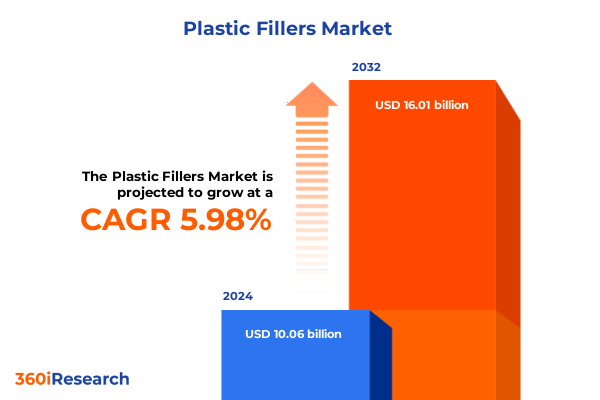

The Plastic Fillers Market size was estimated at USD 10.67 billion in 2025 and expected to reach USD 11.23 billion in 2026, at a CAGR of 5.96% to reach USD 16.01 billion by 2032.

Unveiling the Strategic Significance of Plastic Fillers in Modern Manufacturing and Their Pivotal Role in Enhancing Product Performance

Plastic fillers represent a versatile class of additives integrated into polymer matrices to improve mechanical properties, reduce costs, and tailor functionality. They function as reinforcement agents that enhance stiffness, dimensional stability, and surface finish while offering advantages in opacity control and fire retardancy. Innovations in filler surface treatments and dispersion techniques have driven more uniform particle distributions, translating into improved processability and consistent performance in end-product manufacturing.

Historically, manufacturers incorporated fillers primarily to replace costlier polymers, yet recent developments have elevated fillers to strategic enablers of environmental stewardship. Bio-based and recycled filler options are capturing attention as companies strive to lower carbon footprints and align with circular economy goals. At the same time, digital simulation and material informatics platforms enable engineers to predict composite behavior more accurately, reducing development cycles and accelerating time to market. Consequently, plastic fillers have become pivotal in balancing economic viability with sustainability imperatives.

In light of these evolving dynamics, stakeholders across automotive, packaging, consumer goods, and industrial sectors must recalibrate strategies around filler selection, supply chain resilience, and collaborative innovation. An in-depth understanding of filler attributes, market forces, and regulatory drivers will empower leaders to secure competitive advantage. This introductory perspective lays the foundation for exploring the transformative shifts, regulatory impacts, and strategic imperatives that define the contemporary plastic filler landscape.

As the industry moves toward higher-performance composites, the role of functionalized minerals and engineered particles has expanded. Tailoring surface chemistries and particle morphology unlocks specific end-use performance targets, from UV resistance to thermal conductivity. This multidimensional evolution underscores the necessity for a holistic analysis that accounts not only for material properties but also for logistics, cost optimization, and evolving customer expectations across diverse sectors.

Navigating the Transformative Shifts Reshaping the Plastic Filler Industry Through Innovation, Sustainability, and Regulatory Evolution

Over the past decade, sustainability imperatives, regulatory reforms, and material innovation have converged to reshape the plastic filler industry in profound ways. Stakeholders have embraced bio-based alternatives and functionalized surface treatments, shifting emphasis from cost reduction alone to performance-driven, eco-conscious solutions. In parallel, stringent restrictions on hazardous substances have accelerated the adoption of low-emission fillers, prompting collaboration between material scientists and regulatory bodies to ensure compliance without sacrificing performance.

Simultaneously, digital transformation has introduced predictive modeling and artificial intelligence–enabled design tools that optimize filler dispersion and compatibility with polymer matrices. These platforms facilitate virtual prototyping, reducing trial-and-error cycles and supporting rapid formulation adjustments. Owners and operators of compounding facilities are responding by investing in real-time monitoring systems and advanced downstream processes that guarantee consistent product quality across large-scale production runs.

Furthermore, the advent of circular economy business models has elevated the significance of recycled and waste-derived fillers. Partnerships between recycling specialists and polymer producers have yielded novel materials that maintain mechanical integrity while diverting waste streams. These alliances not only reduce the environmental footprint of finished goods but also open new revenue channels for byproduct valorization. Altogether, these transformative shifts illustrate an industry in dynamic transition, where value creation hinges on the seamless integration of innovation, sustainability, and regulatory foresight.

Assessing the Cumulative Impact of 2025 United States Tariffs on Plastic Fillers and Their Far-Reaching Consequences for Supply Chains and Cost Structures

The implementation of new United States tariffs in 2025 on imported minerals and inorganic additives has generated a ripple effect across the plastic filler supply chain. Manufacturers that once relied heavily on lower-cost imports have faced increased cost pressures, prompting strategic reviews of vendor contracts and encouraging increased collaboration with domestic producers. This pivot has strengthened the role of local suppliers, but it has also necessitated investments in capacity expansion and quality assurance to meet growing demand.

Cost escalations associated with tariff adjustments have led processors to explore alternative feedstocks and optimize formulations to maintain margin stability. For instance, companies have fine-tuned filler blend ratios to strike a balance between functional performance and material expense. At the same time, some compounding operations have resorted to vertical integration, securing upstream mineral operations to exert greater control over raw material costs and supply consistency.

