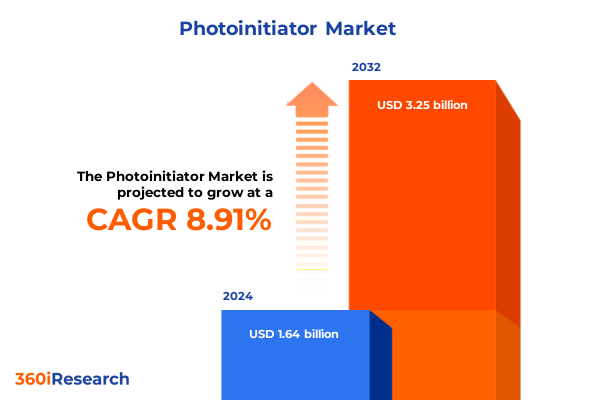

The Photoinitiator Market size was estimated at USD 1.76 billion in 2025 and expected to reach USD 1.90 billion in 2026, at a CAGR of 9.12% to reach USD 3.25 billion by 2032.

Exploring the Fundamental Role of Photoinitiators in Light-Induced Polymerization and Their Strategic Importance in Advanced Manufacturing

In recent years, photoinitiators have emerged as pivotal components in the advancement of light-activated polymerization processes, enabling precise control of reaction kinetics and material properties. Acting at the molecular level, these substances absorb specific wavelengths of light to generate reactive species that initiate free-radical or cationic polymerization, thus underpinning a wide array of industrial applications ranging from high-performance coatings to medical device manufacturing. As demand for rapid curing, energy efficiency, and environmentally conscious processing continues to accelerate, the photoinitiator portfolio has diversified to include formulations tailored to novel light sources, substrate types, and end-use performance requirements.

Furthermore, the shift toward ultraviolet-based curing technologies, coupled with the proliferation of LED systems, has broadened the adoption of photoinitiators across sectors that prioritize throughput and sustainability. This evolution is complemented by an intensified focus on low-migration, bio-based, and halogen-free chemistries designed to align with stringent regulatory frameworks and consumer expectations for safer materials. Consequently, market participants are engaging in targeted research and development initiatives that leverage advanced photophysics, green chemistry principles, and digital formulation tools to optimize performance while reducing environmental footprints.

This executive summary synthesizes critical insights and strategic considerations for stakeholders navigating the dynamic photoinitiator landscape. It outlines transformative industry shifts driven by technological innovation and regulatory developments, examines the cumulative impact of recent tariff measures within the United States, and unpacks granular segmentation and regional insights. Additionally, it highlights the strategic imperatives for leading organizations, presents methodological underpinnings of the research approach, and culminates with actionable recommendations to inform decision-making and future growth trajectories.

How Sustainability Imperatives and Digital Innovations Are Reshaping Research, Formulation, and Adoption Pathways for Photoinitiator Technologies Globally

Across the photoinitiator landscape, transformative shifts are redefining the paradigms of material development and application. Sustainability imperatives now demand low-toxicity, low-migration, and bio-derived photoinitiator systems that can meet rigorous environmental and health regulations without compromising curing performance. In response, researchers are pioneering novel molecular designs that not only absorb at longer wavelengths to maximize light source compatibility but also minimize residual byproducts after cure. These green chemistry initiatives are converging with digital formulation capabilities, enabling predictive modeling of reactivity and kinetics to accelerate product development cycles.

Technological innovations in light sources themselves are further catalyzing change. The transition toward high‐output, narrow‐band LED curing units has unlocked possibilities for on‐demand activation at specific wavelengths, reducing energy consumption and thermal stress on substrates. This trend is accompanied by advances in visible light photoinitiators that can harness less-energetic photons, offering safer and more versatile curing solutions for heat-sensitive materials. As formulators integrate these cutting-edge catalysts into next-generation products, they are also leveraging in-situ monitoring and process analytics to fine-tune cure profiles and ensure consistent quality.

Moreover, digitalization across the value chain-from automated dispensing systems to real-time process control-has become instrumental in orchestrating precise light-curing workflows. These concurrent developments underscore a broader convergence of sustainability and digital innovation, positioning photoinitiators at the heart of a rapidly evolving industrial ecosystem.

