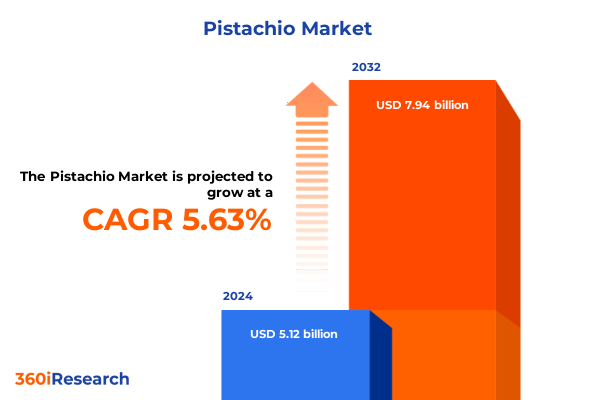

The Pistachio Market size was estimated at USD 5.38 billion in 2025 and expected to reach USD 5.65 billion in 2026, at a CAGR of 5.71% to reach USD 7.94 billion by 2032.

Exploring the Premium Nut Category's Versatility and Multifaceted Growth Drivers in an Increasingly Health-Conscious and Experiential Global Consumer Environment

Pistachios have emerged as one of the most dynamic segments within the global nut category, driven by evolving consumer preferences around health, sustainability, and premium snacking experiences. Globally, consumers are seeking nutrient-dense foods that align with wellness lifestyles, positioning pistachios as a go-to snack recognized for its protein content, healthy fats, and antioxidant profile. Concurrently, the category has transcended traditional snacking into functional ingredients for bakery, confectionery, and plant-based formulations, broadening its application in mainstream and specialty food markets. These multipronged demand drivers have energized both established producers and new market entrants to innovate across cultivars, value-added processing, and packaging formats.

Entering 2025, the pistachio industry landscape is marked by intensified competition, sophisticated supply chains, and accelerated adoption of technology. Strategic partnerships between orchard managers, processors, and distributors are sharpening, as players strive to optimize traceability, reduce waste, and deliver consistent quality. At the same time, digital commerce platforms are reshaping how consumers discover, evaluate, and purchase pistachio products, prompting brands and retailers to elevate direct-to-consumer strategies. Together, these forces are redefining growth trajectories and challenging stakeholders to align operational excellence with consumer-driven innovation.

Understanding the Convergence of Technological Innovations Climate Resilience and Evolving Consumer Preferences That Are Rapidly Transforming the Global Pistachio Landscape

The pistachio landscape is undergoing a transformation propelled by breakthroughs in orchard management, supply chain optimization, and consumer-centric innovations. Climate resilience has become a core focus, with industry leaders investing in drought-tolerant rootstocks and precision irrigation systems that conserve water while stabilizing yields under increasingly erratic weather patterns. Alongside these agronomic advances, genetic breeding programs are delivering new cultivars tailored for uniform shelling, enhanced flavor profiles, and disease resistance, ultimately reducing production risk and strengthening quality consistency.

Simultaneously, digital connectivity is powering end-to-end visibility across the value chain. Real-time monitoring of crop health, automated sorting technologies, and blockchain-enabled traceability are not only ensuring food safety and origin transparency but also enabling more agile response to supply disruptions. On the consumer front, the rise of e-commerce and subscription business models is redefining channel engagement, while flavor innovation-ranging from savory herb infusions to exotic sweet seasonings-continues to expand palates. These intersecting trends are setting a new bar for operational efficiency, sustainable practices, and product differentiation in the pistachio sector.

Assessing the Accumulated Impact of Recent U S Trade Measures and Agricultural Tariff Adjustments on Pistachio Supply Chains and Cost Structures in 2025

Over the past several years, U.S. trade measures have exerted a cascading effect on pistachio supply chains and cost structures, culminating in a complex tariff environment by 2025. Section 232 steel and aluminum duties introduced in 2018 raised the expense of hulling equipment and packing lines, while subsequent Section 301 actions imposed levies on agricultural machinery imported from China, increasing the capital costs of orchard modernization. Additionally, solar module tariffs have indirectly impacted energy expenditures for drying facilities, elevating processing overhead for domestic producers.

These cumulative measures have prompted stakeholders to reevaluate sourcing strategies, with many processors exploring alternative suppliers for equipment and parts to mitigate tariff burdens. At the same time, renegotiations under USMCA and preferential trade agreements have opened limited relief channels for certain inputs, underscoring the importance of strategic duty planning and tariff classification reviews. As input costs remain volatile, profitability margins have come under pressure, encouraging growers and processors to pursue yield improvements, renegotiate logistics contracts, and accelerate investments in tariff avoidance strategies.

