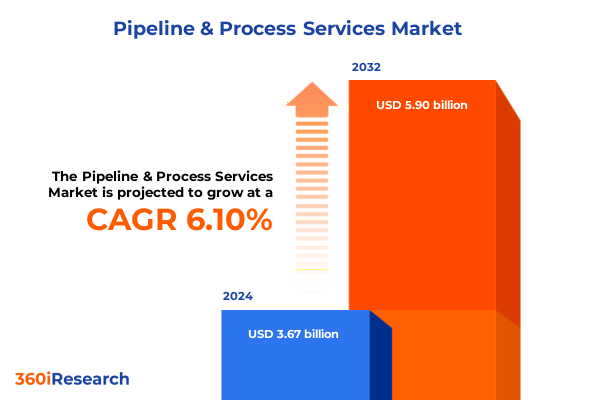

The Pipeline & Process Services Market size was estimated at USD 3.90 billion in 2025 and expected to reach USD 4.11 billion in 2026, at a CAGR of 6.09% to reach USD 5.90 billion by 2032.

Charting the Future of Pipeline and Process Services Amid Heightened Infrastructure Demands, Accelerated Energy Transition Pressures, and Emerging Operational Challenges

In an era where aging pipeline networks underpin critical energy, petrochemical, and industrial operations, service providers face a convergence of operational, regulatory, and market challenges unlike any before. The drive to modernize infrastructure to meet stricter safety regulations, coupled with an accelerating energy transition, has intensified the demand for specialized services that can deliver both efficiency and resilience. Rapid advancements in digital technologies are reshaping expectations, while the imperative to reduce carbon footprints amplifies scrutiny on every phase of the asset lifecycle.

As stakeholders navigate these complexities, they require a partner with deep domain expertise, proven methodologies, and the agility to adapt to shifting market dynamics. From the remote inspection of submerged pipelines to the commissioning of modular process skids, the spectrum of services today demands seamless integration of engineering excellence, data-driven decision making, and sustainable practices. This executive summary provides a structured overview of the forces redefining the landscape, equipping leaders with the insights necessary to anticipate emerging opportunities and mitigate evolving risks.

Embracing Digitalization, Sustainability Imperatives, and Strategic Collaborative Models to Transform Pipeline and Process Service Delivery Across Diverse Industrial Sectors

The pipeline and process services sector is experiencing transformative shifts driven by digitalization, sustainability mandates, and evolving partnership models. The integration of advanced diagnostics, including AI-powered condition monitoring and robotic crawlers, is enabling operators to detect anomalies earlier and optimize maintenance cycles. Meanwhile, chemical cleaning techniques that reduce environmental impact are being adopted at scale, ensuring regulatory compliance and minimizing downtime.

Sustainability imperatives are also prompting the adoption of circular-economy strategies, where the reuse and recycling of materials become central to asset revitalization projects. Strategic alliances-ranging from joint ventures between technology providers and EPC firms to co-development agreements between operators and software vendors-are forming new delivery models that balance capital efficiency with rapid innovation. As the sector adapts, proactive service providers that invest in flexible platforms and cross-disciplinary collaboration will emerge as industry leaders.

Assessing the Far-Reaching Consequences of 2025 United States Steel and Aluminum Tariff Adjustments on Pipeline and Process Infrastructure Supply Chains

In early 2025, comprehensive adjustments to Section 232 tariffs radically altered the cost structure for imported steel and aluminum. On February 11, the administration announced the reinstatement of a full 25% tariff on steel imports and an elevation of aluminum import duties to 25%, while closing all existing country exemptions. These changes took effect on March 12, 2025, eliminating alternative agreements with major trading partners such as Canada, the EU, and Mexico, and reinstating robust ad valorem duties on both primary metals and derivative products.

Subsequently, on June 3, 2025, a new presidential proclamation intensified the impact by increasing Section 232 tariffs on steel and aluminum imports from 25% to 50%, effective June 4, 2025. The higher duties apply strictly to the metal content of imported goods, creating differentiated treatment for downstream products. The sole exception is the United Kingdom, where steel and aluminum imports remain subject to a 25% tariff pending the outcome of an ongoing Economic Prosperity Deal negotiation.

This escalating tariff environment has imposed significant cost pressures on equipment manufacturers and service providers alike. For instance, leading aerospace and defense firms have reported hundreds of millions in increased expenses tied directly to steel and aluminum duties, prompting adjustments to capital expenditure plans and service contract pricing. As these added costs ripple through the supply chain, service providers must recalibrate procurement strategies, explore alternative sourcing, and adopt more aggressive hedging mechanisms to preserve margins and maintain competitive pricing.

