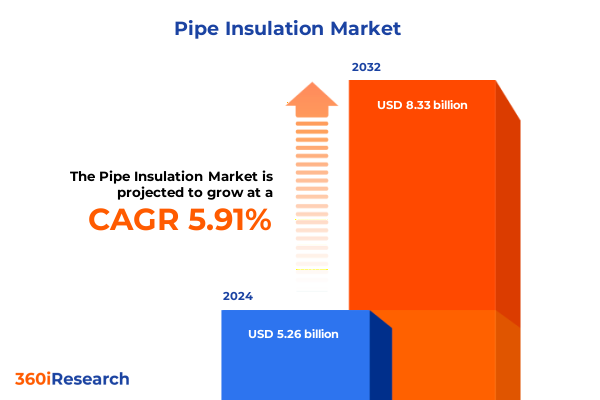

The Pipe Insulation Market size was estimated at USD 5.55 billion in 2025 and expected to reach USD 5.87 billion in 2026, at a CAGR of 5.95% to reach USD 8.33 billion by 2032.

Exploring Foundational Dynamics and Regulatory Milestones That Are Shaping Current Trends in the Global Pipe Insulation Industry

The pipe insulation sector is at a pivotal juncture, driven by an intricate interplay of regulatory mandates, sustainability imperatives, and technological breakthroughs. Industry participants are recalibrating strategies to align with rigorous energy efficiency codes, as exemplified by the adoption of ASHRAE 90.1-2022 and IECC-2024 standards, which specify enhanced thermal performance requirements for mechanical system piping and now include minimum R-value options alongside prescriptive thickness metrics. Concurrently, evolving policy frameworks such as the 2024 IECC mandate have demonstrated measurable impact; the U.S. Department of Energy’s preliminary analysis indicates a 6.7 percent improvement in energy efficiency over the 2021 code, reflecting heightened emphasis on building envelope and piping insulation measures.

Beyond regulatory drivers, global commitments to net-zero emissions are reshaping project priorities. The International Energy Agency highlights that accelerated energy efficiency measures in buildings-including advanced insulation solutions-could deliver over a third of global CO₂ reductions by 2030, underscoring the critical role of thermal and moisture management systems in decarbonization pathways. Meanwhile, demographic trends such as the aging infrastructure in developed markets and the rapid expansion of commercial, industrial, and residential construction in emerging economies are fueling demand for both retrofit and new-construction insulation solutions. As cost rationalization and environmental stewardship converge, stakeholders across the value chain recognize that effective pipe insulation not only curbs energy losses but also mitigates corrosion under insulation (CUI), enhances operational safety, and extends asset lifecycles.

Identifying Critical Technological Innovations, Stringent Sustainability Imperatives, and Evolving Regulatory Agendas Disrupting Traditional Pipe Insulation Paradigms

The pipe insulation landscape is undergoing transformative shifts as legacy models give way to innovation-driven paradigms. IoT-enabled monitoring systems now provide real-time diagnostics of insulation performance, enabling predictive maintenance and reducing unplanned downtime in critical industrial networks. Advances in digital twins and smart sensors facilitate continuous tracking of thermal integrity and moisture ingress, supporting data-driven decisions that optimize energy utilization and lifecycle management.

Sustainability has ascended from a peripheral concern to a strategic imperative. Manufacturers are investing in low-carbon materials and circular design principles, with an increasing share of recycled content and environmental product declarations (EPDs) embedded in product portfolios. Stakeholders are responding to stringent ESG benchmarks and customer expectations by offering solutions verified for health and environmental performance, such as formaldehyde-free formulations and low-VOC certifications.

Regulatory frameworks continue to evolve in lockstep with climate goals. The 2024 International Energy Conservation Code introduced optional R-value compliance paths for piping insulation and has catalyzed state and local jurisdictions to adopt more demanding building performance metrics. Complementing these developments, global energy agencies emphasize deep retrofits and envelope upgrades as cornerstones of net-zero trajectories, amplifying the focus on high-performance insulation across new and existing infrastructure projects.

