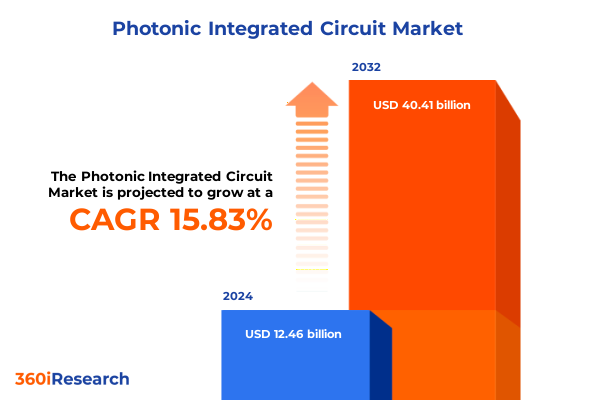

The Photonic Integrated Circuit Market size was estimated at USD 14.41 billion in 2025 and expected to reach USD 16.65 billion in 2026, at a CAGR of 15.87% to reach USD 40.41 billion by 2032.

Emerging Photonic Integration Fuels Next Generation Data Transfer and Sensing Solutions Across Industries with Unprecedented Efficiency Gains

Photonic integrated circuits represent a watershed moment in the evolution of data transmission and sensing technologies, merging the speed of light with the processing power of electronics to overcome the limitations of traditional electrical interconnects. By embedding optical components directly onto semiconductor substrates, Photonic Integrated Circuits unlock new levels of energy efficiency and bandwidth density essential for handling surging digital traffic in cloud computing and telecommunications. The shift from copper to light not only alleviates thermal constraints but also facilitates miniaturization of high-speed interconnects, enabling system architectures that are both more compact and power-frugal.

Moreover, the convergence of photonics and electronics ecosystems is accelerating innovation across industries beyond data centers. Advances in co-packaged optics and integrated photonic-electronic modules are extending the benefits of laser-based interconnects into emerging applications such as autonomous vehicles, advanced medical imaging, and quantum computing platforms. Collaborative initiatives between semiconductor foundries and hyperscale cloud operators have already begun pilot deployments of integrated photonic transceivers, signaling a decisive industry pivot toward light-driven architectures that promise to redefine performance benchmarks.

Breakthrough Developments in Materials, Architectures and Strategic Alliances Are Redefining Photonic Integrated Circuit Capabilities and Applications

The landscape of Photonic Integrated Circuits is undergoing a profound transformation driven by breakthroughs in material science, packaging architectures, and strategic alliances between traditional electronics and photonics specialists. Recent research at the University of California has demonstrated a novel pocket-laser integration method that directly merges quantum dot lasers onto silicon substrates, addressing long-standing challenges of inefficient coupling and thermal instability in monolithic platforms. This advancement paves the way for scalable production processes compatible with established semiconductor manufacturing lines, reducing barriers to commercialization.

Parallel to these developments, major semiconductor vendors are realigning their portfolios to embrace silicon photonics as a core pillar of next-generation interconnects. AMD’s acquisition of photonic IP leader Enosemi underscores the strategic importance of in-house expertise for light-based data transmission, positioning the company to rival incumbents in co-packaged optics and photonic network switches. At the same time, innovations in spin-based photodetection technology promise to accelerate generative AI workloads by delivering response times measured in picoseconds and drastically lowering power consumption for high-speed data transfer. Together, these shifts are redefining the competitive terrain, with ecosystem stakeholders racing to integrate optics and electronics at unprecedented levels of scale and performance.

Analysis of 2025 U.S. Trade Policies Reveals Significant Tariff Pressures Reshaping Photonic Component Supply Chains and Manufacturing Strategies

Trade policy reconfigurations in 2025 have imposed new cost realities for Photonic Integrated Circuit supply chains, compelling firms to reassess sourcing, manufacturing footprints, and strategic partnerships. Since January 1, a 50% tariff on semiconductors imported from China has elevated the cost of critical photonic components such as lasers, modulators, and optical interconnect modules, triggering a wave of offshore capacity shifts and just-in-time procurement strategies to mitigate price inflation.

Subsequent policy announcements have expanded the scope of duties to encompass a wider range of technology products, including domestic production inputs for co-packaged optics. Commerce leaders indicated that new levies targeting semiconductor imports would take effect within months, heightening uncertainty for both OEMs and fabless suppliers. In response, industry participants are accelerating investments in regional fabrication hubs, forging strategic alliances with domestic foundries, and exploring alternative material platforms to reduce exposure to geopolitical risk. This cumulative tariff impact is steering the Photonic Integrated Circuit ecosystem toward greater supply chain resilience and localized manufacturing capabilities.