Leveraging Multi-Dimensional Segmentation Insights to Understand Service, Asset, Technology, and End User Dynamics in Pipeline and Process Markets

A nuanced understanding of the market requires dissecting service offerings by type. Construction services extend beyond broad civil works, encompassing specialized pipeline construction modes such as horizontal directional drilling and trench construction for both onshore pipelines and processing plant installations. Engineering services revolve around detailed design consultancy and FEED (Front End Engineering Design) studies, ensuring project specifications align with operational, safety, and regulatory requirements. Inspection services leverage a spectrum of technologies-from pipeline inspection tools to sewer and tank evaluation methods-while maintenance services focus on pipeline cleaning and rehabilitation repairs to maintain flow assurance and asset integrity.

Equally important is the classification of assets, which spans distribution, gathering, and transmission pipelines; petrochemical plants and refineries; and both aboveground and underground storage facilities. Technology segmentation reveals growing adoption of AI diagnostics that can predict failure points, chemical cleaning solutions that minimize environmental impact, and multiple inspection methodologies such as magnetic flux leakage and ultrasonic testing in smart pigging. Robotic inspection platforms, including autonomous drones and robotic crawlers, enhance access to confined spaces, while trenchless technologies like horizontal directional drilling and microtunneling reduce surface disruption. Finally, end-user segmentation highlights the divergent needs of chemical and petrochemical operators, oil and gas producers, power and energy utilities, and water and wastewater authorities, each demanding tailored service models to align with their unique operational imperatives.

This comprehensive research report categorizes the Pipeline & Process Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Asset Type

- Technology Type

- End User

Comparative Regional Dynamics Shaping Infrastructure Demand for Pipeline and Process Services Across Americas, EMEA, and Asia Pacific Markets

In the Americas, robust investment under infrastructure renewal initiatives has fueled demand for pipeline upgrades, digital inspection solutions, and maintenance contracts. This region’s regulatory environment, shaped by federal and state agencies, emphasizes enhanced safety standards and environmental stewardship, prompting operators to integrate real-time monitoring systems and advanced analytics to support compliance and operational excellence.

Across Europe, the Middle East, and Africa, the convergence of harmonized regulatory frameworks and decarbonization objectives is driving service providers to offer low-carbon process solutions and turnkey EPCM (Engineering, Procurement, Construction, and Management) models. In mature markets, aging networks have created a backlog of integrity assessments, while emerging economies in the Middle East and Africa are investing in new transmission corridors to link remote production fields to processing hubs.

In Asia Pacific, rapid industrial expansion and large-scale petrochemical and LNG developments propel a surge in demand for full-life-cycle services. Governments and operators prioritize indigenous content requirements alongside stringent emissions targets, encouraging local joint ventures and the transfer of advanced technologies. As a result, service providers are forging strategic alliances to combine regional expertise with global best practices, ensuring that projects meet both growth objectives and sustainability benchmarks.

This comprehensive research report examines key regions that drive the evolution of the Pipeline & Process Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Trends Among Leading Pipeline and Process Service Providers Driving Innovation, Consolidation, and Operational Excellence

Leading service providers are positioning themselves at the forefront of innovation through targeted technology investments and strategic alliances. AECOM has deepened its digital twin capabilities to create immersive, data-driven project models that streamline engineering, construction, and ongoing asset management. Jacobs continues to expand its portfolio of AI-powered solutions, deploying advanced data analytics for sewer and pipeline assessments that enable proactive maintenance and risk mitigation. Meanwhile, Worley’s emphasis on sustainable engineering and its Digital Execution Centre of Excellence underscores its commitment to delivering complex offshore pipeline and process plant projects with minimal environmental footprint.

Additionally, strategic collaborations are reshaping the competitive landscape. The global alliance between bp and Worley to enhance site project efficiency exemplifies how operators and service firms are aligning to drive mutual value creation. At the same time, project-specific partnerships-such as Glenfarne’s selection of Worley for final engineering and cost estimates on the Alaska LNG pipeline-highlight the importance of assigning end-to-end engineering and advisory roles to single partners with proven full-lifecycle capabilities. These integrated models offer greater transparency, simplified governance, and the potential for accelerated decision making, setting a new standard for project delivery excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pipeline & Process Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Baker Hughes Company

- Bechtel Corporation

- Caltrol Services India Private Limited

- Douglas Pipeline Company

- Enbridge Inc.

- EnerMech Ltd.

