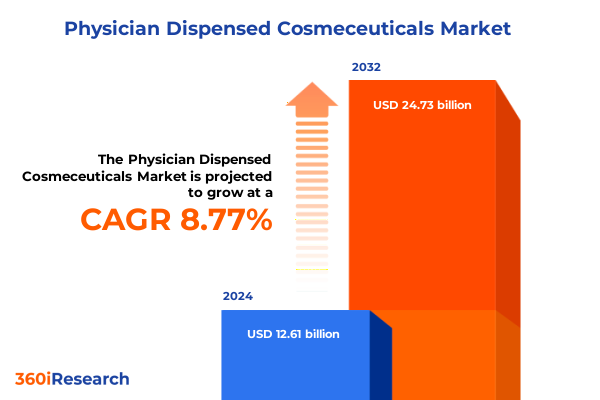

The Physician Dispensed Cosmeceuticals Market size was estimated at USD 13.70 billion in 2025 and expected to reach USD 14.89 billion in 2026, at a CAGR of 8.80% to reach USD 24.73 billion by 2032.

A clear overview of how physician‑dispensed cosmeceuticals bridge clinical care, procedural outcomes, and patient retention in a rapidly evolving healthcare environment

The physician‑dispensed cosmeceuticals space sits at the intersection of clinical care, consumer beauty expectations, and increasingly complex global supply chains. Clinicians now extend their procedural offerings with clinic‑exclusive skincare and adjunctive products that are designed to enhance procedural outcomes, improve recovery, and lock‑in patient loyalty. As a result, product portfolios administered or sold by physicians range from prescription‑grade topical actives to device consumables that directly support in‑clinic procedures. This hybrid nature creates both commercial opportunity and operational complexity for medical practices and manufacturers alike.

Practices that successfully monetize this channel do so by combining evidence‑based product positioning with patient education, authentic clinical endorsement, and convenient access models. Meanwhile, regulatory scrutiny over claims and ingredient concentrations, emergent digital care pathways such as teledermatology, and new trade policies are reshaping how clinics source, price, and present physician‑exclusive products. These trends demand that leaders in clinical dermatology, plastic surgery, and medical spa operations reframe their commercial playbooks around supply‑chain resilience, clinical differentiation, and omnichannel access.

How clinical bundling, digital patient journeys, and product science are jointly transforming physician‑dispensed cosmeceutical strategies and commercial models

Over the past several years the landscape for physician‑dispensed cosmeceuticals has shifted from commodity transactional sales to clinically framed, outcome‑oriented offerings. Neuromodulators and hyaluronic acid injectables remain a central driver of clinic traffic, but parallel shifts are underway: evidence‑led topical actives such as peptides and growth‑factor preparations have migrated from niche research labs into mainstream physician offerings, and complementary device therapies like fractional lasers and chemical peels are increasingly bundled with tailored post‑procedure regimens sold directly to patients. This convergence is forcing manufacturers to think in terms of treatment journeys rather than single products.

Concurrently, the digital transformation of patient intake, diagnosis, and follow‑up-especially through teledermatology and virtual consults-has expanded the reach of physician brands beyond the brick‑and‑mortar clinic. Remote care workflows now routinely include product recommendations, subscription refills, and virtual adherence checks that sustain outcomes between in‑person visits. At the same time, heightened attention on supply‑chain reliability and regulatory clarity is pressuring both clinicians and suppliers to de‑risk sourcing and to differentiate through transparent clinical evidence and quality assurance. In short, successful players are those that can align clinical value, digital access, and supply resiliency into a coherent patient experience.

The 2025 United States tariff realignment and targeted duty changes that reshaped import economics for device consumables and cosmeceutical inputs

Policy shifts in 2025 introduced structural trade changes that are materially relevant to clinics, manufacturers, and distributors in the physician‑dispensed cosmeceutical ecosystem. A broadly applied baseline tariff and a framework for reciprocal country‑level duties altered import economics for active ingredients, finished skincare products, and many device components that support in‑clinic therapies. The policy also included procedural guidance to avoid cumulative stacking of overlapping tariffs and directed federal agencies to issue clarifications and adjustments to harmonized tariff codes, creating a short‑term period of both elevated import costs and regulatory clarification activity. These changes interrupted established sourcing strategies and compelled stakeholders to reassess supplier contracts, buffer inventories, and landed cost models. The executive order and subsequent guidance were explicitly constructed to protect and encourage domestic production while calibrating the application of multiple duties to the same article.

