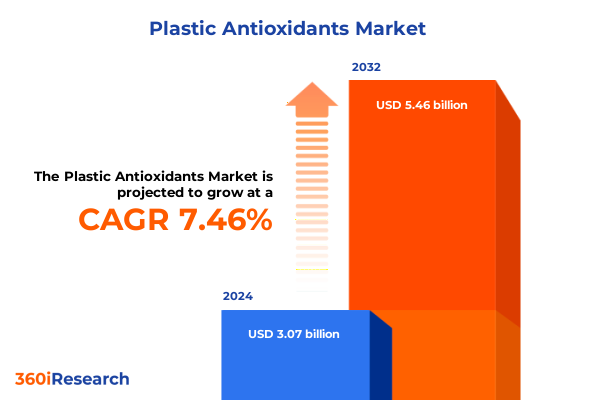

The Plastic Antioxidants Market size was estimated at USD 3.28 billion in 2025 and expected to reach USD 3.51 billion in 2026, at a CAGR of 7.56% to reach USD 5.46 billion by 2032.

Deep Dive into Plastic Antioxidants Market Evolution and Core Drivers Shaping Innovation and Demand Dynamics in Modern Polymer Industries

Plastic antioxidants play a pivotal role in preserving the integrity and performance of polymer materials by inhibiting oxidation processes that lead to discoloration, loss of mechanical strength, and premature degradation. Their unique chemical structures interact with free radicals generated during processing and end use, extending product lifespans and enhancing the reliability of thermoplastics and engineering resins under thermal and UV stress.

The rapid expansion of industries such as automotive, packaging, and electrical and electronics has elevated the importance of antioxidants that can meet stringent performance and regulatory requirements. Moreover, escalating consumer expectations for durable, lightweight, and sustainable plastic products have driven research into high-efficiency phenolic, aminic, and phosphite antioxidants that deliver optimized protection while minimizing environmental impact.

In response to regulatory bodies imposing stricter standards on material stability and safety, leading suppliers have invested in advanced antioxidant formulations and novel catalytic processes. These innovations aim to balance cost efficiency with superior thermal stability and transparency, thereby unlocking new applications in films, fibers, and high-performance molded components.

This executive summary provides a concise overview of transformative shifts, tariff implications, segmentation insights, regional dynamics, competitive landscapes, and strategic recommendations. It sets the stage for a deep exploration of how emerging trends and policy measures are redefining the plastic antioxidants space.

Examining Pivotal Technological, Regulatory and Market Forces Driving the Transformative Shifts Impacting Plastic Antioxidants Landscape Globally

The plastic antioxidants sector has undergone remarkable transformation driven by the convergence of advanced material science and evolving sustainability mandates. Cutting-edge technologies such as nanocomposite integration and reactive extrusion have enabled the creation of multifunctional antioxidant systems that offer not only oxidation inhibition but also enhanced flame retardancy and UV protection. These innovations have been propelled by partnerships between chemical companies, research institutions, and key end users seeking customized solutions.

Concurrently, regulatory frameworks around the globe have tightened thresholds for allowable residuals and extractables in plastic products, prompting suppliers to reformulate existing antioxidant portfolios. In North America and Europe, agencies have raised focus on potential toxicological impacts, while Asia-Pacific regulators are mandating higher performance benchmarks. Consequently, developers of phenolic and phosphite antioxidants have accelerated efforts toward low-migration and non-halogenated variants that align with food contact and medical device requirements.

Market volatility in petrochemical feedstocks has also disrupted conventional supply chains, motivating manufacturers to explore renewable feedstocks and bio-based antioxidant alternatives. Strategic alliances between biopolymer producers and antioxidant specialists have emerged, fostering novel value chains that integrate sustainability and circular economy principles. As a result, plastic antioxidants are no longer limited to performance enhancers but are integral to broader initiatives in green chemistry and lifecycle management.

These transformative shifts underscore a market that is increasingly dynamic, collaborative, and innovation-driven. This landscape sets the context for analyzing how policy measures, such as United States tariffs, will further shape competitive and operational strategies across the industry.

Analyzing the Comprehensive Effects of United States Tariff Policies on Plastic Antioxidants Trade Dynamics Throughout 2025 and Beyond

The imposition of revised tariff schedules by the United States in early 2025 has significantly altered the competitive landscape for importers and domestic producers of plastic antioxidants. With average duties rising to 18 percent on select phenolic and phosphite antioxidant imports primarily sourced from Asia, procurement teams have quickly reassessed global sourcing strategies. Importers are now evaluating nearshore alternatives and long-term contracts with domestic producers to mitigate cost volatility and maintain supply reliability.

