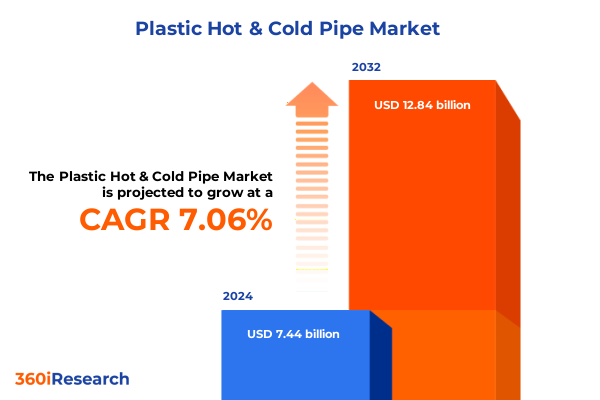

The Plastic Hot & Cold Pipe Market size was estimated at USD 7.89 billion in 2025 and expected to reach USD 8.38 billion in 2026, at a CAGR of 7.19% to reach USD 12.84 billion by 2032.

Setting the Stage for the Dynamic Plastic Hot & Cold Pipe Market by Highlighting Key Drivers, Opportunities, and Emerging Areas of Strategic Focus

In recent years, the plastic hot and cold pipe sector has emerged as a cornerstone of modern fluid conveyance, displacing traditional metallic systems in both domestic and industrial settings. Advances in material science and extrusion technology have enabled a diverse portfolio of products that combine flexibility, corrosion resistance, and simplified installation processes. This shift has been driven by stringent building codes, increasing demand for energy-efficient solutions, and the imperative to deliver reliable performance across a broad temperature range.

Furthermore, water conservation initiatives and evolving standards for potable and process water systems continue to propel the adoption of polymer-based piping. Residential renovation projects now favor lightweight, low-maintenance pipe materials, while large-scale infrastructure endeavors leverage plastic piping for district heating networks and municipal water distribution. At the same time, the agricultural segment is benefiting from targeted irrigation and greenhouse systems designed to optimize water usage and enhance crop yields.

Against this backdrop of accelerated innovation and expanding application scope, this executive summary presents a strategic overview of the plastic hot and cold pipe market. It delves into transformative shifts in technology, evaluates the implications of 2025 tariff adjustments, distills segmentation and regional insights, highlights leading industry participants, and provides actionable recommendations. By outlining the research methodology and concluding with a clear call to action, this summary offers a coherent roadmap for stakeholders seeking to align their strategies with the market’s dynamic evolution.

Navigating Unprecedented Transformations Reshaping the Plastic Hot & Cold Pipe Industry through Cutting-Edge Technology and Sustainability Drivers

The landscape of plastic hot and cold pipe systems is undergoing transformative shifts propelled by breakthroughs in material innovation and digitization. Cross linked polyethylene variants, including PEX-A, PEX-B, and PEX-C, are delivering enhanced thermal performance and long-term durability, prompting manufacturers to refine their resin formulations and extrusion techniques. Simultaneously, composite multilayer structures that integrate aluminum or adhesive barriers are gaining traction for applications that demand superior pressure stability and oxygen impermeability.

Moreover, the integration of smart technologies into piping networks is redefining operational standards. Sensor-equipped joints and leak-detection modules, enabled by the Internet of Things, are increasingly embedded at the factory level, allowing real-time monitoring of flow rates, temperature fluctuations, and potential system breaches. This convergence of polymer engineering and digital oversight not only supports predictive maintenance regimes but also aligns with industry commitments to water stewardship and resource optimization.

Environmental imperatives further reinforce these shifts, as stakeholders adopt closed-loop recycling processes and pursue life cycle assessments to quantify carbon footprints. Manufacturers are collaborating with resin suppliers to incorporate post-consumer and post-industrial recycled content without compromising performance certifications. These trends underscore a market trajectory that is as much defined by sustainability benchmarks as by technical performance, reshaping competitive dynamics and stakeholder expectations across the entire value chain.

