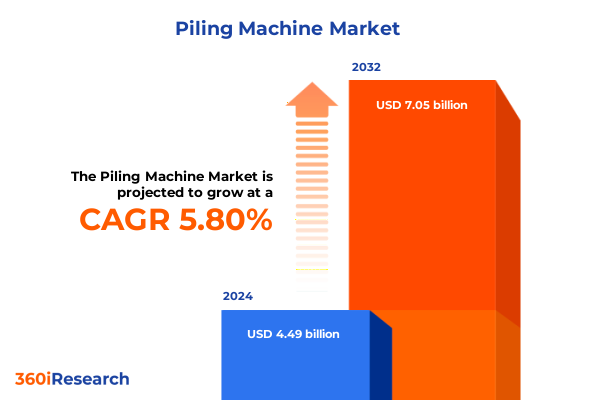

The Piling Machine Market size was estimated at USD 4.73 billion in 2025 and expected to reach USD 5.00 billion in 2026, at a CAGR of 5.84% to reach USD 7.05 billion by 2032.

Unveiling the New Era of Foundation Construction: Critical Trends Shaping the Piling Machine Market in a Rapidly Evolving Infrastructure Landscape

Infrastructure development is a cornerstone of modern economies, and piling machines serve as the linchpin of foundational projects across diverse construction environments. From high-rise urban towers to expansive bridge networks, these specialized machines ensure the stability, safety, and longevity of critical structures. As urban populations swell and governments worldwide renew their focus on infrastructure revitalization, the demand for versatile, high-performance piling equipment has soared, underscoring the strategic importance of this sector.

Moreover, the piling machine industry is undergoing a profound transformation driven by technological innovation and regulatory evolution. Digital monitoring systems now provide real-time performance metrics, enabling operators to optimize drilling parameters and minimize downtime. Autonomous and semi-autonomous functions are gradually being integrated into next-generation rigs, enhancing operational precision while reducing labor intensity. At the same time, heightened environmental regulations have elevated the significance of low-emission powertrains and eco-friendly operational practices.

In addition to these technological and regulatory forces, the competitive landscape has intensified as niche entrants challenge established manufacturers with specialized offerings. Strategic alliances between equipment producers and construction contractors are becoming increasingly prevalent, aimed at delivering turnkey foundation solutions that accelerate project timelines and enhance cost efficiency.

Against this dynamic backdrop, stakeholders require a comprehensive analysis that extends beyond superficial trends to illuminate the underlying forces shaping market behavior. This report delivers that depth of insight, equipping decision-makers with the knowledge needed to navigate supply chain complexities, anticipate regulatory shifts, and harness emerging opportunities in the piling machine domain.

Navigating the Wave of Technological Disruption and Sustainable Innovation Redefining the Global Piling Equipment Ecosystem in 2025

Construction technology is advancing at an unprecedented pace, and piling equipment is at the forefront of this evolution. The infusion of digital technologies such as Internet of Things (IoT) sensors and cloud-based analytics has opened new horizons for operational efficiency. Operators now harness real-time data on machine performance and ground conditions to fine-tune drilling operations, reduce fuel consumption, and prevent mechanical failures, thereby delivering significant cost savings and enhanced safety.

Furthermore, electrification and hybrid power systems are gaining traction as manufacturers respond to the dual pressures of regulatory mandates and sustainability targets. Electric-driven hydraulic hammers and battery-powered auger rigs are being piloted in urban settings to mitigate noise pollution and local emissions. These developments are reshaping expectations around jobsite environmental impact and laying the groundwork for increasingly stringent future regulations.

In parallel, the trend toward sustainable construction has spurred demand for recycling and circular economy practices within the piling segment. Manufacturers are exploring modular designs that facilitate component reuse and streamline maintenance. As a result, lifecycle cost considerations are becoming as critical as initial acquisition prices when evaluating new equipment, reflecting a shift in procurement strategies toward total cost of ownership perspectives.

