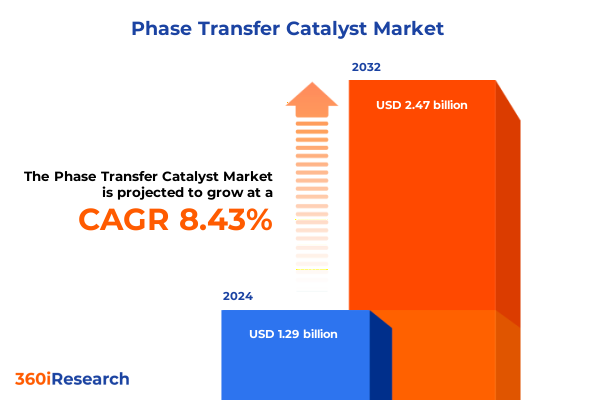

The Phase Transfer Catalyst Market size was estimated at USD 1.40 billion in 2025 and expected to reach USD 1.52 billion in 2026, at a CAGR of 8.44% to reach USD 2.47 billion by 2032.

Unleashing the Power of Phase Transfer Catalysis: Bridging Molecular Boundaries to Fuel Tomorrow’s Sustainable Industrial Processes

Phase transfer catalysts (PTCs) are specialized chemical agents that facilitate the migration of ionic reactants between immiscible phases to accelerate otherwise sluggish reactions. By acting like molecular shuttles, these catalysts transport reactive ions from aqueous environments into organic media where they participate in key transformations. This unique capability often obviates the need for large volumes of hazardous organic solvents, streamlining work‐up procedures and simplifying product isolation.

In industrial settings, PTCs have become indispensable for the synthesis of high‐value materials. They enable the efficient production of polyesters by catalyzing the reaction between acyl chlorides and bisphenol‐A, and they play a central role in the alkylation steps required to generate phosphothioate‐based pesticides. The catalyst’s amphiphilic nature effectively lowers interfacial tension, thereby accelerating reaction rates and improving yields compared with conventional approaches.

The growing emphasis on sustainable manufacturing and regulatory constraints on solvent usage have further elevated the importance of PTCs. By enabling many reactions to proceed in biphasic or even triphasic systems under milder conditions, these catalysts align with green chemistry principles. As industries seek to reduce their environmental footprint, the adoption of phase transfer catalysis is paving the way for safer, more cost‐effective processes that maintain or enhance performance.

Navigating a New Chemical Era: Digital Transformation, Sustainable Innovations, and Circular Economy Principles Reshaping the Landscape

The chemical industry is embracing digital transformation to enhance efficiency, optimize resource utilization, and accelerate innovation. Industry 4.0 technologies-such as advanced data analytics, artificial intelligence, and the Internet of Things-are enabling predictive maintenance and real‐time process monitoring. By integrating digital twins and automated control systems, producers can achieve unprecedented visibility into plant operations, reduce unplanned downtime, and adapt rapidly to shifting market demands.

Simultaneously, sustainability has emerged as a pivotal driver of change. With the sector accounting for an estimated 5–6% of global greenhouse gas emissions, leading organizations are investing in low‐carbon feedstocks and carbon capture solutions. The launch of Europe’s first commercial‐scale e‐methanol facility in Denmark demonstrated how renewable energy and captured CO2 can be combined to produce both green fuel and low‐carbon plastics for major manufacturers. Despite these breakthroughs, meaningful decarbonization remains an industry‐wide challenge that demands both technological innovation and substantial capital investment.

Circular economy concepts are gaining traction as well, with companies rethinking product lifecycles to minimize waste and foster material reuse. The emergence of bio‐based feedstocks-such as lignocellulosic biomass-and advancements in solvent recycling highlight the industry’s shift toward resource efficiency. Regulatory frameworks worldwide are reinforcing these transitions, pushing organizations to adopt cleaner catalysts, reduce emissions, and deliver products that meet evolving environmental standards.

Assessing the Ripple Effects of Recent United States Trade Tariffs on Chemical Supply Chains and Cost Dynamics Across Domestic and Global Markets

Since early 2025, sweeping trade measures announced by the United States government have reshaped global chemical supply chains. Average import tariffs have surged to levels not seen since the mid‐20th century, prompting companies to reevaluate sourcing strategies and logistics networks. These elevated duties have driven increased costs for input materials, compelling many firms to adopt cost‐pass‐through mechanisms or absorb margin pressures until pricing clauses can be renegotiated.

The threat of a 50% duty on certain Brazilian chemical exports triggered a wave of order cancellations, underscoring the fragility of supply relationships. Executives from the Brazilian chemical industry reported that numerous contracts were either partially or wholly voided in anticipation of new fees, jeopardizing revenue streams and stalling downstream production in sectors reliant on those inputs.

Moreover, proposed levies on critical catalyst precursors-such as fluorspar and rare‐earth minerals-have amplified concerns across refining and specialty chemical segments. For example, tariffs on hydrofluoric acid, a key alkylation catalyst, could raise operating costs for fuel‐producing units, while duties on lanthanum and cerium risk inflating expenses for fluid catalytic cracking catalysts. These developments threaten to disrupt product availability, slow expansion plans, and force companies to explore alternative materials or domestic sourcing options where viable.

