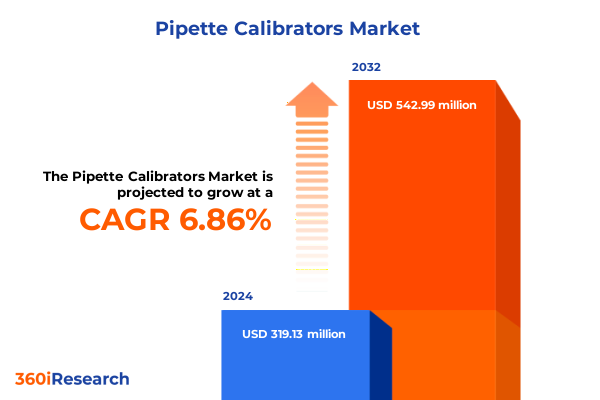

The Pipette Calibrators Market size was estimated at USD 339.70 million in 2025 and expected to reach USD 367.29 million in 2026, at a CAGR of 6.92% to reach USD 542.99 million by 2032.

Unveiling the Essential Function and Complexities of Pipette Calibration as Laboratories Navigate Innovations in Automation Traceability and Quality Governance

Pipettes serve as the foundational instruments for precise liquid handling across research laboratories, clinical diagnostics, pharmaceutical development, and food safety testing. Any deviation from intended volumes can compromise experimental validity, regulatory compliance, and ultimately, product integrity. Consequently, calibration of pipettes and calibration devices adheres to the ISO 8655 standard, which prescribes performance verification intervals and gravimetric methods for volume determination. Under average laboratory conditions, semi-annual calibration suffices to maintain accuracy within defined limits, while highly regulated environments benefit from quarterly checks or even monthly service for critical workflows. These practices ensure traceability of measurements, foster reproducibility of scientific results, and fulfill audits for ISO 17025 accreditation, underscoring calibration’s role in high-stakes environments where precision is non-negotiable.

In parallel with these methodological imperatives, the landscape of calibration technology has evolved to meet escalating demands for efficiency, transparency, and data integrity. Laboratories are increasingly adopting digital and automated calibration platforms that integrate data logging, automated adjustments, and real-time analytics. By minimizing human intervention and administrative overhead, these solutions enhance throughput and support electronic audit trails essential for compliance. Furthermore, the rise of IoT-enabled calibrators allows remote monitoring of device performance and environmental conditions, facilitating predictive maintenance and reducing unplanned downtime. Together, these advancements reflect a broader shift toward digitally driven quality assurance that aligns with contemporary operational and regulatory requirements.

Examining How Digital Transformation and Connectivity Are Redefining Pipette Calibration with Automated Analytics and Traceable Data Workflows

The transition from manual pipette calibration to digital solutions marks one of the most profound shifts in laboratory workflows. Traditional hand-operated calibrators, reliant on visual volume checks and manual adjustments, are being superseded by digital systems that offer automated procedures and built-in error detection. By eliminating transcription steps and standardizing protocols, these platforms reduce variability and enhance the reliability of calibration outcomes. This transformation is particularly impactful in high-throughput settings where large volumes of pipettes must be serviced within tight turnaround windows, driving both productivity gains and quality improvements.

Convergence with Laboratory Information Management Systems (LIMS) and IoT connectivity further amplifies the value of modern calibration equipment. IoT-enabled calibrators can transmit timestamped performance data to centralized databases, enabling laboratories to visualize calibration trends, track instrument drift, and optimize maintenance schedules. Such connectivity not only streamlines regulatory reporting but also empowers data-driven decision-making, as calibration histories can be analyzed to predict when devices may fall out of tolerance. This predictive approach to maintenance reduces unplanned service interruptions and extends the useful life of pipettes and calibrators alike.

Simultaneously, the emergence of portable electronic calibrators has unlocked onsite verification capabilities. Technicians can now perform gravimetric checks and adjustments directly within lab benches or field environments, minimizing the logistical complexities of offsite servicing. This decentralized model of quality assurance accelerates calibration cycles, ensures continuous compliance, and supports dynamic research operations in environments ranging from clinical diagnostics to bioprocessing facilities.

Analyzing the Compound Effects of U.S. Tariff Policies in 2025 on Pipette Calibration Equipment Cost Structures and Supply Chain Resilience

In early April 2025, U.S. laboratories faced sweeping tariff changes that redefined the cost structure for imported lab equipment, including pipette calibrators. A universal tariff of 10% was imposed on most imports, while subsequent country-specific adjustments placed Chinese lab goods under a 145% levy. Meanwhile, Canada and Mexico were exempted from the universal duty but incurred 25% tariffs on non-USMCA goods and 10% on energy and potash exports. These overlapping duties elevated landed costs dramatically, prompting laboratories to reconsider procurement strategies and supply chain arrangements.