The convergence of digitalization, electrification, and sustainability is generating a wave of disruptive innovation that is redefining the global piling equipment ecosystem. Stakeholders who embrace these transformative technologies will gain a decisive competitive edge in an industry increasingly defined by agility, environmental accountability, and data-driven decision-making.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Measures on Piling Machine Supply Chains and Pricing Dynamics

The imposition of tariffs on steel and aluminum imports by United States authorities in 2025 has reverberated throughout the piling machinery supply chain. With steel being a primary raw material for crawler-mounted rigs, rotary piling systems, and impact hammers, increased import duties have directly elevated production costs. Many equipment manufacturers have responded by seeking alternative sourcing arrangements, including nearshoring steel procurement to domestic mills, although this strategy has its own limitations in terms of capacity and pricing volatility.

Beyond raw materials, the tariffs targeting certain Chinese-manufactured construction machinery have complicated the competitive landscape. Suppliers have been compelled to reevaluate their assembly footprints, with some reallocating portions of their manufacturing operations to Southeast Asia or Mexico to avoid punitive duty rates. While these adjustments offer relief from immediate tariff pressures, they have introduced additional logistical complexity and incurred transitional expenses related to workforce training and quality assurance.

Concurrently, cost pressures stemming from tariffs have initiated a phase of pricing realignment within the contracting community. Construction firms, facing higher equipment leasing and acquisition costs, are increasingly negotiating long-term rental agreements to spread capital outlays over extended project durations. At the same time, aftermarket services and extended maintenance contracts have become pivotal value drivers, as operators seek to optimize asset utilization amid an environment of elevated operating expenses.

In sum, the cumulative impact of United States tariff measures in 2025 extends beyond simple cost inflation. It has catalyzed shifts in sourcing strategies, regional manufacturing footprints, and customer procurement behaviors, reshaping the global foundation equipment market in ways that will influence strategic planning well into the next decade.

Revealing Critical Segment-Level Dynamics Behind Product Technology and Application Trends Driving Growth in the Multifaceted Piling Machine Marketplace

The piling machine market exhibits a multifaceted segmentation structure that reflects the diverse requirements of construction projects worldwide. Product type segmentation reveals distinct demand patterns between auger drilling machines-classified further into continuous flight auger rigs and Kelly bar drilling rigs-impact hammers subdivided into diesel and hydraulic variants, rotary piling rigs, and vibratory hammers. Each of these product categories caters to specific geological conditions and project specifications, underscoring the necessity for manufacturers to maintain versatile portfolios.

When examined through the lens of technology, the market delineates clear preferences among diesel, electric, and hydraulic systems. Diesel remains prevalent in large-scale infrastructure applications due to its power density and refueling convenience. However, electric solutions are carving out a niche in urban environments where noise and emissions restrictions are stringent, while hydraulic technologies continue to dominate high-precision piling operations that demand fine control over driving and extraction forces.

The profiling of piling methods further illuminates market nuances, with auger piling and bored piling serving as mainstays for deep foundation projects, impact-driven techniques excelling in high-capacity installations, micro piling carving opportunities in constrained urban sites, and screw piling gaining traction for rapid deployment in light structural work. Simultaneously, mounting type influences mobility and site adaptability, as crawler-mounted rigs offer superior terrain handling and load-bearing capacity, whereas truck-mounted units deliver logistical flexibility and expedited setup times.

End-user dynamics and application segmentation complete the picture, revealing that construction contractors and infrastructure developers leverage piling machines across bridges and highways, building foundations, urban utility projects, marine construction, oil and gas platforms, and wind energy installations. This wide-ranging application spectrum highlights the critical role of product customization, service support, and technology integration in addressing the specialized demands of each sector.

This comprehensive research report categorizes the Piling Machine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Piling Method

- Mounting Type

- Application

- End User

Illuminating Regional Nuances Across the Americas, Europe Middle East Africa and Asia Pacific Markets Fueling Evolution in Piling Machinery Demand

Regional analyses uncover divergent growth trajectories and structural drivers that shape the demand for piling machinery. In the Americas, substantial infrastructure renewal initiatives and public spending programs have generated robust demand for heavy-duty rotary rigs and impact hammers. The prevalence of large-scale bridge replacements and highway expansions has underscored the importance of high-capacity diesel-powered equipment, while government incentives for domestically manufactured machinery have bolstered local production networks.

