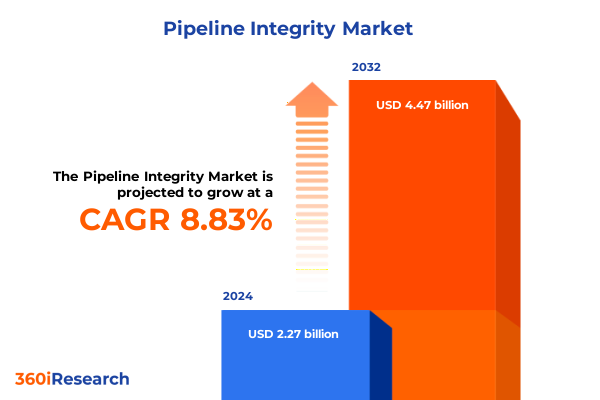

The Pipeline Integrity Market size was estimated at USD 2.44 billion in 2025 and expected to reach USD 2.63 billion in 2026, at a CAGR of 8.99% to reach USD 4.47 billion by 2032.

Framing the Urgency of Pipeline Integrity in the Face of Aging Infrastructure Regulatory Scrutiny and Emerging Digital Transformation Imperatives

Pipeline infrastructure forms the backbone of energy transportation, yet aging assets, evolving environmental mandates, and intensifying regulatory scrutiny have converged to elevate integrity management from a maintenance function to a strategic imperative. Operators face an array of challenges including corrosion, mechanical defects, and unauthorized interventions across vast networks, while public and stakeholder expectations for safety and environmental stewardship continue to rise. In parallel, technological advancement has introduced a wealth of data-driven tools and digital platforms that promise deeper visibility and predictive foresight, creating an inflection point for how integrity programs are conceived and executed.

Momentum for modernization is underscored by recent industry commentary addressing permitting delays and operational bottlenecks, which can impede critical infrastructure enhancements and prolong exposure to integrity risks. Such dynamics underscore the urgency of adopting integrated inspection and analytics frameworks that can accelerate risk identification and remediation activities. These frameworks harness real-time sensor feeds and intelligent analytics to detect anomalies earlier, optimize maintenance schedules, and ultimately extend pipeline service life. As energy demand and geopolitical factors continue to pressure supply chains and regulatory landscapes, the imperative to transform pipeline integrity programs through advanced methodologies and proactive management has never been more pronounced.

Unveiling the Technological and Regulatory Forces Transforming Pipeline Integrity Management for the Next Decade

The landscape of pipeline integrity management is being reshaped by a confluence of technological breakthroughs and shifting stakeholder expectations. Digital twins, once the domain of aerospace and manufacturing, are now being deployed to create virtual replicas of pipeline assets that continuously mirror operational conditions, enabling operators to run complex scenario analyses and optimize maintenance strategies prior to field deployment. Concurrently, the integration of Internet of Things sensors, unmanned aerial systems, and robotics has expanded the modalities of data acquisition, delivering high-resolution defect characterization and reducing the need for extensive manual surveys.

Advancements in non-destructive testing are also redefining detection thresholds. Techniques such as phased array ultrasonic testing and high-resolution magnetic flux leakage offer granular insights into sub-surface anomalies, while augmented reality-assisted inspection tools overlay critical data in real time, enhancing field decision-making. These shifts are further propelled by mounting environmental and safety regulations that mandate stricter leak detection and reporting requirements, driving rapid adoption of continuous monitoring solutions. As the industry pivots from periodic assessments to continuous, risk-based integrity management, organizations are realizing efficiencies through predictive analytics and automated anomaly flagging, marking a profound evolution in how pipeline systems are safeguarded across their operational lifecycle.

Assessing the Multifaceted Consequences of the 2025 Steel and Aluminum Tariff Escalation on Pipeline Infrastructure Programs

In early 2025, the United States reinstated and intensified Section 232 tariffs on steel imports in response to concerns over domestic manufacturing capacity and national security. A February proclamation eliminated alternative arrangements and restored a uniform 25 percent duty on steel, including key downstream products, while a subsequent June proclamation raised steel and aluminum tariffs to 50 percent, with nuanced terms for certain partners such as the United Kingdom under economic agreements. These policy shifts have had tangible downstream effects on pipeline projects, driving up the cost of new pipe, repair components, and specialized inspection tools that rely on high-grade steel.

The elevated tariff environment has prompted operators to reassess supply chains, often favoring domestically sourced materials or pre-negotiated inventory to mitigate exposure to sudden duty adjustments. Equipment manufacturers have recalibrated pricing models, passing a portion of added costs onto end users, which in turn affects capital allocation for integrity projects. In some cases, operators have delayed noncritical upgrades or shifted inspection cycles to manage budgets, creating an imperative for integrity teams to demonstrate clear return on investment. At the same time, renewed focus on domestic steel production has spurred investments in U.S.-based mills, offering long-term supply security but requiring strategic planning to integrate new sourcing channels into established procurement frameworks.

