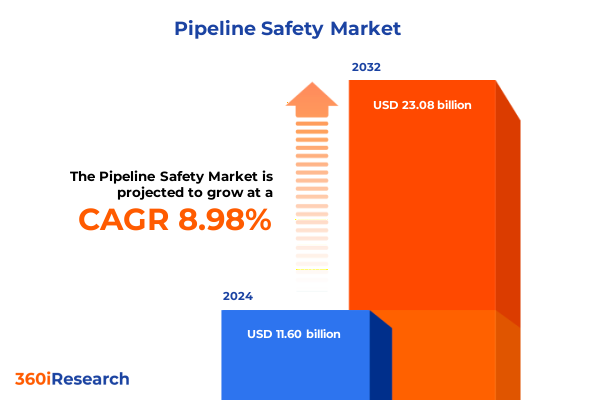

The Pipeline Safety Market size was estimated at USD 12.57 billion in 2025 and expected to reach USD 13.63 billion in 2026, at a CAGR of 9.06% to reach USD 23.08 billion by 2032.

Unveiling the Imperative for Enhanced Pipeline Safety Amid Evolving Energy Demand and Infrastructure Complexity Across Global Markets

In an era defined by accelerating infrastructure demands and heightened environmental scrutiny, pipeline safety has emerged as a critical frontier for engineers, operators, and regulators alike. As energy markets evolve to meet growing consumption patterns, stakeholders must navigate increasingly complex networks of transportation assets that traverse diverse terrains and jurisdictions. This report provides an essential foundation for understanding the multifaceted challenges and opportunities that characterize the current landscape of pipeline safety, weaving together technological innovation, regulatory dynamics, and operational best practices.

The introduction sets the stage by framing the broader context in which pipeline safety operates. It underscores the confluence of factors-from aging assets and geopolitical developments to the integration of renewable energy carriers-that have amplified the need for rigorous risk management. By establishing this groundwork, readers will gain clarity on why a holistic, data-driven approach is indispensable for safeguarding assets, protecting communities, and ensuring long-term viability of energy supply chains. Ultimately, this section primes decision-makers to appreciate the depth and scope of the analyses that follow.

Identifying Pivotal Technological and Regulatory Transformations Reshaping Pipeline Safety Strategies in a Rapidly Changing Energy Infrastructure Environment

The pipeline safety landscape has undergone remarkable transformation driven by advancements in inspection methodologies, digital technologies, and regulatory frameworks. As inline inspection tools evolve from simple caliper devices to sophisticated ultrasonic arrays capable of detecting sub-millimeter flaws, operators can now anticipate maintenance needs before anomalies escalate into costly shutdowns. Coupled with real-time leak detection systems that leverage fiber optic sensing and acoustic monitoring, these technological breakthroughs are redefining proactive integrity management.

Concurrently, the regulatory environment has tightened, with authorities mandating more stringent compliance thresholds and frequent reporting cycles. Enhanced cathodic protection standards now require optimization of both impressed current and sacrificial anode systems to mitigate corrosion risks in varied soil and climatic conditions. Moreover, the growing adoption of remote monitoring solutions-spanning IoT sensors, satellite platforms, and SCADA integration-has created a data-rich ecosystem that empowers continuous surveillance. Taken together, these shifts underscore a move from reactive repairs to predictive maintenance, ushering in a new era of resilience and operational sophistication.

Assessing the Aggregate Effects of 2025 United States Tariff Measures on Pipeline Safety Equipment Sourcing and Cost Structures within the Energy Sector

In 2025, a series of tariff adjustments introduced by the United States government has had tangible repercussions on the sourcing of pipeline safety components and services. Increased duties on certain corrosion protection materials and inline inspection equipment disrupted established procurement channels, prompting operators to reassess their supply chains. As a result, manufacturers responded by diversifying production footprints and forging partnerships in regions not subject to elevated tariff rates, thereby safeguarding continuity of critical components such as fusion bonded epoxy coatings and magnetic flux leakage tool elements.

These tariff measures have also spurred a wave of innovation among service providers. Calibration and maintenance firms expanded their in-house capabilities to minimize reliance on imported calibration sensors and specialized repair parts. Consulting practices intensified collaboration with domestic suppliers to ensure regulatory compliance without incurring prohibitive costs. Although some short-term cost pressures emerged, the cumulative impact catalyzed greater supply chain resilience, accelerated localization of key technologies, and reinforced the strategic imperative for adaptive procurement strategies across the sector.

