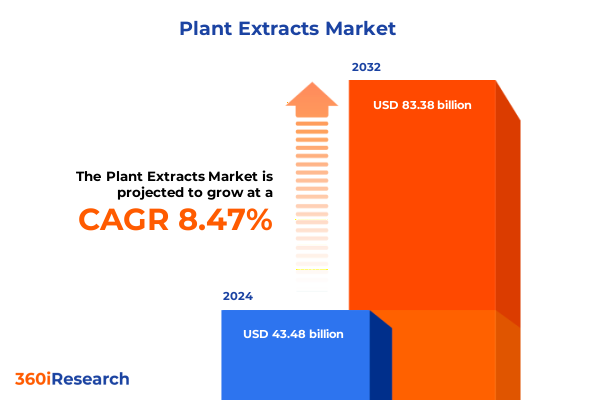

The Plant Extracts Market size was estimated at USD 47.04 billion in 2025 and expected to reach USD 50.91 billion in 2026, at a CAGR of 8.51% to reach USD 83.38 billion by 2032.

Unlocking the Power of Botanical Science to Illuminate the Expansive Global Landscape of Innovative Plant Extracts Applications Across Key Sectors

The global interest in plant extracts has surged as organizations and consumers alike seek natural, sustainable solutions to health, wellness, and personal care needs. Driven by heightened consumer awareness about clean-label ingredients, the plant extracts market is now central to innovation across multiple end-use sectors. Companies are shifting focus toward naturally derived bioactive compounds that offer proven health benefits without synthetic additives, aligning with stringent regulatory frameworks that favor transparency and safety. In parallel, sustainability considerations are reshaping sourcing strategies, with traceability and environmentally responsible cultivation practices taking precedence. Such factors are converging to create an ecosystem where botanical science and commercial imperatives intersect, fostering growth avenues for pioneers in extraction, formulation, and distribution.

Moreover, technological advancements in extraction and purification methods continue to redefine what is possible with botanical materials. From innovative solvent alternatives to precision-controlled processes that maximize yield and bioactivity, these breakthroughs are elevating the performance profile of plant-based ingredients. Simultaneously, research investments in phytochemistry and molecular characterization are uncovering novel compounds with untapped potential. This convergence of consumer demand, regulatory support, and technological capability underscores the critical moment the plant extracts industry finds itself in. As stakeholders navigate these dynamics, a clear view of market drivers and enablers will be essential for charting successful strategies in an increasingly complex landscape.

Mapping the Major Shifts Reshaping the Plant Extracts Market from Sustainable Sourcing to Advanced Extraction Breakthroughs and Evolving Consumer Preferences

The plant extracts market is undergoing transformative shifts that are redefining traditional value chains and product innovation. Environmental sustainability has risen to the top of the agenda, pushing companies to adopt regenerative agricultural practices and pursue certifications that attest to responsible stewardship. This shift is not merely ethical but commercial, as end-users demand clean supply chains free from harmful agrochemicals and deforestation ties. Consequently, partnerships between extraction specialists and sustainable growers are becoming more prevalent, ensuring consistent raw material quality while maintaining ecological balance.

Simultaneously, advances in extraction technologies-ranging from supercritical CO2 and enzyme-assisted methods to ultrasonic- and microwave-assisted processes-are offering new levels of efficiency and selectivity. These techniques reduce solvent usage, preserve delicate phytochemicals, and unlock previously inaccessible fractions, enabling bespoke ingredient solutions tailored to specific applications. In tandem, digitalization and data analytics are enhancing process monitoring and quality control, delivering unprecedented levels of traceability and batch consistency.

At the same time, rising interest in personalized health and clean beauty has stimulated demand for specialized functional extracts with targeted benefits. Innovations in formulation science are integrating plant-derived compounds into next-generation delivery systems, including encapsulated powders and ready-to-drink formats that enhance bioavailability. Taken together, these evolving consumer preferences and technological capabilities are forging a market where agility and innovation determine leadership.

