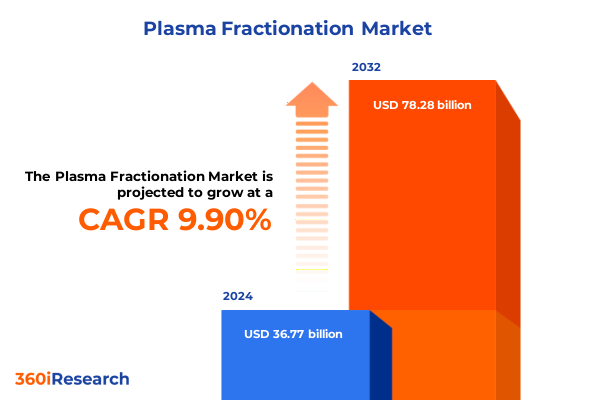

The Plasma Fractionation Market size was estimated at USD 40.22 billion in 2025 and expected to reach USD 44.05 billion in 2026, at a CAGR of 9.97% to reach USD 78.28 billion by 2032.

Exploring the Critical Role and Evolution of Plasma Fractionation in Delivering High-Purity Therapeutic Proteins to Modern Healthcare

Plasma fractionation remains a foundational pillar in modern therapeutic protein production, leveraging time-tested biochemical principles to isolate life-saving plasma components from donor blood. Originally conceptualized in the 1940s, this process has evolved to accommodate advanced separation methods while maintaining the core objective of yielding high-purity albumin, immunoglobulins, coagulation factors, and protease inhibitors from human plasma. Its significance spans critical care, immunodeficiency treatment, and transfusion medicine, underpinning therapies that address a spectrum of hematological, neurological, oncological, and rheumatological conditions.

The advent of the Cohn process introduced cold ethanol precipitation and cryoprecipitation as key fractionation steps, enabling selective protein recovery based on solubility, pH, temperature, and ionic strength parameters. This methodology, refined over eight decades, paved the way for large-scale industrial application and established a robust platform for subsequent innovations in chromatography and viral safety measures.

Beyond therapeutic applications, plasma fractionation supports analytical and diagnostic endeavors by facilitating the removal of high-abundance proteins to reveal low-concentration biomarkers, thus driving advancements in proteomics and personalized medicine. Today, the process integrates multi-step precipitation, centrifugation, and filtration, underscored by rigorous regulatory oversight to ensure patient safety and product efficacy.

How Technological, Regulatory, and Operational Advancements Are Redefining Plasma Fractionation Processes for Enhanced Safety and Purity

Over recent decades, plasma fractionation technology has undergone transformative shifts driven by the integration of chromatographic techniques, dedicated viral inactivation processes, and automation to meet growing safety and purity demands. Traditional ethanol precipitation steps have been augmented by large-scale ion-exchange and affinity chromatography systems to enhance protein recovery yields and achieve higher purity profiles for critical plasma-derived therapies such as intravenous immunoglobulin (IVIG) and coagulation factor concentrates.

Concurrent advancements in virus removal technologies, including low-pH incubation, solvent–detergent treatment, caprylic acid, and nanofiltration, have significantly increased the safety margins against both enveloped and nonenveloped viral contaminants. These measures have become integral to modern fractionation workflows, ensuring compliance with stringent regulatory guidelines and bolstering confidence among healthcare providers and patients.

Moreover, the evolution of continuous-flow centrifugation, high-throughput tangential flow filtration, and digital process controls has optimized operational efficiency, reduced processing times, and facilitated real-time monitoring of critical quality parameters. This confluence of technological and regulatory enhancements has redefined plasma fractionation into a highly controlled pursuit of process excellence, meeting the intricate needs of life-saving biotherapies.

Assessing the Cumulative Impact of 2025 U.S. Tariffs on Plasma Fractionation Supply Chains, Costs, and Strategic Sourcing Decisions

In 2025, a 10% global tariff on nearly all imports into the United States, including active pharmaceutical ingredients and plasma fractionation supplies, came into effect on April 5, impacting the cost base for raw materials and consumables critical to therapeutic protein production. Simultaneously, reciprocal Section 301 tariffs of up to 25% on key drug intermediates sourced from China, and 20% on imports from India, have introduced additional cost pressures for chromatography resins, caprylate reagents, and specialized filtration membranes used in fractionation workflows.

Tariffs of 15% on medical packaging, glass vials, and diagnostic instruments have further escalated expenses associated with final product fill–finish operations. Moreover, a 25% levy on pharmaceutical manufacturing equipment, including lyophilization systems and high-capacity centrifuges, has delayed planned capital expansions and driven strategic sourcing reevaluations by leading fractionators.

Adding to this complexity, the U.S. Department of Commerce’s April 16, 2025, Section 232 investigation into all pharmaceutical imports has created sustained uncertainty around potential new levies on finished therapies and active pharmaceutical ingredients. Manufacturers now face a landscape where tariff mitigation through reshoring and vertical integration is weighed against the operational challenges of establishing compliant domestic facilities within a tightly regulated environment.