These increased duties have driven manufacturers to explore backward integration and collaborative ventures to secure stable access to antioxidant chemistries. Several leading resin producers have announced joint ventures with North American specialty chemical suppliers, aiming to establish localized antioxidant manufacturing hubs. This trend reflects a broader reshoring initiative that aligns with U.S. policy objectives to bolster domestic chemical production and reduce dependency on vulnerable supply chains.

However, the tariff regime has also introduced complexity in regulatory compliance and customs classification, prompting companies to invest in enhanced tariff engineering and legal services. In turn, procurement teams have intensified spend analysis and developed dual-sourcing frameworks that balance cost exposure with agility, ensuring uninterrupted production flows for critical applications such as food-grade packaging and automotive components.

Looking forward, the longer-term implications of these tariff measures will hinge on potential renegotiations under trade agreements and the evolution of global supply-demand dynamics. Industry stakeholders should remain vigilant to policy shifts and adapt strategic sourcing models to safeguard competitive positioning in a tariff-influenced marketplace.

Uncovering Nuanced Segmentation Insights Spanning Antioxidant Types Polymer Variants Applications and Industry End Use Scenarios

Insight into antioxidant modalities reveals distinct performance characteristics across the primary classes of aminic, phenolic, phosphite, and thioether antioxidants. Aminic antioxidants offer exceptional thermal stability, making them ideal for high-temperature processing, whereas phenolic counterparts excel at intercepting oxygen radicals in light-stabilized polymers. Phosphite antioxidants serve dual roles by deactivating hydroperoxides and acting synergistically with primary antioxidants, and thioether solutions provide cost-effective protection in commodity resins under moderate thermal stress.

A deeper look into polymer variants shows that engineering plastics demand higher-grade antioxidant additives to preserve tensile strength and dimensional accuracy. Polyester systems, including PBT and PET, rely heavily on antioxidant blends to maintain clarity and prevent yellowing, while polyolefin families such as HDPE, LDPE, and LLDPE require tailored antioxidant performance to preserve mechanical properties under UV exposure. Similarly, polypropylene grades, differentiated into copolymer and homopolymer types, have diverse stabilization needs, and applications in polystyrene and PVC incorporate specialized antioxidants to prevent polymer degradation during processing and end use.

Application-driven segmentation underscores the adaptability of antioxidant chemistries across product categories. In blow molding operations, antioxidants must withstand shear heating and ensure uniform distribution within thick-walled containers. Cable and wire manufacturing benefits from antioxidants that resist thermo-oxidative aging under continuous electrical loads, while films and sheets applications demand additives that maintain optical clarity and processability. Injection molding processes, with rapid thermal cycles, require antioxidants that can perform instantly, and pipes and fittings benefit from formulations that resist slow crack growth over long service lives.

Across end use industries, agriculture implements antioxidant-stabilized plastics in films and irrigation components resistant to UV-induced deterioration. The automotive sector prioritizes robust antioxidant packages to preserve vehicle exterior and interior components exposed to heat and sunlight. Construction materials, particularly profiles and cladding, integrate antioxidants to ensure durability, while electrical and electronics segments leverage stabilization packages that prevent thermal runaway in sensitive connectors. Packaging applications continue to drive demand for food-grade antioxidant solutions that combine high performance with regulatory compliance.

The physical form of antioxidant additives also plays a crucial role in application efficacy and processing convenience. Granular forms offer ease of handling and dosing in automated lines, liquid antioxidants enable rapid blending into solvent-based formulations, and powder variants provide cost-effective solutions for dry-mix processes. Each form factor aligns to specific manufacturing workflows, influencing selection criteria for producers seeking to optimize both performance and operational efficiency.

This comprehensive research report categorizes the Plastic Antioxidants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Polymer Type

- Form

- Application

- End Use Industry

Delineating Regional Plastic Antioxidants Market Dynamics Across Americas Europe Middle East Africa and Asia Pacific Growth Enablers

In the Americas, robust petrochemical infrastructure and established engineering plastics sectors underpin steady demand for plastic antioxidants. The United States continues to benefit from shale gas–derived feedstocks that lower production costs, thereby attracting investments in additive manufacturing facilities. Latin American markets have seen gradual expansion as domestic resin production grows and local converters adopt sophisticated stabilization packages to meet export standards. Furthermore, ongoing initiatives aimed at enhancing circularity and recycling in the region have spurred interest in antioxidants compatible with mechanically recycled polymers.