Assessing the Ripple Effects of 2025 United States Tariff Measures on Photoinitiator Supply Chains, Cost Structures, and Innovation Trajectories

In 2025, newly enacted tariff measures within the United States imposed additional duties on key chemical imports, reshaping cost structures and supply chain dynamics for photoinitiator materials. These levies, targeting primary precursors and intermediates originating from major exporting regions, prompted manufacturers to reassess sourcing strategies and production footprints. As baseline input costs rose, formulators faced pressure to optimize efficiency and explore alternative chemistries that could be synthesized domestically or sourced from allied trade partners.

Consequently, many organizations accelerated investments in local production capacities and strategic partnerships with regional chemical suppliers. This pivot not only mitigated exposure to import duties but also fostered enhanced collaboration on process optimization, quality control, and logistical integration. At the same time, end users in industries such as automotive and electronics encountered incremental cost burdens that influenced procurement cycles and long-term purchasing agreements. In response, suppliers intensified efforts to develop high-performance photoinitiators that delivered lower dosage rates, thereby reducing overall formulation costs and improving throughput.

Despite these challenges, the tariff environment stimulated innovation by incentivizing research into more efficient photoinitiator frameworks and hybrid formulations. Manufacturers leveraged this climate to refine product portfolios, emphasizing customizable molecular architectures that could be produced at competitive price points. This strategic adaptation underscores the resilience of the photoinitiator ecosystem and its ability to navigate evolving policy landscapes without sacrificing performance or margin objectives.

Unveiling Comprehensive Photoinitiator Market Segmentation Insights Spanning Applications, Chemical Types, Curing Technologies, End Uses, and Physical Forms

The photoinitiator sector exhibits a multifaceted segmentation framework that informs strategy and product development across industry participants. When considering applications, industry stakeholders target adhesives, coatings, and printing inks, each demanding distinct cure profiles, adhesion characteristics, and durability thresholds. The degree of polymerization kinetics required for a high‐performance coating may differ substantially from that in a flexible adhesive strip or a pigment‐loaded ink, necessitating tailored photoinitiator blends and synergistic co-initiator systems.

Segmentation by chemical type further delineates the market into Type I and Type II photoinitiators. Type I compounds, such as acyl phosphine oxides and alpha hydroxy ketones, undergo cleavage upon light exposure to generate radical species, making them well suited for deep cure applications. Conversely, Type II photoinitiators, including benzophenone and thioxanthone, operate via hydrogen abstraction mechanisms and are frequently employed in surface cure scenarios and oxygen-inhibited environments. These distinctions guide formulators in aligning initiator chemistry with substrate compatibility and processing conditions.

Technological segmentation divides the landscape into LED curing, ultraviolet curing, and visible light curing platforms, each driving specific wavelength and intensity requirements for optimal efficiency. End use industries such as automotive, electronics, and medical present unique regulatory, performance, and reliability demands, influencing photoinitiator selection and additive integration. Additionally, the form factor-liquid, powder, or solid-affects handling logistics, storage stability, and dispensing precision. This integrated segmentation perspective enables organizations to pinpoint market opportunities, refine R&D focus, and tailor go-to-market tactics.

This comprehensive research report categorizes the Photoinitiator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Form

- Application

- End Use Industry

Comparative Regional Dynamics Illuminating Growth Potential and Challenges Across Americas, Europe Middle East Africa, and Asia Pacific Photoinitiator Markets

Regional dynamics play a pivotal role in shaping photoinitiator market trajectories, with each geography exhibiting distinct demand drivers and regulatory frameworks. In the Americas, strong growth in automotive manufacturing, electronic assembly, and medical device production has underpinned steady demand for advanced photoinitiator formulations. Favorable government incentives and established infrastructure have encouraged domestic capacity expansions, allowing formulators to shorten lead times and improve supply chain resilience.