In-Depth Examination of Photonic Integrated Circuit Market Segmentation Reveals Diverse Integration Techniques, Materials, Applications, Wavelengths, Users

Photonic Integrated Circuit market analysis must account for multiple integration schemas, each offering distinct trade-offs in performance, cost, and scalability. Heterogeneous integration enables the direct bonding of III-V semiconductor lasers onto silicon waveguides for optimal light emission, whereas hybrid approaches leverage intermediate coupling layers to balance assembly complexity with device yield. Monolithic platforms, on the other hand, embed all photonic and electronic functions within a single chip process but often demand more rigorous design rules and fabrication controls.

Material selection further defines device capabilities, with Indium Phosphide prevailing in applications requiring efficient light generation and detection, Polymer waveguides offering low-cost flexibility for simple routing, Silica circuits excelling in high-temperature stability, and Silicon Photonics platforms gaining traction for compatibility with mainstream CMOS foundries. Application demands are equally diverse: datacom and telecom deployments rely on Hyperscale Data Center interconnects and telecom operator networks, while medical use cases span diagnostics, imaging, and therapeutic instruments. Military and aerospace requirements drive communication links, electronic warfare modules, and surveillance sensors, as sensing technologies extend into biosensing, environmental monitoring, and lidar mapping.

Photon distribution across optical bands-Near Infrared, Shortwave Infrared, and Visible wavelengths-guides design choices for range, resolution, and power efficiency. End users in Aerospace & Defense engage both defense contractors and space agencies for mission-critical platforms, whereas healthcare institutions such as hospitals and research labs integrate photonic diagnostics and imaging systems. Industrial operators adopt PIC-enabled manufacturing automation and process monitoring, and telecom and data center operators deploy advanced transceivers to sustain exponential data demand growth.

This comprehensive research report categorizes the Photonic Integrated Circuit market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Integration Type

- Material

- Wavelength

- Application

- End User

Regional Photonic Development Spotlight Highlights Unique Demand Drivers and Strategic Initiatives Across the Americas, EMEA, and Asia-Pacific Markets

The Americas region continues to lead in Photonic Integrated Circuit development, driven by concentrated investments in semiconductor R&D centers, proximity to hyperscale cloud operators, and robust defense budgets fueling optical sensor requirements. Government initiatives in advanced manufacturing and microelectronic sovereignty are reinforcing domestic production of both silicon photonic wafers and III-V compound process lines, while strategic partnerships between academic institutions and industry are accelerating prototype to product transitions.

Europe, Middle East, and Africa exhibit heterogeneous growth patterns, with European research consortia spearheading standardization efforts for co-packaged optics and integrated photonics modules. Defense agencies in the Middle East are adopting PIC-based surveillance and communications systems, and industrial groups across Africa are piloting optical sensing solutions for environmental monitoring and smart agriculture. Regional markets benefit from diversified fabrication ecosystems and cross-border technology collaborations supported by public-private partnerships.

Asia-Pacific remains the fastest-growing frontier for photonic integration, propelled by aggressive capacity expansions in China, Taiwan, South Korea, and Japan. Hyperscale data center operators in China and India are rapidly deploying silicon photonics interconnects to keep pace with AI workloads, while semiconductor foundries in Taiwan and South Korea are enhancing their wafer services to include photonic device lines. Japan’s materials expertise underpins novel polymer and silica waveguide developments, and regional governments are incentivizing domestic value chain investments to reduce reliance on external suppliers.

This comprehensive research report examines key regions that drive the evolution of the Photonic Integrated Circuit market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Dynamics in Photonic Integrated Circuits Showcase Leading Innovators, Strategic Mergers, and Technology Pioneers Driving Industry Advancement

Industry leaders are competing on multiple fronts to capture emerging opportunities in Photonic Integrated Circuits. Foundry incumbents such as TSMC and GlobalFoundries are embedding photonic process design kits alongside traditional CMOS services to attract consumer electronics and datacom system integrators. At the same time, pure-play photonic foundries and research spin-outs are carving out specialized niches in III-V laser integration and hybrid polymer waveguides for bespoke sensing applications.

On the device manufacturing side, diversified portfolios from companies like STMicroelectronics, which is collaborating with cloud providers on silicon-germanium photonic production, are reinforcing their market positions. Technology conglomerates such as Intel and Cisco are leveraging their legacy switch and router businesses to incorporate optical engines, while agile pure-play vendors like Ayar Labs and Lightelligence are pushing the envelope with quantum-grade photonic computing modules. Strategic acquisitions, exemplified by AMD’s purchase of Enosemi, are further consolidating IP portfolios in light-based interconnects, underscoring the critical role of vertical integration and proprietary process know-how.