Deriving Actionable Insights from Technology, Service, End User, and Pipeline Type Dimensions to Unlock Targeted Opportunities within Pipeline Safety Ecosystems

When analyzing pipeline safety through the lens of technology, a clear stratification emerges between core corrosion mitigation solutions and cutting-edge monitoring instruments. Cathodic protection systems, encompassing both impressed current and sacrificial anode variants, remain foundational for safeguarding metallic pipelines, yet they now coexist with advanced inline inspection tools such as ultrasonic and MFL devices capable of comprehensive metal loss characterization. Coating and lining technologies have likewise diversified, spanning fusion bonded epoxy applications to specialized polyethylene tapes, each tailored to different environmental exposures. Meanwhile, leak detection solutions draw upon acoustic and fiber optic sensing modalities, and remote monitoring frameworks integrate IoT-enabled sensors, satellite telemetry, and SCADA interoperability to deliver uninterrupted oversight.

Shifting to service segmentation reveals a comparable depth of differentiation. Calibration offerings have expanded beyond basic sensor checks to include tailored tool calibration regimens, while consulting services bifurcate into technical and regulatory compliance advisory that guides operators through evolving standards. Inspection regimes now leverage pigging and ultrasonic methodologies in tandem with visual surveys to create multi-dimension assessments of pipeline integrity. Preventive maintenance protocols integrate predictive analytics, bolstered by corrective capabilities that include specialized welding and corrosion repair. Together, these diversified service portfolios enable stakeholders to address site-specific challenges through bespoke end-to-end solutions.

When viewed through end-user categories, the pipeline safety ecosystem adapts to the unique demands of each vertical. In the chemical and petrochemical industries, management of basic and specialty chemical feedstocks demands coatings and linings engineered for corrosive agents. Energy and power operators balance conventional generation infrastructure with emerging renewable expansions, requiring flexible, interoperable monitoring suites. Within the oil and gas sector, downstream, midstream, and upstream segments each present distinct pressure regimes, fluid compositions, and access constraints that drive tailored inspection strategies. Water and wastewater networks, divided between municipal and industrial flows, impose rigorous compliance requirements that heighten the importance of leak detection and corrosion control.

Considering pipeline type segmentation, distribution networks handling gas or liquid payloads prioritize agile leak detection and rapid response mechanisms, whereas transmission pipelines-whether onshore or offshore-necessitate robust remote monitoring and periodic inline inspection to confront extended right-of-way challenges. This multi-pronged segmentation framework underscores the necessity for operators to calibrate their investment and deployment decisions in accordance with specific technological, service, and end-user imperatives, thereby optimizing safety outcomes across diverse operational contexts.

This comprehensive research report categorizes the Pipeline Safety market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service

- Technology

- Pipeline Type

- End User

Analyzing Regional Dynamics and Strategic Imperatives across the Americas, Europe Middle East Africa, and Asia Pacific for Enhanced Pipeline Safety Outcomes

Regional factors exert a defining influence on pipeline safety strategies, beginning with the Americas, where vast networks span diverse terrains from Arctic tundra to tropical lowlands. Operators in North and South America contend with regulatory regimes that emphasize environmental stewardship and indigenous land rights, driving the adoption of robust leak detection and community engagement protocols. In addition, the rising integration of digital twins and remote monitoring platforms addresses the logistical complexities of monitoring expansive transmission corridors across remote locales.

In the Europe, Middle East, and Africa region, stakeholders navigate a mosaic of regulatory frameworks, infrastructural vintages, and climatic conditions. European operators prioritize decarbonization goals, favoring materials and monitoring solutions that adhere to stringent emissions standards. Meanwhile, Middle Eastern markets leverage substantial capital expenditures to modernize aging transmission assets, integrating advanced cathodic and coating systems to extend pipeline life spans. Across Africa, the focus remains on expanding energy access while mitigating environmental impacts, requiring modular inspection services and scalable maintenance models to support nascent networks.

The Asia Pacific region represents a dynamic convergence of rapid infrastructure expansion and high population density corridors. Countries with extensive offshore pipelines invest heavily in remote sensing and leak detection capabilities to protect maritime environments, while onshore distribution networks in densely populated areas adopt high-fidelity inline inspection schedules to preempt disruptions. Regulatory bodies are increasingly harmonizing safety standards to facilitate cross-border trade in energy resources, prompting operators to standardize monitoring architectures and align with international best practices. In each region, these localized drivers underscore the importance of aligning technology adoption and service deployment with jurisdictional imperatives and market maturity levels.

This comprehensive research report examines key regions that drive the evolution of the Pipeline Safety market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industry Players and Their Strategic Initiatives Driving Innovation in Pipeline Safety Solutions across Multiple Market Segments

Leading providers in the pipeline safety sphere are redefining best practices through strategic investments in R&D and collaborative partnerships. Engineers specializing in cathodic protection are now incorporating smart materials and adaptive current controls to minimize maintenance cycles. Inspection technology firms leverage machine learning algorithms to enhance defect recognition within MFL and ultrasonic tool data, thereby elevating predictive maintenance accuracy. Service conglomerates are consolidating capabilities across calibration, consulting, and repair disciplines to deliver integrated solutions under unified contracts.

