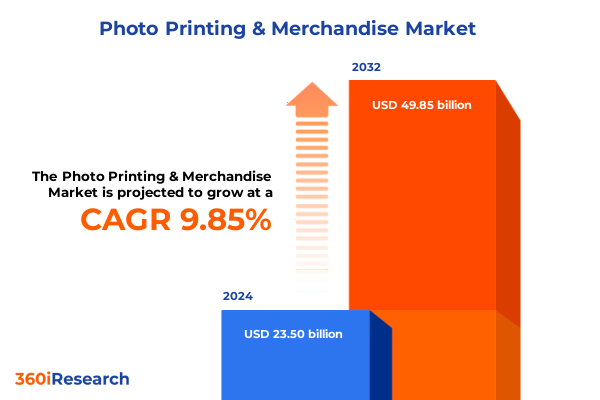

The Photo Printing & Merchandise Market size was estimated at USD 25.35 billion in 2025 and expected to reach USD 27.35 billion in 2026, at a CAGR of 10.14% to reach USD 49.85 billion by 2032.

Unveiling the Evolution of Photo Printing and Merchandise as Creativity and Convenience Drive New Consumer Expectations

Digital ubiquity and personal expression have converged to recast photo printing and merchandise into dynamic platforms for creativity and convenience. What was once a simple service of transforming analog film into prints has now evolved into a multifaceted industry where customization, immediacy, and emotional resonance drive consumer engagement. In recent years, the proliferation of high-resolution smartphone cameras and seamless cloud connectivity has enabled users to curate and order physical products that encapsulate personal narratives with unprecedented speed and precision.

Today’s market leaders harness sophisticated design interfaces and AI-driven editing tools to streamline the creation of canvas prints, greeting cards, photo books, photo gifts, and traditional photo prints. This integration of technology not only accelerates the customer journey from upload to delivery, but also elevates the perceived value of each item through tailored messaging and exclusive embellishments. Beyond core products, demand surges for specialized merchandise-calendars, keychains, mugs, and puzzles-underscore a growing appetite for gifts that blend functionality with sentimental value.

This introduction underscores how the convergence of digital imaging, e-commerce, and personalization platforms is redefining consumer expectations. As we delve into transformative shifts, tariff implications, segmentation, regional variations, company strategies, and actionable recommendations, the following analysis illuminates the pathways to differentiation and growth that industry participants can pursue.

Exploring the Major Transformative Shifts Propelling Photo Printing and Merchandise Toward Personalization Automation and Sustainable Practices

The photo printing and merchandise ecosystem is undergoing a profound transformation propelled by advances in personalization, automation, and sustainability. Personalization now extends beyond simple text overlays to AI-curated layout suggestions and augmented reality previews that allow customers to visualize their products in real time. This deep integration of smart technologies is streamlining the design process while reinforcing emotional engagement.

Automation is also reshaping operational efficiency as companies deploy robotic handling for precise cutting, framing, and packaging. These improvements not only shorten lead times but also maintain consistent quality across high-volume orders. Meanwhile, environmental stewardship has emerged as a critical differentiator, with eco-friendly inks, recycled substrates, and carbon-neutral shipping options gaining traction among environmentally conscious buyers.

Concurrently, direct-to-consumer business models have flourished in parallel with the rise of mobile commerce. Mobile apps and responsive websites now serve as primary touchpoints for browsing, designing, and purchasing photo products. As omnichannel strategies mature, seamless integration between offline experiences-such as in-store photo labs and specialty stores-and digital platforms is enhancing customer convenience and loyalty.

These transformative trends signal that agility and innovation in both technology adoption and sustainability practices will determine market leadership in the years ahead. The following sections dissect how these shifts interact with macroeconomic factors and competitive forces to redefine the landscape.

Analyzing the Far Reaching Effects of United States Tariffs Introduced in 2025 on Photo Printing Supply Chains Costs and Competitive Dynamics

In 2025 the United States implemented new tariff measures targeting a range of imported materials integral to photo printing and merchandise production. These duties have increased input costs for substrates, chemical components in inks, aluminum framing materials, and even certain plastics used in keychains and puzzles. As a result domestic producers have faced immediate cost pressures that are driving adjustments in sourcing strategies and price structures.

To mitigate these impacts, many companies have accelerated nearshoring initiatives that relocate manufacturing closer to end markets. By establishing regional production hubs, firms are reducing lead times and lowering logistical expenses associated with cross-border freight charges and customs clearance. However these shifts require significant capital investment and capacity planning, challenging smaller operators with limited financial bandwidth.

The cumulative effect of these tariffs has also stimulated collaborative consortia among suppliers, allowing for volume-based contracting and shared warehousing solutions. In parallel, strategic renegotiations with carriers and logistics partners have emerged as essential tactics for absorbing tariff-induced cost fluctuations without passing full burdens onto consumers. Price adjustments for premium products such as large canvas prints and panoramic formats have been implemented judiciously to preserve demand elasticity.

