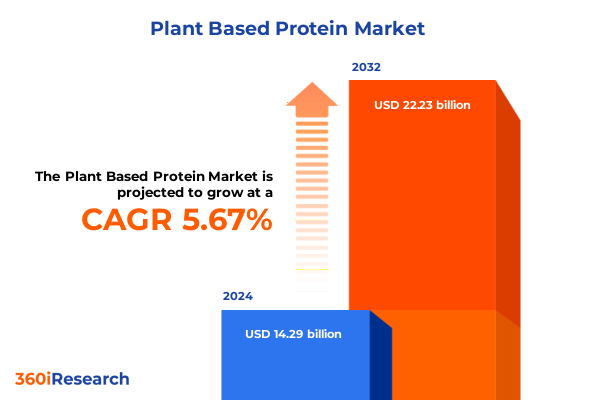

The Plant Based Protein Market size was estimated at USD 14.29 billion in 2024 and expected to reach USD 15.06 billion in 2025, at a CAGR of 5.67% to reach USD 22.23 billion by 2032.

A strategic orientation that frames the plant-based protein landscape for executives facing supply volatility, policy risk, and opportunities in functional innovation

This executive summary opens with a succinct orientation intended for senior leaders making rapid decisions in a volatile global food-ingredient landscape. The plant-based protein sector no longer sits on the perimeter of food-system strategy; it has become a core set of input choices for manufacturers, formulators, retailers, and investors contending with shifting consumer values, supply chain friction, and evolving trade policy. The immediate need for executives is not a primer on categories alone but a clear mapping of commercial risks, supply vectors, and product innovation pathways that will determine competitive position over the next strategic planning cycle.

To that end, this introduction synthesizes the most consequential dynamics shaping sourcing, formulation, and channel economics. It highlights where value is being created-through ingredient diversification, processing technology advances, and premium positioning-and where value is at risk, particularly in commodity-linked feedstocks and cross-border flows. The framing emphasizes actionable priorities: securing resilient ingredient pipelines, investing selectively in functionality-enhancing processing, and accelerating near-term product iterations that deliver recognizable sensory parity for mainstream consumers. This framing primes leaders to interpret subsequent sections through the lens of operational resilience and margin preservation, with an eye toward measured innovation rather than speculative expansion.

Transformative shifts driven by consumer behavior, sourcing reorientation, and processing innovations reshaping ingredient selection and product strategies

The landscape for plant-based protein is shifting through a mix of demand recalibration, raw-material reallocation, and ingredient innovation that is transforming how companies define both risk and opportunity. Consumer reception has proven uneven: while health and sustainability motivations continue to underpin interest, taste, price, and cultural pushback have produce cyclical waves of adoption rather than linear growth. In parallel, primary production and global trade flows for pulse and oilseed crops have reorganized, as new supplier geographies and processing hubs scale to meet demand and as sourcing strategies pivot toward regional resilience.

Technological advances are blurring traditional source boundaries. Novel extractions and functionalization approaches-ranging from enzymatic hydrolysis to fermentation-assisted modification-are enabling pea, chickpea, and even algae proteins to perform more like animal proteins in texture and flavor delivery. This technical progress is enabling manufacturers to substitute across cereals, legumes, oilseeds, and emerging algae inputs with greater predictability. At the same time, product format innovation, especially in high-moisture textured products and clean-label protein blends, is shifting purchasing decisions from ingredient-only criteria to integrated application outcomes. Strategic actors are responding by recombining source mix, processing technology, and distribution strategies to maintain cost and sensory competitiveness. Recent trade actions and supply reorientation have amplified these dynamics, encouraging near-term sourcing diversification and longer-term vertical integration among ingredient buyers to preserve throughput and margin.

Assessment of 2025 U.S. tariff measures and retaliatory responses that have increased landed ingredient costs, supply friction, and sourcing complexity for protein buyers

The cumulative impact of U.S. tariff actions in 2025 has materially increased complexity for protein ingredient sourcing and cost management across the value chain. Broad-brush tariff measures announced in early April introduced a universal minimum duty and a suite of targeted reciprocal levies that can be stacked on existing tariffs, creating immediate cost pressure for finished goods and upstream ingredients alike. For companies that depended on cross-border supply of concentrates, isolates, and specialty flours, the result has been a rapid re-evaluation of landed cost assumptions and an accelerated search for domestic or tariff-exempt alternatives. These policy shifts also raised questions about inventory strategy, trade-compliance burden, and the degree to which tariffs might persist or be retaliated against by trading partners.

