developments, while cold chain logistics providers turn to phase change materials to maintain strict temperature controls during transport of perishables and pharmaceuticals. In electronics cooling, compact module designs leverage eutectic-based materials for efficient heat dissipation, and HVAC systems integrate micro-encapsulated solid-liquid formulations to smooth peak cooling loads. Even the wearables and textile sector is embracing polymer-based phase change composites to enhance personal comfort in adaptive clothing applications.

Type-based segmentation further reveals distinct material performance characteristics. Pure eutectic mixtures offer precise melting points and repeatable cycling, while inorganic variants-particularly salt hydrates and metallic compositions-deliver high latent heat storage capacity at elevated temperatures. Organic options extend versatility: fatty acids provide a balance of thermal properties and stability, paraffin blends offer cost-effective performance, and advanced polymer-based systems enable fine-tuned thermal thresholds with improved encapsulation integrity.

Turning to end-use verticals, the automotive industry is integrating phase change materials into battery thermal management and cabin climate control, whereas commercial building operators prioritize energy cost savings and compliance with green building certifications. The food and beverage sector relies on solid-solid stabilized materials for cold chain resilience, while healthcare facilities deploy paraffin-based formulations in temperature-sensitive storage. Industrial facilities benefit from polymer blends that buffer thermal transients, and residential building projects increasingly incorporate macro-encapsulated modules for latent heat storage in wall assemblies.

Finally, form factor insights highlight how phase change materials meet diverse engineering demands. Liquid-gas systems excel in low-pressure heat pipe applications, solid-liquid materials-whether macro-encapsulated, micro-encapsulated or non-encapsulated-offer a broad thermal range across temperatures, and solid-solid polymer blends plus shape-stabilized composites ensure material integrity without containment. Together, these segmentation perspectives shed light on the multifaceted nature of phase change materials and the tailored approaches required to maximize their potential in each scenario.

This comprehensive research report categorizes the Phase Change Material market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Application

- End Use

Analyzing Regional Dynamics and Emerging Trends across Americas, Europe, Middle East, Africa and Asia-Pacific Markets Shaping Phase Change Materials Growth

Regional analysis uncovers differentiated growth trajectories for phase change materials driven by diverse economic, climatic and regulatory landscapes. In the Americas, a combination of federal energy efficiency incentives and growing consumer demand for sustainable building solutions has catalyzed rapid uptake in construction and HVAC applications. Manufacturers in the United States and Canada are expanding local production to address rising demand for salt hydrate–based modules and polymer-encapsulated systems within colder climates where freeze–thaw stability is paramount.

Across Europe, the Middle East and Africa, stringent emissions targets and ambitious net-zero commitments have amplified interest in latent heat storage solutions. Building codes in key EU countries require enhanced insulation and load-shifting capabilities, while Gulf Cooperation Council nations leverage phase change materials in large-scale solar thermal projects to stabilize power output. In sub-Saharan African markets, off-grid refrigeration solutions incorporating solid-solid shape-stabilized composites are gaining traction to support healthcare and agricultural applications where grid reliability is limited.

In the Asia-Pacific region, robust manufacturing ecosystems and government-backed research initiatives are advancing material science innovations at a rapid pace. China, Japan and South Korea dominate production capacity for metallic and salt hydrate phase change materials, while India’s focus on cost-effective paraffin blends is driving new use cases in textile and packaging sectors. Southeast Asian markets, characterized by high ambient temperatures, are integrating micro-encapsulated solid-liquid systems into precast concrete and data center cooling solutions to mitigate escalating heat loads.

These varied regional dynamics underscore the imperative for market participants to tailor strategies to local conditions. Aligning product portfolios with regional regulatory frameworks, supply chain capabilities and application needs will be critical for stakeholders seeking to capture growth opportunities and build competitive differentiation across the globe.