Uncovering Key Market Segmentation Dimensions That Drive Demand and Innovation in Plasma Fractionation Product Types, Methods, Applications, and End Users

A comprehensive understanding of market segmentation is essential for aligning fractionation strategies with product demand and clinical requirements. Based on product type, the plasma fractionation landscape encompasses albumin, coagulation factor concentrates such as factor VIII and IX, immunoglobulins-with subcategories of intravenous and subcutaneous preparations-and protease inhibitors. Intravenous immunoglobulin remains a cornerstone for treating immunodeficiencies and autoimmune disorders, while subcutaneous formats are gaining traction for patient self-administration and chronic therapy regimens.

Method of fractionation analysis reveals a spectrum of techniques, including centrifugation for solids–liquids separation, cryoprecipitation to isolate cold-insoluble factors, cold ethanol precipitation rooted in the Cohn process, ion-exchange chromatography for high-resolution protein purification, and ultrafiltration to concentrate and diafilter fractions. Advancements in chromatographic media and continuous-flow systems have amplified yield efficiencies and process scalability.

From an application perspective, plasma-derived therapies serve critical roles in hematology for coagulation factor replacement, neurology for immunoglobulin-based immunomodulation, oncology for supportive care treatments, and rheumatology for long-term management of chronic inflammatory diseases. These diverse indications drive differentiated demand profiles and investment priorities across therapeutic cohorts.

End users of fractionated products range from academic institutions conducting proteome exploration and biomarker discovery, to specialized clinical research laboratories developing novel biotherapeutics, and hospitals and clinics delivering life-saving transfusion and replacement therapies directly to patients with hemophilia, immune deficiencies, and other complex conditions.

This comprehensive research report categorizes the Plasma Fractionation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Method of Fractionation

- Application

- End-User

Navigating Regional Dynamics Reveals How the Americas, EMEA, and Asia-Pacific Are Shaping the Global Plasma Fractionation Ecosystem

In the Americas, the United States stands as the preeminent hub of plasma fractionation, characterized by over 900 licensed private plasmapheresis centers that collectively supply more than 45 million liters of source plasma annually for nontransfusional therapeutic production. This robust network, regulated under the Public Health Services Act, underpins the nation’s leading position in albumin and immunoglobulin output and is supported by donor compensation models that fuel consistent high-volume collections.

Across Europe, plasma fractionation is delivered through a mature framework of public and private blood services, with a strong emphasis on voluntary, non-remunerated donations and stringent regulatory oversight to maintain safety, traceability, and ethical standards. National Blood Services in Germany, France, and the U.K. collaborate with industrial fractionators to optimize supply chain resilience and pursue self-sufficiency via regional SoHO regulations that prioritize consistent access to plasma-derived therapies.

Asia-Pacific represents the fastest-growing regional segment, driven by strategic investments in local fractionation facilities and public health initiatives to expand plasma access. Multinational fractionators, including CSL Plasma, have established collection sites in China alongside existing operations in Australia and Japan, while emerging markets in India and Southeast Asia accelerate capacity expansion to reduce import dependence and address rising demand for immunoglobulin and coagulation factor therapies.

This comprehensive research report examines key regions that drive the evolution of the Plasma Fractionation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Moves and Capabilities of Leading Players Driving the Evolution of the Plasma Fractionation Landscape Worldwide

The competitive landscape of plasma fractionation is anchored by a handful of global players that continually expand capacity and enhance technological capabilities. Grifols operates one of the world’s largest fractionation sites in Clayton, North Carolina, with a current throughput of 22 million liters per year and plans to scale to 26 million liters by 2026, leveraging proprietary engineering solutions to optimize process efficiency and quality control.

CSL Plasma, a subsidiary of CSL Behring, manages a network of 320 collection centers in the U.S. and maintains additional facilities in China and Europe. Its integration with CSL Behring’s global manufacturing footprint enables streamlined supply chain coordination for albumin, immunoglobulin, and specialty factor production under unified regulatory standards.

Other key industry participants such as Takeda, Octapharma, Biotest, and Bio Products Laboratory augment the market through focused investments in recombinant alternatives, chromatography-driven purification platforms, and targeted acquisitions of regional plasma collection centers. These strategic initiatives are designed to secure raw material access, promote product diversification, and drive innovation in high-demand therapeutic segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Plasma Fractionation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ADMA Biologics, Inc.

- Bharat Serums and Vaccines Limited

- Biotest AG by Grifols, S.A.

- China Biologic Products, Inc.

- CSL Limited

- Emergent BioSolutions Inc.

- GC Biopharma corp.

- HEINKEL Process Technology GmbH

- Hemarus Therapeutics Ltd

- Intas Pharmaceuticals Ltd.

- Kamada Ltd.

- Kedrion S.p.A.