Retaliatory measures and specific country responses have compounded uncertainty. Several major trading partners announced countermeasures and targeted restrictions that affect key commodity flows such as soy and pulses, and a number of administrative suspensions of import licences were reported for certain U.S. exporters. The combined effect has been uneven availability of some raw materials in traditional corridors and higher transactional costs for ingredients that are imported or pass through multiple tariff regimes. These trade dynamics favor buyers with diversified supplier networks, flexible formulations that accept alternative protein matrices, and the capacity to absorb short-term margin compression while they reconfigure procurement. Firms that accelerate near-term qualification of multiple suppliers and invest in formulation tolerance testing will reduce exposure to repeated tariff shocks, whereas organizations with single-source dependencies face amplified supply and margin risk.

Clear segmentation signals reveal which sources, product forms, and processing investments deliver the greatest commercial leverage across applications and end-use buyers

Segmentation reveals where competitive advantage is forming and where technical investments will produce the largest commercial returns. Source-wise differentiation between algae-derived proteins-specifically chlorella and spirulina-and more established feedstocks such as cereals, legumes, and oilseeds highlights contrasting commercial pathways. Algae proteins are being positioned for premium applications where nutrient density and sustainability claims drive value, while cereals and pseudocereals like oat, quinoa, rice, and wheat remain central to cost-effective protein fortification and bakery applications. Within legumes, chickpea, lentil, pea, and soy each carry distinct allergen, flavor, and functional profiles that determine suitability across meat alternatives, dairy analogs, and snack segments. Oilseeds and nuts such as canola/rapeseed, pumpkin seed, and sunflower are increasingly valued for their fat-protein matrices that improve mouthfeel and shelf stability.

Product-type and form choices are equally decisive. Concentrates, isolates, and flours offer formulators different balances of cost, flavor, and nutrition, while hydrolysates and functionalized ingredients unlock solubility and emulsification advantages in beverages and high-protein bars. Textured proteins, whether high-moisture or low-moisture, have become mission-critical for meat-replacement applications that demand structure and juiciness. Dry forms-flakes, granules, powder-support long shelf life and broad processing compatibility, whereas liquid formats such as concentrated pastes and ready-to-use bases accelerate manufacturing throughput for high-volume applications. Nature and processing pathways also stratify value: organic positioning and advanced processing technologies like enzymatic hydrolysis, fermentation-assisted modification, and physical treatments (heat, high-pressure, pH-shifting) enable premium pricing and improved sensory performance. Packaging and distribution preferences-bulk for co-manufacturers and pouches, ready-to-drink bottles, or tubs for retail-determine how ingredient suppliers scale and how end-users integrate proteins into final SKUs. Finally, application and end-user segmentation-from animal feed to dietary supplements to diverse food and beverage uses, and across contract manufacturers to retail consumers-shapes go-to-market strategies and margin models, underscoring why companies must align segmentation choices with capabilities in formulation, scale, and channel access.

This comprehensive research report categorizes the Plant Based Protein market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Product Type

- Form

- Nature

- Processing Technology

- Packaging

- Application

- End User

- Distribution Channel

Regional dynamics split across the Americas, Europe-Middle East-Africa, and Asia-Pacific create distinct sourcing, pricing, and regulatory priorities for ingredient buyers

Regional dynamics create differentiated imperatives for sourcing, processing investment, and market entry. In the Americas, proximity to large pulse and oilseed production offers advantages for vertically integrated processors and manufacturers, but exposure to bilateral and multilateral tariff shifts has prompted a reconcentration of sourcing strategies and increased interest in domestic processing capacity. Companies operating here must balance scale advantages against the policy risk that can quickly alter import economics, and should prioritize flexible formulations and near-shore suppliers to sustain throughput.

Europe, the Middle East & Africa presents a mixed picture where regulation, premium positioning on organic and sustainability credentials, and strong R&D clusters drive higher-functional product adoption. European buyers are more likely to pay a premium for traceability and processing technologies that reduce off-notes and improve protein functionality. In contrast, the Middle East and Africa are notable as growth regions for feed and snack applications, incentivizing investments in cost-efficient concentrates and local supply chains. Across the region, regulatory nuance and consumer preference for clean labels make ingredient provenance and certification a primary gating factor.

Asia-Pacific remains the most dynamic in terms of production scale and cost competitiveness. Rapid expansion of pea and pulse processing capacity in select geographies and large-scale demand centers have repositioned Asia-Pacific as both a producer and an importer of protein isolates. That scale drives competitive pricing for global buyers but also concentrates geopolitical and trade risk when policies and bilateral relations tighten, necessitating dual-sourcing strategies and active trade compliance monitoring for any multinational ingredient procurement plan.

