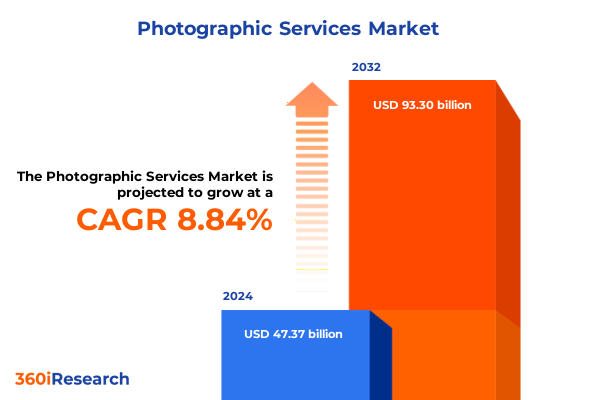

The Photographic Services Market size was estimated at USD 51.65 billion in 2025 and expected to reach USD 55.34 billion in 2026, at a CAGR of 8.81% to reach USD 93.30 billion by 2032.

Setting the Stage for Photographic Services Industry Amid Digital Transformation Shifting Consumer Expectations and Evolving Market Dynamics

The photographic services sector stands at a pivotal juncture, shaped by the relentless advance of digital technologies and an ever more discerning customer base. Over the past few years, rapid improvements in sensor quality, cloud-based editing tools, and high-speed connectivity have converged to redefine expectations around convenience, speed and personalization. Consumers now demand on-the-spot delivery of professional-grade images, seamless integration with social media platforms, and bespoke finishing options that reflect individual tastes and values. At the same time, professional clients seek turnkey solutions that blend creative vision with technical precision, driving service providers to continually adapt their capabilities and expand their portfolios.

Against this backdrop of dynamic change, this analysis aims to deliver a coherent orientation and strategic foundation for decision-makers across service bureaus, studio networks, independent practitioners and enterprise buyers. It illuminates prevailing drivers-from AI-augmented editing workflows and immersive display technologies to evolving regulatory frameworks and supply chain complexities-while surfacing inherent risks and emerging opportunities. In doing so, it offers a clear articulation of the forces reshaping this industry and why they matter to stakeholders seeking to sustain growth and profitability.

Structured to guide both seasoned executives and new entrants, this report synthesizes sector trends, policy impacts and competitive behaviors, mapping out how converging digital and consumer trends will influence operational models. By weaving together empirical observations and expert perspectives, it provides a unified narrative that lays the groundwork for actionable insights and strategic planning across the diverse landscape of photographic services.

Exploring the Paradigm Shifts Reshaping Photographic Services from Traditional Studios to Immersive Digital Experiences with Emerging Technologies and Changing Demand Patterns

Photography is undergoing an unprecedented metamorphosis as technological breakthroughs and changing user behaviors erode longstanding paradigms. Machine learning algorithms now automate raw file processing and retouching, reducing manual overhead while delivering consistently high-quality outputs. Meanwhile, drone-mounted cameras and remote piloting platforms have extended the realm of possibility for aerial cinematography, enabling applications in architecture, infrastructure inspection and immersive event coverage. Augmented and virtual reality interfaces are also merging physical prints with digital overlays, offering experiential layers that captivate audiences in galleries, retail showrooms and live venues.

Furthermore, the expansion of 5G connectivity and edge computing is accelerating the shift toward real-time collaboration, with photographers sharing high-resolution content directly from location shoots to remote editors and clients. This fluid exchange of assets has given rise to new service propositions-ranging from live-streamed brand activations to on-demand portrait booths that instantly deliver personalized digital buffets. As these developments gain traction, traditional studio models are compelled to incorporate modular service bundles and subscription-based offerings to remain competitive.

Consequently, the industry is not simply substituting analog processes for digital ones; it is reimagining the fundamental value proposition of imaging services. From generative content creation to blockchain-based verification of image provenance, the sector is poised for continued disruption. Those who understand and harness these transformative shifts will lead the next wave of innovation and set new benchmarks for excellence.