Unraveling Market Segmentation Through Application, Catalyst Class, Physical Form, Type, and End Use Industry for Targeted Strategy Development

Insight into the phase transfer catalyst market reveals distinct patterns when examined by application, type, end‐use industry, catalyst class, and physical form. From agrochemical synthesis-where quaternary ammonium and phosphonium catalysts streamline fungicide and herbicide production under mild conditions-to emulsion polymerization processes that rely on PTCs for acrylic and vinyl polymer formation, the versatility of these catalysts underpins a wide spectrum of chemical transformations. Likewise, in organic synthesis, phase transfer catalysts facilitate reactions like alkylation, epoxidation, and esterification, enhancing selectivity and minimizing byproducts.

When viewed through the lens of catalyst type, crown ethers, phosphonium salts, and quaternary ammonium salts emerge as primary driver segments, each offering unique thermal stability and solubility profiles. In end‐use industries, agrochemical, pharmaceutical, and polymer plastics sectors distinctly leverage PTC advantages: agrochemicals benefit from efficient synthesis of active ingredients; pharmaceuticals harness improved reaction kinetics for API manufacturing; and polymer producers achieve higher throughput in polyethylene, polypropylene, and polystyrene production.

Examining catalyst class highlights a balance between heterogeneous and homogeneous systems. Immobilized and supported catalysts offer recyclability and simplified separation, whereas soluble catalysts deliver rapid kinetics in homogeneous phases. Similarly, the choice of physical form-liquid dispersions or solutions versus solid granules or powders-enables process engineers to tailor PTC deployment to reactor configurations and handling preferences. These segmentation insights guide strategic investments and application‐specific catalyst selection.

This comprehensive research report categorizes the Phase Transfer Catalyst market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Catalyst Class

- Physical Form

- Application

- End Use Industry

Exploring Regional Dynamics: Insights into the Americas, Europe Middle East and Africa, and Asia Pacific’s Unique Market Drivers and Opportunities

Regional dynamics illustrate how geographic factors shape the adoption and evolution of phase transfer catalysts. In the Americas, established chemical hubs in the United States and Canada drive demand for advanced catalysts, supported by robust R&D funding and proximity to major pharmaceutical and agrochemical customers. This maturity fosters rapid uptake of novel PTC technologies aimed at reducing waste and complying with stringent environmental regulations.

Across Europe, the Middle East, and Africa, a diverse landscape unfolds. Western Europe’s progressive regulatory environment accelerates adoption of green chemistry practices, pushing manufacturers to integrate PTCs that minimize organic solvent usage. Meanwhile, emerging markets in Eastern Europe, the Middle East, and North Africa are investing in new chemical capacity, creating fresh opportunities for catalyst suppliers to introduce cost‐effective, regionally optimized solutions.

In Asia‐Pacific, rising industrialization and an expanding manufacturing base-particularly in China and India-fuel the fastest growth in PTC consumption. Local producers benefit from government incentives for sustainable manufacturing and leverage PTCs to enhance process efficiencies. At the same time, partnerships with global catalyst developers are strengthening technology transfer and supporting the region’s emergence as a major chemical export hub.

This comprehensive research report examines key regions that drive the evolution of the Phase Transfer Catalyst market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Innovators and Strategic Players Shaping the Phase Transfer Catalyst Market with Technological and Sustainable Advancements

Major players in the phase transfer catalyst arena are pursuing a mix of strategic acquisitions, innovation partnerships, and green‐tech investments to secure leadership positions. In March 2025, Nagase & Co., Ltd.'s acquisition of Sachem’s Asian operations underscored the value of consolidating high‐purity catalyst portfolios and leveraging local distribution networks to meet semiconductor and specialty chemical demand. Concurrently, Evonik Industries has committed over €3 billion toward next‐generation solutions and technologies, channeling capital into sustainable catalyst systems designed to reduce CO₂ emissions and optimize production processes by 2030.

Beyond these headline moves, incumbent firms such as Solvay, Merck KGaA, and Dishman Carbogen Amcis are expanding technical‐service footprints and refining supported‐catalyst lines that enhance recyclability. Meanwhile, industry specialists like Tokyo Chemical Industry and Pat Impex are deepening R&D collaborations with academic institutions to explore ionic liquid–based and chiral PTC chemistries. This competitive environment is driving faster commercialization of task‐specific catalysts that offer enhanced selectivity, thermal tolerance, and ease of separation.

The collective efforts of these strategic players are accelerating the transition toward cleaner, more efficient catalytic platforms, fostering partnerships with downstream users, and shaping the next wave of product innovations in pharmaceuticals, agrochemicals, and specialty polymer production.

This comprehensive research report delivers an in-depth overview of the principal market players in the Phase Transfer Catalyst market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Products & Chemicals, Inc.

- American Elements

- Arkema S.A.

- BASF SE

- Central Drug House (P) Ltd.

- Clariant AG

- Dishman Carbogen Amcis Ltd

- Eastman Chemical Company

- Evonik Industries AG

- GFS Chemicals, Inc.