Turning to Europe, the Middle East, and Africa, the market is characterized by a mix of developed and emerging economies with vastly different infrastructure imperatives. Western Europe’s focus on retrofitting aging structures and promoting green building standards has elevated the adoption of low-emission electric and hydraulic rigs. In contrast, key Middle Eastern and African markets are prioritizing rapid urbanization and resource-driven projects, driving demand for robust diesel-powered auger drilling machines and versatile vibratory hammers that can operate efficiently in harsh environmental conditions.

In the Asia-Pacific region, unparalleled urban growth and large-scale investment in renewable energy projects, particularly offshore wind farms and coastal infrastructure, have catalyzed demand for marine construction piling solutions and specialized screw piling units. At the same time, government-led initiatives to enhance seismic resilience and coastal protection have underscored the importance of advanced impact-driven and bored piling methodologies.

These regional divergences underscore the strategic necessity for manufacturers and service providers to tailor their offerings to localized requirements, leveraging flexible production capabilities, aftermarket networks, and technology portfolios that address the distinct priorities of each geographic market.

This comprehensive research report examines key regions that drive the evolution of the Piling Machine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Strategic Innovations Alliances and Competitive Maneuvers Defining the Leadership Landscape Among Global Piling Equipment Manufacturers

Leading manufacturers in the piling machine sphere are deploying a range of strategic initiatives to consolidate their market positions and expand technological capabilities. Partnerships between equipment producers and digital platform providers have enabled the introduction of predictive maintenance solutions, reducing unplanned downtime and extending equipment life cycles. These collaborations illustrate the growing importance of software-driven service models as differentiators in a traditionally hardware-centric industry.

Moreover, competitive dynamics have intensified through targeted acquisitions and joint ventures aimed at securing access to specialized product lines or regional distribution networks. Established global players have pursued bolt-on acquisitions of niche manufacturers, thereby enlarging their portfolios with micro piling and screw piling technologies. Concurrently, they have invested in regional assembly or refurbishment centers to enhance delivery speed and localize aftermarket support.

Research and development efforts also feature prominently in the strategic playbooks of leading stakeholders. Significant capital allocations to electro-hydraulic integration and energy-efficient drive systems reflect a proactive approach to regulatory compliance and customer demand for lower lifecycle costs. Pilot programs for remote operation capabilities and 3D visualization of subsurface geotechnical data underscore a growing emphasis on automation and digital twin frameworks.

In addition, top-tier piling machine firms are refining their customer engagement strategies by offering value-added services such as operator training, performance benchmarking, and fleet optimization consulting. These service extensions not only foster stronger client relationships but also generate recurring revenue streams that buffer against cyclical fluctuations in equipment sales.

This comprehensive research report delivers an in-depth overview of the principal market players in the Piling Machine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABI Equipment Ltd

- Action Construction Equipment Ltd.

- American Piledriving Equipment

- Ashok Industries Pvt Ltd.

- BAUER Maschinen GmbH

- BSP TEX LTD

- Built Robotics, Inc.

- CABR Construction Machinery Technology Co. Ltd.

- Casagrande S.p.A.

- Caterpillar Inc.

- Changsha Tianwei Engineering Machinery Manufacturing Co.,Ltd

- Construcciones Mecánicas Llamada, S.L

- CZM LIMITED

- Dawson Construction Plant Ltd

- Dieseko Beheer B.V.

- Eimco Elecon Limited

- Enteco S.R.L.

- EPIROC AB

- FAYAT SAS

- Gamzen Plast Private Limited

- Giken Ltd.

- HAL Holding N.V.

- Henan Rancheng Machinery Co., Ltd.

- IMT srl

- International Construction Equipment

- J.C.Bamford Excavators Limited

- Junttan Oy

- Kobelco Construction Machinery Co., Ltd.

- Komatsu Ltd.

- Liebherr-International Deutschland GmbH

- MAIT S.p.A.

- Movax Oy

- Nippon Sharyo, Ltd.

- Ozkanlar Grup Makine AŞ

- SANY Group

- Soilmec S.p.A. .

- STARKE Company

- Yongan Machinery

Strategic Prescriptions for Industry Stakeholders to Capitalize on Emerging Technologies and Market Shifts in the Piling Equipment Sector

Industry leaders should prioritize the integration of digital monitoring and predictive maintenance platforms to transform equipment uptime and operational efficiency. By embedding IoT sensors and leveraging machine learning algorithms, companies can anticipate component wear, optimize service intervals, and reduce unplanned stoppages, thereby delivering clear value to end users while strengthening service revenues.