Analyzing the Multifaceted Repercussions of Newly Implemented US Tariffs on Raw Materials and Finished Insulation Products That Reshape Supply Chains and Cost Structures

In 2025, the United States implemented a series of tariffs that have materially influenced material flows and cost structures within the pipe insulation sector. In March, a 20 percent ad valorem tariff on polyurethane raw materials originating from China and Hong Kong took effect, prompting domestic suppliers to adjust Q2 quotations in anticipation of higher input costs, and downstream industries such as automotive, construction, and furniture to reassess procurement strategies. Shortly thereafter, a 25 percent tariff on all steel and aluminum imports, including derivative products used in cladding and protective jacketing for insulation, was instituted under Section 232 authority, covering all previously exempt trading partners and eliminating future product exclusions after February 10, 2025.

These measures have contributed to notable raw material inflation, compelling manufacturers to explore alternative feedstock sources, accelerate localization of production, and optimize supply-chain configurations. The combined impact has been an upward pressure on finished insulation prices and tighter margins for producers, while contractors and end-users face greater project budget volatility. At the same time, supply-chain disruptions have spurred investments in inventory resilience and vendor diversification.

To navigate this landscape, industry actors are deploying a blend of strategic responses: scaling domestic capacity, establishing tariff-avoidance zones within Foreign Trade Zones (FTZs), and negotiating long-term supplier agreements with built-in cost-sharing mechanisms. The evolving trade environment underscores the need for agile risk management practices and underscores the interplay between macroeconomic policy and operational decision making.

Deriving Actionable Intelligence Across Multiple Market Segments to Guide Product Development, Channel Strategies, and Vertical-Specific Solutions

Segmentation analysis reveals nuanced opportunities across multiple vectors of the pipe insulation market. By insulation type, product portfolios span fiberglass, foam, mineral wool, and rubber solutions, each tailored to specific thermal conductivity, fire performance, and operational durability requirements. These material distinctions inform project specifications, with fiberglass offering cost-effective performance and mineral wool providing exceptional fire protection, while elastomeric rubber lends itself to condensate applications in HVAC systems.

Installation scenarios further bifurcate the market into new construction and retrofit domains. In greenfield projects, insulation strategies are integrated at the design phase to optimize building envelope performance, whereas retrofit applications leverage modular and prefabricated solutions to balance installation speed with minimal operational disruption. Application channels-commercial, industrial, and residential-present discrete performance criteria. Within commercial end-uses, specialized segments in fire protection, HVAC, and plumbing insulation demand products with certification for flame spread, smoke development, and microbial resistance.

On the distribution front, the dichotomy between offline and online sales has become more pronounced. Traditional channels through distributors and contractors remain foundational, yet e-commerce platforms and direct manufacturer websites are rapidly gaining traction, driven by streamlined procurement workflows and digital configurators. Finally, end-use industries such as chemical & petrochemical, construction, food & beverages, oil & gas, and power generation impose differentiated performance and regulatory compliance mandates. Each vertical demands customized insulation solutions, from anti-corrosion coatings in petrochemical lines to high-temperature composites in power plant piping.

This comprehensive research report categorizes the Pipe Insulation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Insulation Type

- Installation Type

- Application

- Distribution Channel

- End-Use Industry

Uncovering Distinct Regional Drivers, Policy Mandates, and Market Nuances Shaping Pipe Insulation Adoption Across the Americas, EMEA, and Asia-Pacific

Regional dynamics demonstrate marked contrasts in market drivers, policy frameworks, and adoption rates across the globe. In the Americas, robust residential retrofit incentives-such as the 30 percent Energy Efficient Home Improvement Credit for insulation materials up to a $1,200 annual cap-have energized demand, particularly in the United States and Canada, where aging infrastructure and federal tax programs foster growth. Latin American markets display moderate uptake, propelled by infrastructure modernization in Brazil and regulatory alignment with green building standards.

