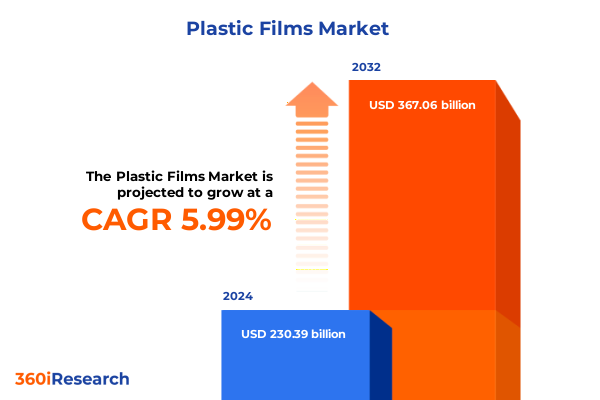

The Plastic Films Market size was estimated at USD 244.24 billion in 2025 and expected to reach USD 255.53 billion in 2026, at a CAGR of 5.99% to reach USD 367.06 billion by 2032.

Introduction capturing the dynamic evolution and emerging trends shaping the global plastic films market landscape and strategic opportunities for innovation

The plastic films market stands at the crossroads of rapid technological innovation, shifting consumer expectations, and stringent environmental mandates. In recent years, intensified regulatory scrutiny on single-use plastics and growing consumer preference for sustainable packaging have compelled brand owners to reevaluate their material strategies, leading to accelerated investments in recyclable and compostable film solutions and circular-economy business models. Concurrently, the surge in e-commerce sales has placed unprecedented emphasis on lightweight, high-performance packaging that balances protection with sustainability, driving the adoption of advanced material blends and format-optimization technologies to curtail dimensional weight fees and enhance supply-chain efficiency.

Moreover, industry participants are leveraging digital printing and smart packaging technologies to meet personalization demands and improve traceability, while advanced recycling methods-from chemical depolymerization to enzymatic back-loop systems-are maturing toward cost parity with virgin resins. These developments, coupled with proactive government policies in key markets incentivizing circular formats and penalizing waste, have reshaped the competitive landscape, paving the way for differentiated, feature-rich film products. As sustainability targets evolve from aspirational pledges to binding regulations, manufacturers and converters must navigate a complex web of technical, economic, and regulatory variables to capture new growth opportunities and maintain operational resilience.

Transformative shifts in raw material sourcing, technology adoption and regulatory frameworks redefining competitiveness and sustainability

Over the past decade, the plastic films industry has undergone transformative shifts in raw material sourcing, driven by volatility in petrochemical feedstock prices and rising demand for bio-based alternatives. Producers are increasingly integrating biopolymer grades such as polylactic acid and polyhydroxyalkanoates, while petrochemical incumbents expand chemical-recycling back-loops to extend the life cycle of polyethylene terephthalate and polypropylene. These supply-chain realignments have been further accelerated by the need for regional resilience, prompting near-shoring of resin production and strategic partnerships with upstream suppliers to mitigate geopolitical risks and scale circular-economy initiatives.

Technological advances are also redefining film performance and functionality. The proliferation of multi-layer co-extrusion and nano-composite barrier systems has enabled ultra-thin constructions that deliver superior mechanical strength and gas-barrier properties, while emerging digital print integration supports mass customization and anti-counterfeiting features. Simultaneously, regulatory frameworks such as the EU Packaging and Packaging Waste Regulation and evolving extended producer responsibility schemes are raising the bar for recyclability and recycled content, compelling stakeholders to innovate in material formulations, recycling infrastructure, and design for disassembly. These converging forces have reshaped competitive dynamics, centering sustainability credentials and advanced technology adoption as critical differentiators in the global plastic films market landscape.

Cumulative impact of United States tariffs driving cost pressures, supply chain realignments and strategic sourcing decisions in the plastic films sector

Since 2018, the United States has maintained 25% Section 301 tariffs on a broad suite of imports from China, including a range of plastic film products, fundamentally altering cost structures and sourcing strategies. By 2024, the United States imported over $413.5 million worth of non-cellular plastic plates, sheets, film, foil, and strip from China, generating an estimated $103.4 million in additional tariff costs annually on that category alone. When combined with self-adhesive films and other specialty formats, the total import bill subject to these duties approaches $720 million annually, creating cumulative cost pressures exceeding $700 million since the tariffs’ inception and directly impacting conversion margins and customer pricing.

In response, many converters and brand owners have diversified their procurement footprints, shifting volumes to Southeast Asian suppliers in Thailand, Vietnam, and Malaysia, and expanding domestic capacity to mitigate tariff exposure. These strategic realignments have not only improved supply-chain resilience but have also catalyzed significant capital investments in U.S. manufacturing. Furthermore, the full pass-through of tariff duties to end-users has tempered consumption growth for certain high-volume film segments, prompting manufacturers to intensify value-added offerings and service differentiation to sustain market share under elevated price environments.