Assessing the Far Reaching Consequences of United States Tariffs Enacted This Year on Photographic Services Ecosystem Amid Operational and Pricing Pressures

Early this year, the United States introduced new tariffs on imported cameras, lenses, printing substrates and related accessories, triggering ripple effects throughout the photographic services ecosystem. Suppliers faced elevated input costs that were subsequently transmitted to service providers, squeezing margins and prompting difficult pricing decisions. Operational budgets for equipment maintenance and studio upgrades were reprioritized as providers sought to offset higher import duties through cost reductions elsewhere. At the same time, uncertainty around future tariff adjustments has hampered long-term capital planning, compelling many to favor flexible lease arrangements over outright purchases.

As a result of these policy measures, a growing number of providers are exploring nearshoring strategies to mitigate exposure to import levies. Domestic manufacturing partnerships have become a critical lever, particularly for high-volume print facilities and equipment rental houses. However, scaling local production capacity involves lead times that clash with the fast-paced nature of client demand cycles. Consequently, some enterprises have diversified supplier networks to blend domestic and international sources, balancing cost efficiencies against service reliability.

In addition, service bureaus and studios have adjusted their service portfolios in response to constrained inputs. Many have emphasized digital delivery channels to reduce dependency on tariffed printing materials, while others have introduced premium offerings-such as archival-grade finishing and bespoke installation services-to preserve revenue streams in a higher-cost environment. Ultimately, these adaptations underscore a broader imperative: the need to build resilient, agile operations capable of withstanding policy-driven disruptions without compromising quality or client satisfaction.

Deriving Actionable Insights from Comprehensive Segmentation Analysis Spanning Service Types Delivery Formats End Users and Distribution Channels to Illuminate Core Strengths and Opportunities

A nuanced examination of the industry’s segmentation reveals distinct growth levers and competitive dynamics across service categories. Commercial imaging services have increasingly integrated end-to-end digital workflows, enabling large enterprises to source complex campaigns from a single provider that specializes in advertising, product demonstration and experiential marketing installations. Meanwhile, event photography continues to diversify: corporate gatherings demand high-volume rapid turnaround, sports coverage requires real-time distribution to broadcast partners, and weddings prioritize emotive storytelling with customizable album solutions and drone-enabled cinematography.

Portrait services have also evolved to meet specialized demands. Family portrait studios blend interactive digital previews with traditional print offerings, catering to multi-generational households. Graduation shoots leverage on-campus pop-up studios equipped with instant digital delivery, while pet portraitists harness social channels to engage niche communities and upsell curated print collections. At the same time, restoration and archival services have witnessed revived interest as organizations and individuals seek to preserve cultural artifacts, family histories and corporate records with advanced scanning and color-correction techniques.

Delivery format remains a critical differentiator. Digital-only offerings appeal to tech-savvy millennials and small businesses seeking cost-effective, shareable assets. Conversely, print-centric experiences-ranging from metallic fine art prints to richly textured canvases-resonate with luxury buyers and institutions prioritizing tangible displays. End users span a broad continuum, from individual consumers commissioning commemorative portraits to professional clients requiring turnkey solutions for brand activations. Distribution channels likewise straddle brick-and-mortar showrooms, pop-up installations and e-commerce platforms, each requiring tailored logistics and customer engagement strategies.

Collectively, these segmentation insights illuminate where service providers can refine value propositions, prioritize investment streams and differentiate through specialized expertise in high-growth verticals.

This comprehensive research report categorizes the Photographic Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Delivery Format

- End User

- Distribution Channel

Unearthing Critical Variations in Photographic Services Across the Americas Europe Middle East Africa and Asia Pacific Driven by Local Trends and Regulatory Environments

Across the Americas, the industry is propelled by a synergy of consumer spending on personalized experiences and strong commercial demand for branded content. North America’s well-established studio networks complement a burgeoning direct-to-consumer scene, where e-commerce platforms and mobile apps expedite bookings, digital proofs and at-home delivery. In Latin American markets, regional economic growth and rising middle-class incomes are fostering greater uptake of event and portrait services, while local studios embrace hybrid business models that combine traditional in-person sessions with virtual consultations.