Dissecting Critical Segmentation Layers to Illuminate Diverse Pipeline Integrity Adoption and Investment Patterns

A granular examination of pipeline integrity market segmentation reveals divergent adoption patterns and investment priorities across technique, service, component, material, platform, and end-user categories. Inspection techniques such as eddy current, magnetic flux leakage, radiographic, ultrasonic, and visual inspection each address unique defect profiles, with operators increasingly deploying pulsed eddy current and high-resolution MFL when conventional methods reach detection limits. Similarly, service segmentation highlights a growing pivot from routine inspection and preventive maintenance toward data-driven monitoring and predictive maintenance, where real-time insights drive operational decision-making and resource optimization.

Component segmentation underscores the criticality of pipeline integrity across fittings, pumps, tanks, valves, and pipeline segments, with distribution pipelines often commanding more frequent assessment due to higher exposure to environmental hazards. Material segmentation reflects a nuanced calculus between cost, durability, and corrosion resistance, as carbon steel remains predominant but stainless steel, composite, and polymer variants gain traction in corrosive or chemically aggressive settings. Platform segmentation has evolved rapidly, with manual tools and inline devices now complemented by aerial drones and robotic systems equipped with advanced sensors, expanding inspection scope and reducing field personnel risk. Finally, end-user segmentation indicates that pipeline operators and oil & gas companies are the primary adopters of robust integrity regimes, yet utilities and chemical plants increasingly invest in advanced solutions to comply with stringent safety and environmental mandates, driving a dynamic interplay between user requirements and technology advancements.

This comprehensive research report categorizes the Pipeline Integrity market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technique

- Service

- Component

- Material

- End User

Examining How Regional Regulations Infrastructure Maturity and Energy Demands Shape Pipeline Integrity Investment Trajectories

Regional dynamics significantly shape the trajectory of pipeline integrity initiatives, influenced by regulatory frameworks, infrastructure maturity, and market drivers. In the Americas, a vast legacy network of crude oil, natural gas, and petrochemical pipelines demands continual integrity management, compounded by tariff-driven material costs and heightened scrutiny following high-profile incidents. Operators in North America increasingly leverage advanced inline tools and autonomous inspection platforms to balance cost pressures with safety imperatives, while Latin American markets pursue modernization projects supported by government incentives to bolster energy exports.

In Europe, the Middle East, and Africa region, stringent EU pipeline directives and national safety regulations have accelerated investments in digital monitoring and data analytics, with many operators integrating smart pigging and digital twin strategies to satisfy compliance and environmental standards. The Middle Eastern market benefits from significant oil and gas infrastructure development, prioritizing high-resolution NDT methods to safeguard critical export pipelines. Meanwhile, Africa’s emerging pipeline networks offer growth opportunities for remote monitoring solutions, addressing challenges such as accessibility and resource constraints.

Across Asia-Pacific, rapid energy demand growth and infrastructure expansion in China, India, and Southeast Asia are catalyzing adoption of ultrasonic testing and smart pigging technologies. Governments in the region are advancing regulatory frameworks to prevent incidents and environmental damage, while operators form joint ventures with global technology providers to deploy predictive maintenance platforms. This region’s blend of greenfield projects and existing network upgrades highlights divergent investment cycles, yet a common trajectory toward integrated, risk-based integrity management emerges.

This comprehensive research report examines key regions that drive the evolution of the Pipeline Integrity market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market Leaders Pioneering Data-Centric Integrity Solutions Through Strategic Innovations Partnerships and Service Diversification

Leading organizations across the pipeline ecosystem are crystallizing the future of integrity management through strategic investments and technology partnerships. GE Vernova’s recent second-quarter performance underscored resilience against tariff pressures, as the company reported tariff impacts at the lower end of estimates, bolstering confidence in its power and electrification segments and validating its emphasis on domestic supply integration. Emerson Automation Solutions has introduced the Roxar FSM Log 48 for permanent, online corrosion monitoring, leveraging field signature methodology to distinguish localized and generalized corrosion without intrusive surveys. ROSEN Group’s participation at the 37th Pipeline Pigging & Integrity Management Conference highlighted its expanded digital twin offerings and advanced inline inspection capabilities, reflecting a commitment to collaborative knowledge sharing and innovation acceleration. Moreover, Schlumberger’s integration of AI into its integrity services and Honeywell’s partnerships to embed IoT sensors across pipeline assets exemplify how technology leaders are forging end-to-end solutions that marry data analytics with field-proven inspection techniques. Collectively, these initiatives illustrate a competitive landscape where differentiation lies in the ability to deliver seamless, data-centric integrity workflows that elevate safety, optimize costs, and align with evolving regulatory imperatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pipeline Integrity market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aker Solutions ASA

- Applus Services, S.A.

- Baker Hughes Company

- Bureau Veritas S.A.

- DNV AS

- Emerson Electric Co.

- Intertek Group plc

- MISTRAS Group, Inc.