The Europe, Middle East & Africa (EMEA) region is characterized by stringent building energy performance directives, exemplified by the EU’s Renovation Wave and progressive EPBD updates that mandate deep retrofits and nZEB (nearly Zero-Energy Building) standards. These initiatives, coupled with elevated carbon pricing mechanisms, are driving investment in advanced insulation systems as a critical lever for achieving EU climate targets. In the Middle East, large-scale petrochemical and power generation expansions sustain demand, while Africa’s urbanization trajectory signals long-term potential amid nascent energy efficiency programs.

Asia-Pacific exhibits dynamic heterogeneity. Mature markets like Japan and Australia are updating codes to mirror IECC-style benchmarks, spurring the adoption of high-performance thermal and acoustic insulation. In China and India, rapid industrialization and megaproject pipelines underpin sustained demand, though local production constraints and import duties shape competitive landscapes. Emerging Southeast Asian economies demonstrate incremental growth as regulatory frameworks and green building certifications gain prominence.

This comprehensive research report examines key regions that drive the evolution of the Pipe Insulation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Sustainability Milestones, Innovation Portfolios, and Strategic Expansions of Leading Stakeholders Driving Differentiation in the Pipe Insulation Sector

Leading industry participants are strengthening their market positions through sustainability commitments, product innovation, and strategic investments. Owens Corning, a global building products leader, published its 2024 Sustainability Report outlining progress toward its 2030 goals. The report highlights that 51 percent of the company’s 2024 revenue was derived from energy-saving solutions, it achieved a 43 percent reduction in Scope 1 and 2 GHG emissions from a 2018 baseline, and it reduced waste to landfill substantially year-over-year through its Safer Together framework.

Knauf Insulation has advanced its formaldehyde-free Performance+ portfolio with the launch of certified pipe and pipe & tank fiberglass insulation products, securing both Asthma & Allergy Friendly® and Verified Healthier Air™ certifications to meet stringent indoor air quality criteria. Further, Knauf expanded its geographic footprint through the acquisition of a low-carbon rock mineral wool plant in Uzbekistan, leveraging electric melting furnaces to curtail CO₂ emissions in production processes.

Armacell, renowned for its flexible elastomeric foams, has integrated ESG principles at the core of its strategy, focusing on energy efficiency, circularity, and stakeholder engagement. Its Sustainability Report 2023 articulates four pillars-Investing in People, Protecting the Planet, Enabling Governance, and Sustainable Growth-and underscores the role of its products in reducing global CO₂ emissions. In June 2025, Armacell further enhanced its innovation footprint by opening a next-generation aerogel insulation plant in India to produce the ArmaGel XG technology, underscoring its commitment to ultra-thin, high-performance insulation solutions.

Across the competitive arena, several other players including Saint-Gobain, ROCKWOOL, Johns Manville, and Armacell’s peers are pursuing digital integration through BIM libraries, modular prefabrication lines, and alliances with technology providers to deliver end-to-end project support. Collaborative partnerships and M&A activities continue to reshape the landscape, emphasizing specialization and regional capacity expansions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pipe Insulation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aeroflex USA, Inc.

- Armacell International S.A.

- BASF SE

- Cole-Parmer Instrument Company, LLC

- Compagnie de Saint-Gobain S.A.

- Covestro AG

- Galaxy Insulation Ltd.

- Huntsman Corporation

- Isoflex Ltd.

- Kingspan Group plc

- Knauf Insulation GmbH

- Owens Corning

- Paramount Intercontinental

- Polycell Korea Corporation

- Rockwool International A/S

- The Dow Chemical Company

- The Johns Manville Corporation

- Thermaflex International B.V.

- Thermotec Pty Ltd

- Zhejiang Shanghe Plastic Rubber Material Co.

Proposing Targeted Strategic Initiatives and Operational Best Practices to Equip Stakeholders for Future Market Disruptions and Growth Opportunities

Industry leaders should intensify supply chain diversification by expanding regional sourcing and leveraging Foreign Trade Zones to mitigate tariff exposure and logistical uncertainties. Prioritizing localization strategies can enhance resilience and cost predictability while fostering collaborative relationships with tier-one suppliers.

