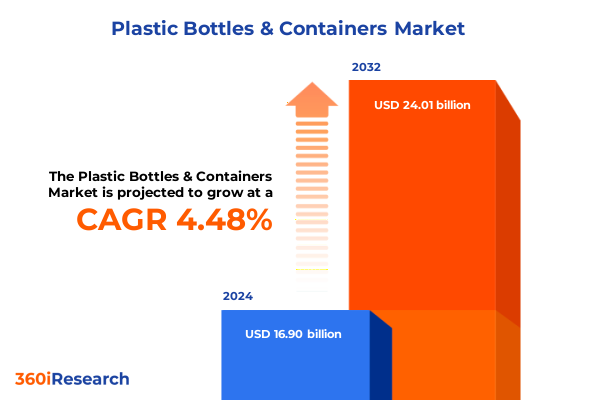

The Plastic Bottles & Containers Market size was estimated at USD 17.67 billion in 2025 and expected to reach USD 18.47 billion in 2026, at a CAGR of 5.67% to reach USD 26.01 billion by 2032.

Exploring Foundational Dynamics and Emerging Drivers in the Plastic Bottles & Containers Market Amid Evolving Regulations and Consumer Demands

The global landscape for plastic bottles and containers is undergoing profound evolution, driven by shifting consumer behaviors, intensifying sustainability mandates, and regulatory interventions worldwide. As emerging markets accelerate their urbanization and middle-class growth, demand for convenient, lightweight, and cost-effective packaging solutions has surged. Simultaneously, the maturation of e-commerce platforms has transformed traditional distribution patterns, compelling manufacturers to re-evaluate channel strategies and invest in digital supply chain capabilities.

Moreover, policymakers in key regions are imposing stricter guidelines to curb plastic pollution, spurring manufacturers to innovate in material science and adopt higher proportions of recycled content. This confluence of consumer expectations and regulatory pressures has ignited a wave of research and development centered on biodegradable polymers, advanced recycling technologies, and lightweighting initiatives. Against this backdrop, stakeholders across the value chain-from resin producers and converters to brand owners and retailers-are reassessing their product portfolios, sustainability commitments, and partnership models to remain competitive and compliant.

Consequently, a holistic understanding of market drivers, competitive dynamics, and emerging technological breakthroughs is essential for decision-makers seeking to capitalize on growth opportunities in the plastic bottles and containers segment. This report lays the groundwork for an informed strategic approach by elucidating core market forces, regulatory trends, and the evolving preferences shaping future demand.

How Technological Innovations and Sustainability Mandates Are Redefining the Plastic Bottles & Containers Industry’s Competitive Landscape

In recent years, the plastic bottles and containers industry has witnessed a profound transformation fueled by technological breakthroughs and shifting societal priorities. Rapid advancements in polymer engineering have enabled manufacturers to create multi-layer structures that optimize barrier properties while significantly reducing material usage. Innovations such as nanocomposite coatings and engineered multimaterial laminates have redefined performance standards, extending shelf life for perishable goods and reducing product spoilage.

Parallel to these technical strides, sustainability has emerged as an imperative strategic focus. Widespread adoption of circular economy principles has prompted companies to invest in mechanical and chemical recycling solutions capable of converting post-consumer waste back into high-quality resin. Collaborative initiatives involving brand owners, waste management firms, and technology providers are accelerating the development of infrastructure needed to scale closed-loop recycling systems. As a result, recycled content is transitioning from a niche selling point to a core requirement specified by both regulators and eco-conscious consumers.

Furthermore, digitalization is reshaping competitive dynamics by enabling real-time tracking, traceability, and dynamic inventory management across global supply chains. The integration of blockchain protocols and IoT sensors allows stakeholders to authenticate material origins and verify recycled content claims, reinforcing consumer trust and regulatory compliance. Taken together, these transformative shifts are redefining market entry strategies, partnership models, and investment priorities for companies aiming to differentiate their offerings and sustain growth in an increasingly complex environment.

Assessing the Cumulative Impact of 2025 United States Import Tariffs on Raw Materials, Production Costs, and Supply Chain Resilience in Packaging

The introduction of new U.S. tariffs in 2025 has substantially affected the cost structure for plastic packaging manufacturers and resin suppliers. On February 1, 2025, the government invoked national emergency powers to impose a 25 percent tariff on plastic resin and related material imports from Canada and Mexico, while a 10 percent levy applies to imports originating in China. These unilateral measures aim to bolster domestic production but have led to higher raw material costs and compelled many processors to seek alternative sourcing strategies.

