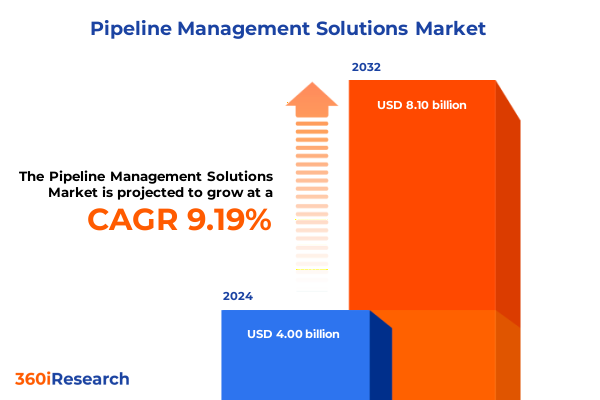

The Pipeline Management Solutions Market size was estimated at USD 4.37 billion in 2025 and expected to reach USD 4.75 billion in 2026, at a CAGR of 9.19% to reach USD 8.10 billion by 2032.

Setting the Foundation for Agile Revenue Acceleration with Innovative Pipeline Management Frameworks That Drive Organizational Efficiency and Growth

Organizations today face unprecedented complexity in aligning sales, marketing, and customer success functions amid rapid digital transformation. As enterprises grapple with dispersed data sources and evolving buyer behaviors, visibility into opportunity pipelines has never been more critical. A robust pipeline management framework not only surfaces actionable insights but also underpins cross-functional collaboration, enabling teams to focus on strategic engagement rather than administrative overhead.

The modern pipeline extends far beyond simple opportunity tracking, evolving into a dynamic system that integrates customer interactions, predictive signals, and performance metrics. This shift demands solutions that can synthesize data from CRM platforms, marketing automation engines, and communication channels into a unified view. Consequently, decision-makers are prioritizing platforms that deliver real-time analytics, automated workflows, and seamless interoperability across enterprise applications.

Amid these demands, solution providers have accelerated innovation through cloud-native architectures and modular component designs. These advancements empower organizations to tailor their pipeline management capabilities to specific operational needs, whether through advanced analytics modules, intuitive dashboards, or API-driven integrations. Early adopters are already realizing enhanced pipeline velocity, improved forecasting accuracy, and stronger alignment between revenue-generating functions.

Drawing from these trends, this executive summary sets the stage for a deeper exploration of the transformative shifts, regulatory and economic factors, segmentation dynamics, and actionable recommendations that define the pipeline management landscape.

Uncovering the Paradigm Shifts Propelling Pipeline Management Solutions into a New Era of Data-Driven Sales Optimization and Customer Engagement Excellence

Over the past year, the pipeline management arena has undergone a profound transformation driven by breakthroughs in artificial intelligence, low-code development, and omnichannel engagement strategies. AI-driven lead scoring and natural language processing have enabled sales teams to prioritize high-impact opportunities by analyzing historical interactions, sentiment data, and deal health indicators. These intelligent capabilities have moved beyond experimental pilots into mainstream deployments, fundamentally reshaping how organizations identify and nurture prospects.

Simultaneously, the rise of low-code and no-code tooling has democratized solution customization, allowing business users to design and deploy bespoke workflows without heavy reliance on IT. This shift has expanded the pool of internal innovators, accelerating time to value and fostering closer alignment between pipeline processes and organizational objectives. Alongside these internal developments, seamless integration with messaging platforms and virtual collaboration tools has become essential, reflecting the distributed nature of modern teams.

These trends reflect a broader move toward data-driven sales optimization, where the boundary between marketing automation and pipeline management continues to blur. Organizations are now investing in unified revenue platforms that deliver end-to-end visibility, from initial lead capture through post-sale renewals and upsell cycles. As a result, pipeline management solutions are no longer siloed applications but integral elements of a holistic revenue ecosystem, powering refined customer experiences and sustainable growth trajectories.

