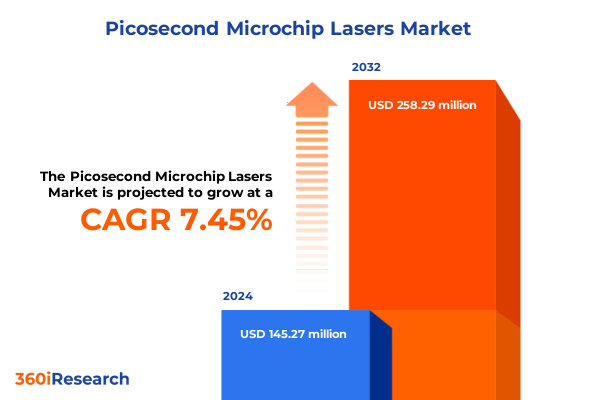

The Picosecond Microchip Lasers Market size was estimated at USD 153.83 million in 2025 and expected to reach USD 165.86 million in 2026, at a CAGR of 7.68% to reach USD 258.29 million by 2032.

Setting the Stage for Picosecond Microchip Laser Technology Revolutionizing Precision Applications in Biomedical Imaging, Manufacturing, and Advanced Research Initiatives

The emergence of picosecond microchip lasers represents a pivotal advance in ultrafast photonics, combining sub-nanosecond pulse durations with compact form factors that cater to precision-driven applications. Unlike conventional Q-switched or nanosecond systems, microchip architectures integrate the gain medium, pumping mechanism, and resonator into a monolithic platform, which yields remarkable temporal stability and superior beam quality. These attributes facilitate reproducible pulse-to-pulse performance, making picosecond microchip lasers indispensable where exacting control is paramount.

Driven by innovations in diode-pumped solid-state technology and refined mode-locking techniques, the latest generation of microchip lasers can consistently deliver pulses in the 10-to-50-picosecond range. This capability supports high-resolution imaging modalities, fine-feature micromachining, and spectral analysis applications that demand minimal thermal load and maximal spatial precision. In turn, research institutions and end-user industries are reallocating resources toward the integration of these sources into next-generation instrumentation.

The modular design ethos, coupled with advancements in materials engineering-such as the adoption of crystalline coatings and engineered saturable absorbers-has enhanced the durability and alignment resilience of microchip lasers. As a result, maintenance intervals have lengthened and operational costs have decreased, expanding the technology’s appeal beyond specialized laboratories and into mainstream manufacturing environments. Furthermore, ongoing improvements in pump diode efficiency and thermal management underscore the trajectory toward scalable production.

In response to these technological breakthroughs, stakeholders are examining key market dynamics, including tariff environments, segmentation strategies, and regional growth drivers. This executive summary encapsulates these factors, offering an informed assessment that equips decision-makers with the context needed to navigate the complexities of the picosecond microchip laser ecosystem.

Identification of Key Technological and Market Shifts Driving Adoption of Picosecond Microchip Lasers in Emerging High-Precision Sectors

Over the past several years, the picosecond microchip laser market has undergone transformative shifts driven by both technological and commercial forces. Advancements in pump diode architectures and nano-fabrication techniques have enabled the production of ever more compact, efficient, and robust laser systems. As the size, weight, and power requirements continue to decline, new application verticals such as in-line semiconductor wafer inspection and portable spectroscopic devices have emerged, illustrating the market’s evolving scope.

Concurrently, integration with photonic circuits and adaptive optics platforms has redefined performance benchmarks. Organizations are leveraging on-chip pulse shaping and real-time feedback control to achieve unprecedented temporal fidelity, effectively widening the use cases that can benefit from synchronized ultrafast pulses. The collaborative convergence of electronics and photonics is unlocking hybrid systems that deliver both high throughput and sub-micron precision.

Market dynamics have further shifted as cost-per-pulse metrics fall due to economies of scale in diode manufacturing. This cost reduction has catalyzed broader adoption among research institutions and OEMs seeking to embed ultrafast laser sources into diagnostic tools and automated inspection lines. At the same time, value-added services around system integration, maintenance contracts, and customized software solutions are becoming critical differentiators among suppliers, shifting the competitive landscape from pure hardware providers to full-solution partners.