Assessing the Far-Reaching Impact of 2025 United States Tariffs on Material Costs, Supply Chain Complexity, and Market Resilience for Plastic Hot & Cold Pipes

In 2025, the implementation of new United States tariffs on imported polymer resins and finished pipe assemblies marked a pivotal moment for industry economics and supply chain strategies. Designed to bolster domestic production, these measures extended beyond conventional polyethylene and polypropylene grades to include specialized chlorinated polyvinyl chloride compounds. Manufacturers reliant on global supply networks faced immediate cost recalibrations as import duties were applied at differentiated levels depending on material classification and country of origin.

As a result, industry participants responded by diversifying procurement channels, accelerating partnerships with regional resin producers, and reevaluating inventory management frameworks. Many firms pursued strategic nearshoring initiatives, establishing localized compounding or extrusion facilities to mitigate exposure to duty fluctuations. In parallel, negotiators within manufacturing consortia began advocating for duty relief on recycled-content resins to sustain circular economy objectives.

Downstream, wholesalers and installers experienced cascading effects on project budgets, prompting collaborative dialogues that balanced margin pressures with the imperative to maintain price competitiveness. The tariff environment also catalyzed innovation in alternative materials and reinforced the importance of robust contract structures. In essence, the 2025 tariff adjustments have acted as both a catalyst for supply chain resilience and a reminder of the interconnected nature of global polymer markets.

Unlocking Actionable Insights from Material, Application, Distribution Channel, Size Range, and Pressure Rating Segmentation to Drive Targeted Market Strategies

A thorough examination of market segmentation reveals nuanced dynamics across multiple dimensions. Material profiling encompasses established polymers such as unplasticized polyvinyl chloride and chlorinated polyvinyl chloride alongside advanced formulations like polyethylene of raised temperature resistance and polypropylene random copolymer. Within the realm of cross linked polyethylene, distinct performance tiers emerge through PEX-A, PEX-B, and PEX-C variants, each exhibiting unique crystallinity patterns and molecular crosslinking techniques that address thermal expansion and mechanical endurance in demanding environments.

Application-based differentiation highlights the breadth of usage scenarios informing product design and specification. In agriculture, precision-engineered pipelines support both greenhouse encapsulation systems and open-field irrigation networks optimized for water conservation. Commercial sectors capitalize on swift deployment options in new construction projects as well as adaptive retrofit solutions during renovation cycles. Industrial installations similarly span high-capacity new builds and strategic facility upgrades, while infrastructure projects encompass district heating loops and expansive potable water distribution corridors. Residential adoption trends pivot around builder-driven initiatives and homeowner-driven renovation projects, where simplicity of installation and regulatory compliance are paramount.

Distribution channels underscore the evolving routes to market, from direct sales models fostering bespoke partnerships to the convenience of online retail platforms, complemented by specialty distributors that offer technical support and by wholesale networks that ensure broad geographic coverage. Meanwhile, pipe dimensions range from sub-32-millimeter conduits tailored for compact systems to lines exceeding 110 millimeters for large-scale flow requirements, with intermediate bands addressing midrange demand clusters. Pressure rating classifications further refine product alignment by segmenting pipelines designed for up to 10-bar operations, high-pressure applications above 16-bar, and the intermediate zone between 10 and 16-bar ratings, directing stakeholders to solutions that match performance expectations.

This comprehensive research report categorizes the Plastic Hot & Cold Pipe market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Size Range

- Pressure Rating

- Application

- Distribution Channel

Revealing Distinct Regional Dynamics in the Plastic Hot & Cold Pipe Market across the Americas, Europe-Middle East & Africa, and Asia-Pacific Zones

Regional dynamics exert a profound influence on competitive positioning and investment decisions. Within the Americas, regulatory frameworks and municipal funding initiatives drive extensive renovation programs, particularly across mature water distribution networks in the United States and Canada. In parallel, Latin American agricultural expansion elevates demand for robust irrigation conduits and greenhouse systems engineered to withstand variable climatic conditions.