Analyzing the Cumulative Effects of United States Tariff Adjustments on Pipeline Software Infrastructure and Operational Cost Structures in 2025

In 2025, adjustments to United States tariff policies have exerted notable pressure on the cost structures of hardware-dependent deployments, particularly those relying on on-premise servers and specialized networking equipment. Organizations maintaining owned data centers or hosted private clouds have faced rising capital expenses as import duties on key hardware components have been revised upward. These changes have compelled many enterprises to reevaluate their infrastructure strategies and consider alternative sourcing or deployment models.

The elevated costs associated with on-premise setups have catalyzed a broader migration toward cloud-based pipeline management solutions. Public and private cloud offerings have become increasingly attractive as they absorb tariff-related expenses within subscription fees, providing predictable cost models and reducing the administrative burden of equipment procurement. Moreover, cloud providers have responded to the shifting economic environment by enhancing their architectures for greater performance and compliance, enabling enterprises to maintain stringent security postures without incurring surcharges tied to hardware imports.

While large enterprises possess the scale to negotiate favorable terms or leverage existing infrastructure investments, small and medium-sized organizations have been quicker to pivot entirely to cloud alternatives. This divergence highlights a bifurcation in deployment preferences influenced by fiscal imperatives. As pipeline management continues to evolve, the interplay between tariff policies, infrastructure flexibility, and total cost of ownership will shape the competitive dynamics of both solution providers and end users.

Exploring Segmentation Dynamics Shaping Pipeline Management Adoption across Deployment Models Organization Sizes Industry Verticals and Functional Components

The adoption patterns of pipeline management solutions vary significantly when analyzed through the lens of deployment models, organizational size, industry verticals, and component focus. Cloud-based architectures, both public and private, have seen surging uptake among businesses seeking rapid scalability and reduced capital expenditure. Public cloud environments offer seamless integration with existing SaaS ecosystems, while private clouds address data residency and compliance requirements. Conversely, organizations with stringent control mandates often leverage hosted private cloud services or maintain owned data center infrastructures to preserve direct oversight and customization capabilities.

Organizational scale further influences solution preferences and feature priorities. Large enterprises typically invest in comprehensive platforms that offer advanced analytics, predictive modeling, and extensive integration capabilities to support complex, multi-regional sales operations. In contrast, small and medium enterprises, including both medium and small enterprise segments, emphasize intuitive user experiences, rapid deployment cycles, and cost-effective subscription models. This distinction underscores the importance of modular architectures that can cater to diverse needs without imposing unnecessary complexity or expense.

Industry-specific requirements also drive differentiation in pipeline management deployments. Financial services entities demand rigorous audit trails and regulatory reporting, while healthcare organizations prioritize patient privacy and compliance with data protection standards. IT and telecom service providers focus on service-level management and contract renewals, whereas manufacturing firms seek visibility into channel partner performance. Retail and e-commerce players, spanning brick-and-mortar and e-tail operations, leverage pipeline solutions to orchestrate promotions, inventory alignment, and post-sale engagement. Within each component domain-analytics, dashboards, integration, and reporting-solution providers have responded by offering descriptive, predictive, and prescriptive analytics modules alongside ad hoc, custom, and standard reporting capabilities to deliver actionable insights.

This comprehensive research report categorizes the Pipeline Management Solutions market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Model

- Component

- Organization Size

- Industry Vertical

Mapping Regional Variances Driving the Strategic Implementation of Pipeline Management Solutions across Americas Europe Middle East Africa and Asia Pacific

Regional considerations play a pivotal role in shaping the strategic implementation of pipeline management solutions. In the Americas, advanced cloud infrastructure and a mature software ecosystem have accelerated the transition from legacy systems to modern platforms. Stakeholders in the United States and Canada place a premium on real-time analytics and mobile access, reflecting a competitive environment where speed to insight can define market leadership. Latin American markets exhibit growing interest in localized support and flexible price structures to accommodate emerging enterprises.

