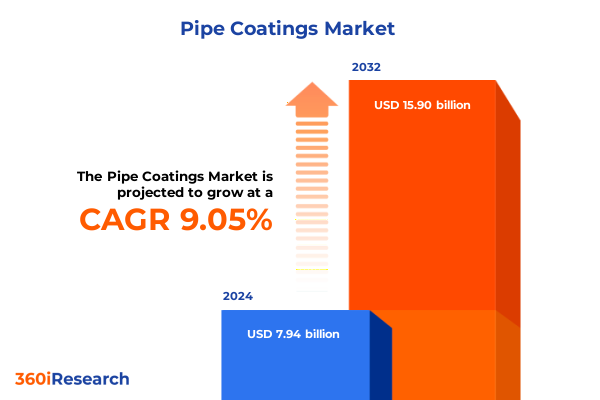

The Pipe Coatings Market size was estimated at USD 8.67 billion in 2025 and expected to reach USD 9.47 billion in 2026, at a CAGR of 9.04% to reach USD 15.90 billion by 2032.

Unveiling the Critical Role of Advanced Pipe Coatings in Enhancing Durability and Performance across Global Infrastructure Networks

Pipe coatings underpin the integrity and reliability of critical fluid transportation networks in water treatment, oil and gas, power generation, and industrial installations. They serve as the primary barrier against corrosion, abrasion, and chemical attack, safeguarding asset lifespans and reducing unplanned shutdowns. As infrastructure ages and environmental regulations tighten, the importance of selecting the optimal coating solution has never been more pronounced.

Over the past decade, stakeholders have shifted from basic protection toward high-performance formulations that balance durability with environmental compliance. This has spurred adoption of advanced resin chemistries and application techniques designed to meet increasingly stringent standards. Consequently, coating suppliers and end users are forging deeper collaborations to align product development with operational needs.

Within this landscape, decision-makers must navigate a complex matrix of performance criteria, regulatory requirements, and total cost of ownership considerations. Emphasis has turned to proactive maintenance strategies, leveraging digital inspection tools and condition-based monitoring to extend coating lifecycles. As a result, pipe coatings have evolved from a commodity offering into a strategic lever for operational efficiency, risk mitigation, and sustainability.

Navigating Transformative Shifts in Pipe Coatings Landscape Driven by Sustainability, Digitalization, and Innovative Material Science Breakthroughs

The pipe coatings sector is undergoing transformative shifts driven by the convergence of sustainability mandates, digitalization, and breakthroughs in material science. Increasingly, regulatory bodies are mandating lower volatile organic compound (VOC) emissions and restricting hazardous additives, which has accelerated the development of eco-friendly resin systems that maintain robust corrosion resistance. In turn, coatings suppliers are investing in bio-based epoxies, low-energy curing processes, and formulations that reduce waste across the value chain.

At the same time, digitalization is reshaping how coatings are specified, applied, and monitored. Remote sensing and digital dual verification platforms enable real-time tracking of coating thickness, temperature, and humidity parameters during application. This level of process control drives higher first-pass success rates and offers unprecedented transparency for quality assurance programs. Moreover, advanced analytics powered by machine learning are facilitating predictive maintenance, pinpointing potential coating failures before they manifest and allowing maintenance teams to intervene proactively.

Material science innovations are further unlocking new performance frontiers. Nanocomposite additives and self-healing technologies are changing the paradigm from passive protection to adaptive defense by autonomously repairing minor breaches. These next-generation formulations extend service intervals and reduce lifecycle costs. Taken together, these developments are redefining industry benchmarks, prompting market participants to rethink traditional approaches and embrace agile, cross-functional collaboration between R&D, manufacturing, and field operations.

