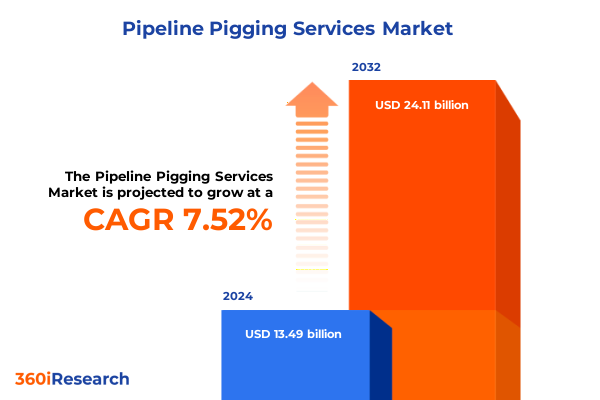

The Pipeline Pigging Services Market size was estimated at USD 14.29 billion in 2025 and expected to reach USD 15.12 billion in 2026, at a CAGR of 7.76% to reach USD 24.11 billion by 2032.

Unveiling the Critical Role of Pipeline Pigging Services in Ensuring Infrastructure Integrity and Operational Efficiency Across Hydrocarbon Networks

Pipeline pigging services are foundational to the safe and efficient operation of hydrocarbon, chemical, and water distribution networks. These specialized operations involve the use of mechanical or chemical devices-commonly referred to as pigs-to perform critical maintenance tasks such as cleaning, decontamination, dewatering, inspection, and separation. By facilitating continuous flow, identifying anomalies, and removing deposits, pigging services significantly extend the service life of pipelines while ensuring regulatory compliance and operational reliability.

As global infrastructure networks age and regulatory frameworks tighten, the demand for advanced pigging solutions continues to grow. Stakeholders across the energy and process industries recognize that adopting the right pigging strategies can prevent costly unplanned shutdowns, mitigate safety hazards, and optimize throughput. The confluence of environmental stewardship, digital transformation, and asset optimization positions pipeline pigging services as an essential component of modern infrastructure management.

Navigating Technological Advancements and Sustainability Imperatives That Are Reshaping Pipeline Pigging Services for a Future-Ready Energy Ecosystem

Rapid technological advancements and heightened sustainability requirements are fundamentally reshaping the landscape of pipeline pigging services. The advent of intelligent pigs equipped with advanced sensors-such as magnetic flux leakage, ultrasonic, and electromagnetic acoustic transducer technologies-enables real-time corrosion assessment and anomaly detection. In parallel, the integration of digital twins and remote monitoring platforms provides operators with predictive maintenance insights, allowing for proactive intervention before defects escalate.

Moreover, environmental imperatives are driving the adoption of eco-friendly pigging materials and processes. Biodegradable gel pigs and polymer-based cleaning solutions reduce ecological impact, while water-based decontamination systems minimize the reliance on hazardous solvents. These transformative shifts underscore a broader industry trend toward harmonizing operational excellence with environmental responsibility, ultimately fostering a more resilient and future-ready energy ecosystem.

Assessing the Enduring Financial and Operational Ramifications of U.S. Steel and Trade Tariffs on Pipeline Pigging Service Providers in 2025

Since the implementation of Section 232 steel tariffs in 2018 and Section 301 measures on certain pipeline components, pipeline pigging service providers have navigated a complex trade environment. Although these tariffs were not specifically designed for pigging equipment, the increased cost of raw materials and imported parts has had cascading effects on service pricing and supply chain strategies. Service providers must absorb elevated procurement costs or pass them on to clients, challenging budget planning and contract negotiations.

In response, leading operators have diversified their supply chains by sourcing domestically produced steel and developing partnerships with tariff-exempt suppliers in allied regions. Some firms have also invested in material innovation-such as fiberglass-reinforced composite pigs-to reduce dependence on tariffed steel. While these adaptations have mitigated immediate cost pressures, the cumulative impact of ongoing trade measures continues to influence capital expenditure planning and operational cadence within the pipeline pigging services sector.