Europe, the Middle East, and Africa present a diverse landscape, where data privacy regulations and multi-country operations drive demand for solutions that ensure compliance alongside robust functionality. Western European organizations emphasize integration with enterprise resource planning systems and advanced forecasting, while markets in the Gulf region and Africa show strong interest in solutions that facilitate rapid deployment and multilingual interfaces. Cross-border sales teams operating in EMEA seek centralized visibility to manage regional variations in product offerings and customer engagement practices.

In the Asia-Pacific region, dynamic growth in digital adoption has spurred rapid uptake of pipeline management tools across a wide spectrum of industries. Mature markets such as Australia and Japan focus on AI-enhanced customer insights and seamless connectivity with local communication platforms. Meanwhile, fast-growing economies in Southeast Asia and India prioritize affordability and scalability, often starting with cloud-based modules that can expand as business requirements evolve. Across APAC, the convergence of mobile-first strategies and evolving omni-channel expectations continues to redefine the parameters of pipeline orchestration.

This comprehensive research report examines key regions that drive the evolution of the Pipeline Management Solutions market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Strategies and Innovations from Leading Pipeline Management Providers to Inform Strategic Partnerships and Investments

Leading providers within the pipeline management domain have pursued distinct innovation paths to address evolving market demands and secure competitive advantage. Established cloud giants have integrated advanced AI capabilities into their core platforms, delivering automated lead scoring, deal health dashboards, and contextual recommendations powered by machine learning models. Their broad ecosystems and partner networks reinforce their value propositions, enabling customers to leverage adjacent services such as marketing automation and customer data platforms.

Emerging specialists have differentiated through vertical-specific offerings, delivering tailored workflows and compliance modules for industries such as financial services, healthcare, and manufacturing. By embedding regulatory requirements and industry terminology directly into the user experience, these providers reduce deployment times and enhance user adoption. Additionally, many have invested in prebuilt connectors to leading CRM and ERP systems, facilitating data synchronization and reducing the need for custom development.

At the same time, agile challengers emphasize user-centric design and transparent pricing, targeting small and medium enterprises with simplified interfaces and rapid setup. Their focus on modularity allows customers to select analytics, reporting, and integration components on demand, avoiding the overhead of enterprise-scale licensing. Across the board, strategic partnerships, mergers and acquisitions, and open API strategies continue to reshape the competitive landscape, as vendors seek to deliver holistic, future-ready pipeline management capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pipeline Management Solutions market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Aspen Technology Inc.

- Autodesk Inc.

- AVEVA Group PLC

- Bentley Systems Incorporated

- Cameron International Corporation

- DNV GL

- Emerson Electric Co.

- Endress Plus Hauser Group

- Energy Solutions International

- FMC Technologies Inc.

- GE Digital

- Hexagon AB

- Honeywell International Inc.

- Intergraph Corporation

- Kongsberg Gruppen ASA

- OpenText Corporation

- Oracle Corporation

- Rockwell Automation Inc.

- SAP SE

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corporation

Empowering Industry Leaders with Actionable Roadmaps to Leverage Pipeline Management Technologies for Enhanced Revenue Performance and Scalability

To harness the full potential of modern pipeline management, industry leaders should prioritize a series of strategic actions. First, embedding AI-driven analytics within daily workflows can elevate lead prioritization and improve win rates, enabling revenue teams to focus on high-impact opportunities. Next, adopting a hybrid deployment approach ensures flexibility, allowing organizations to balance control and scalability by mixing private cloud, public cloud, and on-premise environments based on regulatory and performance considerations.

Leaders must also champion data governance and integration standards across the enterprise, creating a single source of truth that supports cross-department collaboration. Investing in low-code customization capabilities will empower nontechnical stakeholders to refine processes rapidly, aligning pipeline workflows with evolving business objectives without straining IT resources. Additionally, fostering a culture of continuous improvement-through regular training, performance reviews, and feedback loops-will drive user adoption and maximize platform ROI.