This comprehensive research report examines key regions that drive the evolution of the Plant Based Protein market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key competitive patterns show that processing capability, functional innovation, and integrated supply chains determine who captures formulation and application market share

Competitive positioning in the plant-protein ingredient space is increasingly defined by a combination of processing capability, proprietary functionalization techniques, and integrated supply chains. Established agribusiness and ingredient firms have leaned into partnerships and capacity expansions to secure feedstock and control conversion economics, while specialist players focused on algae, fermentation-derived proteins, or advanced texturization stake out higher-margin niches. Firms that bring scale plus formulation capability enjoy advantages in negotiating long-term contracts and delivering application-ready formats to food manufacturers.

Market leaders are differentiating through technology investments-such as high-capacity extraction lines, enzymatic and fermentation platforms, and high-moisture texturization facilities-that reduce sensory trade-offs and broaden use-cases. Strategic collaborations between ingredient houses and food manufacturers accelerate commercial rollouts by pairing ingredient innovation with application expertise. At the same time, a parallel cohort of agile mid-sized firms is winning share by offering modular, rapid-turn product development and faster qualification cycles, which suits brands seeking short time-to-market for differentiated SKUs. Competitive advantage now rests on the ability to combine technical performance with supply resilience and commercialization velocity, rather than pure scale alone.

This comprehensive research report delivers an in-depth overview of the principal market players in the Plant Based Protein market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACI Group Ltd.

- Agropur Cooperative

- AGT Food and Ingredients Inc.

- Ajinomoto Co., Inc

- AMCO Proteins

- Aminola B.V.

- Archer Daniels Midland Company

- Arla Foods Ingredients Group P/S

- Associated British Foods PLC

- Atlantic Natural Foods

- Axiom Foods Inc.

- Batory Foods, Inc.

- BRF S.A.

- Bunge Global SA

- Burcon NutraScience Corporation

- Cargill, Incorporated

- Cooke Inc.

- COSUCRA Groupe Warcoing S.A.

- Dairy Farmers of America, Inc.

- Darling Ingredients Inc.

- DSM-Firmenich AG

- DuPont de Nemours, Inc.

- Eat Just, Inc.

- Emsland Group

- ENOUGH

- Fonterra Co-operative Group Limited

- Fuji Oil Holdings Inc.

- Gelita AG

- Glanbia PLC

- Griffith Foods Worldwide, Inc.

- Gushen Biological Technology Group Co., Ltd.

- Imperial-Oel-Import Handelsgesellschaft mbH

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Kemin Industries, Inc.

- Kerry Group PLC

- Lacto Japan Co., Ltd.

- Lantmännen Group

- Linyi Shansong Biological Products Co., Ltd.

- MGP Ingredients, Inc.

- NCC Food Ingredients

- Nitta Gelatin NA Inc.

- Novo Holdings A/S

- Novonesis Group

- NOW Health Group, Inc.

- Oceana Group

- Proeon

- PURIS

- Relsus Pte Ltd.

- Roquette Freres SA

- Sanimax ABP Inc.

- Shandong Yuwang Group

- SOTEXPRO Forme Juridique

- Tate & Lyle PLC

- Tereos Group

- Tessenderlo Group

- The Green Labs LLC

- The Kraft Heinz Company

- The Scoular Company

- V2 Food Pty Ltd

- Wilmar International Limited

- Yantai Shuangta Food Co., LTD.

Actionable recommendations that prioritize sourcing diversification, process investments, and cross-functional playbooks to protect margins and speed commercialization

Leaders must adopt targeted, actionable moves to protect margin and accelerate viable innovation. The first imperative is to diversify sourcing across both geography and biological family; dual-sourcing pulses, cereals, and oilseed proteins and qualifying algae or novel inputs where functionally appropriate reduce concentration risk. In tandem, companies should prioritize investment in processing technologies that improve solubility, flavor masking, and texture, because technical performance increasingly dictates whether a product achieves mainstream adoption or remains niche.