Unlocking Strategic Market Insights Through Detailed Analysis of Pig Type Service Type Material Diameter Operation Mode and Application Dynamics

A granular segmentation analysis reveals distinct growth drivers and service demands across the pipeline pigging value chain. Within pig types, cleaning pigs-spanning brush, foam, and scraper variants-remain indispensable for routine deposit removal, whereas intelligent pigs equipped with caliper, magnetic flux leakage, ultrasonic, and electromagnetic acoustic transducer capabilities are increasingly deployed for advanced inspection. Batching pigs, including capsule and gel formulations, serve niche chemical cleaning roles, and utility pigs provide versatile solutions across monolithic and solid designs.

Service types also exhibit divergent trajectories, with inspection services-particularly magnetic flux leakage and ultrasonic techniques-gaining prominence alongside traditional cleaning and decontamination offerings. Pipeline material influences pig selection; while carbon steel remains predominant, composite and plastic pipelines prompt tailored pig designs. Diameter-specific considerations drive equipment dimensioning, and the balance between scheduled and unscheduled operations informs service readiness. Application-wise, oil and gas pipelines dominate service volumes, but chemical, petrochemical, food and beverage, and water and wastewater segments increasingly leverage pigging to ensure operational integrity.

This comprehensive research report categorizes the Pipeline Pigging Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Pig Type

- Service Type

- Pipeline Material

- Pipeline Diameter

- Operation Mode

- Application

Examining Regional Growth Trajectories and Service Adoption Patterns Across the Americas Europe Middle East Africa and Asia Pacific

Regional dynamics significantly shape the adoption and evolution of pipeline pigging services. In the Americas, a mature network of hydrocarbon pipelines coupled with stringent integrity regulations underpins a robust demand for cleaning, inspection, and decontamination services. Operators prioritize service reliability and regulatory compliance, driving investments in both legacy fleet maintenance and advanced intelligent pig deployments.

Europe, the Middle East, and Africa present a complex mosaic of developed and emerging markets. European operators, influenced by stringent safety and environmental standards, emphasize non-intrusive inspection and decontamination. In the Middle East, expanding petrochemical and refining capacity propels service demand, while African markets show growing interest in water and wastewater pigging solutions. Meanwhile, the Asia-Pacific region’s rapid infrastructure expansion-particularly in petrochemical, oil and gas, and water treatment sectors-fuels demand for both scheduled maintenance programs and cutting-edge inspection services.

This comprehensive research report examines key regions that drive the evolution of the Pipeline Pigging Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry-Leading Pipeline Pigging Service Providers Highlighting Strategic Capabilities Operational Excellence and Innovation Pipelines

Leading pipeline pigging service providers distinguish themselves through integrated service portfolios that combine technical expertise with digital and operational excellence. Firms that invest heavily in research and development offer advanced intelligent pig fleets, remote monitoring capabilities, and data analytics platforms that enhance inspection precision and predictive maintenance forecasting.

Strategic partnerships with pipeline operators, material suppliers, and technology innovators further strengthen competitive positioning. By forging alliances that streamline supply chains and facilitate knowledge sharing, top service leaders accelerate pilot projects, shorten deployment timelines, and deliver turnkey solutions. These differentiators are increasingly critical as market participants compete on the twin axes of service performance and cost efficiency.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pipeline Pigging Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3P Pipeline, Petroleum & Precision Services GmbH & Co. KG

- American Pipeline Solutions, LLC

- Applus+ Servicios Tecnológicos, S.L

- Baker Hughes Company

- CIRCOR International, Inc.

- Dacon Services AS

- Dexon Technology PLC

- Enduro Pipeline Services, Inc.

- GeoCorr, LLC

- IKM Gruppen AS

- Inline Services, LLC

- Intero Integrity Services B.V.

- MISTRAS Group

- NDT Global GmbH & Co. KG

- Oil States Industries, Inc.

