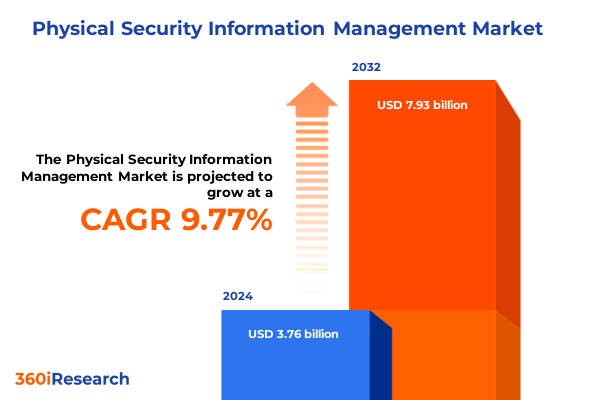

The Physical Security Information Management Market size was estimated at USD 4.11 billion in 2025 and expected to reach USD 4.50 billion in 2026, at a CAGR of 9.83% to reach USD 7.93 billion by 2032.

Unveiling the Strategic Imperative of Physical Security Information Management in a Rapidly Evolving Threat Landscape Accelerated by Technological Innovation and Regulatory Shifts

In today’s rapidly shifting security environment, the convergence of digital transformation and ever-evolving threat vectors has elevated the strategic role of physical security information management (PSIM) solutions. Organizations across sectors are compelled to integrate disparate security systems into unified platforms that deliver real-time situational awareness. This integration is driven by an imperative to mitigate operational risks and safeguard assets in an era marked by heightened regulatory scrutiny and sophisticated security threats.

Moreover, the rise of connected devices and Smart City initiatives has amplified the data volume that security teams must process. PSIM platforms now serve as the nerve center, ingesting inputs from cameras, sensors and network devices to orchestrate automated incident responses. As enterprises and public institutions strive for both efficiency and resilience, understanding the foundational landscape of PSIM has become a critical first step for informed decision-making and strategic planning.

Exploring the Convergence of AI-Powered Analytics, Edge Processing, and Cloud Architectures That Are Redefining PSIM Solutions

The physical security information management market is experiencing profound transformative shifts, driven by rapid advancements in artificial intelligence, cloud computing and edge processing capabilities. AI-powered analytics are enhancing anomaly detection across video surveillance and intrusion detection systems, enabling security operators to prioritize incidents with unprecedented precision. Concurrently, edge computing is decentralizing data processing, reducing latency and alleviating burdens on central servers.

In tandem, the proliferation of cloud and hybrid deployment models has introduced scalable architectures that support dynamic resource allocation. Organizations are migrating from traditional on-premise solutions to flexible cloud environments-both private and public-to optimize cost structures and accelerate deployment cycles. These shifts have fostered a more agile security ecosystem, empowering enterprises to respond to emerging threats with greater speed and accuracy while maintaining compliance with stringent data sovereignty regulations.

Assessing the Ripple Effects of 2025 Tariff Policies on US Procurement Strategies, Vendor Relationships, and Supply Chain Diversification

United States tariffs enacted in 2025 have substantially influenced the economics of PSIM component sourcing and system integration. Tariff adjustments on imported cameras, networking devices, servers and storage units have increased hardware acquisition costs, prompting many integrators to reevaluate vendor relationships and adjust procurement strategies. As a result, there has been a noticeable pivot toward domestic manufacturing partnerships and regionally diversified supply chains.

This tariff impact has also driven cost pressures into service delivery segments, where consulting, implementation and maintenance costs fluctuated in response to changing hardware prices. Organizations have diversified their software sourcing by leveraging local management applications and modular PSIM platforms to mitigate tariff-induced budget constraints. Consequently, the market is witnessing a rebalancing as stakeholders adopt hybrid sourcing models that blend imported and domestically manufactured components to sustain both performance and cost-effectiveness.

Decoding Diverse Adoption Patterns Through Component Specializations, System Convergence, and Segmented Deployment Preferences

The PSIM marketplace is characterized by a multifaceted segmentation framework that illuminates diverse adoption patterns and investment priorities. Component segmentation reveals that hardware remains essential for foundational surveillance, networking and storage, while services such as consulting and ongoing support underpin successful deployments. Software segmentation highlights a growing reliance on cloud-based PSIM platforms alongside mobile applications for remote management, reflecting a shift toward user-centric, platform-driven security.

System type segmentation underscores the convergence of security disciplines, with access control integration, fire alarm integration and video surveillance integration becoming core capabilities of modern PSIM implementations. Deployment models continue to bifurcate between cloud and on-premise solutions, with many enterprises favoring private cloud for data sovereignty. Organization size segmentation differentiates the unique needs of large enterprises, which demand customizable, scalable platforms, from small and medium enterprises that often prioritize cost efficiency and rapid deployment. Industry vertical segmentation further delineates market dynamics, as commercial, government and industrial end users adopt tailored PSIM configurations to address vertical-specific security requirements.

This comprehensive research report categorizes the Physical Security Information Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- System Type

- Deployment Mode

- Organization Size

- End User

Navigating the Impact of Regulatory Environments, Infrastructure Investments, and Digital Transformation Across Key Global Regions

Regional dynamics play a pivotal role in shaping PSIM adoption, driven by regulatory frameworks, technological maturity and investment climates. In the Americas, strong public–private partnerships and robust infrastructure spending have fueled growth, particularly in metropolitan areas where large-scale surveillance and smart infrastructure initiatives intersect.

Meanwhile, Europe, the Middle East and Africa exhibit a varied landscape: stringent data protection requirements in Europe have accelerated private cloud and hybrid deployments, while the Middle East’s emphasis on public security for high-profile events continues to drive demand for integrated video surveillance and access control solutions. Africa’s emerging markets, though nascent, are gradually embracing PSIM as a means to modernize critical infrastructure.

