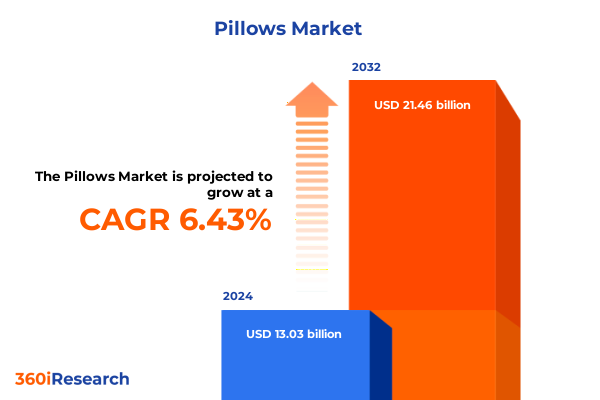

The Pillows Market size was estimated at USD 13.03 billion in 2024 and expected to reach USD 13.82 billion in 2025, at a CAGR of 6.43% to reach USD 21.46 billion by 2032.

Crafting the Pillows Landscape: An Overview of Market Evolution and Emerging Consumer Preferences Driving Industry Transformation

The global pillow industry has undergone a remarkable transformation in recent years, driven by heightened consumer awareness of sleep health and wellness. What once was a commodity constrained to a handful of basic styles now spans a diverse universe of designs, materials, and technologies that cater to all manner of sleep preferences and lifestyle needs. From ergonomically contoured memory foam cushions to eco-friendly botanical fillings, manufacturers are racing to differentiate their portfolios in an environment where innovation and comfort converge.

Meanwhile, shifts in retail dynamics-most notably the surge of direct-to-consumer digital channels-have disrupted traditional department store and specialty shop experiences. This change has empowered brands to develop robust online presences, leverage social proof, and adopt subscription and try-before-you-buy programs that reduce purchase friction. Consequently, the visibility of emerging micro-brands has soared, raising the bar for established players to maintain both relevance and loyalty.

Against this backdrop, the pillow market’s evolution is shaped by a confluence of technological advancements, evolving consumer lifestyles, and supply chain pressures. This introduction sets the stage for a deep dive into the transformative shifts reshaping the landscape, the impact of recent trade policies, and strategic imperatives that industry leaders must adopt to stay ahead.

From Smart Materials to Sustainability: Unpacking the Transformative Shifts Redefining Pillow Design Manufacturing and Consumer Expectations

In recent years, pillow manufacturers have experienced seismic shifts propelled by material science breakthroughs and a growing emphasis on sustainability. Sleep technology integration, once confined to wearable trackers, has migrated into smart pillows embedded with biometric sensors that monitor respiration, heart rate, and movement. These innovations are redefining value propositions, as consumers increasingly prioritize data-driven sleep optimization over traditional softness metrics.

Sustainability has also emerged as a defining trend. Brands are harnessing naturally derived latex, organic buckwheat hulls, and recycled polyester fibers to align with environmental commitments and cater to eco-conscious buyers. This pivot toward greener materials is transforming procurement, manufacturing processes, and end-of-life recycling programs, thereby influencing every stage of the value chain.

Another fundamental shift is the personalized customization model, where pillow construction techniques-ranging from adjustable air chambers to modular shredded-fill cores-allow end users to tailor loft and firmness. This degree of personalization is bolstered by advanced online configurators and rapid fulfillment networks. As a result, industry players are recalibrating production lines to accommodate shorter runs and regional preferences, driving a broader move from mass production to mass customization.

Assessing the Cumulative Consequences of 2025 United States Tariffs on Pillow Imports Supply Chains and Cost Structures Across the Industry

The imposition of additional tariffs on textile and bedding imports in early 2025 has reverberated across the pillows industry, compelling many manufacturers to re-evaluate cost structures and supply chain footprints. With import duties on key raw materials such as latex and down increasing from standard rates to as high as 25 percent, companies dependent on overseas sourcing have experienced margin compression and inventory repricing challenges, particularly those relying on Asian manufacturing hubs.

Consequently, leading suppliers have accelerated nearshoring efforts, forging partnerships with regional producers in Latin America and select Eastern European countries to circumvent steep duties. This strategic pivot has involved substantial investments in localized production facilities and quality assurance protocols to match previous efficiency benchmarks. At the same time, brands maintain a delicate balance between passing incremental costs onto consumers and preserving price competitiveness through value engineering and packaging optimization.

Furthermore, distributors and retailers have adapted merchandising strategies by emphasizing domestic and tariff-exempt lines, thereby reshaping promotional calendars and inventory mix. Although this reorientation has required short-term operational shifts, many industry observers view it as an opportunity to enhance supply chain resilience and underscore provenance narratives that resonate with consumers seeking authenticity and transparency.