Europe, the Middle East & Africa present a diverse regulatory landscape, characterized by stringent environmental and safety standards that drive demand for low-migration and halogen-free photoinitiators. European Union directives on chemical registration and waste reduction have accelerated the adoption of bio-based and specialty initiators, while Middle Eastern investments in petrochemical complexes have increased local availability of base monomers. African markets, although comparatively nascent, are gradually embracing UV-curable technologies in industrial coatings and print finishing, fueled by infrastructure modernization efforts.

Asia-Pacific remains the fastest-growing region, propelled by robust electronics manufacturing hubs, automotive production centers, and medical device suppliers. Government initiatives supporting advanced manufacturing, coupled with competitive feedstock pricing in major producing countries, have attracted significant investment in photoinitiator R&D and production facilities. Furthermore, heightened demand for energy-efficient curing systems and regulatory alignment with global sustainability norms are catalyzing technology transfer and cross-border collaborations across the region.

This comprehensive research report examines key regions that drive the evolution of the Photoinitiator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Photoinitiator Manufacturers and Innovators Driving Technological Advancements, Strategic Collaborations, and Value Chain Integration

Leading photoinitiator manufacturers have demonstrated strategic agility by aligning product portfolios with evolving industry requirements and forging partnerships that enhance technological capabilities. Key players have expanded their R&D centers to focus on next-generation photoinitiator chemistries that offer broader spectral sensitivity, higher reactivity, and reduced environmental impact. Several organizations have also established pilot production lines dedicated to bio-derived and halogen-free initiator variants, anticipating greater regulatory scrutiny and customer demand for sustainable solutions.

Strategic collaborations with equipment providers have emerged as a critical enabler of value chain integration. By co-developing specialized photoinitiator-curing system combinations, these partnerships optimize cure efficiency and enable customers to achieve higher throughput with lower energy inputs. In parallel, targeted mergers and acquisitions have repositioned certain firms to offer end-to-end photopolymerization solutions, spanning photoinitiators, co-initiators, and advanced additive packages.

Competitive differentiation also stems from intellectual property portfolios that encompass novel monomer penetration enhancers, polymerizable dyes, and photosensitizers capable of harnessing visible-light sources. Companies that have invested in robust patent estates are leveraging cross-licensing agreements and technology sharing initiatives to accelerate product deployment in key markets. Collectively, these corporate maneuvers underscore the importance of innovation, partnership, and strategic timing in maintaining leadership within the photoinitiator domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Photoinitiator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allnex B.V.

- Arkema S.A.

- BASF SE

- Bodo Möller Chemie GmbH

- CD BioSciences

- Double Bond Chemical Ind., Co., Ltd.

- Dow Inc.

- Evonik Industries AG

- Guangdong Haohui New Materials CO.,Ltd

- IGM Resins B.V.

- Johnson Matthey PLC

- Merck KGaA

- NAGASE Specialty Materials NA LLC

- National Analytical Corporation

- NewSun Polymer Technology Co., Ltd.

- Spectra Group Ltd

- Tianjin Jiuri New Materials Co., Ltd.

- Zeneka Ltd

Actionable Strategic Recommendations for Photoinitiator Industry Leaders to Enhance Competitiveness, Foster Sustainability, and Accelerate Innovation

Industry leaders seeking to fortify their competitive position in the photoinitiator arena should prioritize investment in sustainable chemistry platforms that align with global regulatory trends and end-user sustainability targets. Accelerating the development of bio-based photoinitiators and halogen-free systems will not only meet tightening environmental mandates but also address consumer and brand owner demands for greener manufacturing processes. In parallel, forging strategic alliances with LED and visible-light curing equipment manufacturers will enable integrated solution offerings that optimize energy efficiency and cure quality.

Diversification of supply chains represents another imperative, particularly in light of recent tariff uncertainties. Establishing regional production capabilities and multi-source procurement strategies can reduce exposure to trade volatility and enhance operational resilience. In tandem, organizations should harness digitalization across formulation and process monitoring, implementing predictive analytics and machine-learning tools to refine cure profiles, minimize waste, and accelerate time-to-market.

Moreover, engaging proactively with regulatory bodies and standard-setting organizations can provide early visibility into evolving compliance requirements and facilitate the co-creation of industry norms. Leaders are encouraged to sponsor collaborative research initiatives and participate in consortia focused on next-generation photoinitiator technologies. By advancing a holistic approach that integrates sustainability, supply chain agility, digital innovation, and regulatory engagement, companies can unlock new growth avenues and secure long-term value.