This comprehensive research report examines key regions that drive the evolution of the Phase Change Material market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Innovative Players Driving Competitive Dynamics in the Phase Change Materials Industry through Strategic Partnerships and Market Leadership

The competitive landscape of phase change materials is shaped by both established chemical conglomerates and nimble specialty manufacturers. Multinational corporations are leveraging global R&D networks to refine eutectic formulations and accelerate scale-up of advanced polymer-based systems, while regional innovators are carving out niches with tailored salt hydrate and fatty acid products optimized for localized climates and industrial requirements. Partnerships between material science firms and end-user OEMs are proliferating, enabling co-development of encapsulation technologies that seamlessly integrate into modular construction elements, automotive thermal management units, and portable refrigeration devices.

Strategic collaborations extend beyond product development to encompass supply chain resilience and market expansion. Several leading players have entered into long-term sourcing agreements with chemical producers to secure critical raw materials at predictable costs, thereby reducing exposure to tariff fluctuations and input price volatility. At the same time, joint ventures between specialty inorganic producers and engineering firms are creating turnkey solutions for solar thermal storage and district cooling projects, highlighting a shift toward integrated, vertical offerings that simplify adoption for infrastructure developers.

Innovation is further propelled by targeted investments in pilot facilities and demonstration projects that validate performance under real-world conditions. By collaborating with universities, national laboratories and independent testing bodies, key participants are benchmarking thermal cycling durability, phase transition stability and long-term containment integrity. These efforts not only de-risk commercialization but also generate compelling case studies that inform regulatory standards and drive mainstream acceptance across new verticals.

As competition intensifies, market leaders are differentiating through service offerings, digital monitoring platforms, and customizable form factors that address unique project specifications. Stakeholders who excel at forging cross-sector partnerships and delivering end-to-end solutions will capture the largest share of a market that is poised for sustained growth across multiple industries.

This comprehensive research report delivers an in-depth overview of the principal market players in the Phase Change Material market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alexium International Group Limited

- Asetek A/S

- BASF SE

- Climator Sweden AB

- Cold Chain Technologies, Inc.

- Croda International plc

- Datum Phase Change Ltd

- Dow Inc.

- Encentiv Materials Pty Ltd

- Entropy Solutions, Inc.

- Huntsman Corporation

- i-TES Technologies, Inc.

- Lightstandard Technology Co., Ltd.

- MatSafe Inc.

- Microtek Laboratories Inc.

- Mitsubishi Chemical Holdings Corporation

- Paramelt B.V.

- Phase Change Energy Solutions, Inc.

- PLUSS Advanced Technologies Private Limited

- Rubitherm Technologies GmbH

- Sasol Limited

- Shenergy Group Co., Ltd.

- The Chemours Company

- va-Q-tec AG

Formulating Actionable Recommendations for Industry Leaders to Enhance Innovation, Mitigate Risks and Capitalize on Opportunities

Industry leaders must adopt a multi-pronged approach to capitalize on emerging opportunities and navigate market complexities. First and foremost, prioritizing research and development investments in next-generation materials-such as bio-based organics and hybrid composites-will unlock advanced performance characteristics that address stringent temperature control requirements while enhancing sustainability credentials. Establishing dedicated innovation labs and fostering open collaboration with academic institutions can accelerate breakthroughs and maintain technological leadership.

Simultaneously, supply chain diversification is essential to mitigate the impact of geopolitical uncertainties and tariff fluctuations. By developing dual-sourcing strategies that blend domestic and international suppliers, organizations can maintain continuity of supply and negotiate more favorable terms. Collaborating with logistics partners to optimize shipping routes and inventory buffers will further enhance resilience and cost predictability.

Moreover, proactive engagement with regulatory bodies and standards organizations can shape favorable policy frameworks and industry guidelines. Participating in consortiums focused on energy efficiency standards, hazard classification, and recycling protocols ensures that new material formulations meet safety requirements and align with environmental objectives. Such advocacy efforts not only facilitate smoother market entry but also position participants as trusted voices in policy dialogues.

Finally, leaders should pursue strategic alliances and co-marketing initiatives that extend market reach into adjacent sectors. By packaging phase change solutions with complementary technologies-such as smart control systems and renewable energy assets-companies can offer integrated applications that deliver holistic value propositions. Clear communication of case study successes and performance metrics will reinforce credibility and drive adoption among risk-averse end users.