Finally, the confluence of Industry 4.0 initiatives and increasing demand for non-thermal processing techniques is driving the integration of picosecond microchip lasers into smart factory frameworks. Coupled with data analytics and machine-learning algorithms, these lasers are not only enabling high-precision microstructuring but also delivering real-time quality monitoring and adaptive control. Such developments underscore the market’s maturation and the strategic importance of aligning technological prowess with end-user requirements.

Analyzing the Cumulative Effects of 2025 United States Tariff Adjustments on Global Picosecond Microchip Laser Supply Chains and Pricing Structures

In December 2024, the Office of the United States Trade Representative (USTR) announced a significant revision under Section 301, increasing tariffs on select imported components critical to photonics manufacturing. Effective January 1, 2025, duty rates for solar-grade wafers and polysilicon rose to fifty percent, while certain tungsten products, integral to mirror substrates and precision optics, saw tariffs climb to twenty-five percent. These measures, part of a broader strategy to counteract unfair trade practices, directly affect the cost structure of picosecond microchip laser production, as many suppliers rely on high-purity crystalline wafers and specialized optical materials sourced from China.

The cumulative impact of these tariff adjustments extends beyond direct import costs. Manufacturers have faced increased prices for raw substrates used in microchip laser gain media, resulting in upward pressure on end-product pricing. Additionally, logistics and customs processing delays have amplified lead times, disrupting Just-In-Time (JIT) inventory models and prompting companies to reconsider their supply chain strategies. As duties went into effect at the start of the calendar year, several original equipment manufacturers reported budgetary re-evaluations for capital projects slated for mid-2025 deployment.

Recognizing the strain on critical medical and research applications, the USTR concurrently extended certain product exclusions originally set to expire on May 31, 2025. In late May 2025, the exclusions for 164 intermediate components and 14 categories of solar manufacturing equipment were prolonged through August 31, 2025. While the exclusion extension offers temporary relief for parts catalogued under those HTS codes, it does not cover bespoke optical assemblies or custom-engineered resonator components, leaving a portion of the supply chain exposed to full duty rates.

In response, industry leaders have pursued mitigation measures including dual sourcing, onshoring partnerships, and strategic inventories to hedge against tariff volatility. Some firms are exploring tariff engineering-modifying product classifications to align with excluded categories-while others are engaging trade experts to secure retrospective refunds on improperly classified imports. Policy advocacy efforts have also intensified, with manufacturers seeking stability in trade policy to underpin long-term capital investments.

Looking ahead, the interplay between evolving tariff regimes and domestic incentives for advanced manufacturing will shape the cost trajectory of picosecond microchip lasers. Stakeholders must remain vigilant, balancing short-term tactical responses with sustainable supply chain configurations that can absorb external shocks and capitalize on policy-driven opportunities.

Deep-Dive Analysis into Critical Market Segmentation Categories Shaping Picosecond Microchip Laser Application and Industry Adoption

A holistic understanding of the picosecond microchip laser market requires a nuanced breakdown by application, encompassing five core areas. Biomedical imaging constitutes a leading segment, further differentiated into fluorescence lifetime imaging, optical coherence tomography, and two-photon microscopy, each leveraging ultrafast pulses to capture dynamic biological processes. Flow cytometry represents another critical application domain, with cell sorting and fluorescence detection techniques demanding high repetition rates and stable pulse widths. In manufacturing, micromachining applications such as cutting, drilling, and surface structuring rely on precise energy deposition, while semiconductor inspection is bifurcated into mask inspection and wafer defect detection. Spectroscopy, spanning Raman and time-resolved modalities, completes the application spectrum by utilizing picosecond pulses to resolve complex material fingerprints at the molecular level.