Second, synchronize procurement, R&D, and commercial teams to enable rapid qualification of alternate inputs and to create formulation libraries that tolerate ingredient substitution without sacrificing sensory acceptability. This requires centralized data on functional performance and cost-to-serve metrics. Third, establish tariff-mitigation and compliance playbooks: scenario modeling for landed cost under layered tariffs, contractual clauses with suppliers that share downside, and near-shoring options where economically feasible. Fourth, accelerate channel-specific product strategies: simplify retail formulations for price-sensitive consumers while reserving more advanced functional proteins for the channels willing to pay for clean-label and performance attributes. Finally, embed strategic partnerships with co-manufacturers and select ingredient developers to reduce time-to-market for proof-of-concept SKUs and to de-risk scale-up decisions. Collectively, these actions prioritize resiliency, technical differentiation, and pragmatic commercialization timelines.

Research methodology combining structured primary interviews, triangulation with public filings, and landed-cost scenario analysis to produce resilient strategic insights

This research synthesizes primary and secondary methods to produce defensible, decision-quality findings. Primary input included structured interviews with procurement leads, R&D heads, and senior commercial officers across ingredient suppliers, co-manufacturers, and brand owners to validate functional performance claims and to surface emergent procurement strategies. Secondary input drew on trade publications, regulatory notices, and company disclosures to triangulate reported capacity additions, partnership announcements, and trade policy developments.

Data were cross-checked through a triangulation approach that reconciled interview insights, public filings, and trade event disclosures. Functional performance claims for processing technologies were validated where possible through vendor technical briefs and application notes. Tariff and policy impacts were modeled using landed-cost scenarios that reflect stacking of new levies on top of existing duties and reported retaliatory actions. Where estimates were directional rather than precise, findings emphasize relative movement and risk exposure rather than absolute projections, ensuring that recommendations remain actionable under different trade and demand assumptions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Plant Based Protein market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Plant Based Protein Market, by Source

- Plant Based Protein Market, by Product Type

- Plant Based Protein Market, by Form

- Plant Based Protein Market, by Nature

- Plant Based Protein Market, by Processing Technology

- Plant Based Protein Market, by Packaging

- Plant Based Protein Market, by Application

- Plant Based Protein Market, by End User

- Plant Based Protein Market, by Distribution Channel

- Plant Based Protein Market, by Region

- Plant Based Protein Market, by Group

- Plant Based Protein Market, by Country

- United States Plant Based Protein Market

- China Plant Based Protein Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 3816 ]

Conclusion that emphasizes the need to balance functional innovation, sourcing resilience, and policy-aware scenario planning to retain commercial momentum

In conclusion, the plant-based protein landscape for ingredient and product strategists is defined by three concurrent imperatives: technical performance, supply resilience, and regulatory navigation. Advances in processing and functionalization are steadily reducing sensory gaps and enabling broader substitution across cereals, legumes, oilseeds, and algae, which creates fresh product opportunities. At the same time, policy-driven trade uncertainty and the reconfiguration of global pulse and oilseed flows have made procurement more complex, raising the value of diversified sourcing and rapid supplier qualification.

Companies that align R&D investment with pragmatic procurement and tariff-mitigation strategies will be best positioned to protect margins and capture growth where consumer preferences favor sustainability and functional nutrition. The near-term window rewards disciplined innovation-delivering demonstrable sensory parity and cost competitiveness-rather than speculative expansion into unproven channels. For leaders, the operational task is clear: shore up supply flexibility, accelerate functional performance improvements that matter to consumers, and institutionalize scenario planning to absorb policy shocks while pursuing measured market expansion.

Engage the Associate Director for a private briefing and report purchase to secure tailored plant-based protein intelligence and licensing options

For procurement, strategy, or to secure a full copy of the comprehensive plant-based protein market report, please contact Ketan Rohom, Associate Director, Sales & Marketing, to arrange a tailored briefing and purchase. Ketan can walk prospective buyers through available chapters, custom data pulls, and licensing options so decision-makers rapidly align insights to product roadmaps, sourcing strategies, or investor diligence needs. Engaging directly with the sales lead expedites access to reproducible tables, primary interview excerpts, and bespoke segmentation outputs that support cross-functional planning and commercial deployment.

A short briefing with the sales lead can clarify which sections of the research best support a client’s objectives, whether the focus is ingredient sourcing, manufacturing technology selection, channel go-to-market strategies, or regulatory exposure. Timely engagement also unlocks client-only addenda and dynamic data feeds where available, enabling teams to translate the report’s findings into procurement scenarios, cost-risk assessments, or partnership prioritization. Reach out to coordinate a demo and confirm scope, licensing, and timelines so buyers receive an actionable bundle calibrated to their commercial priorities.

- How big is the Plant Based Protein Market?

- What is the Plant Based Protein Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?