This comprehensive research report delivers an in-depth overview of the principal market players in the Photonic Integrated Circuit market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Broadcom Inc.

- Cisco Systems, Inc.

- Coherent Corp.

- Fujitsu Limited

- Hamamatsu Photonics

- Infinera Corporation

- Intel Corporation

- Ligentec SA

- LionIX international

- Lumentum Operations Inc.

- MACOM Technology Solutions Holdings, Inc.

- NeoPhotonics Corporation

- Rockley Photonics Ltd

Action-Oriented Strategies for Industry Leaders to Accelerate Photonic Integration Adoption, Mitigate Trade Risks, and Capitalize on Emerging Market Niches

Industry leaders should prioritize diversification of their photonic supply chains to mitigate the immediate impacts of tariff-driven cost pressures. By establishing multi-regional manufacturing partnerships and exploring material alternatives such as polymer and silica waveguides, firms can balance performance requirements with economic resilience. Investing in modular packaging architectures will enable faster time-to-market and facilitate customization for segments ranging from hyperscale data centers to precision lidar deployments.

Collaborative research and development alliances with universities and national laboratories offer a low-risk avenue for co-innovation, particularly in frontier areas like quantum photonics and spin-based detection. Firms are encouraged to engage in standards bodies for co-packaged optics and open optical networking protocols to ensure interoperability and reduce integration complexity. Finally, aligning product roadmaps with end-user roadmaps, whether for automotive autonomy, defense communications, or medical diagnostics, will drive deeper market penetration and unlock new revenue streams.

Comprehensive Research Framework Combining Primary Interviews, Secondary Analysis, and Rigorous Validation Techniques Underpinning Photonic Market Insights

This research initiative combined extensive secondary research with in-depth primary interviews to ensure comprehensive coverage of Photonic Integrated Circuit market dynamics. Secondary sources included peer-reviewed journals, technology white papers, and industry news outlets to track material innovations, architectural breakthroughs, and policy shifts. Publicly available regulatory filings and patent databases provided insights into emerging IP landscapes and competitive positioning.

Primary data collection involved structured interviews with senior executives at semiconductor foundries, device manufacturers, and end-use system integrators, supplemented by expert consultations with academic researchers and trade association representatives. Data triangulation and cross-validation techniques were employed to resolve inconsistencies, while dedicated quality assurance protocols ensured the integrity of channel checks and model assumptions. Ultimately, this blended methodology delivers a rigorously vetted framework underpinning the strategic guidance and segmentation insights provided herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Photonic Integrated Circuit market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Photonic Integrated Circuit Market, by Integration Type

- Photonic Integrated Circuit Market, by Material

- Photonic Integrated Circuit Market, by Wavelength

- Photonic Integrated Circuit Market, by Application

- Photonic Integrated Circuit Market, by End User

- Photonic Integrated Circuit Market, by Region

- Photonic Integrated Circuit Market, by Group

- Photonic Integrated Circuit Market, by Country

- United States Photonic Integrated Circuit Market

- China Photonic Integrated Circuit Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Transformational Trends and Strategic Imperatives in Photonic Integrated Circuits to Inform Decision Making and Future Innovation Roadmaps

The Photonic Integrated Circuit landscape is at an inflection point, where material breakthroughs, architectural convergence, and strategic trade policies are collectively reshaping industry trajectories. Through the integration of lasers, modulators, and detectors onto single chips, the promise of energy-efficient, high-bandwidth interconnects is transitioning from concept to widespread adoption across data centers, telecommunications networks, and emerging precision sensing applications.

While U.S. tariffs in 2025 have introduced temporary supply chain realignments, they have also catalyzed efforts to localize manufacturing and diversify material platforms, ultimately fostering greater ecosystem resilience. As key players continue to consolidate through strategic acquisitions and collaborative alliances, the emphasis on co-packaged optics and heterogeneous integration will intensify, driving the next wave of performance and cost improvements. Stakeholders who align their investments with these transformational trends will be best positioned to captivate new markets and sustain long-term competitive advantage.

Engage with Our Associate Director to Secure Exclusive Photonic Integrated Circuit Market Research Insights and Drive Strategic Growth Opportunities Today

To gain unparalleled visibility into the strategic opportunities and risks shaping the future of Photonic Integrated Circuits, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. His expertise will guide you through the comprehensive research dossier and bespoke analysis that empowers your organization’s growth in this rapidly evolving domain. Connect with Ketan today to secure your copy of the full market research report and position your business at the forefront of photonic innovation.

- How big is the Photonic Integrated Circuit Market?

- What is the Photonic Integrated Circuit Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?