The end-user industry segmentation further refines the landscape across five verticals. In aerospace, material characterization and surface treatment processes benefit from non-thermal processing to preserve substrate integrity. Automotive sectors employ component testing and material analysis, integrating ultrafast lasers in both R&D and production lines. The electronics industry harnesses lasers for intricate electronics packaging and semiconductor manufacturing, where fine feature resolution is paramount. Healthcare end-users-diagnostic labs, hospitals, and research laboratories-deploy these systems for live-cell imaging and minimally invasive surgery validation, while government labs and universities under the research institutions category continue to push the boundaries of fundamental photonics research.

Technology type segmentation highlights three principal platforms. Diode-pumped microchip lasers, including laser-diode-pumped (LD-pumped) and optically pumped semiconductor laser variants, offer compactness and energy efficiency. Fiber laser counterparts-Erbium-doped and Ytterbium-doped fiber architectures-deliver flexible wavelength tunability and high beam quality. Solid-state configurations, typified by Nd:YAG and Ti:Sapphire crystals, remain the workhorse in high-energy pulse generation, valued for their proven reliability and scalability.

Wavelength range segmentation underscores the diversity of photonic interactions. Mid-infrared emissions at two and three micrometers facilitate advanced sensing in environmental monitoring, while near-infrared outputs at 1064, 1550, and 800 nanometers support telecommunications and biomedical applications. Ultraviolet wavelengths of 213, 266, and 355 nanometers enable high-precision surface ablation, and visible lines at 447, 532, and 589 nanometers cater to specialized spectroscopic and display technologies.

Finally, laser cavity type delineation differentiates by mode control and pulse formation. Kerr-lens cavities, employing hard and soft aperture configurations, enable self-starting mode-locking. Active and passive mode-locked designs govern pulse dynamics, while Q-switched systems offer both active and passive Q-switch implementations for high-peak-power bursts. Semiconductor saturable absorber mirror (SESAM) technologies, with fast and slow recovery variants, add another dimension of pulse shaping, ensuring stability across diverse operational regimes.

This comprehensive research report categorizes the Picosecond Microchip Lasers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- End-User Industry

- Technology Type

- Laser Cavity Type

Comparative Regional Dynamics Influencing Growth Trajectories of the Picosecond Microchip Laser Market across Major Global Territories

The Americas region continues to lead innovation and adoption in picosecond microchip laser technology, supported by a robust ecosystem of research universities, national laboratories, and high-tech manufacturing hubs. The United States benefits from targeted funding initiatives aimed at next-generation photonics, driving collaboration between industry and academia. Canada’s growing photonics clusters in Ontario and Quebec further strengthen North America’s position, while Brazil’s expanding industrial base and government incentives in advanced manufacturing signal emerging opportunities for localized deployments.

In Europe, Middle East, and Africa, established centers of excellence in Germany, France, and the United Kingdom sustain high-precision optics manufacturing and research collaborations. Germany’s strong automotive sector integrates ultrafast lasers into both R&D and production quality control, while the UK’s strategic investments in photonics innovation hubs propel advances in aerospace instrumentation. Middle Eastern efforts, notably in the United Arab Emirates and Saudi Arabia, emphasize diversification through high-tech sectors, leveraging picosecond laser-based processes for energy and petrochemical applications. Africa, although nascent in advanced photonics, shows promise through academic partnerships and pilot projects in medical diagnostics.

The Asia-Pacific region exhibits dynamic growth fueled by government-led initiatives and a mature electronics manufacturing landscape. China’s significant investment in domestic photonics capacity is complemented by aggressive subsidy programs and technology transfer mandates, although ongoing trade policy tensions introduce complexity. Japan’s leadership in precision instrumentation and South Korea’s advanced materials research underpin a strong market presence, especially in healthcare imaging and semiconductor inspection. India’s emerging laser industry is catalyzed by increasing demand for cost-effective diagnostic tools, while Australia leverages its research institutions to pioneer environmental sensing applications. Across the region, the interplay of local production incentives, import regulations, and ecosystem partnerships continues to define competitive positioning.