Illuminating Key Segmentation Insights Across Filling Materials Construction Channels Applications Shapes and Pricing Tiers to Guide Strategic Positioning

A nuanced understanding of consumer preferences emerges when exploring the pillow market through various segmentation lenses. Examining filling materials reveals a spectrum that spans the breathable, artisanal appeal of buckwheat and the timeless luxury associated with down, alongside the resilient responsiveness of latex, the adaptive pressure relief of memory foam, and the cost-conscious versatility of polyester. Each filling type carries distinct performance attributes that influence ergonomic comfort and price positioning.

Delving into construction approaches exposes the evolution from fixed-shape solid cores to more sophisticated systems. Adjustable pillows leverage inflatable chambers to accommodate individual loft requirements, whereas air-filled alternatives focus on dynamic compliance. Shredded-fill configurations deliver malleability and user control, and water-filled models-long a niche therapeutic solution-are gaining renewed attention for neck support. These construction innovations challenge manufacturers to scale flexible production modules.

Distribution channels further segment the landscape, as department stores continue to offer tactile shopping experiences, mass retailers drive high-volume sales, and online platforms deliver curated digital journeys. Within digital commerce, brand-owned websites cultivate direct relationships and loyalty programs, contrasted with e-commerce marketplaces that prioritize assortment and convenience. Specialty retail, differentiated by bed and bath boutiques or furniture houses, upholds expert guidance and premium service.

Applications span core bedding functions, medical and therapeutic settings where specialized support is paramount, and travel contexts that demand compact, portable designs. Pillow shapes reflect these use cases, from cervical and contour profiles addressing spinal alignment to king, queen, and standard formats for home environments, and U-shaped styles optimized for transit comfort. Price range tiers segment consumer demand, with high-end offerings showcasing advanced materials and smart integrations, mid-range products balancing features and affordability, and low-end lines competing on basic functionality.

This comprehensive research report categorizes the Pillows market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Filling Material

- Construction

- Distribution Channel

- Application

- Shape

- Price Range

Analyzing Regional Dynamics Impacting Pillow Consumption Patterns and Growth Drivers Across Americas Europe Middle East Africa and Asia Pacific

Regional market dynamics underscore significant variations in consumer behavior, distribution infrastructure, and regulatory frameworks. In the Americas, robust demand in North America is driven by health and wellness trends, bolstered by high digital adoption rates that favor direct-to-consumer channels and subscription offerings. Meanwhile, Latin American markets are witnessing accelerated urbanization and rising middle-class income levels, creating fertile ground for value-oriented pillow solutions and hybrid retail models.

Across Europe, Middle East, and Africa, sustainability regulations in the European Union are influencing material innovation, while Middle Eastern luxury hotel projects provide avenues for premium bedding partnerships. In sub-Saharan Africa, market penetration remains nascent, yet entrepreneurial local brands are testing alternative distribution formats, including mobile-based commerce and micro-retail networks.

In Asia-Pacific, China continues to lead in production capacity and cost efficiency, supplying both domestic and export markets. Rising affluence in India and Southeast Asia is fueling demand for memory foam and latex pillows, with local manufacturers increasingly adopting advanced foaming technologies. Simultaneously, Japan and Australia represent mature segments that favor natural down and certified organic fillings, often blending traditional craftsmanship with modern comfort standards.

This comprehensive research report examines key regions that drive the evolution of the Pillows market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Shaping Pillow Innovation Operational Excellence and Market Competitiveness Through Strategic Collaboration and Technology

The competitive landscape features a blend of long-established mattress and bedding conglomerates alongside agile pure-play pillow innovators. Industry stalwarts such as Tempur-Sealy leverage decades of material science expertise and global distribution networks to maintain leadership in pressure-relief solutions. Sleep Number has carved a niche in adjustable sleep systems, integrating personalized comfort with digital monitoring to capture discerning customer segments.

MyPillow, a pioneer in direct-to-consumer marketing, continues to harness digital advertising and augmented reality try-on tools to drive engagement. Challenger brands like Coop Home Goods have risen by offering fully adjustable shredded memory foam pillows that cater to an on-demand customization ethos. Purple Innovation, recognized for its proprietary hyper-elastic polymer grid, crosses boundaries between mattresses and pillows, showcasing the potential of cross-category R&D collaboration.

Mass-market players Serta and Simmons rely on scale economies and extensive retail partnerships to serve entry and mid-tier segments, while smaller specialists in niche botanical and therapeutic pillows invest heavily in certifications and clinical endorsements. Across this spectrum, strategic alliances with textile mills, tech startups, and hospitality brands are becoming increasingly prevalent as companies seek to differentiate and expand their market foothold.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pillows market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 10MINDS CO.,LTD.

- American Textile Company

- Brooklyn Bedding, LLC

- Comfy Quilts Ltd.

- Englander Sleep Products, L.L.C.

- GioClavis Co., Ltd.

- Hanesbrands Inc.

- Hollander Sleep Products, LLC.

- Hunan Mendale Hometextile Co., Ltd.

- IKEA Group

- John Cotton Group Ltd.

- Kingsdown, Inc.

- Luolai Lifestyle Technology Co. Ltd.

- MAETEL

- Magniflex S.p.A.

- Malouf Fine Linens

- My Pillow, Inc.

