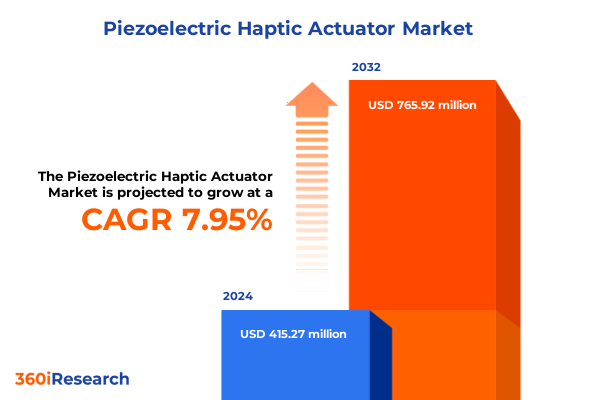

The Piezoelectric Haptic Actuator Market size was estimated at USD 415.27 million in 2024 and expected to reach USD 445.80 million in 2025, at a CAGR of 7.95% to reach USD 765.92 million by 2032.

Discover the transformative potential of piezoelectric haptic actuators as they redefine tactile feedback and user interaction across cutting-edge industries worldwide

Piezoelectric haptic actuators represent a sophisticated class of electromechanical transducers that harness the inverse piezoelectric effect to deliver precise tactile sensations. When an electric field is applied to piezoelectric materials, such as PVDF or lead zirconate titanate (PZT), rapid mechanical deformations occur, generating high-frequency vibrations with sub-millisecond response times and minimal latency. Unlike mass-driven actuators, these devices consume energy only during active motion, making them inherently more power-efficient-an advantage that is critical for battery-operated and portable systems.

Uncover the key technological advancements, material innovations, and emerging applications that are driving monumental shifts in the piezoelectric haptic actuator ecosystem

Recent years have witnessed a confluence of technological breakthroughs and material innovations that are reshaping the piezoelectric haptic actuator landscape. Researchers have integrated nanomaterials and composite structures into actuator designs to reduce hysteresis, enhance durability, and expand operational bandwidth. These advances in material science are enabling thinner multilayer stacks that operate at lower voltages while delivering higher force outputs.

Concurrently, the rise of intelligent driver electronics and software-driven calibration has unlocked new layers of performance. Leading semiconductor firms have introduced dedicated amplifier ICs capable of generating high-voltage waveforms with precise frequency and amplitude control. These driver platforms, often integrated with machine learning algorithms, dynamically adjust haptic patterns in real time, resulting in more nuanced tactile experiences that adapt to user behavior and context.

Moreover, the proliferation of immersive technologies such as augmented reality, virtual reality, and advanced automotive human-machine interfaces is fueling demand for high-definition haptics. In 2024, global unit shipments of haptic-enabled AR/VR devices surpassed 12 million, while automotive OEMs embedded tactile feedback subsystems in over 21 million vehicles to enhance safety and user engagement.

Analyze how the sweeping tariff changes implemented in 2025 have reshaped supply chains, pricing dynamics, and manufacturing strategies for piezoelectric haptic actuators

In March 2025, the U.S. government enacted a 25% tariff on steel and aluminum imports-fundamental materials in piezoelectric actuator housings, mass elements, and multilayer stack substrates. This levy drove component costs higher by an estimated 8–15%, compelling manufacturers to either absorb increased expenses or pass them through to end buyers, thereby squeezing margins and catalyzing price volatility across consumer electronics, automotive, and industrial segments.

Shortly thereafter, reciprocal tariffs on China-origin goods surged to 125% in early April 2025, encompassing raw materials such as rare earth compounds and finished piezoelectric modules. A trade agreement announced on May 12, 2025, subsequently reduced this rate to 10%, but not before triggering widespread supply chain disruptions. OEMs and distributors scrambled to reroute procurement through Vietnam, Taiwan, and Mexico to mitigate punitive duties, while some Chinese manufacturers refocused on non-U.S. markets to preserve revenue streams.

These tariff-driven dynamics have accelerated a shift toward near-shoring and domestic production. Companies are investing in stateside assembly plants and forging strategic alliances with local driver IC and material suppliers to insulate their operations from future trade policy swings. At the same time, inventory management strategies such as strategic stockpiling and long-term contract renegotiations are becoming standard tactics to manage lead times and stabilize component availability.

Explore the multifaceted segmentation of the piezoelectric haptic actuator market across diverse applications, types, materials, actuation modes, end users, and sales channels

Segmentation analysis reveals that piezoelectric haptic actuators have permeated a diverse array of applications and end markets. Within aerospace, these actuators provide tactile cues in cockpit controls and immersive simulation systems, enhancing pilot awareness. In the automotive domain, they deliver responsive feedback through infotainment interfaces, steering wheel alerts, and tactile switches that confirm driver inputs. Consumer electronics leverage compact haptic modules in gaming controllers, smartphones, tablets, and wearables to elevate user engagement. Healthcare devices-from diagnostic imaging consoles to rehabilitation equipment and surgical robotics-depend on finely tuned tactile sensations for procedural accuracy. Industrial environments integrate these actuators into manufacturing equipment, process control panels, and collaborative robots to improve precision and operator safety.