Assessing the Cumulative Impact of United States Tariff Measures in 2025 on Raw Material Sourcing, Supply Chains, and Industry Dynamics

In 2025, the implementation of updated export-import tariffs in the United States introduced significant shifts in the supply chain for core raw materials used in pipe coatings. Resin manufacturers that previously relied on cost-effective overseas intermediates found themselves recalibrating sourcing strategies. Many turned to nearshoring or domestic production to mitigate tariff exposure, fostering a wave of capital investments into local resin polymerization facilities. This realignment has delivered enhanced supply chain resilience and shorter lead times, albeit with incremental cost pressures.

Meanwhile, logistics networks have adapted to the new tariff structure by optimizing shipping routes and consolidating volume to retain economies of scale. Coatings formulators have explored alternative chemistries that allow substitution of higher-cost resins without compromising performance specifications. In parallel, strategic alliances between raw material suppliers and end users have proliferated, centered on long-term supply agreements that hedge pricing volatility.

As a result, the industry is witnessing a gradual migration toward vertically integrated business models, where key players control multiple steps from monomer synthesis to finished coating application. This shift helps buffer against abrupt cost escalations and regulatory tightening. Taken together, the cumulative impact of these tariff measures has been a reconfiguration of competitive dynamics, spurring innovation in process efficiencies and a renewed focus on collaborative risk management.

Deriving Key Segmentation Insights from Diverse Resin Types, Technologies, Substrate Materials, End-Use Verticals, Application Methods, and Coating Approaches

Analysis of market segmentation reveals how distinct resin types offer tailored performance outcomes and dictate application methods. Epoxy resins dominate where chemical resistance and adhesion are paramount, with fusion bonded epoxy leading in high-temperature and pressure environments. Controlled thin film variants enable precise coating thickness for critical gas distribution pipelines, while powder fusion epoxy delivers superior abrasion protection for heavy industrial lines. Liquid epoxies, in both single component and two component formats, provide versatility for maintenance tasks where rapid cure and ease of application are required.

Polyesters and polyurethane resins have secured strong footholds in sectors demanding flexibility and impact resistance. Polyester formulations excel in water and wastewater systems due to their hydrophobic properties, whereas polyurethane coatings deliver enhanced weathering resistance for aboveground corrosion protection. Vinyl ester coatings, although representing a smaller niche, are chosen for their resilience to aggressive acids and solvents, making them indispensable for chemical plant piping.

Technological distinctions further refine the selection process. Air-assisted spray methods ensure uniform coverage in complex geometries, while airless deployment maximizes productivity on long-distance runs. Substrate diversity spans precast and reinforced concrete conduits, ductile iron mains, PVC branches, carbon steel trunk lines, and stainless steel fittings. Each substrate class demands specific surface preparation and primer compatibility for optimal adhesion and longevity.

End use industries from oil and gas extraction to power generation and food and beverage processing apply coatings via external field applications for infrastructure maintenance and via shop-applied processes during new build fabrication. Internal methods such as centrifugal lining and slip lining are increasingly adopted to rehabilitate aging water mains with minimal service disruption. Collectively, these segmentation insights underscore the imperative for solution providers to maintain flexible production capabilities, invest in modular application equipment, and partner with engineering teams to align product portfolios with evolving customer requirements.

This comprehensive research report categorizes the Pipe Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Technology

- Substrate Material

- Coating Method

- End Use Industry

- Application Type

Highlighting Critical Regional Dynamics Influencing Pipe Coatings Evolution across the Americas, Europe Middle East Africa, and Asia-Pacific Markets

Regional dynamics illustrate profound variations in regulatory priorities, infrastructure maturity, and growth trajectories. In the Americas, established water and sewage networks are focused on rehabilitation programs, driving demand for low-disruption internal coating methods and fast-curing maintenance solutions. Stringent federal and state-level environmental standards incentivize the adoption of certified low-VOC and lead-free formulations. Meanwhile, capital reinvestment in oil and gas pipelines prompts parallel demand for fusion bonded epoxy systems that withstand offshore conditions and extended mechanical stress.