Looking ahead the interplay between tariff policy and global supply chain resilience will continue to shape competitive dynamics. Companies that proactively adapt their procurement networks and invest in flexible production capabilities will be better positioned to sustain margin performance and customer satisfaction in a tariff-constrained environment.

Illuminating Essential Segmentation Insights That Reveal Distinct Consumer and Professional Behaviors Across Product Types Print Sizes and Distribution Channels

Examining segmentation through the lens of product type reveals that traditional photo prints remain foundational for core customer engagement, while canvas prints and photo books command growing preference among individuals seeking premium home décor and tactile storytelling experiences. Within the photo gifts category, items such as bespoke calendars and personalized mugs have transcended seasonal usage to become year-round offerings, while keychains and puzzles are increasingly popular as impulse purchases and corporate branding tools.

End user distinctions illustrate divergent behaviors between consumers and professionals. Consumer segments are characterized by casual projects and gift-driven purchasing cycles, whereas professional channels-comprising businesses and photographers-prioritize high-volume orders, consistent color fidelity, and expedited turnaround times. For photographers, specialized print quality and archival materials are critical for reinforcing brand reputation among clientele.

Print size segmentation further underscores that standard formats cater to everyday documentation and mass production, panoramic sizes are leveraged for event backdrops and wall art installations, and large prints dominate in retail and exhibition environments. This tripartite size division informs inventory mix decisions and equipment investments across production facilities.

Distribution channels delineate the evolving interplay between offline and online touchpoints. Offline channels such as hypermarkets, photo labs, and specialty stores remain vital for immediate gratification and expert guidance, while online pathways spread across mobile app and website platforms continue to expand reach, enabling dynamic upselling through digital design experiences. Understanding these multidimensional segmentation frameworks is essential for tailoring marketing, pricing, and product development strategies that resonate with targeted customer cohorts.

This comprehensive research report categorizes the Photo Printing & Merchandise market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Print Size

- End User

- Distribution Channel

Revealing Critical Regional Dynamics Shaping Photo Printing and Merchandise Trends Across The Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics in the Americas reflect mature market structures where e-commerce penetration is high and consumers increasingly demand eco-friendly offerings. In North America the tipping point has shifted toward same-day and next-day delivery options for photo merchandise, while Latin American markets demonstrate growth through rising digital adoption and expanding middle-class segments embracing personalized gifting and decor.

Across Europe Middle East and Africa, diverse regulatory landscapes around sustainability and trade create a complex tapestry for manufacturers and retailers. Western European countries often lead in the adoption of recycled materials and carbon footprint labeling, whereas emerging markets in Eastern Europe and North Africa are catching up through partnerships with global platform providers that streamline access to advanced printing technologies.

In the Asia Pacific region rapid urbanization and increasing disposable incomes fuel demand for immersive home styling products such as large format prints and custom photo furnishings. Japan and South Korea showcase high smartphone penetration driving digital-first purchasing journeys, while Southeast Asian countries demonstrate accelerated uptake of mobile-only photo services.

Understanding these region-specific trends is paramount for companies seeking to optimize distribution networks, align product portfolios with local preferences, and anticipate regulatory shifts that may affect sourcing and operational practices in diverse geopolitical contexts.

This comprehensive research report examines key regions that drive the evolution of the Photo Printing & Merchandise market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Competitive Positioning of Leading Companies Driving Innovation Growth and Collaboration in the Photo Printing and Merchandise Market

Leading companies in the photo printing and merchandise space are redefining competitive playbooks through strategic investments in technology partnerships, sustainable materials, and ecosystem integration. Global platform providers have forged alliances with software developers to embed AI-driven ordering and image enhancement tools directly into consumer-facing applications, shortening the path from inspiration to purchase.

Meanwhile equipment manufacturers have responded by launching next-generation digital printers capable of handling mixed substrates and specialty finishes, enabling service providers to expand their product portfolios without compromising throughput. These enhancements support new lines of merchandise such as metallic prints and textured canvases that command premium price premiums.

Several market incumbents have prioritized sustainability, transitioning to plant-based inks and implementing closed-loop water recycling systems in production facilities. These initiatives reinforce corporate environmental commitments while attracting eco-conscious customers who factor green credentials into purchasing decisions.

In professional channels, dedicated B2B portals offering customized pricing tiers and API integration for automated print workflows have streamlined order management for businesses and photographers. By tailoring solutions to unique buyer requirements, top players are cultivating long-term partnerships that fortify recurring revenue streams and create high barriers to entry for new entrants.

This comprehensive research report delivers an in-depth overview of the principal market players in the Photo Printing & Merchandise market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Artifact Uprising

- Canon Inc.

- CEWE

- Cimpress N.V.