Detailed Research Methodology Employed to Gather, Validate, and Analyze Primary and Secondary Data for Photoinitiator Market Intelligence

The research methodology underpinning this analysis combined rigorous secondary research with targeted primary engagements to ensure comprehensive market intelligence. Secondary inputs were drawn from technical journals, regulatory publications, patent databases, and industry white papers to capture evolving trends in photoinitiator chemistry, application techniques, and emission standards. These sources provided the foundational context for mapping segmentation frameworks, regional dynamics, and competitive landscapes.

Complementing this desk research, primary interviews were conducted with formulators, R&D directors, procurement specialists, and end-use manufacturers across key industries. These discussions yielded qualitative insights into formulation challenges, emerging performance criteria, and decision-making drivers. They also facilitated validation of observed shifts in demand patterns and technology adoption rates. In addition, a series of workshops with subject matter experts helped refine key assumptions and stress-test strategic hypotheses.

The data collection process was augmented by quantitative analysis of trade flows, import-export tariffs, and capacity utilization metrics, enabling triangulation of cost and supply chain impacts. Throughout the research lifecycle, an iterative validation protocol involving cross-functional expert panels ensured accuracy, reliability, and objectivity of findings. This methodological approach delivers a robust intelligence framework designed to inform strategic decisions and identify high-potential opportunities in the photoinitiator market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Photoinitiator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Photoinitiator Market, by Type

- Photoinitiator Market, by Technology

- Photoinitiator Market, by Form

- Photoinitiator Market, by Application

- Photoinitiator Market, by End Use Industry

- Photoinitiator Market, by Region

- Photoinitiator Market, by Group

- Photoinitiator Market, by Country

- United States Photoinitiator Market

- China Photoinitiator Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Forward-Looking Perspectives to Chart the Future Course of Photoinitiator Technologies and Market Development

Bringing together the insights from segmentation, regional dynamics, tariff impacts, and corporate strategies, this executive summary outlines a clear vision for the future of photoinitiator technologies. The diversified segmentation landscape underscores the importance of aligning chemical type and cure technology to specific application requirements, while regional analysis highlights geographic nuances in regulatory pressures and market growth drivers. The introduction of 2025 tariff measures in the United States has served as both a challenge and a catalyst for supply chain optimization and innovation acceleration.

Key manufacturers have responded by expanding sustainable chemistry portfolios, partnering with equipment suppliers, and exploring bio-derived initiator systems to meet escalating performance and environmental criteria. These strategic maneuvers illustrate the sector’s resilience and capacity for adaptation in the face of policy shifts and evolving end-user demands. Looking ahead, the integrated deployment of digital formulation tools, energy-efficient curing platforms, and circular economy principles will underpin the next wave of photoinitiator advancements.

Ultimately, organizations that adopt a forward-looking posture-embracing collaborative R&D, diversified sourcing, and proactive regulatory engagement-will be best positioned to capitalize on emerging opportunities and sustain growth. This synthesis of current industry dynamics and prospective trends offers a roadmap for stakeholders to navigate the complexities and unlock value within the photoinitiator ecosystem.

Engage with Ketan Rohom to Gain Expert Guidance and Access the Definitive Photoinitiator Market Research Report for Informed Strategic Decision Making

Engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to explore how this comprehensive photoinitiator market intelligence can inform your strategic priorities and unlock competitive advantage. By partnering with Ketan Rohom, you will gain access to an in-depth market research report that delves into the nuances of application segments, emerging chemistries, regional developments, and corporate strategies, providing the insights needed to make data-driven decisions. Whether you are seeking to refine your product roadmap, optimize your supply chain, or anticipate regulatory shifts, this report offers actionable guidance tailored to your organizational objectives. Reach out to Ketan Rohom to secure your copy of the full report and discover how you can leverage these findings to drive innovation, mitigate risk, and achieve sustainable growth in the photoinitiator market.

- How big is the Photoinitiator Market?

- What is the Photoinitiator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?