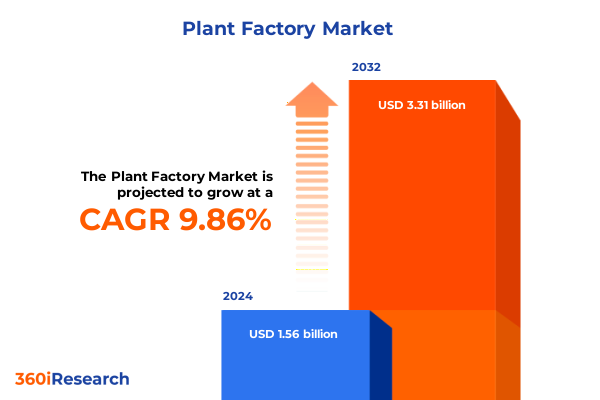

The Plant Factory Market size was estimated at USD 1.50 billion in 2025 and expected to reach USD 1.68 billion in 2026, at a CAGR of 11.99% to reach USD 3.33 billion by 2032.

Discovering the Rise of Controlled-Environment Agriculture and the Strategic Role of Plant Factories in Modern Food Production Paradigms

Plant factories represent a revolutionary shift in agricultural practice, transforming traditional food production into a precise, controlled-environment paradigm that addresses global challenges such as urbanization, supply chain disruption, and resource scarcity. By leveraging advanced technologies in climate management, lighting, and nutrient delivery, these facilities ensure consistent crop quality and yield while minimizing water use and land footprint. This report provides decision-makers and stakeholders a roadmap to understanding the critical forces shaping this space and highlights strategic considerations for capitalizing on emerging trends.

As consumer demand for year-round, fresh produce intensifies, plant factories have evolved from pilot projects to large-scale operations, supported by innovations in automation, system integration, and data analytics. This introduction paints a comprehensive picture of the plant factory landscape, underlining its significance as a scalable, sustainable solution to food security and showing how stakeholders can navigate market complexity to achieve operational excellence and competitive differentiation.

Exploring How Technological Breakthroughs and Strategic Partnerships Are Recasting the Plant Factory Sector Landscape

In recent years, the controlled-environment agriculture sector has undergone transformative shifts driven by technological advancements and evolving market expectations. Innovations in LED lighting have unlocked spectral tuning capabilities that optimize photosynthesis and energy efficiency, while climate control platforms now integrate predictive algorithms for real-time environmental adjustments. These developments have redefined what constitutes best practices in facility design and operation, enabling growers to achieve unprecedented consistency and quality across crop cycles.

Simultaneously, the convergence of IoT sensors, robotics, and AI-powered analytics has facilitated a new era of precision agriculture, where granular insights into plant physiology and system performance inform dynamic decision-making. This fusion of hardware and software has significantly reduced labor dependencies, enhanced traceability, and bolstered sustainability credentials by minimizing resource overuse. Furthermore, mounting investor interest and strategic partnerships have accelerated commercialization efforts, fostering ecosystem development and lowering barriers to entry for mid-sized and emerging operators.

Analyzing the Ramifications of Newly Implemented United States Tariff Regimes on Plant Factory Equipment and Supply Chains

The introduction of new tariff measures in the United States during 2025 has reshaped the competitive dynamics of the plant factory industry, particularly for imports of critical hardware components such as climate control units, lighting modules, and nutrient delivery systems. Domestic manufacturers have cited tariff protections as a means to bolster local production capacity, while international suppliers have revisited pricing and supply chain strategies to mitigate margin pressure.

Consequently, plant factory operators have had to adapt procurement calendars, explore alternative sourcing from tariff-exempt regions, and accelerate localization of key component manufacturing. These adjustments have introduced complexity into project planning cycles and necessitated reevaluation of capital expenditure models. In this context, a hybrid approach-blending imported high-specification modules with domestically produced equipment-has emerged as a prudent pathway to balance cost efficiency with technological performance objectives.

Unveiling the Nuanced Layering of Component, System, Automation, Crop, Structural, and End-User Segmentation Dynamics

The plant factory ecosystem can be deconstructed into distinct segments that reveal unique opportunities and challenges. When examining components, the emphasis on climate control systems extends to specialized HVAC assemblies, precision thermostat controls, and advanced ventilation frameworks that ensure stable growing conditions. Within the growing materials domain, the dichotomy between engineered growing media and balanced nutrient solutions underscores the importance of substrate optimization alongside hydroponic formulations. Lighting systems present a multi-faceted landscape that spans traditional fluorescent and HID arrays through to induction modules and the latest high-efficacy LED architectures, each catering to diverse crop photobiology needs.