In addition, China-specific tariffs introduced earlier in the year include a baseline 145 percent rate on non-steel imports and an additional 20 percent IEEPA surcharge, creating extreme price volatility for materials derived from polymer feedstocks produced in Asian markets. The layering of multiple tariff rates has disrupted conventional trade flows, accelerating the reconfiguration of supply chains toward more tariff-resilient geographies.

Consequently, domestic resin manufacturers have ramped up capacity expansions to meet rising local demand, while converters have prioritized importing recycled feedstock exempt from many of the import duties. In parallel, brand owners are recalibrating packaging mix strategies-shifting emphasis toward locally sourced materials and adopting hybrid designs that blend limited recycled content with virgin resin to balance performance and cost considerations. In this environment of elevated material costs and supply uncertainty, companies that demonstrate agility in tariff mitigation and supply chain diversification are positioned to preserve margins and maintain service levels.

Uncovering Critical Market Segmentation Insights by Resin, Distribution Channels, Product Types, Materials, and End-Use Industries to Drive Targeted Strategies

A nuanced evaluation of the market necessitates dissecting performance across multiple segmentation dimensions, each revealing unique consumer and operational imperatives. When examining resin sourcing, the dichotomy between recycled and virgin polymers underscores divergent cost profiles and sustainability footprints. Demand for recycled resin continues to rise as brands seek to meet regulatory mandates and consumer expectations, though virgin resin retains its stronghold in applications requiring stringent purity and barrier characteristics.

Delving into distribution channels reveals a bifurcation between offline and online sales. While traditional brick-and-mortar outlets such as hypermarkets, supermarkets, convenience stores, and pharmacies maintain robust volume flows for bulk purchases and impulse buys, the rapid proliferation of e-commerce has altered purchase cycles for smaller format bottles. Market players now estimate that a growing share of adult consumers leverage digital platforms for subscription-based deliveries of household chemicals and personal care products, thereby reshaping packaging design criteria toward lightweight, easy-to-ship configurations.

From a product taxonomy standpoint, the bottles segment commands leadership due to its versatility across liquid and semi-liquid goods, with specific demand patterns observed for sizes ranging from less than 500 mL up to five liters. Drums and carboys, particularly those within the 21 to 50-liter and above-50-liter categories, remain indispensable for industrial chemicals and food-grade oil storage. Complementing these are jars and tubs, which cater to thicker formulations in sectors like dairy and personal care.

Material type further stratifies market opportunity, with PET-distributed in clear configurations for water and carbonated drinks, and colored variants for premium or niche offerings-being the material of choice for bottling applications. HDPE and LDPE maintain prominence in tightening containers for household chemicals, while PP copolymer and homopolymer blends deliver robust performance for hot-fill processes. PVC, although facing scrutiny over health concerns, continues to serve specialized applications where its rigidity and chemical resistance are indispensable.

Considering end-use industries, beverage packaging-encompassing beer, bottled water, carbonated soft drinks, and juices-remains the single largest driver of volume growth, with sustainability commitments pushing leaders to adopt higher recycled content thresholds. Food applications such as dairy and condiments increasingly rely on lightweight jars and tubs designed for multi-serve and single-serve consumption. Household chemicals and oil & lubricants segments exhibit steady demand for larger drums, while personal care and pharmaceutical sectors prioritize containers that balance aesthetic appeal with regulatory compliance. This holistic segmentation perspective informs product development pipelines, channel partnerships, and investment frameworks for organizations seeking to capture cross-category growth and deepen market penetration.

This comprehensive research report categorizes the Plastic Bottles & Containers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Source

- Product Type

- Material Type

- Distribution Channel

- End Use Industry

Analyzing Regional Growth Dynamics Across Americas, Europe Middle East & Africa, and Asia Pacific to Optimize Market Penetration and Localization Tactics

Regional performance in the plastic bottles and containers market displays marked variation across the Americas, Europe Middle East & Africa (EMEA), and Asia Pacific, influenced by unique regulatory, economic, and cultural drivers. In the Americas, the progression of extended producer responsibility (EPR) laws has spurred robust investment in recycling infrastructure and incentivized brand owners to elevate recycled resin usage. Alongside this, North American consumer preferences for personalization and premium packaging have fostered a renaissance in high-clarity PET bottles with custom labeling.