Key segmentation insights unlocking nuanced perspectives on material types, process technologies, product forms, thickness profiles, environmental nature and end use industry applications

The plastic films market exhibits a multifaceted segmentation landscape driven by material diversity, process technologies, structural configurations, thickness profiles, environmental considerations, and end-use applications. Material type spans from polyethylene variants-encompassing high density, linear low density, and low density-through polyethylene terephthalate, polypropylene, and polyvinyl chloride films, each bringing distinct performance attributes and processing requirements. Process technology further differentiates the market between blown film, which excels in film toughness and clarity, cast film optimized for precision gauge control and printability, and extruded coating enabling functional barriers in coated structures.

Product form segmentation ranges from monolayer constructions that offer streamlined recyclability and cost-effectiveness to multilayer laminates engineered for enhanced barrier performance and mechanical strength. Thickness categories from thin, medium, to thick films address diverse protective and structural needs, while the nature axis-biodegradable versus conventional-reflects the industry’s pivot toward renewable and end-of-life optimized materials. Finally, the end-use industry spans critical sectors such as agriculture, automotive, construction, electronics, and packaging. Within automotive, applications extend from durable exterior protective films through advanced interior component laminates to under-the-hood thermal and fluid barrier solutions, while construction films serve insulation, roofing and cladding, and vapor barrier functions. These overlapping segmentation dimensions not only reveal nuanced market niches but also underscore the necessity for tailored product portfolios aligned with specific functional, regulatory, and sustainability requirements.

This comprehensive research report categorizes the Plastic Films market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Process Technology

- Product Form

- Thickness

- Nature

- End Use Industry

Key regional insights unveiling diverse growth patterns, preferential policies and market drivers across the Americas, EMEA and Asia Pacific markets

Regional markets for plastic films display a tapestry of growth drivers shaped by economic conditions, regulatory environments, and industry investments. In the Americas, North America’s robust consumption is fueled by expanding e-commerce and food-grade packaging demand, supported by sizeable capital commitments to state-of-the-art recycling and compounding facilities. Latin American markets are increasingly adopting flexible films in agriculture and consumer goods packaging, driven by evolving retail formats and government incentives for bio-based plastics.

Europe Middle East Africa (EMEA) is at the forefront of sustainability mandates, with stringent EU regulations on recycled content and single-use plastics catalyzing advanced circular-economy implementations. European converters lead in scalable mechanical and chemical recycling solutions, while the Middle East leverages abundant feedstock to invest in high-barrier film production for food service and industrial applications. Africa’s nascent film market is characterized by small-scale extrusion and growing demand for agricultural films and low-cost packaging in urbanizing economies.

Asia Pacific remains the fastest-growing region, propelled by escalating domestic consumption in China, India, and Southeast Asia, where urbanization, disposable income growth, and expanding cold-chain infrastructure drive demand for specialty packaging films. Government-led initiatives to reduce plastic pollution and boost recycling capacity further reinforce the region’s growth trajectory, as converters forge partnerships with global material suppliers to introduce high-performance and sustainable film solutions.

This comprehensive research report examines key regions that drive the evolution of the Plastic Films market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key company insights profiling leading innovators and strategic players shaping capacity expansions, sustainability initiatives and competitive strategies in the plastic films domain

Leading participants in the plastic films arena are executing strategic initiatives to fortify market positions through capacity expansions, sustainability commitments, and portfolio optimization. Dow Chemical has scaled up its post-consumer recycled polyethylene output at its Freeport, Texas facility, aligning production with evolving customer sustainability mandates and enhancing circularity credentials. LyondellBasell has pursued bolt-on acquisitions in Europe’s recycled content space, integrating chemical-recycling technology to diversify feedstock options and reduce virgin polymer dependence.

Berry Global, now combined with Amcor, has undertaken major capital investments in cast film lines in North America and Europe, while advancing its Impact 2025 strategy to incorporate higher recycled content and renewable feedstocks across its performance films portfolio. ExxonMobil and SABIC continue to invest in next-generation catalyst technologies and process optimizations to enhance resin properties and manufacturing efficiency, whereas regional specialists such as Mitsubishi Chemical and Toray Industries are leveraging proprietary barrier film innovations to serve growth in electronics and automotive segments. These strategic actions underscore an industry-wide pivot toward resource efficiency, regulatory alignment, and customer-focused solution development.