- Fujifilm Holdings Corporation

- Gelato

- Mpix

- Printful

- Printify

- Redbubble

- Shutterfly

- Snapfish

- Walmart Photo

- WhiteWall

- Zazzle

Presenting Strategic Actionable Recommendations to Empower Industry Leaders to Capitalize on Emerging Opportunities and Navigate Market Challenges Effectively

Industry leaders can seize emerging opportunities by prioritizing sustainability as a core differentiator. Implementing renewable materials in substrates and eco-certified packaging solutions not only aligns with regulatory trends but also resonates with a growing segment of environmentally conscious consumers. Simultaneously, bolstering omnichannel capabilities through unified commerce platforms will ensure a frictionless experience irrespective of whether customers engage via hypermarkets, photo labs, specialty stores, mobile apps, or websites.

To enhance personalization and upsell potential, investing in AI-powered design engines can guide users through curated product recommendations and dynamic layout adjustments based on image content. At the same time, augmenting production flexibility with modular manufacturing cells allows rapid scalability for large canvas runs or bespoke photo gift orders without disrupting standard operation flows.

Supply chain resilience should be fortified through diversified supplier networks and nearshoring initiatives that mitigate tariff exposure and logistics disruptions. Developing strategic inventory buffers for critical materials and negotiating long-term partnerships with carriers will further stabilize cost structures and delivery performance.

Finally fostering collaborative innovation with software, materials, and logistics partners will unlock new product categories and streamlined service models. By embedding these strategic actions into core business plans, industry players can reinforce competitive advantages and navigate the shifting landscape with confidence.

Outlining a Rigorous Multimethod Research Methodology That Ensures Data Integrity Relevance and Comprehensive Insights for Informed Decision Making

This analysis employs a rigorous multimethod research framework designed to ensure depth, accuracy, and relevance. Primary research was conducted through in-depth interviews and workshops with executives, production managers, and design professionals across the photo printing and merchandise spectrum to capture firsthand perspectives on operational practices, consumer preferences, and technological investments.

Secondary research comprised a comprehensive review of publicly available company disclosures, trade association reports, regulatory filings, and academic publications to validate market trends and contextualize competitive strategies. Data triangulation across multiple sources strengthened the reliability of key observations and mitigated potential biases.

Segmentation analysis was performed by categorizing market participants according to product type, end user, print size, and distribution channel segments. This structured approach allowed for granular insights into consumer and professional behaviors, purchase drivers, and channel dynamics.

Expert validation sessions were held with industry consultants and supply chain specialists to refine strategic implications and ensure that recommendations reflect practical feasibility. Throughout the process, adherence to strict data governance protocols upheld confidentiality and integrity, resulting in a robust evidence base to inform executive decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Photo Printing & Merchandise market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Photo Printing & Merchandise Market, by Product Type

- Photo Printing & Merchandise Market, by Print Size

- Photo Printing & Merchandise Market, by End User

- Photo Printing & Merchandise Market, by Distribution Channel

- Photo Printing & Merchandise Market, by Region

- Photo Printing & Merchandise Market, by Group

- Photo Printing & Merchandise Market, by Country

- United States Photo Printing & Merchandise Market

- China Photo Printing & Merchandise Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Summarizing the Core Findings and Strategic Imperatives That Define the Future Landscape of Photo Printing and Merchandise Innovation and Growth

The current photo printing and merchandise landscape is characterized by rapid technological innovation, evolving consumer expectations, and shifting regulatory and macroeconomic forces. Personalization tools powered by AI are redefining the customer journey, while sustainability commitments drive material and operational changes. Tariff pressures in 2025 have underscored the importance of supply chain agility and strategic sourcing.

Segmentation insights reveal nuanced demand patterns across product types, end-user categories, print sizes, and distribution channels, highlighting opportunities for targeted portfolio optimization. Regional analyses show that maturity, digital adoption, and regulatory environments vary significantly across the Americas, Europe Middle East and Africa, and Asia Pacific, necessitating bespoke market approaches.

Competitive benchmarking illustrates how leading companies are leveraging partnerships, next-generation production technologies, and eco-innovation to build differentiation and secure recurring revenue streams. Actionable recommendations emphasize the imperatives of omnichannel integration, AI-driven personalization, nearshoring, and sustainability to maintain resilience and unlock growth.

Together these insights form a roadmap for industry stakeholders seeking to navigate complexity and drive strategic initiatives that will define the next chapter in photo printing and merchandise evolution.

Take Advantage of Expert Guidance from Ketan Rohom Associate Director Sales and Marketing to Secure Your Comprehensive Photo Printing and Merchandise Market Research Report Today

Thank you for exploring these insights into the evolving photo printing and merchandise market. To secure the comprehensive market research report that equips your organization with actionable intelligence, reach out to Ketan Rohom Associate Director Sales and Marketing. Ketan Rohom is ready to guide you through the report’s full suite of strategic analyses including detailed segmentation, regional dynamics, tariff impacts, and competitive benchmarking.

Act now to partner with an experienced industry specialist who can tailor the insights and recommendations to your unique objectives and empower your business to thrive in a rapidly changing marketplace

- How big is the Photo Printing & Merchandise Market?

- What is the Photo Printing & Merchandise Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?