In contrast, the EMEA region is navigating a complex tapestry of recycling targets, import restrictions on virgin polymers, and ambitious roadmaps for carbon neutrality. European Union mandates require minimum percentages of recycled content within specified timeframes, thus accelerating adoption of chemical recycling processes that restore polymer quality for food-contact applications. Meanwhile, Middle Eastern markets capitalize on their feedstock-rich landscapes to develop local resin production capacity, reducing dependency on imports and stabilizing price fluctuations.

Asia Pacific commands the lion’s share of volume growth, underpinned by rapid urbanization, expanding retail ecosystems, and proliferation of direct-to-consumer outlets. Nations such as India and China are witnessing parallel surges in bottled water consumption and e-grocery adoption, compelling packaging suppliers to enhance local manufacturing footprints and introduce modular, stackable container designs. Sustainability consciousness is also ascending in urban centers across the region, leading governments to pilot deposit-return schemes and incentivize biopolymer innovations. This tripartite regional analysis provides critical context for aligning manufacturing investments, distribution alliances, and innovation roadmaps with localized market dynamics.

This comprehensive research report examines key regions that drive the evolution of the Plastic Bottles & Containers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Plastics Packaging Companies Driving Innovation, Sustainability, and Competitive Advantage Through Strategic Investments and Collaborations

Industry leaders are demonstrating varied yet complementary strategies to navigate the evolving landscape of plastic bottles and containers. Global converters have prioritized capacity expansions in North America and Asia Pacific, leveraging brownfield and greenfield investments to align with shifting tariff environments and localized demand patterns. Concurrently, multinational packaging firms have accelerated mergers and acquisitions, particularly targeting recycled resin specialists and niche polymer technology providers to augment their sustainability credentials.

Technology partnerships between resin producers and brand owners have emerged as a focal point, enabling co-development of proprietary formulations that balance performance, cost, and recycled content. Some companies have pioneered in-house digital printing platforms, reducing lead times for customized labeling and reinforcing traceability from resin origin to finished container. Moreover, leading players are forging cross-sector alliances-ranging from food and beverage titans to personal care conglomerates-to streamline post-consumer collection schemes and ensure a more robust supply of recycled feedstock.

In parallel, several forward-thinking organizations have established dedicated innovation centers focused on next-generation materials research, encompassing biodegradable polymers, enzyme-based depolymerization processes, and additive-driven barrier enhancements. By integrating real-time market intelligence with advanced capacity for rapid prototyping, these firms are accelerating time-to-market for differentiated packaging solutions and reinforcing their competitive positions across global markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Plastic Bottles & Containers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpla Werke Alwin Lehner GmbH & Co KG

- Amcor PLC

- Berry Global, Inc.

- Esterform Ltd

- Graham Packaging Company, L.P.

- KHS GmbH

- Nolato AB

- Plastipak Holdings, Inc.

- Saniton Plastic LLC

- Silgan Holdings Inc.

- YuHuan Kang-Jia Enterprise Co., Ltd.

Strategic Actionable Recommendations to Accelerate Growth, Enhance Sustainability, Mitigate Risks, and Drive Operational Excellence in Plastic Packaging

To thrive in the face of evolving regulatory, environmental, and consumer imperatives, industry leaders must adopt a multifaceted strategic roadmap. First, embedding sustainability at the core of product development is essential: firms should expand partnerships with certified recycling operators and invest in advanced sorting and purification technologies to secure a consistent supply of high-quality recycled resin. This will not only satisfy growing EPR mandates but also strengthen transparency and consumer trust through traceable material provenance.

Second, companies need to diversify distribution strategies by balancing traditional retail commitments with digital fulfillment capabilities. Establishing dedicated micro-fulfillment centers and leveraging data analytics for dynamic inventory management will enable more efficient last-mile delivery of smaller package formats, while preserving service standards in hypermarkets and convenience outlets. Integrating brand-owned e-commerce channels with third-party marketplaces can further extend market reach and capture shifting consumer purchase behaviors.