On the technology front, bimorph designs offer precise bending motion in space-constrained assemblies, while stack actuators yield higher force outputs for robust feedback in larger interfaces. Unimorph variants strike a balance between displacement and voltage requirements, making them well-suited for mid-range power applications. Material selection further differentiates device performance: PVDF delivers lightweight flexibility for wearable and mobile form factors, PZT provides superior electromechanical coupling for automotive and medical applications, and quartz offers exceptional dimensional stability in precision instrumentation.

The mode of actuation also influences design trade-offs. Shear-mode configurations generate lateral surface waves ideal for large touch panels, single-ended actuation simplifies implementation in handheld devices, and double-ended actuation doubles displacement for more immersive feedback. From an end-user perspective, OEMs embed actuators into next-generation products while aftermarket specialists retrofit haptic modules into legacy platforms. Sales channels blend direct engagements for bespoke solutions with broad distribution networks that extend global accessibility.

This comprehensive research report categorizes the Piezoelectric Haptic Actuator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Drive Mechanism

- Feedback Type

- End User

- Sales Channel

Examine the distinct growth drivers, regulatory influences, and market dynamics shaping piezoelectric haptic actuator adoption across the Americas, EMEA, and Asia-Pacific regions

The Americas region, anchored by the United States and Canada, is characterized by robust adoption in automotive and healthcare markets. North American automakers have integrated haptic feedback into advanced driver-assistance systems and next-generation infotainment consoles, driven by regulatory mandates for improved driver-vehicle interaction. Simultaneously, medical device manufacturers are leveraging piezoelectric actuators in minimally invasive surgical robotics and rehabilitation platforms to enhance tactile precision and patient outcomes.

Europe, the Middle East, and Africa (EMEA) market is shaped by stringent safety regulations and high-end automotive manufacturing. The EU’s General Safety Regulation and ECE R79 standards have propelled haptic integration in volume models, exemplified by premium vehicles incorporating sub-5ms latency piezoelectric systems in steering wheels and dashboards. Concurrently, industrial automation hubs across Germany, France, and Scandinavia are deploying haptic sensors in collaborative robots and process control systems to optimize assembly precision and worker safety.

Asia-Pacific stands out as the fastest-growing region, fueled by the high concentration of consumer electronics giants and surging smartphone penetration. Chinese and Korean manufacturers dominate production volumes, supplying thin-profile piezo modules for foldable phones and wearable devices. Emerging Southeast Asian markets, including Vietnam and Indonesia, are rapidly scaling localized manufacturing capabilities, driven by cost efficiencies and government initiatives that incentivize high-tech assembly clusters.

This comprehensive research report examines key regions that drive the evolution of the Piezoelectric Haptic Actuator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Gain in-depth intelligence on leading piezoelectric haptic actuator suppliers, their strategic priorities, and innovation roadmaps driving competitive differentiation

Several key players have emerged as strategic architects of the piezoelectric haptic actuator market. AAC Technologies holds a commanding position in Asia, supplying over 25% of thin-profile actuators for foldable smartphones and investing heavily in AI-driven calibration software to enhance tactile fidelity. The company’s network of high-volume production facilities in China and Vietnam underpins its cost-effective scalability.

Murata Manufacturing leads the materials segment with proprietary PZT formulations that deliver 35% higher energy efficiency than industry benchmarks. Its multi-layer ceramic actuators serve critical roles in automotive ADAS modules and robotic surgery interfaces, reflecting a dual focus on performance and reliability.

U.S.-based PI Ceramic specializes in high-force piezo stacks engineered for industrial condition monitoring and robotics, offering products rated for tens of millions of operational cycles under harsh environments. The company’s emphasis on durability and precision control underscores its niche within heavy-duty applications.

Complementary to these material and actuator leaders, Texas Instruments supplies driver amplifiers purpose-built to generate the 60–100 Vpp waveforms required for high-definition haptics. Meanwhile, Kyocera’s extensive patent portfolio on asymmetrical voltage driving methods provides licensing leverage that shapes module design across multiple OEM partnerships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Piezoelectric Haptic Actuator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAC Acoustic Technologies (Shenzhen) Co., Ltd

- APC International, Ltd. by Schneider Electric SE

- Audiowell Electronics (Guangdong) Co., Ltd..

- Boréas Technologies Inc.

- CTS Corporation

- Hubei Hannas Tech Co., Ltd

- Johnson Electric Holdings Limited.

- Microchip Technology Inc.

- Murata Manufacturing Co., Ltd.

- Nidec Corporation

- Precision Microdrives

- PUI Audio, Inc.

- Taiyo Yuden Co., Ltd.