Moving to Europe, the market exhibits a heightened focus on regulatory compliance and eco-design principles. Stringent requirements set by REACH and national agencies have compelled suppliers to innovate non-toxic, low-migration antioxidant blends suitable for food contact and biomedical applications. In addition, growing demand for lightweight automotive and aerospace components has driven the integration of advanced antioxidant systems capable of sustaining high mechanical loads. The Middle East and Africa region presents a mixed landscape, with petrochemical hubs in the GCC emphasizing capacity expansion, while sub-Saharan markets remain in nascent stages with opportunity for growth as industrialization progresses.

The Asia Pacific region remains the largest and fastest-growing market for plastic antioxidants, fueled by extensive polymer production in China, India, and Southeast Asia. China’s expansive manufacturing base has catalyzed investments in local antioxidant production, reducing dependency on imports. Indian converters, meanwhile, are rapidly adopting performance-driven antioxidants to cater to domestic packaging and automotive requirements. ASEAN economies are emerging as key sites for regional distribution and specialized additive blends, leveraging strategic proximity to major resin producers and expanding consumption in electronics and packaging applications.

This comprehensive research report examines key regions that drive the evolution of the Plastic Antioxidants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Stakeholders Advancing Innovations and Strategic Collaborations in the Plastic Antioxidants Sector for Competitive Advantage

Global leaders in the plastic antioxidants arena have demonstrated relentless dedication to research and development, forming the backbone of today’s market dynamics. Large diversified chemical conglomerates have leveraged their extensive R&D platforms to introduce next-generation antioxidant systems that combine multifunctionality with compliance to evolving global regulations. These entities continue to secure strategic patents and establish innovation centers to deliver tailored antioxidant solutions for high-performance applications.

Mid-tier specialists and regional producers play an equally critical role by offering flexible production capacities and niche expertise in specific antioxidant chemistries. Through partnerships with academic institutions and technology startups, these stakeholders are pursuing breakthroughs in bio-based antioxidants and sustainable manufacturing processes. Collaborative ventures between specialty additive companies and resin producers have further accelerated the deployment of customized stabilization packages optimized for diverse polymer matrices.

In addition, cross-border alliances have gained traction as companies pursue geographic expansion and technology transfer. Joint ventures between North American players and Asian manufacturers have enhanced supply chain resilience and enabled co-development of formulations that utilize locally available feedstocks. Alliances with end users in the automotive, packaging, and construction sectors translate directly into real-world validation of antioxidant performance, cementing competitive differentiation and fostering longer-term procurement agreements.

Looking ahead, key stakeholders are expected to drive growth through strategic M&A activities, capacity expansion, and digitalization of supply chain operations. The integration of predictive analytics and real-time monitoring in production and quality control processes promises to further optimize antioxidant efficacy and reduce time-to-market for new polymer stabilization innovations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Plastic Antioxidants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adeka Corporation

- BASF SE

- Clariant AG

- Eastman Chemical Company

- Emerald Kalama Chemical, LLC

- Italmatch Chemicals S.p.A.

- Krishna Antioxidants Pvt. Ltd.

- Kumho Petrochemical Co., Ltd.

- LANXESS AG

- Lycus Ltd.

- Mayzo, Inc.

- Oxiris Chemicals, SA

- SI Group, Inc.

- Solvay S.A.

- Songwon Industrial Co., Ltd.

Actionable Strategic Imperatives for Industry Leaders to Navigate Emerging Opportunities Risks and Technological Advances in Plastic Antioxidants

Industry leaders must proactively align their business models to the dual imperatives of sustainability and performance to capture emerging opportunities. Investing in research collaborations with academic institutions and technology incubators can expedite development of bio-derived antioxidant chemistries, positioning companies at the forefront of green innovation. Furthermore, establishing modular manufacturing lines with flexible capacity will enable rapid adaptation to shifting demand patterns and tariff-induced supply chain disruptions.

Risk mitigation strategies should focus on diversifying supplier networks and strengthening dual-sourcing protocols. By incorporating alternative feedstock options and securing long-term supply agreements with regional partners, organizations can reduce exposure to unilateral policy changes and feedstock price shocks. In addition, leveraging digital procurement platforms to gain real-time visibility into supplier performance and logistics can enhance resilience in the face of geopolitical uncertainties.

Technological investment in advanced analytics and process automation represents another critical imperative. Implementing predictive quality control tools for antioxidant blending and extrusion processes can optimize additive dosing and ensure consistent product performance. Furthermore, exploring digital twin simulations of polymer stabilization scenarios will facilitate rapid prototyping and refine antioxidant formulations for specific end-use requirements.

Finally, industry leaders should prioritize forging strong alliances with resin manufacturers and major end users to co-create value-added stabilization solutions. Collaborative development programs that integrate performance testing in real-world applications will foster deeper customer insights and drive incremental innovation, reinforcing competitive advantage in an increasingly dynamic market.