Third, resilience planning should encompass targeted supply chain realignment to mitigate tariff exposure and raw material shortages. By mapping alternative sourcing corridors across tariff-exempt jurisdictions and forging flexible contract structures with resin suppliers, organizations can preempt cost shocks and maintain production continuity. Additionally, deploying predictive analytics to forecast resin price fluctuations and inventory demands will enhance decision-making agility.

Ultimately, embedding innovation through cross-functional collaboration-spanning R&D, manufacturing, procurement, and marketing-will unlock efficiencies and accelerate differentiation. By committing to a structured roadmap that prioritizes sustainable sourcing, digital enablement, and risk diversification, industry leaders can capture new growth opportunities while safeguarding against emergent challenges.

Comprehensive Research Methodology Detailing Primary and Secondary Data Collection, Stakeholder Interviews, and Analytical Frameworks Ensuring Rigorous Validation

This research employs a rigorous blend of primary and secondary methodologies to ensure comprehensive and validated insights. The study begins with in-depth desk research, analyzing public filings, trade association reports, and government regulations to map the landscape of plastic bottles and containers. This is followed by structured interviews with key stakeholders, including resin manufacturers, converters, brand owners, and channel partners, to glean nuanced perspectives on market drivers and operational challenges.

Quantitative data collection encompasses proprietary surveys distributed to a cross-section of industry participants, coupled with analyses of import-export datasets and customs records to quantify trade flows impacted by 2025 tariff measures. Secondary research sources include reputable industry publications and specialized technical journals to track developments in polymer technologies, recycling innovations, and digital supply chain solutions.

Data triangulation is achieved by cross-verifying findings from multiple streams, while an expert panel review validates analytical frameworks and forecasts. The result is an integrated, multi-dimensional view of market segmentation, competitive dynamics, and regulatory impacts, underpinned by transparent documentation of research protocols and assumptions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Plastic Bottles & Containers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Plastic Bottles & Containers Market, by Resin Source

- Plastic Bottles & Containers Market, by Product Type

- Plastic Bottles & Containers Market, by Material Type

- Plastic Bottles & Containers Market, by Distribution Channel

- Plastic Bottles & Containers Market, by End Use Industry

- Plastic Bottles & Containers Market, by Region

- Plastic Bottles & Containers Market, by Group

- Plastic Bottles & Containers Market, by Country

- United States Plastic Bottles & Containers Market

- China Plastic Bottles & Containers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Synthesizing Critical Takeaways and Strategic Imperatives to Navigate Challenges and Capitalize on Opportunities in the Plastic Packaging Market

The plastic bottles and containers market stands at a pivotal juncture, shaped by the intersection of sustainability mandates, technological innovation, and tariff-induced supply chain realignments. Core findings underscore the rising importance of recycled resin as both a regulatory compliance tool and a differentiator in consumer-facing communications. Simultaneously, advanced material formulations and digital traceability solutions are becoming non-negotiable prerequisites for market access in leading geographies.

Regional analysis highlights distinct growth catalysts: robust demand and EPR-driven investments in the Americas, regulatory harmonization and feedstock localization in EMEA, and rapid consumption expansion coupled with nascent sustainability frameworks in Asia Pacific. Leading companies exemplify best practices through strategic acquisitions, capacity expansions, and cross-sector partnerships, reinforcing the competitive imperative for agility and collaboration.

Looking ahead, companies that proactively integrate resilient sourcing strategies, digital distribution capabilities, and circular economy principles will be well positioned to navigate emergent challenges and capitalize on new value pools. The convergence of market segmentation insights, regional dynamics, and actionable recommendations forms a strategic playbook for stakeholders aiming to secure and expand their presence in this dynamic packaging sector.

Connect with Ketan Rohom to Unlock Comprehensive Plastic Bottles & Containers Market Intelligence and Drive Strategic Decisions through Research Reports

Elevate your strategic outlook by securing this market research report tailored to plastic bottles and containers, guided personally by Ketan Rohom, Associate Director of Sales & Marketing. Engage with an expert to explore in-depth analyses, validate your business priorities, and customize data that aligns with your unique objectives. Initiate a conversation today to unlock the competitive intelligence and actionable insights needed to propel your organization forward in a rapidly evolving packaging landscape

- How big is the Plastic Bottles & Containers Market?

- What is the Plastic Bottles & Containers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?