In addition, investing in electrification and hybrid powertrain development is imperative for complying with tightening environmental standards and addressing urban noise and emission constraints. Collaborative ventures with battery technology firms and electrical drive specialists can accelerate the commercialization of low-emission rigs, positioning companies at the vanguard of sustainable foundation engineering solutions.

Moreover, stakeholders are advised to diversify their product portfolios through targeted M&A and strategic alliances, thereby gaining access to specialized piling methods such as micro piling, screw piling, and marine construction equipment. Expanding aftermarket service networks and training programs will further enhance customer retention and foster long-term partnerships, mitigating the cyclical nature of capital equipment markets.

Finally, agile supply chain strategies-incorporating nearshoring of key components, multi-sourcing of critical raw materials, and digitalized logistics tracking-can help protect margins amid tariff uncertainties and global disruptions. Such resilience measures will be instrumental in securing competitive advantage and sustaining growth in an increasingly complex international trade environment.

Methodological Rigor and Analytical Frameworks Underpinning Comprehensive Insights in Piling Machine Market Research Execution

The research underpinning this report combines primary and secondary methodologies to achieve a high degree of analytical rigor. Primary research involved in-depth interviews with senior executives at equipment manufacturers, construction contractors, and industry consultants, alongside on-site visits to manufacturing facilities and project deployments to observe operational best practices firsthand.

Secondary research encompassed a comprehensive review of industry journals, regulatory filings, and patent databases, as well as trade publications and technical white papers. These sources provided critical context on historical trends, competitive landscapes, and technological innovation trajectories. Data triangulation was applied rigorously to validate insights, cross-referencing quantitative findings with qualitative feedback from expert interviews.

Analytical frameworks within the study included segmentation analysis across product type, technology, piling method, mounting type, application, and end user. Regional market dynamics were evaluated through a combination of infrastructure spending patterns, regulatory environments, and competitive positioning. The cumulative impact of tariff measures was assessed through cost modeling and supply chain scenario planning.

Throughout the research process, best practices in market intelligence-such as peer benchmarking, sensitivity analysis, and ethical compliance with data privacy standards-were strictly observed to ensure objectivity, reliability, and relevance of the findings presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Piling Machine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Piling Machine Market, by Product Type

- Piling Machine Market, by Technology

- Piling Machine Market, by Piling Method

- Piling Machine Market, by Mounting Type

- Piling Machine Market, by Application

- Piling Machine Market, by End User

- Piling Machine Market, by Region

- Piling Machine Market, by Group

- Piling Machine Market, by Country

- United States Piling Machine Market

- China Piling Machine Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesis of Core Findings and Strategic Imperatives for Stakeholders Navigating the Complex Terrain of Piling Machine Industry

In synthesizing the core findings, it is evident that the piling machine market stands at the intersection of technological disruption, regulatory pressure, and shifting customer expectations. Digitalization and electrification are no longer peripheral considerations but foundational elements of product development and service delivery strategies. Concurrently, regional infrastructure agendas and tariff landscapes underscore the need for agile manufacturing footprints and localized support networks.

Stakeholders aiming to excel in this environment must embrace an integrated approach that balances innovation with operational resilience. By aligning product portfolios with emerging sustainability imperatives, forging strategic alliances to expand technological capabilities, and deploying data-driven service models, companies can position themselves for durable competitive advantage. The imperative now is to translate these insights into coherent strategic roadmaps that anticipate market shifts and capitalize on the transformative forces reshaping the industry.

Connect with Ketan Rohom to Unlock In-Depth Intelligence and Accelerate Strategic Decisions with a Bespoke Piling Machine Market Research Report

For organizations seeking a competitive advantage in foundation engineering, accessing detailed market intelligence is essential. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how our bespoke report can illuminate critical trends, emerging opportunities, and strategic considerations tailored to your specific requirements. Secure your copy now to equip your leadership team with the actionable insights necessary to drive growth, mitigate risks, and capitalize on the evolving dynamics of the global piling machine market

- How big is the Piling Machine Market?

- What is the Piling Machine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?