This comprehensive research report examines key regions that drive the evolution of the Picosecond Microchip Lasers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles and Competitive Strategies of Leading Picosecond Microchip Laser Manufacturers and Innovators in the Industry

Leading suppliers in the picosecond microchip laser domain differentiate themselves through a blend of technological innovation, strategic alliances, and comprehensive service offerings. Several established manufacturers have broadened their portfolios to include turnkey solutions that integrate high-precision lasers with customized optics and control software, effectively transitioning from component vendors to full-system architects. This trend underscores the imperative for seamless integration and reliability in mission-critical applications.

Collaboration agreements between laser OEMs and specialized component producers have become increasingly common, enabling rapid prototyping and co-development of novel laser architectures. These partnerships often center on next-generation gain materials, advanced saturable absorber technologies, and custom wavelength outputs tailored to specific end-use scenarios. Alliances with academic research centers further amplify these R&D efforts, granting early access to breakthrough discoveries and accelerating time-to-market for innovative products.

Mergers and acquisitions have also reshaped the competitive landscape, with strategic targets selected for their unique IP portfolios or regional distribution capabilities. By consolidating complementary expertise-such as fiber laser specialists acquiring microchip laser innovators-companies can offer diversified laser sources under a unified brand, increasing their appeal to global clients seeking a single-vendor solution. Additionally, some market participants have invested in service networks and training programs, recognizing that customer support and operator proficiency are key drivers of long-term loyalty.

Emerging entrants, particularly technology-driven start-ups, are challenging incumbents by focusing on disruptive approaches such as machine-learning-enhanced beam control and integrated photonic packaging. Although these challengers typically operate with leaner structures, they benefit from agility in responding to niche requirements and pioneering new markets. Their presence has prompted established firms to prioritize continuous improvement and foster a culture of rapid innovation, ensuring sustained competitiveness in the evolving picosecond microchip laser sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Picosecond Microchip Lasers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aimil Ltd.

- Altechna R&D UAB

- Amplitude Systèmes SAS

- EKSPLA UAB

- II-VI Incorporated

- Jenoptik AG

- Light Conversion UAB

- Lumentum Operations LLC

- MKS Instruments, Inc.

- NKT Photonics A/S

- Thorlabs, Inc.

- TOPTICA Photonics AG

- TRUMPF GmbH + Co. KG

Strategic Recommendations for Industry Leaders to Capitalize on Technological Advances and Market Opportunities in Picosecond Microchip Lasers

To navigate the complexities of the picosecond microchip laser ecosystem, industry leaders should prioritize sustained investment in R&D initiatives that advance both pulse dynamics and system reliability. By allocating resources to develop novel gain media and cavity designs, companies can deliver differentiated performance metrics that meet exacting end-user demands. Partnerships with public and private research entities will catalyze these efforts and provide early insights into emerging technologies.

Supply chain resilience must remain a strategic cornerstone-particularly given evolving tariff landscapes and geopolitical uncertainties. Establishing multi-regional sourcing networks and exploring near-shoring opportunities will mitigate exposure to import duties and logistical disruptions. Collaborative tariff engineering and engagement with trade policy stakeholders can further optimize cost structures and preserve competitive pricing strategies.

Enhancing service offerings through digital platforms and remote diagnostics capabilities will create value-added channels that deepen customer relationships. By integrating cloud-based monitoring and predictive maintenance features, manufacturers can reduce downtime and foster long-term service agreements. Customized training modules and certification programs will also empower end users to maximize system performance and extend product lifecycles.

Expanding application-specific bundles-combining laser hardware, application software, and consumables-will streamline procurement processes for end users and enable recurring revenue streams. Tailored solutions for key verticals such as biomedical imaging, semiconductor inspection, and micromachining will address unique workflow requirements, making it easier for decision-makers to justify capital investments.

Finally, robust intellectual property and standard-compliance strategies are essential to fortify market positions. Securing patents for innovative techniques and aligning products with emerging interoperability standards will enhance credibility and simplify integration into broader photonic ecosystems. These proactive measures position organizations to seize growth opportunities and reinforce leadership in the picosecond microchip laser arena.