Advancing material innovation must remain at the forefront, with targeted investments in low-carbon formulations, recycled content integration, and next-generation aerogel composites. Embracing circular economy principles-including environmental product declarations and end-of-life reclamation initiatives-will bolster ESG profiles and support evolving regulatory mandates.

Digitalization offers a path to operational excellence and customer engagement. Deploying IoT-enabled insulation monitoring, BIM-driven design libraries, and AI-powered performance modeling can shorten project timelines, reduce errors, and enable prescriptive maintenance. These capabilities will increasingly define market differentiation and value-added services.

Finally, policymakers and industry bodies should collaborate to streamline code adoption and provide incentive frameworks for deep retrofits and energy-performance upgrades. By aligning financial mechanisms with sustainability objectives, stakeholders can accelerate market transformation and achieve collective decarbonization goals.

Detailing the Robust Multi-Source Research Framework, Expert Consultation Processes, and Validation Protocols Underpinning the Pipe Insulation Market Analysis

This research employed a multi-layered methodology integrating extensive secondary research, primary expert interviews, and rigorous data triangulation. Secondary sources included industry association publications, regulatory code documents, corporate sustainability reports, and trade press. Primary insights were gleaned from structured interviews with C-level executives, technical specialists, and channel partners spanning manufacturing, distribution, and contracting segments.

Quantitative data points were validated through cross-referencing public financial disclosures, tariff schedules, and official policy announcements. Qualitative trends and thematic drivers were synthesized via thematic coding techniques to ensure comprehensive coverage of emerging dynamics. Wherever possible, findings were corroborated through multiple independent sources to enhance reliability. All analysis adhered to ethical research standards, while acknowledging potential limitations related to evolving tariff structures and jurisdictional code adoptions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pipe Insulation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pipe Insulation Market, by Insulation Type

- Pipe Insulation Market, by Installation Type

- Pipe Insulation Market, by Application

- Pipe Insulation Market, by Distribution Channel

- Pipe Insulation Market, by End-Use Industry

- Pipe Insulation Market, by Region

- Pipe Insulation Market, by Group

- Pipe Insulation Market, by Country

- United States Pipe Insulation Market

- China Pipe Insulation Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Key Findings and Reinforcing the Strategic Imperatives That Will Shape the Future Trajectory of the Pipe Insulation Industry

The pipe insulation industry stands at the intersection of intensifying energy codes, sustainability imperatives, and digital innovation. Regulatory shifts-particularly the 2024 IECC updates and new U.S. tariffs-are reshaping material flows and performance benchmarks, compelling stakeholders to revisit supply-chain strategies and product designs. Emerging technologies such as IoT-based monitoring and prefab digital workflows are unlocking operational efficiencies, while ESG commitments drive deeper material and lifecycle optimizations.

Segment-level and regional analyses highlight divergent growth trajectories across insulation types, vertical applications, and geographic clusters, reinforcing the importance of targeted strategies aligned with local policy frameworks and end-use demands. Leading companies are distinguishing themselves through sustainability achievements, health-focused certifications, and capacity expansions, yet the pace of change necessitates continued vigilance and agility.

Looking ahead, collaboration between industry, government, and technology partners will be essential to navigate trade complexities, accelerate deep reductions in building emissions, and enhance system reliability. The path forward lies in integrating advanced materials, digital platforms, and circular economy principles into a unified value proposition that meets the needs of an increasingly decarbonized global economy.

Engage with Ketan Rohom to Access Tailored Market Intelligence and Transform Strategic Initiatives in the Pipe Insulation Ecosystem

To explore deeper insights, gain tailored strategic guidance, and secure ongoing updates on emerging trends and regulations, contact Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan’s expertise in pipe insulation market dynamics and his commitment to client success ensure you receive a customized intelligence package that aligns with your organizational objectives and empowers data-driven decision making. Reach out today to request a detailed proposal and discover how comprehensive market research can unlock competitive advantages, fuel growth, and mitigate risks in your critical insulation projects.

- How big is the Pipe Insulation Market?

- What is the Pipe Insulation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?