- Halliburton Company

- INTECH Process Automation Inc.

- Jindal Saw Limited

- Kinder Morgan, Inc.

- Larsen & Toubro Limited

- Oceaneering International, Inc.

- Pipetech Engineering Solution Private Limited

- Saipem S.p.A.

- Schlumberger Limited

- STATS (UK) Ltd.

- T.D. Williamson, Inc.

- TC Energy Corporation

- TechnipFMC plc

- Welspun Enterprises Limited

Implementing Proactive Strategies to Enhance Competitiveness, Operational Resilience, and Sustainable Growth in Pipeline and Process Services

To thrive amid mounting competitive pressures and regulatory complexities, industry leaders should embed digital diagnostics at every project phase, from initial design reviews to ongoing integrity management. By adopting AI-driven condition monitoring, service providers and operators can shift from reactive maintenance to predictive strategies that extend asset life and reduce unplanned outages. Concurrently, diversifying the supply base beyond traditional steel and aluminum channels will mitigate tariff-related risks, ensuring access to critical materials through nearshoring, alternative alloys, or recycled feedstock sources.

Collaborative engagement models, such as integrated project delivery and outcome-based contracting, can foster shared accountability and align incentives across stakeholders. Prioritizing workforce upskilling in areas like robotics operation, data analytics, and sustainable process technologies will build organizational resilience. Finally, scenario planning exercises that incorporate geopolitical, regulatory, and climate considerations will equip decision-makers to navigate uncertainty, optimize capital allocation, and capture emerging growth opportunities in both mature and emerging markets.

Detailing a Comprehensive Research Approach Combining Primary Expert Consultations, Secondary Data Analysis, and Rigorous Quality Assurance Protocols

This research approach combined extensive primary consultations with senior executives and technical experts spanning pipeline EPC firms, asset owners, technology providers, and regulatory bodies. Interviews were structured to elicit qualitative insights into market drivers, regulatory impacts, and technology adoption challenges. Secondary data sources included publicly available government documents, industry association publications, company annual reports, and trade journals to validate and enrich primary findings.

A rigorous triangulation methodology was applied to ensure data integrity and mitigate bias. Qualitative inputs were cross-checked against quantitative benchmarks and validated through expert review panels. A multi-stage quality assurance process reviewed key assumptions, standardized terminology, and verified data points to deliver a robust, actionable analysis that meets the highest standards of research excellence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pipeline & Process Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pipeline & Process Services Market, by Service Type

- Pipeline & Process Services Market, by Asset Type

- Pipeline & Process Services Market, by Technology Type

- Pipeline & Process Services Market, by End User

- Pipeline & Process Services Market, by Region

- Pipeline & Process Services Market, by Group

- Pipeline & Process Services Market, by Country

- United States Pipeline & Process Services Market

- China Pipeline & Process Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Summarizing Critical Findings and Reinforcing the Strategic Imperatives for Stakeholders in the Evolving Pipeline and Process Service Sector

The pipeline and process services sector stands at a pivotal moment, shaped by accelerated digital transformation, evolving regulatory landscapes, and geopolitical trade dynamics. Segmentation analysis revealed the intricate interplay between service type, asset class, technology solutions, and end-user needs, while regional insights underscored the diverse growth trajectories across the Americas, EMEA, and Asia Pacific. Major service providers are differentiating through advanced digital platforms, strategic alliances, and sustainable engineering frameworks.

As tariff adjustments reshape supply chain economics and environmental imperatives drive innovation, stakeholders that embrace proactive strategies-investing in predictive analytics, diversifying material sourcing, and fostering integrated collaboration-will be best positioned to lead the next chapter of infrastructure modernization. This executive summary offers a clear roadmap for navigating these complex forces and capitalizing on the most compelling opportunities in 2025 and beyond.

Connect with the Associate Director of Sales and Marketing for Exclusive Access to Your Customized Market Research Report Today

To unlock the full breadth of insights detailed in this executive summary and gain a competitive edge in the evolving pipeline and process services sector, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Through a personalized consultation, you will explore how the comprehensive market research report aligns with your strategic priorities, whether you are investigating digital transformation pathways, assessing tariff implications, or expanding into high-growth regions. Engage directly with Ketan to discuss tailored licensing options, data access modules, and value-added services designed to inform high-stakes decision making. Act now to secure the definitive resource that will guide your organization through the complexities of infrastructure modernization, regulatory shifts, and technological innovation in 2025 and beyond.

- How big is the Pipeline & Process Services Market?

- What is the Pipeline & Process Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?