Looking at growing systems, aeroponics and aquaponics demonstrate resource-efficient vertical integration with water-based cultivation methods, while hybrid and hydroponic frameworks continue to lead scalability efforts alongside soil-based approaches that retain familiar agronomic principles. The spectrum of automation-from fully automated smart farms to manual and semi-automated operations-highlights varying capital intensities and operational skill requirements. Crop type segmentation further delineates market focus, with flowering ornamentals like lilies, orchids, and roses, alongside fruiting crops such as bell peppers, strawberries, and tomatoes, sharing the spotlight with herb varieties including basil, cilantro, mint, and parsley as well as leafy greens like arugula, kale, lettuce, and spinach. Structural distinctions among greenhouses, indoor farms, and vertical farms influence real estate footprints and system architectures, while end-user categories split between large-scale commercial growers and direct consumer applications, underscoring the breadth of market engagement strategies.

This comprehensive research report categorizes the Plant Factory market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Growing System

- Automation Level

- Facility Type

- Technology Type

- Crop Type

- End-User

Examining the Distinctive Development Paths and Policy Drivers Shaping Plant Factory Adoption Across Global Regions

Regional analysis of the plant factory market reveals divergent development trajectories and strategic priorities. In the Americas, a combination of technological leadership and robust venture funding has propelled vertical farming startups and large commercial installations, with a growing emphasis on reducing carbon footprints and localizing fresh produce availability in urban centers. Meanwhile, Europe, Middle East & Africa exhibits a fragmented yet synergistic landscape, where stringent sustainability regulations in Western Europe intersect with rapid desert agriculture innovation in the Middle East, fostering a blend of policy-driven adoption and private sector investment.

Transitioning to Asia-Pacific, expansive urbanization and favorable government incentives in East Asia and parts of Oceania have accelerated facility rollouts, with emerging markets in Southeast Asia demonstrating strong interest in food security applications. Throughout these regions, climatic variations, infrastructure maturity, and regulatory frameworks shape the pace of technology uptake and the configuration of plant factory solutions. Understanding these regional nuances is critical for tailoring product offerings and partnership models to local requirements and growth drivers.

This comprehensive research report examines key regions that drive the evolution of the Plant Factory market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Strategic Moves and Innovative Offerings of Market Leaders Driving Plant Factory Evolution

Leading players in the plant factory arena have rapidly expanded their portfolios through strategic collaborations, product innovation, and selective acquisitions. Key lighting specialists have introduced modular LED fixtures with customizable spectra to meet specific crop photoperiod requirements, while climate control innovators have leveraged cloud-based platforms to deliver subscription-based environmental management services. Companies specializing in nutrient formulations have partnered with biotechnology firms to develop bioactive nutrient blends that enhance plant immunity and accelerate growth cycles.

Noteworthy market entrants have also emerged from adjacent industries, including traditional greenhouse equipment suppliers and industrial automation conglomerates, applying their engineering prowess to the controlled-environment segment. Collectively, these organizations are refining end-to-end solutions-integrating hardware, software, and service components-to create unified platforms that streamline installation, monitoring, and optimization. Their competitive strategies underscore the importance of scalability, interoperability, and total cost of ownership in capturing a growing customer base across commercial and consumer segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Plant Factory market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AeroFarms, Inc.

- Signify N.V.

- Gotham Greens Holdings, PBC

- Taikisha Ltd.

- ams-OSRAM AG

- Plenty Unlimited Inc.

- BrightFarms, Inc.

- Oishii

- Babylon Micro-Farms

- Spread Co., Ltd.

- MIRAI Co., Ltd.

- Freight Farms, Inc.

- FUJIAN SANANBIO TECHNOLOGY CO.,LTD.

- Vertical Harvest Farms

- Square Roots Urban Growers, Inc.

- TruLeaf Sustainable Agriculture

- CityCrop Automated Indoor Farming P.C

- YesHealth Agri-Biotechnology Co., Ltd.

- Urban Crop Solutions BV

- 4D Bios, Inc.