This comprehensive research report delivers an in-depth overview of the principal market players in the Plastic Films market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMCOR PLC

- BASF SE

- Berry Global Group Inc

- Constantia Flexibles

- Cosmo First Limited

- Exxon Mobil Corporation

- Futamura Chemical Co Ltd

- Huhtamaki Oyj

- Inteplast Group Corporation

- Jindal Poly Films Limited

- Klöckner Pentaplast Group

- LyondellBasell Industries Holdings BV

- Mitsui Chemicals Tohcello Inc

- Mondi plc

- Novolex Holdings LLC

- Oben Holding Group S.A.

- Printpack Holdings, Inc

- ProAmpac LLC

- SABIC Saudi Arabia Basic Industries Corporation

- Sealed Air Corporation

- Sigma Plastics Group

- SRF Limited

- Taghleef Industries LLC

- Toray Industries Inc

- Uflex Limited

Actionable recommendations guiding industry leaders to navigate market complexities through strategic investments, sustainable innovation, supply chain resilience and collaborative partnerships

Industry leaders should prioritize investments in advanced material solutions that strike a balance between performance and end-of-life considerations, emphasizing scalable recycling methods and bio-based feedstock integration. Simultaneously, diversifying raw material sources by establishing strategic partnerships across multiple regions will mitigate cost volatility and geopolitical risks. Manufacturers can enhance value propositions through modular manufacturing architectures that enable swift adaptation to emerging customer requirements and regulatory changes.

Embracing digitalization across the value chain-from predictive maintenance in extrusion operations to AI-driven supply chain optimization-will unlock productivity gains and improve responsiveness to market shifts. Collaboration with global standards bodies and participation in cross-industry sustainability consortia will facilitate harmonized design-for-recyclability guidelines, accelerating circular-economy adoption. Finally, strengthening customer engagement by co-developing customized solutions and offering integrated service models-such as on-site recycling logistics and performance testing-will reinforce competitive differentiation and foster long-term partnerships.

Transparent research methodology detailing rigorous primary interviews, comprehensive secondary analysis, quantitative data modeling and robust validation protocols

This research integrates a structured, multi-phase methodology combining extensive secondary research, primary insights, and quantitative modeling. The secondary phase entailed a comprehensive review of global trade databases, regulatory filings, patent literature, and corporate disclosures to map historical and current market dynamics. Primary inputs were gathered through in-depth interviews with key industry stakeholders, including film manufacturers, resin suppliers, converters, brand owners, and trade association representatives, ensuring a 360-degree perspective on trends and pain points.

Quantitative analysis employed demand-side modeling calibrated to end-use industry consumption metrics and trade flow statistics, supplemented by scenario planning to assess impacts of regulatory shifts and tariff regimes. Data triangulation techniques validated findings through cross-comparison of independent data sources and trend extrapolation. The methodology’s robustness is reinforced by iterative expert reviews and peer validation to ensure accuracy, objectivity, and relevance for decision-making audiences.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Plastic Films market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Plastic Films Market, by Material Type

- Plastic Films Market, by Process Technology

- Plastic Films Market, by Product Form

- Plastic Films Market, by Thickness

- Plastic Films Market, by Nature

- Plastic Films Market, by End Use Industry

- Plastic Films Market, by Region

- Plastic Films Market, by Group

- Plastic Films Market, by Country

- United States Plastic Films Market

- China Plastic Films Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Conclusion synthesizing critical findings, strategic implications and future pathways for stakeholders in the evolving global plastic films market

The global plastic films market is characterized by converging dynamics of technological advancement, sustainability imperatives, and regulatory complexities. Transformative shifts in material innovations-from bio-based polymers to advanced recycling loops-are reshaping competitive landscapes, while cumulative tariff impacts have prompted strategic realignments in sourcing and manufacturing footprints. Detailed segmentation and regional analyses reveal distinct pockets of opportunity, each requiring tailored solutions and go-to-market strategies.

Market leaders are responding with ambitious capacity expansions, M&A activity, and sustainability roadmaps that align with evolving customer expectations and policy frameworks. As the industry progresses toward a circular future, stakeholders that holistically integrate performance, environmental responsibility, and operational agility will capture disproportionate value. The insights herein offer a strategic compass for navigating this dynamic environment and unlocking pathways to growth, resilience, and competitive excellence.

Get direct access to the comprehensive plastic films market research report by contacting Ketan Rohom Associate Director Sales & Marketing

For tailored strategic insights, exclusive data access, and to secure the full plastic films market research report, reach out to Ketan Rohom, Associate Director Sales & Marketing, who will guide you through the next steps and provide personalized support to ensure your organization leverages this comprehensive analysis for competitive advantage.

- How big is the Plastic Films Market?

- What is the Plastic Films Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?