In Europe, Middle East and Africa, regulatory frameworks and cultural preferences shape divergent trajectories. Stricter data privacy regulations in Europe have elevated the importance of secure image handling and consent management tools, driving providers to adopt encrypted storage and advanced rights-management solutions. In the Middle East, lavish wedding celebrations create sustained demand for high-end storytelling through cinematic photography, prompting specialized studios to offer multi-day coverage and luxury print collections. Meanwhile, in African markets the growth of telecommunications infrastructure and mobile payment systems enhances accessibility for remote shoots and on-site photo kiosks, extending service reach to previously underserved communities.

Asia-Pacific presents one of the most dynamic environments, driven by rapid urbanization and digital native populations. In Greater China, a high volume of social media influencers fuels demand for innovative lifestyle and branded content services, while subscription-based studio memberships have gained traction among young professionals. India’s expanding events sector has spurred demand for large-scale wedding cinematography and corporate conference coverage, with providers investing in drone fleets and remote broadcasting capabilities. Across Southeast Asia and Oceania, collaborative ventures between global equipment manufacturers and local service bureaus are enabling faster deployment of next-generation imaging technologies, reinforcing the region’s position at the forefront of industry innovation.

This comprehensive research report examines key regions that drive the evolution of the Photographic Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Profiles and Pivotal Growth Initiatives of Leading Photographic Services Providers to Identify Best Practices and Competitive Differentiators in a Rapidly Evolving Industry Landscape

Dominant incumbents and agile challengers are vying for leadership positions through strategic investments in technology and partnerships. Longstanding providers have diversified beyond traditional studio offerings, integrating AI-based asset management systems and cloud-native collaboration platforms to support global brand clients. Some have forged alliances with hardware manufacturers to secure preferential access to limited-edition equipment and service training, strengthening their technical capabilities and enhancing client trust.

Meanwhile, digital-first entrants have leveraged scalable online platforms to deliver on-demand editing, rapid e-commerce fulfillment and subscription-style service bundles. These players emphasize brand simplicity and self-service interfaces, attracting small businesses and individual creators. Concurrently, specialized studios focusing on heritage restoration and archival digitization have carved niche leadership by investing in non-destructive scanning technologies and color fidelity verification protocols that meet institutional and legal requirements.

Consolidation activity has also intensified. A wave of mergers and acquisitions has brought complementary portfolios under unified management, allowing firms to cross-sell services across commercial and consumer segments. Joint ventures between regional studios and global distribution channels have emerged as a mechanism to penetrate new territories quickly. Smaller operators differentiate themselves through hyper-local marketing strategies and bespoke service articulations, cultivating loyal client communities in competitive markets.

Overall, the competitive landscape is characterized by a tension between scale-driven efficiency and highly customized offerings. Success hinges on the ability to blend operational excellence with creative differentiation and to anticipate the evolving needs of diverse client profiles.

This comprehensive research report delivers an in-depth overview of the principal market players in the Photographic Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bay Photo Lab

- Canon Inc.

- Cewe Color Holding AG

- Cimpress plc

- CPI Card Group Inc.

- Eastman Kodak Company

- Fujifilm Holdings Corporation

- Hallmark Cards, Incorporated

- Lifetouch Inc.

- Milan AC, Inc. (MpixPro)

- Mpix LLC

- National Geographic Partners, LLC

- Nikon Corporation

- Polaroid Corporation

- Shutterfly, LLC

- Target Corporation

- The Darkroom Photo Lab Inc

- Vistaprint B.V.

- Walgreen Co.

- White House Custom Colour, LLC

Delivering Practical Guidance for Industry Leaders to Navigate Disruption Embrace Innovation and Strengthen Competitive Positioning in Photographic Services Markets

Leaders in photographic services must prioritize agility by embedding modular technologies that enable rapid adaptation to evolving client demands. Investing in AI-enhanced editing pipelines and cloud-based delivery platforms will not only streamline workflows but also reduce time to market for large-scale campaigns. Furthermore, cultivating strategic supplier relationships-both domestic and international-can mitigate the risks associated with policy shifts and supply chain disruptions while ensuring continuous access to critical materials and equipment.

In parallel, embracing an omnichannel strategy is essential. By harmonizing in-studio experiences with robust e-commerce and mobile applications, providers can capture new revenue streams and foster deeper customer engagement. Personalized service tiers, loyalty programs and value-added content-such as educational tutorials or virtual studio tours-will reinforce brand affinity and drive repeat business among both consumer and enterprise segments.