- LFB SA

- Merck KGaA

- Octapharma AG

- PlasmaGen BioSciences Pvt. Ltd.

- Prothya Biosolutions B.V.

- Shanghai Raas Blood Products Co. Ltd.

- SK Plasma Co.,Ltd.

- STERIS plc

- Takeda Pharmaceutical Company Ltd.

Actionable Recommendations to Optimize Supply Chain Resilience, Technological Innovation, and Strategic Partnerships in Plasma Fractionation

To build supply chain resilience, industry leaders should diversify sourcing by establishing multi-region plasma collection and fractionation alliances, thereby mitigating geopolitical and tariff-related disruptions. Concurrently, investing in advanced chromatographic and continuous-processing technologies can yield higher protein recovery rates and lower operating costs, enabling more flexible response to demand fluctuations.

Engagement with regulatory bodies to accelerate approval pathways for novel viral inactivation and removal techniques will enhance patient safety and shorten time-to-market for next-generation plasma therapies. Forming strategic partnerships with academic research centers and technology providers can foster co-development of precision fractionation methods tailored to emerging biomarkers and recombinant protein integration.

Furthermore, adopting digital twin modeling and data analytics within manufacturing execution systems will enable real-time process optimization and predictive maintenance, reducing downtime and ensuring consistent product quality. Finally, exploring vertical integration opportunities, such as in-house reagent manufacture and fill–finish capabilities, can insulate operations from external cost shocks and support long-term sustainable growth.

Unveiling the Rigorous Multi-Method Research Approach Underpinning Insights into Plasma Fractionation Trends and Market Dynamics

This analysis synthesizes insights from a multifaceted research methodology combining primary and secondary data sources. Primary research was conducted through structured interviews with senior executives at leading fractionators, academic experts in proteomics, and regulatory officials overseeing plasma-derived product approvals. These conversations provided real-world perspectives on supply chain dynamics, technology adoption, and policy impacts.

Secondary research encompassed a rigorous review of peer-reviewed journals, regulatory filings, and industry white papers, including landmark publications on the Cohn process and modern chromatography applications. Data triangulation was employed to validate findings across multiple sources, ensuring accuracy and consistency in segmentation definitions, tariff impact assessments, and regional analyses.

Quantitative data were further corroborated through analysis of public corporate disclosures, clinical trial registries for emerging plasma therapies, and manufacturing capacity filings, which provided granular insight into production volumes, facility expansions, and investment trends. This comprehensive approach underpins the robustness of the strategic recommendations and market segmentation insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Plasma Fractionation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Plasma Fractionation Market, by Product Type

- Plasma Fractionation Market, by Method of Fractionation

- Plasma Fractionation Market, by Application

- Plasma Fractionation Market, by End-User

- Plasma Fractionation Market, by Region

- Plasma Fractionation Market, by Group

- Plasma Fractionation Market, by Country

- United States Plasma Fractionation Market

- China Plasma Fractionation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Concluding Insights Highlight How Technological Progress, Trade Dynamics, and Strategic Segmentation Are Shaping the Plasma Fractionation Future

The plasma fractionation landscape is characterized by enduring biochemical principles augmented by continuous innovation in separation technologies, viral safety processes, and digital manufacturing controls. These transformations have fortified the capability to deliver high-purity albumin, immunoglobulin, coagulation factor, and protease inhibitor therapies at scale.

Concurrent trade and tariff developments in 2025 have underscored the importance of strategic sourcing, regulatory engagement, and operational flexibility, prompting fractionators to adapt supply chain strategies and reassess capital deployment in key global regions.

Segmentation insights illustrate how focused product, method, application, and end-user analyses can inform tailored approaches to capture emerging opportunities across hematology, neurology, oncology, and rheumatology. Regional dynamics highlight the continued dominance of the United States, the structured resilience of European SoHO systems, and the rapid capacity expansions underway across Asia-Pacific markets.

Leading companies are responding through capacity scaling, technological partnerships, and targeted acquisitions, setting the stage for a period of sustained evolution in the plasma fractionation domain. Collectively, these findings provide an authoritative roadmap for stakeholders seeking to navigate the complex interplay of science, policy, and market forces.

Empower Your Strategy Today by Partnering with Ketan Rohom to Secure the Definitive Plasma Fractionation Market Research Report

For a comprehensive, in-depth analysis of the plasma fractionation market and access to proprietary insights on emerging trends, competitive landscapes, and strategic imperatives, reach out to Ketan Rohom. As Associate Director, Sales & Marketing, he can guide you through the robust scope of our research offerings, tailor data to your specific requirements, and ensure you have the actionable intelligence needed to drive growth and innovation. Don’t miss the opportunity to leverage expert-led recommendations, exclusive segmentation breakdowns, and detailed regional and tariff impact assessments. Contact Ketan today to secure your copy of the definitive market research report and position your organization at the forefront of the plasma fractionation industry.

- How big is the Plasma Fractionation Market?

- What is the Plasma Fractionation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?