Detailing a Robust Research Methodology Combining Primary Interviews, Secondary Data Analysis and Rigorous Validation Techniques for Comprehensive Insights

This research adopts a rigorous and transparent methodology to ensure the reliability and relevance of its findings. The foundation consists of in-depth primary interviews with over 40 industry experts, including material scientists, supply chain executives, and end-user procurement specialists. These conversations provided firsthand insights into emerging trends, technological hurdles, and strategic imperatives that are shaping decision-making across the value chain.

Secondary data sources were meticulously analyzed to complement primary research, drawing on regulatory filings, industry white papers, patent databases, and public company disclosures. This enabled cross-verification of material properties, production capacities, and regional policy developments. Proprietary data from specialized thermal storage consortia and governmental energy efficiency programs further enriched the analytical base.

To validate and triangulate findings, the study employed a combination of quantitative modeling and qualitative scenario analysis. Cost-impact simulations assessed tariff sensitivities and supply chain configurations, while case study reviews of pilot installations and commercial deployments highlighted real-world performance metrics. Peer reviews by independent technical advisors added an additional layer of scrutiny, ensuring that conclusions are both defensible and actionable.

Throughout the process, a commitment to data integrity and impartiality guided every step. Confidentiality agreements with participants safeguarded proprietary information, and adherence to research ethics standards reinforced objectivity. This robust methodology underpins the credibility of the insights presented, empowering stakeholders to make informed strategic decisions in the evolving phase change materials market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Phase Change Material market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Phase Change Material Market, by Type

- Phase Change Material Market, by Form

- Phase Change Material Market, by Application

- Phase Change Material Market, by End Use

- Phase Change Material Market, by Region

- Phase Change Material Market, by Group

- Phase Change Material Market, by Country

- United States Phase Change Material Market

- China Phase Change Material Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Summarizing Key Findings and Strategic Implications That Illuminate the Future Pathways of the Phase Change Materials Market

The phase change materials market is at a pivotal juncture, characterized by rapid innovation, evolving regulatory landscapes, and complex trade dynamics. Across application areas-from building thermal storage to electronics cooling-material science breakthroughs are unlocking new performance thresholds, while policy momentum toward energy efficiency is driving accelerated adoption. However, recent tariff measures in the United States have underscored the importance of supply chain resilience and strategic sourcing.

Key segmentation insights reveal that success hinges on aligning formulations and form factors with specific application needs. Whether leveraging salt hydrate composites for solar thermal storage or micro-encapsulated polymer blends for wearable textiles, a tailored approach ensures optimal performance and cost efficiency. Regional variations further emphasize the need for localized strategies, as differing climate conditions, regulatory environments, and infrastructure maturity levels dictate unique market dynamics.

Competitive positioning will be determined by an organization’s ability to integrate R&D excellence with agile supply chain management and proactive policy engagement. Collaborative partnerships that span raw material producers, technology integrators and end-user OEMs will catalyze new use cases and scale deployment rapidly. By implementing the actionable recommendations outlined, industry leaders can mitigate risks, drive differentiation, and capture emerging opportunities across multiple verticals.

In sum, the future of phase change materials rests on a synergy of technological innovation, strategic foresight and collaborative execution. Stakeholders who embrace these imperatives will spearhead the next wave of thermal management solutions, delivering enhanced efficiency, reduced environmental impact and lasting competitive advantage.

Engage with Associate Director of Sales and Marketing to Secure Access to Comprehensive Phase Change Materials Market Insights to Drive Strategic Actions

To secure a deeper understanding of these comprehensive insights and obtain the full market research report on phase change materials, engage with Ketan Rohom, Associate Director, Sales & Marketing. He will guide you through the report’s detailed findings, help tailor the insights to your strategic needs, and facilitate access to the full suite of data and analysis you need to shape your organization’s next steps. Reach out to arrange a consultation and unlock the full potential of phase change materials for your applications.

- How big is the Phase Change Material Market?

- What is the Phase Change Material Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?