Additionally, leaders should champion workforce development, equipping teams with the skills necessary to master emerging tools such as drone piloting, immersive media production and blockchain-based asset tracking. Cross-functional collaboration between creative, technical and sales teams will accelerate innovation and improve responsiveness to evolving project briefs. Embedding sustainability principles-such as eco-friendly printing substrates and energy-efficient studio design-can further differentiate offerings while aligning with growing stakeholder expectations for responsible business practices.

Finally, forging partnerships with complementary service providers, technology firms and content platforms can expand service ecosystems and unlock new commercial models. Leveraging these alliances to pilot proof-of-concepts and co-create unique client experiences will position forward-thinking companies at the forefront of industry transformation.

Illustrating the Rigorous Methodological Framework Employed to Generate Comprehensive Credible Photographic Services Insights through Multi Stage Data Collection and Analysis

The insights presented in this document derive from a multi-layered analytical framework designed to ensure both depth and credibility. Primary data was gathered through structured interviews with senior executives at leading studios, service bureaus and equipment suppliers, supplemented by in-depth discussions with creative directors and operational managers. These qualitative inputs were triangulated with secondary sources including trade association reports, industry journals and publicly available financial statements, providing robust cross-validation of trends and strategic initiatives.

Quantitative analysis leveraged a comprehensive database of historical service volumes, transaction values and pricing structures across multiple geographies. Statistical techniques were applied to identify correlation patterns between technology adoption rates, regulatory changes and service mix shifts. Segmentation models were developed to map demand drivers and profitability metrics across service types, delivery formats, end-user categories and distribution channels, enabling a fine-grained understanding of performance differentials.

To capture regional nuances, a dedicated review of policy developments and local market conditions was conducted, encompassing import tariff schedules, data privacy regulations and cultural event calendars. These findings were then integrated into scenario analyses to assess sensitivity across key variables and to highlight potential inflection points. Finally, the overall framework was peer-reviewed by a panel of independent industry experts to confirm the validity of assumptions and to refine strategic implications.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Photographic Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Photographic Services Market, by Service Type

- Photographic Services Market, by Delivery Format

- Photographic Services Market, by End User

- Photographic Services Market, by Distribution Channel

- Photographic Services Market, by Region

- Photographic Services Market, by Group

- Photographic Services Market, by Country

- United States Photographic Services Market

- China Photographic Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings to Provide a Coherent Perspective on Emerging Trends Strategic Imperatives and Value Creation Opportunities within Photographic Services

In summary, the photographic services industry is experiencing a period of profound transformation fueled by technological innovation, shifting consumer behaviors and regulatory pressures. Service providers are redefining traditional value chains, embracing digital and hybrid offerings to meet the rising demand for immediate, personalized and immersive experiences. Meanwhile, policy actions such as import tariffs have underscored the necessity of resilient supply chains and flexible operational models.

Segmentation analysis has revealed clear opportunities to specialize across service categories-from high-volume commercial imaging to bespoke ceremonial coverage and heritage preservation. Regional dynamics further highlight the importance of localized strategies that address unique cultural, regulatory and infrastructural conditions. Competitive analysis shows that success will favor those who can integrate scale efficiencies with creative differentiation, leveraging partnerships and digital platforms to extend reach and enhance client satisfaction.

As the industry continues to evolve, stakeholders who prioritize agility, invest in emerging capabilities and proactively manage regulatory risks will be best positioned to capture value. The insights and recommendations contained herein serve as a strategic guide for decision-makers seeking to navigate disruption and to capitalize on the transformative forces shaping the future of photographic services.

Initiating Engaging Collaboration with the Associate Director of Sales and Marketing to Secure Strategic Photographic Services Intelligence and Propel Business Decision Making

To unlock the full spectrum of insights, strategic frameworks and empirical benchmarks included in this comprehensive photographic services report, reach out to Ketan Rohom, Associate Director of Sales and Marketing. Engage directly to secure privileged access and customized presentations tailored to your organization’s needs. Ensure your team benefits from timely intelligence that will inform procurement strategies, operational enhancements and competitive positioning within this dynamic industry.

- How big is the Photographic Services Market?

- What is the Photographic Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?