Across Europe, the Middle East, and Africa, divergent regulatory frameworks coexist with burgeoning industrial expansion zones. In Western Europe, circular economy initiatives and carbon neutrality goals are catalyzing bio-based resin trials and energy-efficient curing technologies. The Middle East’s petrochemical hubs rely heavily on high-temperature-resistant coatings capable of resisting extreme operating conditions, while North African water scarcity challenges have accelerated slip lining projects for municipal water grids. Sub-Saharan upgrades in mining infrastructure emphasize abrasion-resistant polyurethane linings to extend equipment lifecycles under heavy wear.

The Asia-Pacific region, led by China, India, and Southeast Asian emerging economies, continues to invest heavily in new build pipelines for urban water distribution and cross-border oil and gas connectivity. Rapid urbanization and industrialization initiate a parallel surge in prefabricated steel pipelines requiring shop-applied epoxy and polyester coatings that balance productivity with compliance to local emission controls. Furthermore, public–private partnerships in Australia and Japan are piloting smart coatings embedded with corrosion sensing to support predictive maintenance strategies in critical utilities.

This comprehensive research report examines key regions that drive the evolution of the Pipe Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Insights from Leading Industry Players Shaping the Competitive Pipe Coatings Arena through Innovation and Collaboration

Leading global suppliers have shaped the competitive landscape through differentiated portfolios and multi-tier distribution networks. Multinational corporations have leveraged extensive R&D capabilities to introduce premium resin formulations that address niche performance gaps, such as ultralow-temperature impact resistance or self-healing microcapsule integration. These firms maintain robust global production footprints, allowing rapid response to regional demands and streamlined logistics for project-critical timelines.

At the same time, specialist coating houses have emerged as agile players, focusing on end-use customization and integrated service offerings. By combining on-site technical support with proprietary inspection tools, these companies have cultivated strong customer loyalty in sectors where application challenges are complex and risk intolerance is high. Strategic acquisitions have been a key tactic, enabling mid-sized firms to expand geographic reach and diversify technology stacks without the developmental lag of internal R&D.

Additionally, collaborative consortiums involving materials producers, applicators, and engineering firms have gained traction. These alliances facilitate joint pilot projects that validate next-generation chemistries under real-world conditions, shortening time to market. Across the ecosystem, the interplay between innovation-driven multinationals, nimble specialists, and cross-functional partnerships defines the competitive tempo and shapes the priorities of new market entrants.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pipe Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- A.W. Chesterton Company

- Akzo Nobel N.V.

- Arkema S.A.

- Axalta Coating Systems Ltd.

- BASF SE

- Celanese Corporation

- Dura-Bond Industries, LLC

- Hempel A/S

- Jotun A/S

- Kansai Paint Co., Ltd.

- LyondellBasell Industries Holdings B.V.

- Nippon Paint Holdings Co., Ltd.

- Perma-Pipe International Holdings, Inc.

- PPG Industries, Inc.

- RPM International Inc.

- Seal For Life Industries, Inc.

- Shawcor Ltd.

- Sika AG

- The Sherwin-Williams Company

- Tikkurila Oyj

- Wasco Energy Group of Companies

Formulating Actionable Recommendations for Industry Leaders to Capitalize on Emerging Coating Technologies and Navigate Supply Chain Complexities

Industry leaders should prioritize investment in research and development to advance low-impact resin chemistries and digital application systems that reduce labor overhead and environmental footprint. By adopting a modular equipment strategy, organizations can swiftly switch between liquid, powder, and spray technologies to meet diverse project specifications without capital-intensive retooling. Furthermore, company executives must cultivate deeper integration with raw material suppliers through long-term procurement contracts that amortize tariff risks and stimulate collaborative innovation.

In parallel, operational teams should embrace predictive maintenance frameworks powered by sensor-embedded coatings and data analytics platforms. Early detection of corrosion anomalies can dramatically lower unplanned downtime and extend service intervals. To reinforce these capabilities, training programs for applicators and inspectors should be expanded, emphasizing digital verification tools and quality assurance protocols.