For consumable device categories that clinics rely on-such as syringes, needles, and certain single‑use accessories-authorities applied elevated duties on specific tariff lines, prompting immediate supply‑chain reviews across hospital pharmacies and in‑clinic pharmacies. Trade actions targeting certain countries produced the greatest price pressure where manufacturers had concentrated production of low‑margin, high‑volume components. Professional organizations and health systems publicly warned that higher import duties on high‑volume disposables and device inputs would increase procurement costs and complicate budgeting for small practices and ambulatory centers. These tariff‑driven dynamics accelerated interest in alternative sourcing, on‑shore contract manufacturing, and inventory optimization as risk mitigation strategies.

A layered segmentation perspective detailing how product types, treatment indications, end‑user models, and distribution channels dictate clinical positioning and channel economics

Segmentation within physician‑dispensed offerings must be read as a layered clinical and commercial taxonomy that informs product design, go‑to‑market approaches, and inventory models. Product type considerations span injectables such as botulinum toxin-where Type A brands and their positioning require physician‑level trust-to chemical peels whose active formulations range from superficial alpha‑hydroxy and beta‑hydroxy preparations to deeper phenol and TCA chemistries that carry distinct in‑office procedural protocols and aftercare needs. Dermal fillers vary by scaffold chemistry, from calcium hydroxylapatite to hyaluronic acid and longer‑lasting poly‑l‑lactic acid or polymethyl methacrylate, and each class implies different storage, handling, and clinical counseling responsibilities. Laser portfolios include ablative, fractional, and non‑ablative devices that bring distinct capital, service, and consumable economics, while skin care product assortments range from anti‑aging creams and serums to sunscreens and moisturizers that support both procedural outcomes and daily maintenance.

Treatment indication segmentation-covering acne, hair removal, pigmentation, scar management, skin rejuvenation, and wrinkle reduction-drives both product formulation and clinical workflow design; it is the clinical problem set that determines whether a patient receives a device‑led protocol, an in‑office chemical refurbishment, or a physician‑only topical regimen. End‑user segmentation across aesthetic clinics, dermatology practices, medical spas, and plastic surgery centers defines how product education, rep detailing, and in‑clinic merchandising must be tailored to practitioner skill set and regulatory environment. Finally, distribution channels stratify into clinic sales via hospital and in‑clinic pharmacies, direct sales through physician representatives or distributors, and online channels served by e‑commerce marketplaces and manufacturer websites. This layered segmentation should shape SKU rationalization, sample programs, rep training, and digital fulfillment pathways to ensure the right product is delivered in the right clinical context with appropriate counseling and warranty of outcome.

This comprehensive research report categorizes the Physician Dispensed Cosmeceuticals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Treatment Indication

- Distribution Channel

- End User

Regional commercial and regulatory contrasts across the Americas, Europe‑Middle East‑Africa, and Asia‑Pacific that influence physician adoption, evidence strategies, and channel partnerships

Regional dynamics shape product demand, regulatory expectations, and distribution strategy across the Americas, Europe‑Middle East‑Africa, and Asia‑Pacific. In the Americas, clinical adoption is driven by high procedural volumes, an established clinician‑dispensed channel, and a regulatory environment that permits physician‑exclusive commercialization strategies; these conditions favor premium physician lines, clinic loyalty programs, and integrated procedure‑to‑product treatment bundles. In EMEA markets, regulatory heterogeneity and stricter claim‑making frameworks often require localized evidence packages and careful labeling strategies, which increases time‑to‑market for physician lines but also raises barriers to copycat entrants, creating opportunities for well‑documented clinical brands. Asia‑Pacific presents a dual dynamic: leading innovation hubs such as South Korea and Japan drive ingredient and device adoption at the upper end of the market, while rapidly growing demand in other APAC markets is expanding the base of physician‑administered products and creating distribution partnerships with regional players.