Overview of Research Framework Employed for Comprehensive Analysis of the Picosecond Microchip Laser Market and Data Validation Processes

The research methodology underpinning this analysis employs a multi-pronged approach designed to ensure rigor, transparency, and actionable insights. Initial desk research encompassed a comprehensive review of public policy documents, regulatory filings, and patent databases to map the landscape of technological developments and tariff regulations affecting picosecond microchip lasers. This foundational phase established critical context for subsequent data collection.

Primary research consisted of in-depth interviews with key stakeholders, including laser system manufacturers, component suppliers, end-user engineers, and trade policy experts. These conversations provided nuanced perspectives on supply chain dynamics, technology adoption rates, and strategic priorities. Respondent feedback was systematically validated against publicly available metrics to confirm consistency and reliability.

Quantitative data was sourced from proprietary databases tracking production volumes, import/export flows, and R&D investment patterns. These datasets were analyzed using statistical modeling techniques to identify correlations between tariff adjustments and cost variations, as well as to delineate segment-specific growth drivers. Scenario analysis was employed to simulate potential policy shifts and market disruptions.

Finally, findings underwent a peer-review process involving subject-matter experts from academic, industrial, and policy domains. Feedback from this validation workshop informed refinements to the segmentation framework, regional classifications, and strategic recommendations, ensuring that the final deliverable represents a balanced, evidence-based perspective on the picosecond microchip laser market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Picosecond Microchip Lasers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Picosecond Microchip Lasers Market, by Application

- Picosecond Microchip Lasers Market, by End-User Industry

- Picosecond Microchip Lasers Market, by Technology Type

- Picosecond Microchip Lasers Market, by Laser Cavity Type

- Picosecond Microchip Lasers Market, by Region

- Picosecond Microchip Lasers Market, by Group

- Picosecond Microchip Lasers Market, by Country

- United States Picosecond Microchip Lasers Market

- China Picosecond Microchip Lasers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3498 ]

Synthesis of Insights and Strategic Imperatives from the Picosecond Microchip Laser Executive Summary to Guide Decision-Making

This executive summary synthesizes the interplay of technological innovation, market segmentation, regional dynamics, and policy influences shaping the picosecond microchip laser industry. The convergence of robust mode-locking techniques, compact microchip architectures, and diversified application needs underscores the technology’s transformative potential. Stakeholders who understand the nuances of each segmentation dimension and regional trend are better positioned to capitalize on evolving demand.

The analysis of the United States’ tariff adjustments highlights the importance of proactive supply chain management and trade policy engagement. While increased duties on wafers and optical substrates present near-term cost challenges, strategic sourcing and exclusion extensions offer pathways to mitigate financial impact. Leaders who balance tactical responses with longer-term localization efforts will gain resilience against future disruptions.

As the market matures, competitive advantage will stem from holistic strategies that integrate R&D excellence, service innovation, and policy acumen. Organizations that invest in advanced materials, foster collaborative ecosystems, and refine customer-centric offerings stand to lead the next phase of adoption. Ensuring alignment between technological capabilities and end-user workflows will be central to capturing growth opportunities in the dynamic picosecond microchip laser landscape.

Unlock Comprehensive Market Intelligence on Picosecond Microchip Lasers by Connecting with Associate Director of Sales & Marketing Ketan Rohom Today

If your organization is seeking a deeper, more actionable understanding of the forces shaping the picosecond microchip laser landscape, now is the time to secure the full research report. Engage directly with Ketan Rohom, an experienced Associate Director of Sales & Marketing, to explore tailored insights, access detailed data tables, and receive a personalized briefing that aligns to your strategic objectives.

Whether you are evaluating new partnerships, refining your product roadmap, or seeking competitive intelligence on emerging technologies, Ketan Rohom stands ready to guide you through the next steps. Connect today to unlock a comprehensive resource designed to empower decision-makers and accelerate growth in the rapidly evolving picosecond microchip laser market.

- How big is the Picosecond Microchip Lasers Market?

- What is the Picosecond Microchip Lasers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?