- Penspen Limited

- Pigs Unlimited International LLC

- Pigtek Limited

- PIPECARE Group AG

- Quest Integrity Group, LLC

- ROSEN Group AG

- SGS Société Générale de Surveillance SA

- T.D. Williamson, Inc.

- Trans-Asia Pipeline Services Pte Ltd.

Empowering Pipeline Operators and Service Leaders with Targeted Strategies for Operational Optimization Sustainability and Technological Differentiation in Pigging

Industry leaders should prioritize investment in digital transformation, expanding intelligent pig fleets equipped with multi-sensor payloads to capture comprehensive integrity data. By coupling these deployments with analytics platforms, operators can transition from reactive maintenance to predictive asset management, reducing downtime and enhancing safety outcomes.

In parallel, adopting sustainable pigging materials and processes will meet growing environmental and regulatory demands. Collaboration with material scientists can yield biodegradable cleaning agents and composite pig designs that reduce ecological footprints. Finally, active engagement with policymakers and participation in standards development ensure that evolving trade and safety regulations support innovation while safeguarding operational viability.

Detailing the Rigorous Multimethod Research Approach Employed to Capture Market Dynamics Validate Data and Ensure Comprehensive Insights in Pipeline Pigging

This research employs a multi-methodology framework, integrating primary interviews with pipeline operators, service providers, and regulatory experts alongside extensive secondary sources. Detailed expert surveys and roundtable discussions validate emerging trends and capture nuanced operational challenges across regions and applications.

Data collection is reinforced through triangulation of market reports, industry publications, regulatory filings, and patent analyses. Segmentation matrices are developed iteratively, and findings undergo peer review by industry specialists to ensure accuracy, comprehensiveness, and actionable relevance for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pipeline Pigging Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pipeline Pigging Services Market, by Pig Type

- Pipeline Pigging Services Market, by Service Type

- Pipeline Pigging Services Market, by Pipeline Material

- Pipeline Pigging Services Market, by Pipeline Diameter

- Pipeline Pigging Services Market, by Operation Mode

- Pipeline Pigging Services Market, by Application

- Pipeline Pigging Services Market, by Region

- Pipeline Pigging Services Market, by Group

- Pipeline Pigging Services Market, by Country

- United States Pipeline Pigging Services Market

- China Pipeline Pigging Services Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3180 ]

Synthesizing Essential Insights and Strategic Pillars to Empower Stakeholders in Navigating the Evolving Pipeline Pigging Services Landscape with Confidence

Pipeline pigging services stand at the crossroads of technological innovation, environmental stewardship, and regulatory complexity. As intelligent inspection tools evolve and sustainability imperatives gain prominence, service providers must adapt their offerings to deliver both performance and ecological compliance. Concurrently, enduring trade measures underscore the importance of supply chain diversification and material innovation.

By synthesizing insights across segmentation, regional dynamics, and competitive strategies, stakeholders can navigate the evolving landscape with confidence. Leveraging advanced methodologies and actionable recommendations, businesses can optimize asset integrity programs, align with emerging market demands, and secure long-term value in this critical infrastructure domain.

Connect with Ketan Rohom to Secure Your In-Depth Pipeline Pigging Services Market Report and Gain a Competitive Edge in Infrastructure Operations

Leading industry research underscores the importance of obtaining comprehensive competitive intelligence and strategic market insights to maintain a leadership position in pipeline integrity management. Engaging with Ketan Rohom, Associate Director of Sales & Marketing, opens the door to tailored guidance and expert interpretation of the market landscape. By securing this in-depth research report, stakeholders can align operational plans with emerging trends, mitigate regulatory and tariff-driven risks, and capitalize on technological developments to achieve superior asset performance.

Early access to the full analysis provides a competitive advantage, enabling procurement teams, operations managers, and business strategists to make informed decisions on capital allocation and service partnerships. Reach out today to discuss how this report can be customized to address your organization’s unique challenges and to arrange a personalized consultation with Ketan Rohom.

- How big is the Pipeline Pigging Services Market?

- What is the Pipeline Pigging Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?