Taken together, these regional patterns mean that commercial strategies must be tailored by geography: Americas teams prioritize physician loyalty and omnichannel fulfillment; EMEA teams invest earlier in regulatory and clinical evidence to protect claims and pricing; and Asia‑Pacific strategies combine innovation adoption with scalable distribution partnerships to capture both premium and mass physician markets. Awareness of these regional distinctions helps manufacturers decide where to prioritize sample distribution, clinical investigator trials, and local regulatory investment to maximize physician trust and traction.

This comprehensive research report examines key regions that drive the evolution of the Physician Dispensed Cosmeceuticals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

An overview of competitive archetypes spanning legacy injectables and devices to clinical skincare specialists and contract manufacturers shaping clinic economics

Competitive dynamics in physician‑dispensed cosmeceuticals are characterized by a mix of legacy pharmaceutical firms that dominate injectables and laser manufacturers, specialist clinical skincare houses that focus on physician‑only formulations, and nimble private‑label or contract manufacturers that support clinic brands. Leading injectable providers continue to defend clinical channels through investment in brand education, patient adherence programs, and physician training. Device manufacturers invest in consumable ecosystems and service contracts that make devices economically sticky for clinics, while medical skincare houses differentiate by publishing clinician‑led studies and aligning product families to procedural protocols.

Across the supply chain, contract packagers and specialty ingredient suppliers play a critical role in enabling rapid new product introductions and private‑label solutions for practices seeking margin enhancement. Strategic partnerships between device OEMs and skincare brands-where in‑office procedures are bundled with post‑procedure physician‑dispensed regimens-are becoming more common and create higher lifetime value per patient. Given the tariff environment and concentrated supplier footprints for certain consumables, companies that control multiple nodes of the value chain-ingredient sourcing, finished goods manufacturing, clinical education-have a distinct advantage in stabilizing margins and protecting availability. Evidence‑backed claims, strong clinician relationships, and adaptable fulfillment options are the primary competitive levers available to market leaders.

This comprehensive research report delivers an in-depth overview of the principal market players in the Physician Dispensed Cosmeceuticals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Alastin Skincare, Inc.

- Beiersdorf AG

- Cantabria Labs S.A.

- Crown Laboratories Inc.

- Galderma Laboratories, L.P.

- INNOVATIVE SKINCARE

- Jan Marini Skin Research, Inc.

- Johnson & Johnson

- L'Oréal Groupe

- Merz Pharma

- Obagi Cosmeceuticals LLC

- PCA Skin, LLC

- Pierre Fabre Dermo-Cosmétique

- Procter & Gamble Co.

- SkinMedica, Inc.

- The Estée Lauder Companies Inc.

- ZO Skin Health, Inc.

Actionable strategic priorities for industry leaders to strengthen supply resilience, clinical differentiation, and omnichannel access in physician‑dispensed portfolios

Industry leaders should prioritize a threefold playbook that addresses supply‑chain resilience, clinical differentiation, and modern access models. First, develop multi‑sourcing strategies for critical actives and device consumables and evaluate near‑shoring or regional production partnerships that reduce exposure to variable duties and transport disruptions. When possible, renegotiate contract terms to include tariff‑adjustment clauses and expand safety stock policies for high‑use consumables while simultaneously investing in inventory analytics to avoid unnecessary capital lock‑up.

Second, double down on clinical evidence and integrated treatment protocols that make physician‑dispensed products a demonstrable enhancer of procedural outcomes. Invest in clinician education, sponsor pragmatic clinic‑based outcome registries, and produce concise evidence summaries clinicians can use at point‑of‑care to support recommendations. Packaging your product as part of a treatment journey-combining device, in‑clinic procedure, and take‑home regimen-creates defensibility and supports premium pricing.

Third, expand omnichannel access by formalizing telehealth product workflows, subscription refill programs, and secure e‑commerce solutions that integrate with clinic EMRs and pharmacy fulfillment. Teledermatology pathways that include product prescription, virtual follow‑up, and adherence nudges will extend clinical reach and retention. Additionally, ensure compliance teams vet online sales and repackaging models against local regulatory rules to protect labeling claims and clinician reputation. Together these measures reduce operational risk, strengthen clinical trust, and create repeatable commercial models that can withstand tariff and supply shocks.