The cumulative tariff burden has exerted substantial pressure on budgets across academic, clinical, and industrial laboratories. Imported calibration devices, which often incorporate precision electronics and high-accuracy sensors sourced from global suppliers, now command significantly higher prices. In response, organizations are auditing supplier origins, prioritizing domestically manufactured or USMCA-compliant alternatives, and negotiating long-term agreements with local distributors who maintain buffer stocks. Such strategic adjustments aim to mitigate volatility stemming from fluctuating tariff policies and ensure uninterrupted access to essential calibration services.

Unpacking Market Dynamics by Product End User Pipette Type Calibration Location and Service Provider to Reveal Strategic Segmentation Insights

An in-depth perspective on the pipette calibration ecosystem emerges through multiple segmentation lenses. When viewed by product type, laboratories weigh the choice between digital pipette calibrators-valued for their integrated data management and consistent adjustment algorithms-and manual calibrators, which remain preferred in cost-sensitive settings that demand straightforward operation.

Examining end-user segments reveals a diverse spectrum of calibration needs. Academic research and government institutions, from national research agencies to university laboratories, demand high-volume calibration capacity coupled with rigorous documentation. Clinical diagnostics laboratories prioritize rapid turnaround and compliance with health-care regulations, whereas food and beverage operators require routine verifications to uphold safety standards. In pharmaceutical and biotechnology environments-spanning both biotech innovators and large pharmaceutical firms-calibration solutions must seamlessly integrate with quality management systems and support complex validation workflows.

Further differentiation arises when considering pipette type, with electronic, multi-channel, and single-channel instruments each presenting unique calibration requirements and service intervals. Calibration location also shapes procurement decisions: onsite calibration accelerates service cycles and reduces equipment downtime, while offsite calibration provides access to specialized facilities and expert technicians. Finally, the choice between in-house service teams and third-party providers influences control over calibration scheduling, cost allocations, and alignment with internal quality assurance protocols.

This comprehensive research report categorizes the Pipette Calibrators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Pipette Type

- Calibration Location

- Service Provider

- End User

Evaluating Regional Dynamics Across Americas Europe Middle East & Africa and Asia Pacific to Reveal Growth Drivers and Challenges in Pipette Calibration Solutions

Regional markets exhibit distinct characteristics that influence calibration practices and equipment adoption. In the Americas, laboratory infrastructure benefits from extensive networks of service centers and established distribution channels. Domestic manufacturers and calibration service providers can leverage proximity to end users, and companies like Mettler-Toledo have capitalized on this by reporting a 12% increase in fourth-quarter lab instrument sales driven by robust demand for analytical balances and calibration equipment-even amidst challenges from shipping delays and currency fluctuations.

Within Europe, the Middle East & Africa, calibration standards are shaped by the European Union’s stringent medical device regulations and Good Laboratory Practice directives. In this region, suppliers emphasize compliance with MDR and IVDR guidelines, while local service firms offer tailored calibration packages that address country-specific accreditation requirements. Regulatory harmonization efforts across EMEA also facilitate cross-border service agreements, enabling multinational organizations to maintain consistency in their calibration protocols.

Asia-Pacific has emerged as a dynamic growth frontier, propelled by expanding life sciences R&D and government-backed initiatives in China, India, and Southeast Asia. The Bioprocess Solutions segment saw sales growth of 8.1% in Q1 2025, underscoring growing investments in biopharmaceutical manufacturing and the need for precise liquid handling validations. In this landscape, suppliers are introducing regionally priced calibration bundles and partnering with local distributors to support rapid lab expansions and compliance with evolving quality standards.

This comprehensive research report examines key regions that drive the evolution of the Pipette Calibrators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players’ Performance Patterns and Strategic Moves Driving Innovation and Market Presence in Pipette Calibration Solutions

Mettler-Toledo International has leveraged its strong presence in analytical instruments to drive robust pipette calibration device sales. Forecasting upbeat 2025 profit, the company reported a 12% year-on-year increase in fourth-quarter lab instrument revenue to $1.05 billion, attributing growth to sustained demand for precision measurement tools despite supply chain delays and currency headwinds.

Sartorius AG, in its Lab Products & Services division, has navigated a cautious investment environment by focusing on consumables and service-based revenue. Although end markets for capital equipment remained muted with a 4.4% sales decline in Q1, Sartorius maintained an underlying EBITDA margin of 29.8%, underscoring its ability to balance operational discipline with strategic R&D initiatives in bioanalytics and calibration solutions.

Thermo Fisher Scientific has continued to outperform expectations in its laboratory products segment, achieving $6 billion in second-quarter sales. The company credited its "practical process improvement" strategy for supply chain optimization and tariff management, which supported a 3% revenue increase to $10.85 billion overall and outpaced consensus earnings forecasts by emphasizing resilience and customer-centric service models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pipette Calibrators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avantor, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories Inc.

- Brand GmbH + Co Kg

- Corning Incorporated

- Dragon Laboratory Instruments Limited -

- Eppendorf SE

- Gilson, Inc.

- Hamilton Company

- Heathrow Scientific

- Hirschmann Laborgeräte GmbH & Co. KG

- Integra Biosciences AG

- Labnet International

- Labtron Equipment Ltd.