Unveiling Key Consumer and Channel Segmentation Dynamics Shaping Product Performance Across Distribution Channels Forms and Organic Status Categories

Examining distribution dynamics reveals that convenience outlets are gaining traction by catering to on-the-go consumers seeking single-serve, portable packages, whereas traditional supermarket hypermarket channels continue to leverage bulk formats and private-label variants to drive volume. Meanwhile, online retail has witnessed exponential growth due to subscription services and targeted digital marketing, capturing consumer segments willing to pay a premium for curated flavor assortments and direct-to-door convenience. Product type segmentation underscores differing consumer occasions: unshelled nuts resonate with at-home uses and nostalgia-driven rituals, while shelled pistachios excel in on-the-go snacking and culinary applications.

Delving into form, raw pistachios maintain a loyal base among health purists focused on minimally processed ingredients, but roasted variants are commanding higher margins through flavor innovation and texture optimization, with salted profiles delivering nostalgic comfort and unsalted options appealing to clean-label advocates. Application analysis highlights the expanding roles of pistachios within foodservice channels-particularly upscale dining and specialty cafés-as well as growing incorporation of pistachio ingredients in bakery, confectionery, and plant-based formulations. Kernel size preferences further segment the market: large-kernel pistachios are prized for premium confectionery and gift sets, medium sizes fit mainstream consumption, and small kernels find niche appeal in blending applications. Finally, the organic segment continues to outpace conventional growth, driven by consumer willingness to pay a premium for sustainably grown, non-GMO nuts.

This comprehensive research report categorizes the Pistachio market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Kernel Size

- Organic Status

- Application

- Distribution Channel

Revealing Regional Contrasts and Growth Patterns Across Americas EMEA and Asia-Pacific Markets That Define Future Pistachio Demand and Supply Opportunities

In the Americas, the United States remains both the leading producer and consumer market for pistachios, supported by a robust infrastructure of large-scale orchards, processing facilities, and a mature retail landscape that balances private-label offerings with branded innovations. Export growth to Canada and Latin American markets continues to build, aided by streamlined logistics corridors and expanded port capacities on the West Coast. Conversely, in Europe, Middle East & Africa, demand is heavily influenced by cultural consumption patterns in Mediterranean countries and by staple usage in confectionery sectors across Western Europe, while Middle Eastern markets favor premium gift packaging during festive seasons. Supply from Iran and Turkey illustrates the competitive pressure on pricing and highlights the importance of quality differentiation.

Asia-Pacific is experiencing the fastest consumption growth, with China and India driving incremental demand through burgeoning middle-class populations and a growing affinity for Western-style snacks. Distribution networks are evolving accordingly, as e-commerce platforms and modern grocery chains extend their reach beyond major urban centers. Regional regulatory frameworks around food safety and import regulations are also maturing, compelling exporters to invest in compliance capabilities and local partnerships to navigate a complex landscape.

This comprehensive research report examines key regions that drive the evolution of the Pistachio market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Positioning and Competitive Agility of Leading Players Driving Innovation Sustainability and Market Expansion in the Pistachio Industry

Leading companies within the pistachio sector are strategically leveraging vertical integration, brand equity, and innovation pipelines to fortify their competitive positions. U.S. based industry consortia have fostered collaboration on research, quality standards, and marketing initiatives, elevating the category’s profile globally. Major multinational players are accelerating acquisitions of regional processors to secure supply stability and margin enhancement, while investing in proprietary flavor development, sustainable packaging solutions, and clean-label certifications to resonate with discerning consumers.

Beyond core producers, strategic alliances with foodservice chains and ingredient formulators are unlocking new demand streams, as companies co-create bespoke pistachio blends for vegan meat analogues, dairy alternatives, and confectionery applications. Simultaneously, investments in renewable energy for drying and processing facilities demonstrate an industry-wide commitment to lowering carbon footprints and achieving long-term cost containment. These efforts underscore a unified drive toward resilience, market differentiation, and the pursuit of higher-value segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pistachio market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arimex UAB

- Besana S.p.A.

- Germack Pistachio Company

- Hellas Farms LLC

- Horizon Growers Cooperative

- Jupiter Pistachios GmbH

- Keenan Farms, Inc.