Moreover, these tariff shifts have accelerated conversations around nearshoring and onshoring strategies. Stakeholders are conducting rigorous risk assessments to determine the feasibility of relocating critical processing and compounding facilities closer to end markets. While this enhances supply chain resilience, it also brings into focus labor, infrastructure, and environmental permitting considerations. As the industry adapts to these structural changes, decision makers must weigh short-term cost implications against long-term strategic benefits.

Revealing Key Insights from Comprehensive Segmentation to Illuminate Market Dynamics Across Filler Types, Forms, Polymer Types, Industries, and Applications

A nuanced understanding of market segmentation is essential to decoding the complexity of plastic filler dynamics. When evaluated by filler type, the landscape spans calcium carbonate characterized by ground and precipitated variants, alongside kaolin offered in both calcined and hydrous forms, mica available as natural and synthetic grades, as well as silica that includes fumed and precipitated formats, talc with unique plate-like morphologies, and wollastonite differentiated into ground and standard particle sizes. Each of these mineral families presents distinct performance attributes and processing considerations that influence formulation decisions.

Beyond mineral origin, form factors play a critical role. Granular fillers tend to offer improved flow characteristics and dust control during handling, whereas powder grades can deliver finer particle distributions for applications requiring high surface area. Polymer compatibility represents another vital dimension, where acrylonitrile butadiene styrene (ABS), diverse polyethylene grades such as high-density, low-density, and linear low-density variants, polypropylene in both copolymer and homopolymer forms, and polyvinyl chloride split into plasticized and rigid grades each interact with fillers in unique ways, affecting mechanical strength and thermal performance.

End use industries further refine this segmentation profile. Fillers find applications across adhesives and sealants seeking improved rheology, cosmetics demanding opacity and tactile enhancement, paints and coatings that require pigment dispersion control, paper manufacturing focused on opacity and bulk, pharmaceutical excipients for controlled release matrices, general plastics processing, and rubber compounding for dynamic performance. Finally, applications such as automotive components, construction materials, consumer goods, electrical and electronics assemblies, medical devices, packaging formats, and textile fibers harness fillers to meet specialized demands. This layered segmentation framework enables stakeholders to pinpoint growth pockets and tailor strategies that align with precise market needs.

This comprehensive research report categorizes the Plastic Fillers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Filler Type

- Form

- Polymer Type

- End Use Industry

- Application

Uncovering Regional Trends Reshaping the Global Plastic Filler Supply Landscape with In-Depth Analysis of the Americas, EMEA, and Asia-Pacific

Regional dynamics shape how plastic filler markets evolve and where investment opportunities emerge. In the Americas, demand has been fueled by robust automotive production and increasing consumer packaging needs, driving suppliers to emphasize logistical efficiency and service responsiveness. North American processors have diversified their raw material sources to mitigate supply risks, whereas Latin American markets are exploring partnerships to boost local compounding capabilities.

Meanwhile in Europe, Middle East and Africa, regulatory stringency around chemical safety and environmental reporting plays a decisive role. Stakeholders in these regions prioritize low-emission and recycled filler options, often collaborating with sustainability consultancies to align product portfolios with circular economy targets. Infrastructure investments in the Middle East complement local capacity additions, while African markets are beginning to scale through joint ventures aimed at meeting burgeoning construction and electrical equipment requirements.

Asia-Pacific remains a growth powerhouse, underpinned by rapid industrialization and infrastructure expansion. Manufacturers have increased regional production hubs to meet the rising consumption of packaging and consumer electronics applications. Supply chain optimization initiatives emphasize port capacity enhancements and multimodal connectivity. Across these three macroregions, the interplay of regulatory frameworks, application drivers, and logistical ecosystems dictates unique market trajectories that demand region-specific strategic responses.

This comprehensive research report examines key regions that drive the evolution of the Plastic Fillers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Companies and Their Strategic Maneuvers That Are Driving Innovation, Partnerships, and Operational Excellence in the Plastic Filler Sector

Leading material suppliers are engaging in strategic initiatives to secure market positions and address evolving customer requirements. One tier-one producer has invested in advanced surface modification facilities to offer silane-treated minerals that enhance polymer adhesion and moisture resistance. Another global leader has forged alliances with chemical technology firms to co-develop proprietary coupling agents that improve compatibility across diverse polymer systems.

Selective capacity expansions have emerged as a key theme. A specialist in engineered inorganic additives recently announced the construction of a new compounding plant designed to streamline filler-polymer integration, while another top player has retrofitted existing lines to accommodate bio-based and recycled feedstocks. These investments signify a commitment to operational agility and sustainability credentials.

Cross-industry collaborations are also on the rise, as companies partner with end users in automotive and packaging to tailor formulations for specific performance targets. Joint research programs focus on lightweighting, thermal management, and enhanced durability, reflecting a shift from commodity supply to value-added partnerships. Overall, corporate strategies emphasize flexible production capabilities, differentiated product portfolios, and targeted R&D efforts to navigate the complexities of the modern plastic filler ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Plastic Fillers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A1 Polymers

- Alankar Polymers

- Bajaj Plast Private Limited

- BASF SE

- Clariant AG

- Dhanvi Polymer

- Dolphin Poly Plast Pvt. Ltd.