- AGEYE Technologies, Inc.

- AppHarvest, Inc.

- Artechno Growsystems

- Avisomo

- CubicFarm Systems Corp.

- Danfoss A/S

- FARMINOVA Plant Factory by CANTEK GROUP

- Inevitable Tech

- Lowpad

- Lufa Farms Inc.

- Mitsubishi Chemical Group Corporation

- Sky Greens

- Smallhold

- VerticalField

Implementing Standardized Modular Platforms and Data-Driven Partnerships to Accelerate Sustainable Growth

To navigate this rapidly evolving sector, industry leaders should prioritize the consolidation of modular technologies into standardized platforms that reduce integration risks and lower adoption barriers for new entrants. Emphasizing open architecture and interoperability will facilitate seamless expansion and foster a vibrant ecosystem of complementary solutions. Furthermore, operators should incorporate robust data analytics capabilities from the outset, leveraging predictive insights not only to optimize plant performance but also to refine maintenance schedules and supply chain resilience.

Collaboration between system providers and research institutions can accelerate product validation and drive continuous improvement in lighting spectra and nutrient protocols. Executives should also consider forging strategic alliances with logistics and distribution partners to enhance last-mile delivery of perishable produce. Finally, balancing capital deployment between automation investments and workforce development will ensure that skilled personnel can fully harness emerging digital tools, ultimately driving operational efficiency and long-term sustainability.

Detailing a Triangulated Research Framework Combining Secondary Sources and Field-Verified Expert Insights for Rigorous Analysis

Our research approach combined extensive secondary research, drawing on scientific journals, industry whitepapers, and regulatory publications, with primary insights gleaned from expert interviews and site visits to operational plant factories. Quantitative data were validated through cross-referencing technical specifications and public disclosures, while qualitative assessments incorporated feedback from growers, technology vendors, and logistics providers. The segmentation framework was developed iteratively, ensuring alignment with real-world practice and stakeholder priorities.

Analysts also applied triangulation methods to reconcile divergent viewpoints and employed scenario analysis to stress-test the impact of policy shifts, tariff changes, and emerging technology adoption rates. The regional mapping exercise utilized proprietary databases and geospatial overlays, illuminating growth pockets and investment hotspots. This rigorous methodology underpins the credibility of our insights and provides a transparent audit trail of assumptions and data sources.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Plant Factory market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Plant Factory Market, by Growing System

- Plant Factory Market, by Automation Level

- Plant Factory Market, by Facility Type

- Plant Factory Market, by Technology Type

- Plant Factory Market, by Crop Type

- Plant Factory Market, by End-User

- Plant Factory Market, by Region

- Plant Factory Market, by Group

- Plant Factory Market, by Country

- United States Plant Factory Market

- China Plant Factory Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Synthesizing Innovation, Regulation, and Strategic Agility as the Cornerstones of Future Success in Plant Factory Markets

In summary, the plant factory segment stands at the intersection of food security, technological innovation, and sustainable development, offering a compelling avenue for stakeholders to future-proof operations. The convergence of advanced lighting, precision climate control, and integrated automation is redefining efficiency benchmarks and unlocking new revenue models through vertical integration and service offerings.

Looking ahead, strategic agility will determine which organizations capture the most value, as regulatory landscapes evolve and capital flows gravitate towards proven scalable solutions. By understanding segmentation intricacies, regional dynamics, and the competitive landscape, decision-makers can chart pathways to success that balance risk with opportunity. The imperative is clear: embracing an ecosystem mindset, fostering strategic partnerships, and maintaining a relentless focus on data-driven performance will be key to thriving in the next chapter of controlled-environment agriculture.

Unlock Competitive Advantage in Controlled-Environment Agriculture with Expert Insights and Personalized Consultation Opportunities

For personalized guidance on how plant factory innovations can be tailored to your strategic goals, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Our team is prepared to walk you through the comprehensive findings of this report, including detailed breakdowns of technology integrations, regional nuances, and segmentation specifics that are critical for informed decision-making. Engage with us today to explore targeted solutions that will drive operational efficiency, sustainability objectives, and return on investment in your plant factory endeavors. Secure your competitive advantage by leveraging our expert analysis and actionable insights-contact Ketan to discuss custom enterprise packages and unlock the full potential of controlled-environment agriculture.

- How big is the Plant Factory Market?

- What is the Plant Factory Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?