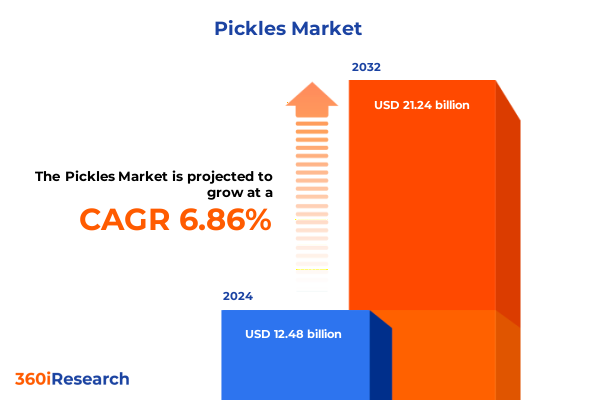

The Pickles Market size was estimated at USD 13.28 billion in 2025 and expected to reach USD 14.14 billion in 2026, at a CAGR of 6.93% to reach USD 21.24 billion by 2032.

Unveiling the Tangy Evolution of the Global Pickle Industry Through Consumer Trends, Production Innovations, and Flavorful Market Dynamics

The global pickle industry has evolved from a simple preserved vegetable staple into a dynamic market shaped by shifting consumer preferences, innovative processing techniques, and expanding distribution networks. Rising interest in clean-label products has driven producers to adopt natural fermentation and minimal-ingredient recipes, reducing reliance on artificial additives. Meanwhile, adventurous flavor palettes have inspired infusions with everything from spicy peppers to exotic spices, appealing to millennials and Gen Z consumers eager for novel taste experiences.

Simultaneously, the convergence of health and convenience trends has elevated the status of pickles beyond a mere condiment to a flavorful, functional snack. Brands are capitalizing on the perceived gut-health benefits of fermented products, positioning pickles within the burgeoning wellness category. Additionally, the growth of e-commerce and direct-to-consumer subscription models has opened new channels, allowing smaller craft producers to reach national and international audiences.

As the industry continues to mature, sustainability has emerged as a critical driver of competitive differentiation. From sourcing cucumbers through regenerative agriculture practices to adopting eco-friendly packaging, companies are embracing circular economy principles. With this backdrop, the following sections unpack the transformative shifts, tariff impacts, segmentation nuances, regional dynamics, leading players, and strategic imperatives shaping the future of pickles.

Navigating the Pickle Industry’s Transformative Landscape Fueled by Flavor Diversification, Sustainability Imperatives, and Production Process Innovations

The pickle landscape is undergoing a profound transformation underpinned by three key forces: flavor diversification, sustainability imperatives, and production technology advancements. First, flavor profiles have expanded far beyond classic dill, with producers experimenting with global influences such as Korean kimchi-style brines, Latin American aji peppers, and Mediterranean herbs. This culinary cross-pollination has resonated with consumers seeking authentic, regionally inspired products.

Furthermore, the emphasis on sustainability has redefined ingredient sourcing and packaging protocols. Producers are increasingly partnering with local farmers to reduce transportation emissions, while innovations in biodegradable films and lightweight jars demonstrate a commitment to reducing plastic waste. In parallel, water- and energy-efficient fermentation vessels are being deployed to minimize the environmental footprint of large-scale pickle operations.

Advances in manufacturing technologies are also catalyzing growth. Automated brine injection systems, real-time fermentation monitoring using IoT sensors, and high-pressure processing (HPP) for extended shelf life without preservatives are becoming standard. These process enhancements not only yield consistent product quality but also enable rapid scaling to meet surges in demand. Consequently, the pickle sector is now characterized by a blend of artisanal creativity and industrial precision, setting the stage for sustained innovation.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Pickle Supply Chains, Pricing Structures, and Consumer Accessibility

In early 2025, sweeping U.S. tariffs introduced a 25% duty on most Mexican and Canadian produce shipments, alongside additional 10–20% levies on goods from select Asian markets, directly affecting cucumber imports used in pickle production. These measures have triggered a sharp increase in wholesale costs, with aggregate duties projected to inflate border prices of cucumbers by nearly a quarter within weeks of enforcement. Moreover, retaliatory responses from Canada and China add uncertainty to import volumes, intensifying supply chain volatility.

As import duties accrue, manufacturers are beginning to pass through elevated costs into retail pricing. Fresh produce tariffs are anticipated to drive up-brine and jarred pickle prices, as distribution partners integrate the added levies into their invoices. According to industry analysts, grocery shelves could reflect a 4% uptick in per-item pricing for pickle jars over the next quarter, narrowing margins for value-focused brands.