- TDK Corporation

- Yageo Corporation

Empower industry leaders with targeted strategies to innovate product portfolios, optimize supply chains, and capitalize on emerging piezoelectric haptic actuator opportunities

Industry leaders should prioritize investment in advanced material research to develop lead-free piezoelectric compositions and composite architectures that reduce hysteresis, lower drive voltages, and enhance device longevity. By collaborating with academic institutions and materials consortia, manufacturers can accelerate breakthroughs in nanostructured piezo formulations that unlock new performance thresholds.

To mitigate the risks of trade policy volatility, companies must diversify their supply chains by establishing production footholds in lower-tariff jurisdictions such as Vietnam, Mexico, and Eastern Europe. Developing strategic partnerships with local contract manufacturers and logistics providers will ensure resilience and cost optimization while maintaining just-in-time delivery capabilities.

Forging alliances between piezo actuator specialists, driver IC developers, and system integrators can streamline product development cycles, enabling the rapid deployment of turnkey haptic solutions. Co-development frameworks that integrate mechanical, electrical, and software expertise will yield differentiated user experiences and shorten time to market.

Leveraging AI-driven haptic algorithms and real-time signal processing can transform static feedback patterns into adaptive tactile experiences. By incorporating machine learning models that adjust output based on user interaction data, OEMs can craft personalized haptic signatures that enhance brand loyalty and device engagement.

Finally, expanding into high-growth verticals-such as immersive AR/VR headsets, medical training simulators, and electric vehicle control systems-will allow firms to capture premium margins. Targeted go-to-market strategies that emphasize the value of high-fidelity feedback in safety-critical and experiential applications will unlock new revenue streams.

Detail the rigorous research framework, data sources, and analytical approaches employed to ensure the accuracy and integrity of this piezoelectric haptic actuator market study

This research study employed a comprehensive, multi-phase methodology to ensure the rigor and reliability of its findings. Secondary research encompassed the review of industry publications, regulatory filings, patent databases, and trade association reports to build a foundational understanding of market drivers and competitive dynamics. Primary research was conducted through in-depth interviews with executive-level stakeholders at actuator manufacturers, OEMs, materials suppliers, and logistics experts to capture nuanced perspectives on technological trends and supply chain challenges.

Quantitative data was collected from proprietary company disclosures, global trade statistics, and financial reports, then triangulated using a bottom-up approach to validate segment-level insights. Qualitative analysis involved expert panel workshops and scenario modeling to stress-test assumptions around tariff impacts and material innovations. Throughout the process, data integrity was maintained via cross-verification protocols and periodic peer reviews, ensuring that the conclusions drawn reflect a balanced and accurate portrayal of the piezoelectric haptic actuator market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Piezoelectric Haptic Actuator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Piezoelectric Haptic Actuator Market, by Product Type

- Piezoelectric Haptic Actuator Market, by Material Type

- Piezoelectric Haptic Actuator Market, by Drive Mechanism

- Piezoelectric Haptic Actuator Market, by Feedback Type

- Piezoelectric Haptic Actuator Market, by End User

- Piezoelectric Haptic Actuator Market, by Sales Channel

- Piezoelectric Haptic Actuator Market, by Region

- Piezoelectric Haptic Actuator Market, by Group

- Piezoelectric Haptic Actuator Market, by Country

- United States Piezoelectric Haptic Actuator Market

- China Piezoelectric Haptic Actuator Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesize the pivotal insights uncovered in this report to underscore the strategic imperatives and future outlook for piezoelectric haptic actuator stakeholders

This report has illuminated the pivotal forces shaping the piezoelectric haptic actuator landscape, from material breakthroughs and AI-driven driver electronics to the geopolitical currents of trade policy. Segmentation analysis underscored the technology’s versatile applicability across aerospace, automotive, consumer electronics, healthcare, and industrial equipment. Regional assessments revealed distinct trajectories in the Americas, EMEA, and Asia-Pacific, each driven by regulatory frameworks, manufacturing capabilities, and end-user demands.

Key players such as AAC Technologies, Murata Manufacturing, PI Ceramic, and Texas Instruments exemplify how integrated capabilities in materials, electronics, and software can yield competitive moats. The cumulative impact of 2025 tariff measures has highlighted the importance of flexible supply chains and near-shoring strategies. As the market moves forward, companies that blend advanced R&D, diversified sourcing, and strategic partnerships will be best positioned to capture the next wave of growth.

Overall, the piezoelectric haptic actuator market stands at an inflection point. Stakeholders that implement the actionable recommendations-focused on innovation, resilience, and market expansion-will not only navigate current challenges but also pioneer the future of tactile feedback technology.

Secure your competitive advantage by connecting with Ketan Rohom to acquire the comprehensive piezoelectric haptic actuator market research report tailored to your strategic needs

To secure immediate access to in-depth analysis, granular data, and strategic guidance, reach out to Ketan Rohom, Associate Director, Sales & Marketing. By connecting with him, you can purchase this comprehensive market research report and gain the competitive intelligence required to refine product development roadmaps, optimize supply chain decisions, and unlock new revenue streams in the piezoelectric haptic actuator landscape.

- How big is the Piezoelectric Haptic Actuator Market?

- What is the Piezoelectric Haptic Actuator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?