Assessing the Far-reaching Cumulative Impact of 2025 United States Tariff Measures on the Dynamic Plant Extracts Supply Chain

The United States’ implementation of tariff measures on select botanical raw materials throughout 2025 has generated significant ripple effects across the plant extracts supply chain. Import duties imposed on bulk herbs and specialized bioactive powders have elevated input costs for manufacturers, prompting many to explore alternative sourcing strategies. While some companies have absorbed these expenses to maintain price stability for end customers, others have accelerated initiatives to nearshore procurement or cultivate strategic partnerships with growers in tariff-friendly regions to mitigate financial strain.

As a cumulative outcome, the tariff environment has encouraged a diversification of supply networks. Stakeholders are increasingly evaluating domestic and hemispheric production alongside traditional Asian and European suppliers. This realignment is not solely cost-driven; it is also part of a broader risk management framework assessing geopolitical volatility, currency fluctuations, and compliance complexities. Concurrently, research and development teams are optimizing extraction and concentration techniques to counterbalance cost pressures by maximizing active yields and minimizing waste.

Moreover, downstream participants in cosmetics, nutraceuticals, and functional foods are recalibrating their value propositions to reflect shifting cost structures. Marketing messages emphasize traceability, quality assurance, and product efficacy to justify premium positioning even in the face of higher raw material expenses. In essence, the 2025 U.S. tariff landscape has acted as a catalyst for supply chain innovation, compelling the industry to rethink traditional models and reinforce resilience against future trade uncertainties.

Illuminating Essential Segmentation Landscape to Unlock Deep Insights across Applications Types Extraction Technologies Forms Functionalities and Sales Channels

A granular examination of market segmentation reveals a tapestry of interlocking opportunities shaped by applications, botanical types, extraction platforms, product forms, functionality attributes, and sales channels. In terms of application, the plant extracts space extends beyond traditional pharmaceuticals to encompass animal feed compositions such as aquafeed, livestock feed, and poultry feed, alongside cosmetics and personal care segments including haircare, oral care, and skincare. Simultaneously, the food and beverage domain integrates functional beverages, functional foods, and seasoning and spice blends, while nutraceutical and dietary supplements encapsulate capsules and tablets, gummies, powders, and ready-to-drink offerings.

When viewed through the lens of botanical type, the market draws on heritage ingredients such as garlic, gingko, ginseng, green tea, and turmeric-each bringing distinctive phytochemical profiles that inform product positioning and efficacy claims. Meanwhile, diverse extraction technologies from cold press and enzyme-assisted approaches to microwave- and ultrasonic-assisted processes, steam distillation, supercritical CO2, and solvent extraction are enabling tailored recovery of target compounds. This breadth of technological choice supports the creation of standardized extracts and highly concentrated isolates alike.

Regarding product form, stakeholders deliver extracts in capsule, liquid, powder, and tablet formats, catering to consumption preferences and application requirements. Functionality segmentation highlights anti-inflammatory, anticancer, antimicrobial, antioxidant, and digestive health benefits, reflecting the evolving demands of health-oriented consumers. Finally, the distribution landscape spans direct sales alongside traditional brick-and-mortar retail and digitally powered online platforms, illustrating a continuum of engagement models. The interplay among these segments underpins strategic decision-making, investment priorities, and innovation roadmaps across the market.

This comprehensive research report categorizes the Plant Extracts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Form

- Extraction Technology

- Functionality

- Application

- Sales Channel

Unlocking Pivotal Regional Insights Revealing Unique Drivers Opportunities and Challenges among Americas Europe Middle East Africa and Asia Pacific

Regional dynamics in the plant extracts market underscore distinct growth patterns and strategic implications across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, the United States maintains its position as both a major consumer market and innovation hub, driven by robust regulatory frameworks and a vibrant nutraceutical industry. Canada and Latin American sources provide complementary strength, supplying sustainably cultivated raw materials that support North American refiners and formulators seeking high-quality input. Strategic trade agreements within the Western Hemisphere continue to facilitate tariff-friendly exchanges, bolstering supply chain resilience.

Turning to Europe, the Middle East and Africa, European Union regulations on food safety and cosmetic ingredient approval have set high standards for botanical authenticity and traceability. This has fostered an environment where certified organic and ethically sourced extracts command premium positioning. Meanwhile, Middle Eastern markets are embracing botanical actives in both beauty and wellness applications, influenced by cultural heritage and modern lifestyle aspirations. In Africa, emerging extraction initiatives and public-private partnerships aim to maximize the continent’s rich biodiversity, although infrastructure constraints and regulatory variability present ongoing challenges.