Packaging also faces cost headwinds from aluminum and plastics tariffs, amplifying pressure on bottle and jar suppliers. Producers reliant on HDPE and PET bottles report input surcharges of up to 15%, compelling them to explore alternative materials or absorb costs temporarily to maintain shelf competitiveness.

Given that roughly three-quarters of U.S. cucumber imports originate from Mexico and Canada, the risk remains that sustained tariffs could depress availability during peak summer harvests. If duties persist, domestic growers may expand acreage to capitalize on higher price realizations, yet long-term contractual lags mean supply adjustments could take multiple seasons to materialize.

Uncovering Critical Pickle Market Segmentation Strategies Across Types, Packaging Formats, Processing Methods, Distribution Channels, and Ingredient Sources

A nuanced understanding of pickle varieties reveals that traditional categories like Bread & Butter and Dill remain consumer favorites, while Gherkin and Kosher styles continue to carve out passionate followings among niche audiences. These distinctions highlight the importance of tailoring flavor profiles and brine formulations to meet diverse taste expectations across regions.

Packaging innovations further refine product appeal. Bottled formats in HDPE and PET offer lightweight convenience for on-the-go consumption, while glass jars project a premium image that aligns with artisanal and organic positioning. Laminated and standup pouches present a disruptive alternative, reducing material use and offering resealable features that resonate with sustainability-minded shoppers.

Processing choices-pasteurization versus unpasteurization-play a pivotal role in both product authenticity and shelf stability. While pasteurization ensures extended life and safety, unpasteurized options preserve live cultures that appeal to health-centric consumers.

Alongside direct-to-consumer and specialty store channels, supermarkets and hypermarkets remain critical for mass penetration, though digital platforms are fast emerging as growth accelerators. Finally, ingredient sourcing spans pure cucumber offerings in both conventional and certified organic forms, as well as mixed vegetable blends that introduce carrots, peppers, and cauliflower to enrich nutritional profiles. Each segment demands customized product development to optimize consumer resonance and operational efficiency.

This comprehensive research report categorizes the Pickles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging

- Processing Type

- Distribution Channel

- Source

Examining the Regional Drivers Influencing Pickle Industry Expansion in the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional market dynamics underscore the varied drivers fueling pickle consumption globally. In the Americas, robust demand is sustained by a deep-rooted cultural affinity for traditional Dill and Bread & Butter pickles, further bolstered by growing interest in organic and fermented snack options. Retailers in North America are increasingly showcasing pickled innovations alongside health foods, reflecting a shift toward functional snacking.

Within Europe, Middle East & Africa, pickles occupy a storied place in culinary traditions, from Eastern European sauerkrauts to Middle Eastern torshi. Premiumization trends have led to premium jarred assortments infused with regional spices like za’atar and sumac. Across these markets, urbanization and younger demographics are driving interest in novel interpretations of classic recipes.

Meanwhile, the Asia-Pacific region is characterized by a blend of bold, spicy pickles and quick-serve street-food formats. Innovations in fermentation techniques are yielding higher-value products tailored to local taste profiles, while modern retail chains are introducing shelf-stable variants that appeal to busy urban consumers. Growing disposable incomes and expanding modern retail infrastructure continue to underpin strong growth expectations across key APAC economies.

This comprehensive research report examines key regions that drive the evolution of the Pickles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Pickle Industry Innovators and Market Leaders Driving Product Innovation, Operational Efficiency, and Strategic Growth Initiatives

A handful of established players and emerging challengers are shaping the pickle landscape through strategic investments, partnerships, and product innovations. Leading firms with global reach are leveraging integrated supply chains to ensure consistent quality and scale, while nimble craft producers excel at rapid flavor experimentation that captures niche audiences.

Notable incumbents have fortified their positions by introducing limited-edition seasonal flavors, collaborating with celebrity chefs, and expanding into health-oriented lines that highlight gut-friendly benefits. This has prompted adjacent food companies to explore acquisitions and joint ventures, integrating pickle brands into broader portfolios spanning sauces, dressings, and snack dippers.

Meanwhile, digital-first startups are leveraging social media and e-commerce platforms to engage directly with consumers, using data analytics to refine flavor launches and optimize fulfillment. Their agility has demonstrated that targeted social campaigns and subscription models can unlock new revenue streams with minimal upfront investment.

Cross-sector partnerships are also emerging, as tech players introduce smart labeling and blockchain traceability to bolster transparency and food safety-initiatives that increasingly differentiate brands in a crowded marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pickles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADF Foods Limited

- Angel Camacho Alimentación S.L.

- B&G Foods, Inc.

- Bennett Opie Ltd.