- Nitetronic Holding LTD

- Paradise Sleeping Pillow Inc.

- Relax The Back by Interactive Health Solutions, Inc

- Richard Behr & Co.

- Serta Simmons Bedding, LLC

- Tempur-Pedic International Inc.

- Wendre AS

- Technogel S.r.l.

Delivering Actionable Recommendations for Industry Leaders to Capitalize on Consumer Trends Technological Advancements and Regulatory Shifts

Industry leaders must prioritize sustainable material sourcing by integrating certified organic fibers, recycled foams, and plant-based alternatives into core product lines, thereby addressing both regulatory requirements and evolving consumer expectations. Investing in modular manufacturing capabilities will enable rapid adjustment of production runs to accommodate emerging customization trends and regional preferences without significant downtime.

Enhancing digital commerce strategies is imperative as consumers demand seamless omnichannel experiences; brands should refine their online configurators, deploy virtual reality tools for product testing, and expand subscription-based replenishment models to foster loyalty. Concurrently, companies should diversify supply chains by establishing multi-regional manufacturing partnerships to mitigate tariff risks and geopolitical disruptions, ensuring continuity and cost predictability.

Forging strategic partnerships with healthcare providers and research institutions can substantiate therapeutic claims and unlock new application channels in medical and senior care settings. Moreover, embedding emerging technologies such as non-invasive sleep monitoring sensors and AI-driven sleep coaching software into high-end pillow offerings can catalyze premiumization and create data-driven service extensions. By embracing these actions, industry players will secure a competitive edge, capturing both core and adjacent market opportunities.

Outlining Robust Research Methodology Combining Primary Qualitative Engagements Secondary Analytics and Expert Validation for Comprehensive Insights

This research adopts a hybrid methodology combining qualitative and quantitative approaches to ensure comprehensive and reliable insights. Primary research involved in-depth interviews with executives across leading pillow manufacturers, retail executives, material suppliers, and design specialists, complemented by focus groups with consumers representing diverse demographic and usage profiles. These engagements probed product performance perceptions, purchase drivers, and unmet innovation needs.

Secondary research encompassed a thorough review of trade association publications, patent filings relevant to sleep technology, regulatory databases tracking textile and environmental standards, and logistics data from customs authorities to elucidate tariff impacts and trade flows. Industry journals, technical white papers, and reputable academic studies on ergonomics and sleep science provided additional context.

Data triangulation was achieved by correlating findings across sources, while an expert validation panel comprised of sleep researchers, supply chain consultants, and retail strategists reviewed preliminary conclusions. This iterative validation process ensured both methodological rigor and applicability, yielding actionable insights that reflect current market realities and anticipate future trends.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pillows market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pillows Market, by Filling Material

- Pillows Market, by Construction

- Pillows Market, by Distribution Channel

- Pillows Market, by Application

- Pillows Market, by Shape

- Pillows Market, by Price Range

- Pillows Market, by Region

- Pillows Market, by Group

- Pillows Market, by Country

- Competitive Landscape

- List of Figures [Total: 32]

- List of Tables [Total: 693 ]

Synthesizing Key Findings Emphasizing Strategic Imperatives and Future Directions to Navigate the Evolving Pillow Industry Landscape

The analysis underscores that success in the evolving pillow industry hinges on a triad of strategic imperatives: relentless innovation in materials and smart features, unwavering commitment to sustainability, and agile supply chain configurations that balance cost and resilience. Companies that harmonize these elements will not only meet rising consumer expectations for personalized comfort and eco-credentials but also navigate shifting regulatory landscapes and trade dynamics.

Market differentiation will arise from the ability to integrate health-oriented technologies-such as sleep monitoring sensors and AI-driven coaching-into user-centric pillow platforms. At the same time, expanding into adjacent therapeutic and travel applications will unlock incremental revenue streams. Regional strategies must be nuanced, reflecting distinct consumption patterns and regulatory environments across the Americas, EMEA, and Asia-Pacific.

Ultimately, the competitive frontier will be defined by those organizations capable of synthesizing robust R&D, data-enabled personalization, and transparent sustainability practices into compelling value propositions. By heeding the insights presented, industry stakeholders can chart a path forward that maximizes growth potential and fortifies market leadership.

Take the Next Step in Unlocking Market Intelligence on the Pillow Industry by Engaging with Ketan Rohom Associate Director Sales Marketing for Exclusive Insights

To gain exclusive access to in-depth data, bespoke analysis, and actionable insights that will empower your next strategic move, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan brings a deep understanding of market dynamics and client objectives, and will guide you through the various subscription options and custom research services tailored to your organization’s needs. By engaging with Ketan, you will receive priority scheduling for one-on-one consultations, clarity on specific methodologies, and the fastest possible delivery of the full market report.

Connect today to ensure you harness the latest intelligence on consumer preferences, regulatory developments, supply chain innovations, and competitive positioning in the global pillows industry. Don’t miss the opportunity to transform these insights into tangible growth strategies and reinforce your leadership in an increasingly dynamic market.

- How big is the Pillows Market?

- What is the Pillows Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?