- Evonik Industries AG

- Exxon Mobil Corporation

- Gaurav Polymers

- Kandui Industries Private Limited

- Lanxess AG

- LyondellBasell Industries N.V.

- Micro Poly Colours India

- Puja Packaging

- Sachin Plastic

- Saudi Basic Industries Corporation (SABIC)

- Solvay S.A.

- The Dow Chemical Company

- Vardhaman Polychem

Empowering Industry Leaders with Actionable Strategies to Mitigate Risks, Capitalize on New Opportunities, and Enhance Competitive Advantage for Plastic Fillers

Industry leaders must adopt proactive approaches to mitigate risks associated with supply chain disruptions and regulatory volatility. By diversifying raw material sourcing across multiple geographic regions and establishing strategic alliances with both upstream mineral producers and downstream compounders, firms can achieve greater continuity of supply and cost effectiveness. Prioritizing transparent supplier audits and real-time visibility tools will further strengthen resilience.

At the same time, dedicating resources to the development of sustainable filler solutions-such as bio-based minerals, recycled glass powders, and industrial byproducts-will align product portfolios with emerging environmental standards. Collaborative R&D efforts between materials scientists and end users can accelerate the commercialization of next-generation fillers tailored for lightweighting, flame retardancy, or thermal conductivity.

Finally, integrating digital material design platforms and predictive analytics into formulation workflows will streamline development cycles and optimize performance parameters. Leaders should invest in skill development for simulation tools, establish cross-functional innovation teams, and leverage pilot-scale trials to validate new compounds rapidly. These coordinated strategies will empower organizations to capitalize on emerging opportunities while maintaining competitive advantage in a dynamic market environment.

Outlining Rigorous Research Methodologies That Underpin Data Integrity, Expert Validation, and Comprehensive Analysis for Plastic Filler Market Insights

This report’s insights derive from a rigorous, multi-tiered research methodology designed to ensure data integrity and analytical precision. Primary research involved in-depth interviews with senior executives, R&D specialists, and procurement managers across key filler producers, compounders, and end-use industries. These conversations provided nuanced perspectives on technology adoption, regulatory compliance challenges, and strategic priorities.

Complementing this, secondary research encompassed extensive reviews of industry journals, patent filings, technical white papers, and publicly available corporate disclosures. Data triangulation across these diverse sources enabled validation of emerging trends and confirmed market drivers. Statistical quality checks and consistency analyses were performed to identify and rectify discrepancies, ensuring robust findings.

Furthermore, proprietary databases and custom surveys facilitated the quantification of qualitative insights, while expert panels convened to refine interpretations and stress-test hypotheses. Throughout the research process, stringent confidentiality protocols safeguarded sensitive information, reinforcing the credibility and reliability of the analysis presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Plastic Fillers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Plastic Fillers Market, by Filler Type

- Plastic Fillers Market, by Form

- Plastic Fillers Market, by Polymer Type

- Plastic Fillers Market, by End Use Industry

- Plastic Fillers Market, by Application

- Plastic Fillers Market, by Region

- Plastic Fillers Market, by Group

- Plastic Fillers Market, by Country

- United States Plastic Fillers Market

- China Plastic Fillers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Summarizing Critical Findings and Strategic Imperatives That Will Guide Stakeholder Decisions in the Plastic Filler Ecosystem

The key findings underscore how sustainability mandates, digital innovation, and regulatory realignment have collectively redefined the plastic filler industry’s competitive landscape. Transformative shifts in material science and processing technologies are driving the adoption of advanced fillers that meet stringent performance and environmental criteria. At the same time, the imposition of 2025 tariffs has catalyzed supply chain reconfigurations, prompting strategic onshoring and nearshoring decisions that enhance resilience but require new operational considerations.

Segmentation insights reveal that granular and powder form factors, combined with tailored polymer compatibilities across polyethylene, polypropylene, ABS, and PVC, create opportunities for differentiated applications in sectors ranging from automotive to medical devices. Regional analysis highlights divergent growth drivers: the Americas benefit from mature automotive and packaging markets, EMEA emphasizes regulatory compliance and sustainability, and Asia-Pacific focuses on industrialization and infrastructure expansion.

Corporate strategies center on capacity expansions, surface treatment investments, and collaborative R&D to unlock performance advantages. By synthesizing these critical imperatives, this executive summary guides decision makers toward targeted actions that address immediate challenges and position organizations for long-term success in the evolving plastic filler sector.

Engaging Call to Action with Associate Director Sales & Marketing to Secure Customized Plastic Filler Market Research Report and Empower Strategic Decisions

To capitalize on rapidly evolving market opportunities, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure your tailored comprehensive report and accelerate strategic decision making. Discuss how customized insights can inform raw material sourcing, strengthen product portfolios, and optimize cost efficiencies. Engage now to ensure your organization leads with data-driven strategies in the competitive plastic filler industry landscape

- How big is the Plastic Fillers Market?

- What is the Plastic Fillers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?