Supply chain resilience demands diversification across multiple geographies and the development of regional warehousing hubs for critical binder components. Leaders should evaluate joint ventures with local resin producers to secure preferential access and cost stability. Finally, sustainability objectives must be integrated into corporate strategy, with clear metrics for VOC reduction, waste minimization, and circular material flows. Embedding these priorities into product roadmaps and customer engagement models will differentiate market leaders and drive long-term stakeholder value.

Detailing a Robust and Transparent Research Methodology Underpinning Comprehensive Analysis of Pipe Coatings through Multi-Source Data Collection

This analysis is underpinned by a multi-pronged research methodology combining secondary data exploration, primary stakeholder interviews, and rigorous validation protocols. Secondary intelligence was gathered from industry publications, regulatory filings, patent records, and technical white papers to map prevailing technology trends, regulatory trajectories, and competitive landscapes. Concurrently, a series of in-depth interviews with coating formulators, application specialists, and end users across water management, oil and gas, and industrial sectors provided granular insights into real-world application challenges and performance criteria.

Quantitative data on raw material trade flows and tariff impacts were synthesized with shipping and logistics reports to pinpoint supply chain reconfigurations. Qualitative hypotheses were then tested through workshops with engineering consultants and certification bodies, ensuring that findings reflect operational realities and compliance thresholds. A robust peer review process involving independent coating experts was employed to validate key assertions and refine strategic implications.

To maintain objectivity, conflicting viewpoints were balanced, and all proprietary supplier data was anonymized. The iterative research cycle concluded with triangulation sessions that reconciled secondary research, primary input, and expert feedback, resulting in a comprehensive and credible market analysis framework.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pipe Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pipe Coatings Market, by Resin Type

- Pipe Coatings Market, by Technology

- Pipe Coatings Market, by Substrate Material

- Pipe Coatings Market, by Coating Method

- Pipe Coatings Market, by End Use Industry

- Pipe Coatings Market, by Application Type

- Pipe Coatings Market, by Region

- Pipe Coatings Market, by Group

- Pipe Coatings Market, by Country

- United States Pipe Coatings Market

- China Pipe Coatings Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Concluding Insights on the Evolving Imperatives of Pipe Coatings Industry Emphasizing Sustainability, Risk Management, and Strategic Partnerships

The evolving pipe coatings industry is characterized by an unrelenting drive toward sustainable formulations, digital process integration, and resilient supply chain structures. Stakeholders must recognize that tomorrow’s competitive advantage will hinge on the ability to deliver high-performance coatings with minimal ecological impact while leveraging real-time data for maintenance optimization.

Furthermore, strategic partnerships between material innovators, applicators, and technology providers will become increasingly critical to accelerate time to market and de-risk complex projects. Emphasizing transparent collaboration models can unlock new synergies and foster standardized testing protocols, benefiting the wider ecosystem.

Ultimately, industry leaders who adopt an integrated approach-balancing product innovation, operational excellence, and environmental stewardship-will be best positioned to navigate regulatory headwinds and capitalize on growth opportunities. By embedding these imperatives into organizational strategy, coating companies can transform challenges into avenues for sustainable value creation.

Engaging with Associate Director of Sales & Marketing for Exclusive Access to In-Depth Pipe Coatings Market Research Insights and Strategic Recommendations

To explore the full breadth of in-depth findings, technical evaluations, and strategic recommendations contained in this comprehensive report, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, for personalized guidance and exclusive access. Ketan’s expert team can tailor a presentation to align with your organization’s unique objectives, ensuring that you can leverage the insights on supply chain optimization, sustainability practices, and technological innovation to drive competitive advantage. Engage now to unlock critical data and actionable strategies for staying ahead in the rapidly evolving pipe coatings arena

- How big is the Pipe Coatings Market?

- What is the Pipe Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?