A clear description of the mixed‑methods research approach combining primary clinician engagements with secondary policy and procedural evidence to illuminate commercial implications

This research combined primary qualitative engagements with clinic leaders, purchasing managers, physician sales representatives, and regulatory experts with secondary analysis of public regulatory notices, professional society procedural statistics, and tariff guidance. Primary interviews focused on procurement workflows, in‑clinic merchandising practices, clinical evidence needs, and digital patient engagement models. Secondary sources reviewed policy documents, procedural trends from major professional societies, telehealth policy statements, and public filings to triangulate operational impact and channel behaviour.

Analysts synthesized findings by mapping product families to treatment indications and by modelling distribution permutations across clinic pharmacies, direct sales teams, and digital channels. Supply‑chain impact analysis relied on tariff announcements, harmonized tariff guidance, and trade counsel interpretation to identify vulnerable tariff lines and to generate practical mitigation options. Wherever possible the methodology privileged clinically meaningful measures-such as adoption behaviours, in‑clinic counseling practices, and procedural bundling-rather than market sizing, to better inform operational decision making and commercial playbooks.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Physician Dispensed Cosmeceuticals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Physician Dispensed Cosmeceuticals Market, by Product Type

- Physician Dispensed Cosmeceuticals Market, by Treatment Indication

- Physician Dispensed Cosmeceuticals Market, by Distribution Channel

- Physician Dispensed Cosmeceuticals Market, by End User

- Physician Dispensed Cosmeceuticals Market, by Region

- Physician Dispensed Cosmeceuticals Market, by Group

- Physician Dispensed Cosmeceuticals Market, by Country

- United States Physician Dispensed Cosmeceuticals Market

- China Physician Dispensed Cosmeceuticals Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

A concise synthesis of why clinical credibility, supply resilience, and omnichannel patient access will determine leadership in physician‑dispensed cosmeceuticals

Physician‑dispensed cosmeceuticals represent a resilient corner of aesthetic and clinical dermatology because they fuse clinical credibility with recurring product demand. The channels that deliver these products are evolving: injectables and device‑adjacent consumables remain core traffic drivers, while evidence‑based topical actives and integrated aftercare regimens are increasingly essential to preserving outcomes and patient loyalty. Digital care pathways and teledermatology create an ongoing point of contact that supports repeat purchase and adherence, but they require careful integration to preserve clinical standards and regulatory compliance.

In an environment shaped by shifting trade policy and elevated duties on certain device inputs and ingredients, commercial resilience will be won by organizations that can assure continuity of supply, document clinical benefit, and meet patients where they increasingly seek care-both in clinic and online. Combining clinician trust, demonstrable outcomes, and operational agility will separate leaders from followers in the coming years.

Speak with Ketan Rohom, Associate Director, Sales & Marketing, to request the full physician‑dispensed cosmeceuticals market report and tailored briefings

For senior leaders evaluating a purchase, speak directly with Ketan Rohom, Associate Director, Sales & Marketing, to request the full report, secure customized briefings, or arrange a private briefing tailored to your leadership team’s priorities. Ketan can coordinate delivery of the executive deck, arrange a tailored walkthrough of segmentation and regional implications, and set up a confidential Q&A session with the lead analysts to explore how the findings translate into commercial strategy.

If you are preparing procurement, partnership, or product road‑map decisions, reach out to request a sample chapter that highlights the supply‑chain analysis and regulatory implications for physician‑dispensed products. For commercial teams focused on physician adoption, request the clinical adoption playbook and channel performance deep dive that show practical tactics to protect margin while improving patient education and retention. Ketan will also facilitate licensing discussions for repackaging, private‑labeling, or distribution rights, and can coordinate competitive landscape updates to support investor or board level reviews.

Take action now to turn insight into advantage: request the tailored briefing, review the sample chapter, and schedule a vendor‑agnostic planning session with the analyst team. Ketan will coordinate next steps and ensure your questions are routed to the subject‑matter experts who can provide the tactical templates and risk mitigation checklists needed to move from insight to implementation.

- How big is the Physician Dispensed Cosmeceuticals Market?

- What is the Physician Dispensed Cosmeceuticals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?