Leveraging Robust Quantitative and Qualitative Approaches to Ensure Rigorous Research Validity Reliability and Comprehensive Market Understanding

The research methodology underpinning this analysis combined a structured quantitative framework with in-depth qualitative insights to guarantee a balanced and verifiable understanding of the plastic antioxidants market. A global database of industry participants, spanning manufacturers, distributors, and end users, was compiled to conduct targeted primary interviews. These discussions provided direct perspectives on emerging trends, regulatory impacts, and innovation trajectories, enhancing the contextual richness of the findings.

Quantitative data was harvested from a range of reputable secondary sources, including trade publications, regulatory filings, and financial disclosures of publicly listed chemical companies. Rigorous data triangulation techniques were employed to cross-validate information on product portfolios, capacity expansions, and tariff influences. Statistical tools were then applied to aggregate and analyze this data, revealing underlying patterns and corroborating anecdotal evidence collected during interviews.

Qualitative assessments involved scenario analysis and expert panels to evaluate the implications of new regulatory measures and technological breakthroughs. These activities facilitated a deeper exploration of strategic dilemmas faced by chemical producers and converters across diverse geographic regions. In parallel, pilot case studies examined the real-world performance of novel antioxidant formulations, shedding light on best practices for formulation optimization and supply chain integration.

Throughout the research process, confidentiality protocols and ethical guidelines were strictly observed to protect proprietary insights shared by industry stakeholders. A continuous review cycle and peer validation ensured that the conclusions drawn reflect a current, balanced, and actionable market perspective.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Plastic Antioxidants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Plastic Antioxidants Market, by Type

- Plastic Antioxidants Market, by Polymer Type

- Plastic Antioxidants Market, by Form

- Plastic Antioxidants Market, by Application

- Plastic Antioxidants Market, by End Use Industry

- Plastic Antioxidants Market, by Region

- Plastic Antioxidants Market, by Group

- Plastic Antioxidants Market, by Country

- United States Plastic Antioxidants Market

- China Plastic Antioxidants Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Drawing Conclusions That Synthesize Market Evolution Key Drivers Competitive Dynamics and Future Prospects in Plastic Antioxidants Industry

The evolution of the plastic antioxidants market is defined by an interplay of technological innovation, regulatory pressures, and strategic realignments in response to global trade policies. Advanced antioxidant chemistries are increasingly integrated into diverse polymer formulations, enabling superior performance in high-temperature, UV-exposed, and mechanically demanding applications. Meanwhile, stricter regulatory standards have accelerated the transition to safer, low-migration additives, forging new pathways for product differentiation.

The introduction of heightened tariff measures in the United States during 2025 has underscored the importance of supply chain agility and nearshoring strategies. Companies that have proactively diversified their sourcing and forged local partnerships have been able to sustain growth trajectories while mitigating cost pressures. In parallel, segmentation insights across antioxidant types, polymer variants, applications, and end-use sectors have illuminated pockets of high value, driving focused R&D and targeted market penetration.

Regional dynamics continue to shape competitive priorities, with the Americas emphasizing feedstock cost advantages, Europe prioritizing regulatory compliance, and Asia-Pacific driving sheer volume growth and capacity expansions. Leading stakeholders have responded with strategic collaborations, digital transformation initiatives, and sustainability commitments, positioning themselves for long-term resilience.

Looking ahead, the convergence of digital analytics, green chemistry, and circular economy principles promises to redefine product roadmaps and operational models. Organizations that internalize these trends and execute on the actionable imperatives outlined will be best placed to capture emerging opportunities and navigate uncertainties, securing their leadership position in the plastic antioxidants ecosystem.

Take Decisive Action Today to Secure Invaluable Market Intelligence and Drive Growth by Engaging with Our Plastic Antioxidants Research Offerings

For organizations seeking to translate these insights into strategic advantage, engaging directly with our in-depth research is the next step. By partnering with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, you can access tailored consulting sessions and secure a comprehensive report that addresses your unique operational challenges and growth objectives. Ketan’s deep understanding of market dynamics and track record of enabling data-driven decision-making will ensure you are equipped with the intelligence needed to stay ahead of competitive and regulatory changes.

Reach out to arrange a personalized briefing where specific market segments and strategic recommendations can be discussed in detail. Investing in this research will empower your team with actionable insights, facilitate informed capital allocation, and support the development of robust procurement and innovation roadmaps. Take advantage of this opportunity to reinforce your leadership in the plastic antioxidants sector and achieve sustainable growth in a shifting global environment.

- How big is the Plastic Antioxidants Market?

- What is the Plastic Antioxidants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?