In Asia Pacific, the convergence of traditional medicinal knowledge with large-scale agricultural production underscores the region’s dominance in both supply and demand. China’s well-established herb cultivation and extraction capabilities, combined with India’s long history of Ayurvedic practices, deliver a steady pipeline of botanical ingredients. At the same time, growing consumer affluence in Southeast Asia, Japan, and Australia is expanding the downstream market for premium plant-derived formulations. Collectively, these regional drivers emphasize that localized strategies and collaborative networks are essential for capturing growth across geographies.

This comprehensive research report examines key regions that drive the evolution of the Plant Extracts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling the Strategic Dynamics and Competitive Positioning of Leading Players Shaping the Evolution of the Global Plant Extracts Industry

The competitive landscape of the plant extracts industry is defined by a blend of established ingredient suppliers, emerging biotechnology innovators, and specialized contract manufacturers. Leading organizations are deepening their portfolios through strategic acquisitions and partnerships, securing access to rare botanicals and proprietary extraction platforms. Concurrently, nimble startups and academic spin-offs are accelerating the commercialization of novel bioactive molecules through venture funding and co-development agreements. This dual-track dynamic is fostering a vibrant ecosystem where scale and specialization coexist.

In addition to structural consolidation, companies are investing heavily in traceability solutions, leveraging blockchain and digital monitoring to provide end-to-end visibility from farm to finished product. These investments cater to consumer demands for transparency and regulatory requirements for ingredient documentation. Research alliances between industry players and universities are also expanding the frontiers of phytochemical discovery, enabling the translation of traditional botanical knowledge into scientifically validated ingredient solutions.

Moreover, leading market participants are enhancing competitiveness through regionally integrated supply chains that balance cost efficiency with quality control. These supply models often combine global sourcing networks with local processing hubs, optimizing logistics and reducing carbon footprints. In parallel, marketing strategies are increasingly anchored in evidence-based efficacy demonstrations, underscoring the importance of clinical studies and peer-reviewed research to support health claims. Together, these strategic moves illustrate how companies are fortifying their positions to thrive in a rapidly evolving market environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Plant Extracts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- Bio Answer Holdings Inc.

- Blue Sky Botanics Ltd.

- Botanic Healthcare Group

- Dohler GmbH

- Euromed S.A.

- FLAVEX Naturextrakte GmbH

- Givaudan S.A.

- Herbal Creations

- Indena Spa

- International Flavors & Fragrances Inc.

- Kalsec Inc.

- Kemin Industries Inc.

- Kerry Group plc

- Koninklijke DSM N.V.

- Kuber Impex Ltd

- Martin Bauer GmbH & Co. KG

- Natac, S.L.U

- Native Extracts Pty Ltd.

- Novonesis Group

- Organic Herb Inc.

- S.A. Herbal Bioactives LLP

- Sensient Technologies Corporation

- Symrise AG

- Synthite Industries Ltd.

- Tokiwa Phytochemical Co., Ltd.

- Vidya Herbs Pvt. Ltd.

Actionable Strategic Recommendations Empowering Leaders to Capitalize on Emerging Trends and Drive Sustainable Growth in the Plant Extracts Sector

Industry leaders can strengthen their competitive edge by prioritizing the adoption of green extraction technologies that reduce environmental impact and enhance yield consistency. By investing in pilot-scale trials of supercritical CO2 or enzyme-assisted systems, organizations can demonstrate sustainability credentials while improving the purity and potency of botanical actives. Furthermore, forging long-term partnerships with growers in diversified geographies will mitigate the risks associated with single-source dependencies and trade disruptions.

To capitalize on emergent demand trends, companies should integrate advanced analytics within their innovation pipelines to identify high-potential phytochemicals tied to anti-inflammatory, antioxidant, or digestive health functionalities. Leveraging consumer insights and clinical evidence, product development teams can tailor offerings that resonate with wellness-focused audiences and meet evolving regulatory standards. Concurrently, enhancing omnichannel engagement-spanning direct sales, offline retail activation, and personalized digital platforms-will be critical for reaching target demographics and deepening brand loyalty.