- Haldor Topsoe A/S

- Merck KGaA

- Mitsubishi Chemical Corporation

- Nippon Chemical Industrial Co., Ltd.

- Otto Chemie Pvt. Ltd.

- Pacific Organics Pvt Ltd

- PAT Impex

- SACHEM, Inc.

- Solvay S.A.

- Strem Chemicals, Inc.

- Tatva Chintan Pharma Chem Ltd

- The Dow Chemical Company

- Tokyo Chemical Industry Co., Ltd.

- Volant‑Chem Corp.

Strategic Roadmap for Industry Leaders to Advance Sustainable Practices, Optimize Processes, and Harness Innovation in Phase Transfer Catalyst Applications

Industry leaders can strengthen their competitive position by embracing sustainability at every stage of the PTC lifecycle. Investing in catalyst recyclability programs and alternative feedstock research will reduce reliance on nonrenewable resources and mitigate exposure to tariff‐driven raw material cost spikes. For instance, establishing closed‐loop solvent recovery systems paired with immobilized catalyst platforms can slash waste and accelerate time‐to‐market for new products.

Furthermore, adopting advanced digital tools-such as predictive maintenance algorithms and process simulation models-will enable real‐time optimization of reaction parameters. By integrating continuous‐flow reactor technology with robust process analytics, manufacturers can achieve higher throughput, minimize batch variability, and enhance safety. Collaboration across the value chain, from raw material suppliers to end‐users, will unlock synergies in scaling these innovations.

Finally, forging partnerships with academic and research institutions to co‐develop next‐generation PTC chemistries-such as bio‐derived macromolecular catalysts or ionic liquid hybrids-will position early adopters as innovation leaders. Structured pilot programs and joint ventures can expedite technology validation, ensuring that new solutions meet stringent regulatory requirements and performance benchmarks.

Robust Research Methodology Leveraging Primary Interviews, Secondary Data Sources, and Rigorous Triangulation for Comprehensive Market Intelligence

This analysis combined a rigorous blend of primary and secondary research methodologies. Expert interviews were conducted with senior technical leads, process engineers, and industry analysts to validate emerging trends and identify technology adoption barriers. Detailed discussions with catalyst suppliers and end‐user procurement teams enriched our understanding of strategic priorities and operational challenges.

Secondary data sources included academic publications, patent filings, regulatory documentation, and authoritative industry press. Information from trade associations and public financial disclosures of key players provided context for market dynamics and competitive strategies. Triangulation of these data points was achieved through cross‐sector benchmarking and comparative analysis of regional regulatory frameworks.

Data validation steps incorporated consistency checks, scenario testing, and sensitivity analyses to ensure data integrity. Segmentation logic was refined through iterative reviews with domain experts, guaranteeing that application, type, end‐use, catalyst class, and physical form categories accurately reflect market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Phase Transfer Catalyst market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Phase Transfer Catalyst Market, by Type

- Phase Transfer Catalyst Market, by Catalyst Class

- Phase Transfer Catalyst Market, by Physical Form

- Phase Transfer Catalyst Market, by Application

- Phase Transfer Catalyst Market, by End Use Industry

- Phase Transfer Catalyst Market, by Region

- Phase Transfer Catalyst Market, by Group

- Phase Transfer Catalyst Market, by Country

- United States Phase Transfer Catalyst Market

- China Phase Transfer Catalyst Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Concluding Insights on Emerging Catalytic Technologies, Sustainability Imperatives, and Collaborative Strategies Driving Future Growth in the Catalyst Sector

The convergence of sustainability mandates, digitalization trends, and regulatory evolution is reshaping the landscape for phase transfer catalysts. Green chemistry initiatives and carbon neutrality pledges are driving demand for catalysts that minimize environmental impact while maintaining or improving process efficiency. At the same time, digital tools and continuous‐flow methodologies are unlocking new levels of operational precision and scalability.

Competitive dynamics will pivot around partnerships and strategic acquisitions that expand geographic reach and technical capabilities. Organizations that prioritize modular, recyclable catalyst systems and invest in novel chemistries-such as ionic liquid derivatives or bio‐based macromolecular catalysts-will be best positioned to address the complex requirements of pharmaceutical, agrochemical, and polymer sectors.

Looking ahead, collaboration across the value chain-from raw material sourcing to end‐user application-will be critical for unlocking the full potential of phase transfer catalysis. By aligning R&D efforts with evolving market needs and regulatory frameworks, stakeholders can drive continuous innovation and deliver sustainable, high‐performance solutions that shape the next era of chemical manufacturing.

Connect with Ketan Rohom to Secure Detailed Phase Transfer Catalyst Market Intelligence and Empower Your Strategic Decision Making Today

For a personalized walkthrough of these insights and to secure comprehensive access to our detailed analysis on phase transfer catalyst dynamics and strategies, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. He can guide you through the full report features, subscription packages, and tailored data solutions designed to empower your strategic decision making. Start the conversation today to unlock targeted market intelligence and gain the competitive advantage you need.

- How big is the Phase Transfer Catalyst Market?

- What is the Phase Transfer Catalyst Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?