Finally, organizations should cultivate strategic alliances with vendors and system integrators that bring domain expertise and complementary technologies. By engaging partner ecosystems, leaders can accelerate innovation cycles, leverage best practices from adjacent markets, and futureproof their pipeline management investments against emerging challenges.

Detailing a Comprehensive Framework Integrating Primary Interviews Quantitative Analysis and Data Validation to Uphold Integrity and Insight Reliability

This research leveraged a multi-stage approach to ensure comprehensive and reliable insights. Initial desk research was conducted to establish foundational understanding of the pipeline management landscape, compiling information from financial disclosures, industry white papers, and technology briefings. Subsequently, in-depth interviews were held with senior executives, solution architects, and power users across diverse sectors to capture firsthand perspectives on current challenges and emerging requirements.

Quantitative data analysis complemented qualitative findings by examining usage patterns, integration frequencies, and user satisfaction metrics across deployment models, organization sizes, and industry verticals. Proprietary data validation techniques were applied to reconcile discrepancies, triangulating information from vendor roadmaps, client case studies, and third-party benchmarks. Throughout the process, methodological rigor was maintained via peer reviews and iterative validation sessions with subject-matter experts, ensuring that conclusions reflect real-world conditions and forward-looking trends.

By blending primary and secondary research with robust analytic frameworks, this study delivers actionable intelligence that decision-makers can trust. The resulting insights offer a holistic view of pipeline management dynamics, equipping stakeholders to navigate complex environments and capitalize on growth opportunities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pipeline Management Solutions market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pipeline Management Solutions Market, by Deployment Model

- Pipeline Management Solutions Market, by Component

- Pipeline Management Solutions Market, by Organization Size

- Pipeline Management Solutions Market, by Industry Vertical

- Pipeline Management Solutions Market, by Region

- Pipeline Management Solutions Market, by Group

- Pipeline Management Solutions Market, by Country

- United States Pipeline Management Solutions Market

- China Pipeline Management Solutions Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Summarizing Key Insights on Pipeline Management Evolution and Highlighting Strategic Imperatives for Futureproofing Sales Operations

In summary, the evolution of pipeline management solutions underscores the pivotal role of technology in orchestrating efficient, data-driven revenue processes. From transformative AI enhancements to flexible deployment options and nuanced segmentation strategies, organizations must navigate a landscape defined by rapid innovation and shifting economic variables. Understanding regional and industry-specific dynamics further refines decision-making, ensuring that solution investments align with regulatory, operational, and cultural imperatives.

Key insights reveal that cloud-based architectures are gaining ground in response to infrastructure cost pressures, while modular component strategies cater to diverse organizational scales and vertical needs. Competitive differentiation hinges on integration depth, user experience design, and the strategic application of analytics modules, be they descriptive, predictive, or prescriptive. As tariff policies and global supply dynamics continue to influence total cost of ownership, the ability to pivot between on-premise and cloud models will remain a critical success factor.

Looking ahead, industry leaders can solidify their competitive positions by embedding intelligent automation, fostering data governance, and nurturing collaborative partner ecosystems. Doing so will not only accelerate pipeline velocity but also lay the groundwork for sustainable growth and market resilience. Equipped with these strategic imperatives, stakeholders are well-positioned to capitalize on emerging opportunities and shape the future of pipeline management across the enterprise.

Take Action Today to Secure In-Depth Expert Analysis on Pipeline Management Ecosystems by Connecting Directly with Associate Director for Sales and Marketing

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure access to this comprehensive pipeline management solutions report and drive informed decision making that propels revenue growth and operational efficiency.

- How big is the Pipeline Management Solutions Market?

- What is the Pipeline Management Solutions Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?