- Lubeca A/S

- Nichols Farms, Inc.

- Primex Farms, LLC

- Puratos NV/SA

- Ready Roast Nut Company, LLC

- Santa Barbara Pistachio Company, Inc.

- Setton Pistachio of Terra Bella, Inc.

- The Wonderful Company LLC

Delivering Actionable Strategies for Industry Leaders to Enhance Operational Efficiency Mitigate Trade Risks and Capitalize on Emerging Growth Segments

Industry stakeholders seeking to strengthen their market positions should prioritize strategic investments in water-use efficiency technologies to safeguard yields and reduce input volatility. Diversification across distribution channels is critical: enhancing subscription models and direct-to-consumer platforms can complement traditional retail partnerships, while expanding presence in foodservice can tap high-margin occasions. Product innovation must remain at the forefront, with flavor line extensions, functional ingredient integrations, and premium packaging formats designed to meet specific consumer demands.

To mitigate tariff exposure, companies should conduct comprehensive supply-chain audits, exploring alternate equipment suppliers and tariff classification optimizations. Collaborating with industry associations to advocate for regulatory clarity can further reduce compliance risks. Embracing advanced analytics and digital traceability solutions will not only enhance operational visibility but also empower data-driven decision making across procurement, production, and distribution. Ultimately, those who align sustainability commitments with consumer-driven innovation and robust risk management will secure a competitive edge in a rapidly evolving marketplace.

Detailing an Integrated Multi-Source Research Methodology Combining Primary Insights Secondary Data and Rigorous Validation to Ensure Robust Market Intelligence

Our research methodology integrates both primary and secondary approaches to ensure the most robust market intelligence. On the primary side, the study engaged in-depth interviews with key grower associations, processing executives and leading channel partners to capture firsthand perspectives on supply-chain bottlenecks, technology adoption and consumer insights. Concurrently, surveys of specialty and mass-market retailers provided quantitative validation of distribution and pricing dynamics. Secondary sources included comprehensive trade and customs databases, regulatory filings, industry publications and academic research to triangulate macroeconomic trends and tariff developments.

Data triage and validation processes were implemented to resolve discrepancies and reinforce reliability, with proprietary algorithms applied for consistency checks across diverse datasets. Qualitative findings were subjected to expert panel reviews, ensuring that emerging themes were contextualized within strategic imperatives. The integrated approach balances rigorous data analytics with domain expertise, enabling a nuanced understanding of the pistachio ecosystem and laying the foundation for actionable guidance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pistachio market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pistachio Market, by Product Type

- Pistachio Market, by Form

- Pistachio Market, by Kernel Size

- Pistachio Market, by Organic Status

- Pistachio Market, by Application

- Pistachio Market, by Distribution Channel

- Pistachio Market, by Region

- Pistachio Market, by Group

- Pistachio Market, by Country

- United States Pistachio Market

- China Pistachio Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Comprehensive Insights on Market Drivers Challenges and Strategic Imperatives to Chart the Pistachio Industry's Next Growth Trajectory

The pistachio market’s evolution is defined by the interplay of health-driven consumer trends, operational innovations and external trade dynamics. While rising input costs and tariff pressures present tangible challenges, they also spur efficiency improvements and strategic realignments across the value chain. Segmentation insights highlight differentiated opportunities-whether in premium large-kernel offerings, organic-certified lines or direct-to-consumer digital channels-underscoring the importance of tailored strategies that address specific consumer occasions.

Regionally, a diversified approach is essential, as growth trajectories vary markedly between the mature U.S. market, the culturally nuanced EMEA region and the high-growth Asia-Pacific arena. For industry leaders, success will hinge on the ability to fuse sustainability initiatives, advanced analytics and robust risk management into a unified growth agenda. Armed with these consolidated insights, stakeholders are well positioned to navigate complexity and unlock new value in the next phase of pistachio market development.

Connect Directly with Our Associate Director to Unlock In-Depth Market Intelligence and Customized Pistachio Industry Solutions for Strategic Advantage

To secure a comprehensive understanding of the trends shaping the pistachio market and equip your organization with actionable insights, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan will guide you through the report’s highlights, discuss customizing data to your strategic priorities, and ensure you have the intelligence needed to outpace competition. Engage with our expert team today to access detailed analyses on channel dynamics, tariff impacts, regional nuances, and innovation strategies that will accelerate growth and resilience in 2025 and beyond.

- How big is the Pistachio Market?

- What is the Pistachio Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?