- Merck KGaA

- Mettler Toledo

- Nichiryo Co., Ltd.

- Ohaus Corporation

- Qiagen NV

- Sartorius AG

- Socorex ISBA SA

- Tecan Group Ltd.

- TEKTRONIX, INC.

- Thermo Fisher Scientific Inc.

- Transcat, Inc.

Strategic Imperatives for Market Leaders to Embrace Digital Innovations Navigate Tariff Pressures and Elevate Calibration Service Differentiation

Laboratory leaders should accelerate the deployment of digital calibration platforms that integrate automated adjustment algorithms, secure data logging, and cloud-based analytics. By harnessing advanced software modules that identify performance drift and suggest optimized calibration intervals, organizations can elevate precision standards while freeing technical staff to focus on higher-value tasks. Integrating pipette calibration workflows with broader LIMS or quality management systems will further enhance visibility across laboratory operations and foster continuous improvement initiatives.

To mitigate the impact of evolving tariff landscapes, companies must conduct thorough audits of their supply chains, mapping origins of all critical components and assessing exposure to Section 301 or Section 232 duties. Establishing partnerships with U.S.-based distributors and exploring tariff exclusion processes can reduce landed costs and bolster supply continuity. Additionally, investing in regional assembly or calibration centers allows firms to circumvent punitive duties and demonstrate responsiveness to customer needs in a rapidly shifting trade environment.

Collaboration with regulatory agencies and participation in international standard-setting committees will enable industry stakeholders to shape calibration guidelines, streamline machinery exclusion protocols, and expedite the adoption of best practices. By engaging proactively in policy and accreditation discussions, pipette calibrator providers can ensure their solutions remain aligned with future regulatory expectations and help laboratories navigate compliance complexities.

Detailing the Rigorous Research Framework Involving Data Collection Expert Dialogues and Multistep Validation Methods Underpinning This Report

The research methodology underpinning this report combines comprehensive secondary data analysis with primary qualitative insights. Secondary sources include industry publications, regulatory databases, tariff schedules, and financial disclosures from publicly traded calibration equipment manufacturers. These data were systematically reviewed to identify market dynamics, emerging technologies, and trade policy impacts.

Primary research involved structured interviews and surveys with calibration service providers, laboratory managers, research directors, and regulatory experts. Responses were analyzed using thematic coding to extract common challenges, best practices, and adoption barriers. Cross-validation techniques, including triangulation of quantitative data points and consistency checks against published standards such as ISO 8655, ensured robustness.

A dedicated expert panel of calibration scientists and industry analysts reviewed preliminary findings to refine interpretations and validate the accuracy of technical content. Statistical methods, including trend analysis and correlation assessments, were applied to verify relationships between tariff shifts, equipment adoption patterns, and regional demand fluctuations. This multilayered approach guarantees that the report’s conclusions are grounded in reproducible evidence and stakeholder consensus.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pipette Calibrators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pipette Calibrators Market, by Product Type

- Pipette Calibrators Market, by Pipette Type

- Pipette Calibrators Market, by Calibration Location

- Pipette Calibrators Market, by Service Provider

- Pipette Calibrators Market, by End User

- Pipette Calibrators Market, by Region

- Pipette Calibrators Market, by Group

- Pipette Calibrators Market, by Country

- United States Pipette Calibrators Market

- China Pipette Calibrators Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Reflections on the Role of Advanced Calibration Techniques in Ensuring Laboratory Precision and Sustaining Competitive Edge

The convergence of digital advancements, regulatory mandates, and shifting trade policies is reshaping the pipette calibration sector. Laboratories that invest in automated calibration technologies, integrate their workflows with broader information systems, and embrace predictive maintenance strategies will achieve unprecedented levels of precision and operational efficiency.

At the same time, the evolving U.S. tariff environment underscores the importance of agile supply chain management and strategic localization. Organizations that proactively audit supplier origins, leverage domestic distribution channels, and engage in policy dialogue will mitigate cost pressures and maintain service continuity.

Together, these insights highlight a dual imperative: harness technological innovation to elevate calibration accuracy, and cultivate resilient procurement and compliance frameworks to navigate macroeconomic uncertainties. By adopting these approaches, calibration equipment providers and end users alike can secure a sustainable competitive advantage and drive scientific excellence in laboratories worldwide.

Engage with Ketan Rohom to Secure Exclusive Access to In-Depth Pipette Calibration Intelligence and Propel Your Laboratory Strategies Forward

To explore these comprehensive insights and secure your team’s competitive edge, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, who can provide tailored guidance on acquiring the full report. Elevate your laboratory’s performance and strategic planning by accessing detailed analysis, industry benchmarks, and actionable intelligence tailored to your organizational needs. Dr. Rohom is ready to assist you in unlocking the full potential of these findings and driving impactful outcomes across your calibration operations.

- How big is the Pipette Calibrators Market?

- What is the Pipette Calibrators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?