Across Asia-Pacific, rapid urbanization and digital transformation agendas have spawned significant demand for AI-enabled PSIM platforms. Governments and industrial conglomerates alike are investing in next-generation security ecosystems that harness edge analytics and cloud-native architectures to secure smart cities and large-scale industrial sites.

This comprehensive research report examines key regions that drive the evolution of the Physical Security Information Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring the Multifaceted Competitive Arena Where Global PSIM Innovators, Hardware Giants, and System Integrators Shape the Industry

The competitive landscape of PSIM is distinguished by a range of global and niche players, each bringing unique strengths and specializations. Leading providers of PSIM platforms have invested heavily in research and development to integrate artificial intelligence and machine learning capabilities, differentiating their solutions through advanced analytics and automated incident response.

Simultaneously, established security hardware manufacturers have expanded their portfolios to include integrated software modules, leveraging their extensive distribution networks to drive PSIM adoption. Specialist system integrators and value-added resellers play a critical role in customizing solutions for vertical-specific use cases, offering end-to-end services from consulting and design to deployment and ongoing maintenance. The interplay between platform vendors, hardware incumbents and system integrators continues to evolve as partnerships and alliances shape the pathway to market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Physical Security Information Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AARMTech Engineering Pvt. Ltd.

- Axxonsoft

- BOLD Group

- Brivo, Inc.

- Champion Group of Companies

- Condortech Services Inc.

- Genetec Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Intel Corporation

- Isarsoft GmbH

- Johnson Controls International PLC

- Mactwin Security

- NEC Corporation

- Nedap N.V.

- NICE Systems Ltd.

- Octopus Systems Ltd.

- Persistent Sentinel LLC

- Reliable Fire & Security

- SAS Systems Engineering

- Senstar Corporation

- Siemens AG

- TATA Consultancy Services Limited

- TeleGroup d.o.o

- Utimaco Management Services GmbH

- Western Advance Group

Strategic Imperatives for Embedding AI-Driven Insights, Hybrid Deployments, and Collaborative Ecosystem Partnerships to Elevate PSIM Capabilities

Industry leaders should prioritize a strategic blend of technological innovation and agile operational practices to capitalize on the evolving PSIM landscape. First, integrating artificial intelligence and advanced analytics can unlock predictive insights, enabling security teams to anticipate and preempt incidents rather than react post hoc. Concurrently, adopting hybrid deployment frameworks that combine private cloud for sensitive data with public cloud for scalable processing can optimize both performance and compliance.

Furthermore, forging collaborative partnerships across the ecosystem-from hardware suppliers and software vendors to specialized integrators-can streamline procurement and deployment cycles. Organizations must also invest in workforce training and change management initiatives to ensure that security personnel are proficient in leveraging new capabilities and workflows. By aligning technology roadmaps with organizational objectives and regulatory requirements, industry leaders can enhance resilience and drive sustained competitive advantage.

Applying a Rigorous Multi-Phase Research Framework That Combines Secondary Analysis, Expert Engagements, Quantitative Modeling, and Peer Review

This research anchors its findings in a robust multi-step methodology encompassing secondary data analysis, expert interviews and rigorous data triangulation. Initial secondary research synthesized information from industry reports, regulatory publications and technical white papers to map the evolving PSIM market framework. Subsequently, qualitative insights were gathered through structured interviews with security directors, system integrators and solution architects to validate key trends and challenges.

The quantitative phase incorporated data modeling techniques to cross-verify input variables and uncover correlations across segmentation categories. A data triangulation process reconciled discrepancies between secondary sources and primary inputs, ensuring analytical integrity. Finally, a peer review mechanism engaged external industry experts to critique and refine the analysis, reinforcing the credibility and relevance of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Physical Security Information Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Physical Security Information Management Market, by Component

- Physical Security Information Management Market, by System Type

- Physical Security Information Management Market, by Deployment Mode

- Physical Security Information Management Market, by Organization Size

- Physical Security Information Management Market, by End User

- Physical Security Information Management Market, by Region

- Physical Security Information Management Market, by Group

- Physical Security Information Management Market, by Country

- United States Physical Security Information Management Market

- China Physical Security Information Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing the Convergence of Intelligent Integration, Regulatory Dynamics, and Supply Chain Resilience as Foundations for Future Security Strategies

The physical security information management market stands at a pivotal juncture where intelligent integration, data-driven insights and adaptive deployment strategies converge to redefine organizational resilience. As technological advances in AI, edge computing and cloud architectures continue to accelerate, stakeholders must remain vigilant in recalibrating their security strategies. The interplay between tariff-induced supply chain realignments and evolving regulatory mandates further underscores the need for flexible procurement and compliance frameworks.

Ultimately, success in this dynamic environment will hinge on an organization’s ability to harness holisticPSIM platforms that seamlessly unite hardware, software and services. By anchoring decisions in robust segmentation insights and regional dynamics, decision-makers can craft security ecosystems that not only address current threats but also anticipate future challenges, securing long-term operational continuity and stakeholder confidence.

Engage with Ketan Rohom, Associate Director, Sales & Marketing, to Secure Exclusive Access to Comprehensive Physical Security Information Management Market Insights

To explore the comprehensive insights and secure actionable intelligence for strengthening your organization’s security posture, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to obtain your full copy of the market research report. Benefit from tailored analysis and strategic guidance designed to empower decision-makers with clarity and confidence. Engage today to elevate your understanding of the evolving physical security information management sector and position your enterprise at the forefront of resilience and innovation.

- How big is the Physical Security Information Management Market?

- What is the Physical Security Information Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?