Organizations should also engage in open innovation frameworks, collaborating with research institutes and biotech startups to co-create proprietary ingredient libraries. This approach accelerates discovery timelines and diversifies product portfolios without bearing the full burden of R&D expenditure. Finally, embedding a culture of continuous improvement across supply chain operations-through regular audits, digital traceability systems, and quality assurance protocols-will ensure the reliability and compliance required to maintain premium market positioning.

Detailing a Comprehensive Research Methodology Integrating Diverse Primary Secondary and Analytical Approaches to Ensure Robust Market Insights

This study employs a rigorous research methodology combining primary and secondary data sources to deliver comprehensive insights into the plant extracts market. Primary research involved in-depth interviews with senior executives, R&D specialists, and procurement managers across leading ingredient suppliers, end-use manufacturers, and industry associations. These conversations provided qualitative perspectives on strategic priorities, supply chain dynamics, and innovation pipelines.

Complementing this, secondary research encompassed an extensive review of regulatory filings, trade databases, academic journals, and industry publications to aggregate quantitative data on production capacities, export volumes, and consumption patterns. Proprietary databases and historical market performance records informed trend analyses, while company reports and press releases offered context for recent strategic initiatives.

Analytical techniques integrated both qualitative frameworks such as SWOT and Porter’s Five Forces with quantitative methods including CAGR analysis and price variance assessments. Data triangulation was employed to validate findings across multiple sources, and an expert advisory panel provided iterative feedback to refine assumptions and ensure relevance. This multi-tiered approach ensures that the research delivers actionable, reliable, and holistic market insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Plant Extracts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Plant Extracts Market, by Source

- Plant Extracts Market, by Form

- Plant Extracts Market, by Extraction Technology

- Plant Extracts Market, by Functionality

- Plant Extracts Market, by Application

- Plant Extracts Market, by Sales Channel

- Plant Extracts Market, by Region

- Plant Extracts Market, by Group

- Plant Extracts Market, by Country

- United States Plant Extracts Market

- China Plant Extracts Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Drawing Conclusive Insights That Synthesize Key Findings and Highlight the Strategic Imperatives Shaping the Future Trajectory of Plant Extracts

The convergence of sustainability imperatives, advanced extraction technologies, and evolving consumer preferences positions the plant extracts market at a pivotal juncture. As regulatory landscapes tighten and supply chain resilience becomes paramount, stakeholders must balance cost optimization with quality assurance and environmental responsibility. The ripple effects of 2025 U.S. tariff measures have underscored the importance of diversified sourcing and strategic nearshoring, catalyzing innovation in both procurement and process engineering.

Segmentation analysis reveals that opportunities abound across applications from animal feed and personal care to functional foods, dietary supplements, and pharmaceutical formulations. By understanding the distinct requirements of each segment-whether targeting antioxidant capacity, digestive health benefits, or antimicrobial efficacy-organizations can tailor their investments and product launches for maximum impact. Furthermore, regional variances in regulatory frameworks, consumer behavior, and raw material availability underscore that localized strategies are key to unlocking growth.

Looking ahead, companies that embrace open innovation, foster cross-sector collaborations, and integrate digital traceability will be best equipped to navigate market complexities. Strategic partnerships with biotech innovators, investment in clinical validation, and a steadfast commitment to sustainability will define the leaders of the next wave of botanical ingredient development.

In summary, the plant extracts ecosystem is evolving rapidly, driven by a blend of technological advancements, trade dynamics, and consumer demands. Those who align their strategic priorities with these core trends will capture value and shape the future trajectory of this vibrant industry.

Take Action Today by Contacting Ketan Rohom to Secure Exclusive Access to The Definitive Market Research Report on Plant Extracts

To access the full breadth of strategic intelligence and customized analysis on the plant extracts market, reach out to Ketan Rohom to secure your report today. His in-depth understanding of industry nuances and tailored approach will ensure you receive the insights needed to make informed decisions and stay ahead in this rapidly evolving sector. Don’t miss the opportunity to leverage a comprehensive research resource that delivers actionable recommendations, definitive segmentation breakdowns, and region-specific analysis all in one indispensable package.

- How big is the Plant Extracts Market?

- What is the Plant Extracts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?