In parallel, a select group of companies has pioneered cloud-based analytics platforms that harmonize field sensor inputs with historical integrity records, enabling real-time risk assessments and decision support. Collaborative ecosystems are forming between technology vendors and end users, driving co-development of bespoke solutions aligned with unique operational profiles. Through these concerted efforts, leading companies are not only advancing the state of the art in pipeline safety but also reinforcing competitive differentiation by offering holistic service portfolios that blend hardware, software, and expert advisory components.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pipeline Safety market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Baker Hughes Company

- Emerson Electric Co.

- General Electric Company

- Halliburton Company

- Honeywell International Inc.

- MSA Safety Incorporated

- Schlumberger Limited

- Schneider Electric SE

- Siemens Aktiengesellschaft

Formulating Strategic Actions and Best Practices for Industry Leaders to Strengthen Pipeline Safety Frameworks and Accelerate Operational Resilience

Industry leaders can capitalize on the insights presented herein by first establishing a unified data governance framework that consolidates inputs from inline inspection tools, remote sensors, and maintenance records. By deploying cloud-native analytics engines, organizations can surface early warning indicators and streamline decision-making processes. Next, forging strategic alliances with domestic manufacturing partners can mitigate tariff-related supply chain disruptions, ensuring steady access to critical corrosion control materials and inspection components.

Furthermore, stakeholders should prioritize pilot programs that validate the efficacy of emerging leak detection technologies, such as distributed fiber optic sensing, within their specific operating environments. Investing in workforce training to cultivate proficiency in advanced inspection methodologies will reinforce organizational readiness and foster a culture of continuous improvement. Finally, by adopting a risk-based inspection schedule informed by predictive analytics, operators can allocate maintenance resources more effectively, balancing safety imperatives with operational efficiency. Collectively, these recommendations provide a clear roadmap for enhancing pipeline integrity and sustaining competitive advantage.

Outlining the Rigorous Research Framework, Data Acquisition Processes, and Analytical Techniques Underpinning Comprehensive Pipeline Safety Intelligence

This analysis is underpinned by a robust research design that synthesizes primary interviews, expert panel consultations, and comprehensive secondary literature reviews. Primary data was gathered through discussions with pipeline integrity managers, regulatory authorities, and technology developers, ensuring a diverse range of perspectives. Secondary sources include technical white papers, trade association guidelines, and publicly available regulatory filings, all critically evaluated to validate consistency and accuracy.

Quantitative insights were derived from a structured evaluation of equipment specifications, service procedure benchmarks, and patent databases, while qualitative assessments emerged from scenario analysis workshops that explored the implications of tariff adjustments and regulatory shifts. Cross-verification of findings was conducted through peer reviews and stakeholder validation sessions. This multi-method approach guarantees that the conclusions and recommendations articulated herein rest on a foundation of rigorous, triangulated evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pipeline Safety market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pipeline Safety Market, by Service

- Pipeline Safety Market, by Technology

- Pipeline Safety Market, by Pipeline Type

- Pipeline Safety Market, by End User

- Pipeline Safety Market, by Region

- Pipeline Safety Market, by Group

- Pipeline Safety Market, by Country

- United States Pipeline Safety Market

- China Pipeline Safety Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3339 ]

Synthesizing Core Findings to Illuminate the Path Forward for Stakeholders Seeking to Enhance Pipeline Safety and Infrastructure Integrity Globally

The distilled insights from this report illuminate the converging forces that shape contemporary pipeline safety paradigms, from technological innovations to market disruptions. By synthesizing the transformative shifts, tariff implications, segmentation nuances, regional dynamics, and company strategies, stakeholders gain a comprehensive understanding of the factors driving both risk and opportunity in the energy transportation sector.

As the industry advances toward an integrated, data-centric future, the capacity to adapt swiftly to regulatory changes and leverage emerging technologies will determine competitive positioning. This conclusion underscores the imperative for ongoing collaboration among operators, service providers, and policymakers to foster resilient infrastructure ecosystems. Embracing the strategic recommendations outlined above will empower organizations to preempt integrity challenges, optimize resource allocation, and secure long-term operational continuity.

Engage with Ketan Rohom to Secure In-Depth Pipeline Safety Intelligence and Propel Your Organization’s Strategic Initiatives Forward

To transform insights into strategic initiatives and unlock the full potential of the intelligence provided, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Discover how this authoritative pipeline safety report can inform your next steps and elevate your competitive edge. Engage today to secure tailored guidance, arrange a comprehensive briefing, and obtain immediate access to the in-depth findings that will drive operational excellence and risk mitigation within your organization.

- How big is the Pipeline Safety Market?

- What is the Pipeline Safety Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?