- NDT Global GmbH & Co. KG

- Quest Integrity Group, LLC

- ROSEN Group AG

- Schlumberger Limited

- Schneider Electric SE

- SGS S.A.

- T.D. Williamson, Inc.

Implementing a Holistic Pipeline Integrity Strategy That Integrates Predictive Technologies Supply Chain Resilience and Cross-Functional Collaboration

To navigate the evolving pipeline integrity landscape, industry leaders should prioritize a multifaceted strategy that balances technology adoption, supply chain resilience, and stakeholder engagement. First, accelerating the deployment of predictive analytics platforms and digital twin frameworks can enable proactive risk identification and streamline maintenance planning, reducing unplanned downtime and extending asset life. Aligning these initiatives with regulatory compliance and environmental objectives will ensure that integrity programs not only mitigate hazards but also advance corporate sustainability goals.

Second, diversifying material and equipment sourcing to incorporate domestic and allied-country manufacturers can buffer against tariff volatility while reinforcing supply chain security. Establishing long-term agreements and collaborative forecasting mechanisms with key suppliers will further stabilize project execution and cost management. Third, fostering cross-disciplinary collaboration between integrity, operations, and IT teams will drive seamless integration of data streams, empowering decision makers with holistic visibility and facilitating rapid response to emerging threats. Finally, investing in workforce capability through specialized training in advanced NDT techniques, data analytics, and remote inspection platforms will equip personnel to leverage new technologies effectively, ensuring that human expertise complements digital innovation in safeguarding pipeline assets.

Explaining the Comprehensive Research Framework Combining Secondary Intelligence Primary Interviews and Rigorous Validation for Actionable Insights

This analysis is underpinned by a robust methodology that combines exhaustive secondary research with targeted primary data collection and rigorous validation protocols. Secondary research involved reviewing government publications, industry conference proceedings, regulatory filings, and credible energy sector journalism to map tariff developments, regulatory shifts, and technological trends. Primary research entailed structured interviews with pipeline integrity experts, including inspection service providers, technology vendors, and end-user asset managers, to capture nuanced perspectives on segmentation performance, regional priorities, and strategic imperatives.

Data triangulation was achieved by correlating insights from market participants with operational data, equipment deployment case studies, and publicly released performance metrics. The segmentation framework was tested through comparative analysis of multiple use-case scenarios, ensuring that technique, service, component, material, platform, and end-user categorizations reflect real-world adoption patterns. Regional and company profiles were validated through follow-up consultations and peer review by subject-matter experts to confirm factual accuracy and relevance. Throughout the research process, confidentiality and data integrity protocols were strictly observed, resulting in a comprehensive, reliable foundation for the insights and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pipeline Integrity market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pipeline Integrity Market, by Technique

- Pipeline Integrity Market, by Service

- Pipeline Integrity Market, by Component

- Pipeline Integrity Market, by Material

- Pipeline Integrity Market, by End User

- Pipeline Integrity Market, by Region

- Pipeline Integrity Market, by Group

- Pipeline Integrity Market, by Country

- United States Pipeline Integrity Market

- China Pipeline Integrity Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Synthesizing Insights to Illuminate the Path Forward for Robust Pipeline Integrity Management in an Era of Complexity and Change

Pipeline integrity stands at a critical inflection point where aging infrastructure, regulatory tightening, and the rise of advanced inspection and analytics technologies converge to reshape asset management paradigms. The 2025 tariff landscape has introduced cost pressures that underscore the importance of strategic supply chain planning and domestic partnerships. At the same time, segmentation analysis reveals that a blend of inspection techniques, service models, and platform innovations is essential to address diverse operational challenges across global regions. Market leaders are responding with data-centric solutions that fuse AI-driven predictive analytics, digital twins, and automated monitoring, while regional dynamics from the Americas to Asia-Pacific illustrate a shared movement toward integrated, risk-based integrity regimes.

Moving forward, organizations that embrace a holistic approach-one that harmonizes technological adoption with supply chain diversification and cross-functional collaboration-will be best positioned to optimize pipeline reliability, safety, and sustainability. Investing in workforce expertise and robust research methodologies will further solidify decision-making frameworks, ensuring that integrity programs deliver measurable value in an environment defined by complexity and rapid change. This synthesis of insights and strategic guidance serves as a blueprint for industry leaders committed to reinforcing the integrity of critical pipeline networks.

Connect with Our Associate Director to Unlock Comprehensive Pipeline Integrity Insights and Drive Strategic Outcomes

To secure comprehensive insights into evolving pipeline integrity dynamics and inform strategic decision-making, engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings unparalleled expertise in translating complex industry trends into actionable intelligence, ensuring that your organization gains a competitive edge through deep, data-driven analysis tailored to your specific operational challenges. Reach out today to explore how our report can empower your business to optimize asset performance, mitigate risks, and capitalize on emerging market opportunities, all grounded in meticulous research and expert validation.

- How big is the Pipeline Integrity Market?

- What is the Pipeline Integrity Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?