- Carl Kühne KG

- Conagra Brands, Inc.

- Del Monte Foods, Inc.

- Desai Foods Pvt. Ltd.

- G.D. Foods Pvt. Ltd.

- Hengstenberg GmbH & Co. KG

- Hugo Reitzel AG

- Mt. Olive Pickle Company, Inc.

- Nilon's Enterprises Pvt. Ltd.

- Orkla ASA

- The Kraft Heinz Company

Empowering Industry Stakeholders with Actionable Strategies to Capitalize on Pickle Market Trends, Streamline Operations, and Enhance Competitive Positioning

To capitalize on evolving consumer behaviors and regulatory shifts, industry leaders should prioritize clean-label recipes, phasing out artificial preservatives and highlighting transparent ingredient sourcing on packaging. By integrating regenerative agriculture partnerships and adopting eco-friendly materials, companies can strengthen brand credibility and appeal to sustainability-minded demographics.

Simultaneously, bolstering digital channels-ranging from direct-to-consumer subscriptions to partnerships with meal-kit providers-will enable real-time engagement and data collection to inform rapid iteration of flavor innovations. Technological investments in smart fermentation monitoring and high-pressure processing will drive operational efficiencies and maintain product integrity without compromising health claims.

Given the complexity introduced by new tariff regimes, securing diversified supply agreements and expanding domestic procurement of cucumbers and ancillary inputs will mitigate import risks. Developing contingency plans for packaging materials and exploring composite alternatives can safeguard cost structures and ensure continuity.

Finally, forging collaborative alliances with retailers and foodservice operators to co-create limited-edition variants or co-branded campaigns will unlock incremental revenue opportunities and amplify shelf visibility in core channels.

Detailing Rigorous Research Methodologies Blending Primary Interviews, Secondary Data Analysis, and Industry Validation to Deliver Robust Market Insights

This research draws upon a robust blend of primary and secondary analyses to deliver actionable insights. Primary inputs include structured interviews with senior executives from leading pickle producers, brining equipment manufacturers, packaging suppliers, and retail category managers. These conversations provided qualitative perspectives on strategy, innovation roadmaps, and supply chain resilience.

Secondary research encompassed a comprehensive review of regulatory filings, trade association publications, and public financial disclosures to validate historical performance and benchmark operational metrics. Additional data were sourced from government import-export databases and agricultural ministry reports to quantify trade flows, duty structures, and cultivation trends.

Quantitative market modeling employed data triangulation techniques, reconciling production volumes, consumption patterns, and price movements without relying on single-source projections. Key findings underwent corroboration through expert panels and roundtable discussions, ensuring that thematic interpretations reflect both ground-level realities and forward-looking strategic considerations.

Ethical research practices were upheld throughout, with confidentiality agreements safeguarding proprietary insights and compliance with data privacy regulations governing personal and corporate information.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pickles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pickles Market, by Packaging

- Pickles Market, by Processing Type

- Pickles Market, by Distribution Channel

- Pickles Market, by Source

- Pickles Market, by Region

- Pickles Market, by Group

- Pickles Market, by Country

- United States Pickles Market

- China Pickles Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Summarizing Key Insights and Implications Highlighting the Future Trajectory of the Pickle Industry and Strategic Imperatives for Stakeholders

By synthesizing emerging flavor trends, sustainability priorities, and technological innovations, this analysis highlights the intricate tapestry of factors redefining the pickle industry. Segmentation across types, packaging, processing methods, distribution channels, and ingredient sources reveals multiple pathways for tailored growth, while regional dynamics underscore the importance of localized strategies to address distinct consumer palates and regulatory environments.

The ripple effects of 2025 tariff policies underscore the necessity of agile supply chain frameworks and diversified sourcing to cushion against cost pressures and availability risks. Meanwhile, the ascent of digital and direct-to-consumer channels offers new avenues for brand engagement and margin optimization.

Leading companies that proactively integrate clean-label credentials, sustainable practices, and advanced manufacturing processes are best positioned to capture incremental value. By embracing collaborative partnerships and data-driven decision making, stakeholders can navigate the complexities of global trade, regulatory shifts, and evolving consumer demands. Ultimately, the evolutionary forces at play signal a vibrant future for pickles-one defined by experiential flavors, responsible stewardship, and enduring brand loyalty.

Connect with Ketan Rohom to Unlock Comprehensive Pickle Market Intelligence and Drive Strategic Decision Making for Lasting Business Growth

To explore the full depth of consumer insights, supply chain analysis, and segmentation strategies outlined in this summary, connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure your comprehensive report and gain a competitive edge today.

- How big is the Pickles Market?

- What is the Pickles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?