Across Europe, Middle East & Africa, a tapestry of directives governs pipeline selection, with stringent EU water efficiency regulations and ongoing investments in district heating infrastructure shaping preferences for multilayer and cross linked variants. In the Middle East, desalination-driven potable water projects generate specific requirements for corrosion-resistant plastic assemblies, while North African urbanization efforts underscore the need for cost-effective distribution networks.

In Asia-Pacific, rapid urban growth and industrialization spur demand for plastic piping in high-density residential complexes and large-scale commercial developments. Seasonal irrigation needs across Southeast Asia and Australia emphasize the value of polyethylene of raised temperature resistance for temperature-variable environments. Simultaneously, regional manufacturing hubs in China, South Korea, and India leverage economies of scale to supply both domestic and export markets, fueling a dynamic competitive landscape focused on material quality, logistical efficiency, and compliance with evolving sustainability mandates.

This comprehensive research report examines key regions that drive the evolution of the Plastic Hot & Cold Pipe market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Competitive Moves by Premier Plastic Hot & Cold Pipe Manufacturers Showcasing Innovation, Strategic Partnerships, and Quality Leadership

Leading manufacturers are actively differentiating through targeted product innovation and strategic collaborations. Some are expanding their cross linked polyethylene portfolios by integrating advanced peroxide and silane crosslinking methods to elevate thermal performance. Others are introducing novel chlorinated polyvinyl chloride blends with enhanced flow characteristics and reduced installation weight, directly addressing installer efficiency and regulatory demands for fire resistance.

Partnerships between resin suppliers and pipe fabricators are becoming increasingly common, enabling co-development of next-generation polymers that balance recycled content integration with consistent mechanical properties. In parallel, distribution alliances and joint ventures are facilitating new market entry across emerging regions, while select firms are acquiring specialty distribution platforms to secure direct access to large-scale infrastructure projects.

On the operational front, a growing number of companies are deploying digital twins and automated quality control systems to optimize production yields and reduce scrap rates. Concurrently, corporate sustainability agendas are translating into circular economy commitments, with pilot programs focused on reclaiming and reprocessing post-installation pipe streams. These combined efforts underscore a competitive landscape defined by innovation velocity, partnership networks, and an unwavering focus on long-term resource stewardship.

This comprehensive research report delivers an in-depth overview of the principal market players in the Plastic Hot & Cold Pipe market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Al Tamam Modern Plastic Factory

- Aliaxis Group SA

- Bogda Machinery Group

- Charlotte Pipe and Foundry

- Chevron Phillips Chemical Company LLC

- Clover Pipelines Pty Ltd.

- CRH PLC

- Elysee Irrigation Ltd.

- Genuit Group PLC

- Georg Fischer Ltd.

- Heap Wah Enterprise Sdn. Bhd.

- Iplex Pipelines Australia Pty Limited

- JM Eagle, Inc.

- Liang Chew Hardware Pte Ltd

- Mitsubishi Chemical Infratec Co.,Ltd. by Mitsubishi Chemical Group Corporation

- Modern Technology Factory For Plastic

- MrPEX Systems

- Ningbo Sunplast Pipe Co., Ltd.

- Popular Pipes Group of Companies

- Prince Pipes And Fittings Ltd.

- REHAU Vertriebs AG

- Reliance Industries Limited

- RIFENG Enterprise Group Co., Ltd.

- Sekisui Chemical Co., Ltd.

- Shamo Plast Industries LLC

- Sioux Chief Mfg. Co., Inc.

- Supreme Industries Limited

- Truflo by Somany Impresa Group

- Uponor Corporation

- Wavin B.V.

- Wienerberger AG

Recommendations for Leaders to Accelerate Sustainability, Strengthen Supply Chain Agility, Leverage Digital Advances, and Reduce Tariff-Induced Challenges

Industry leaders are advised to intensify investment in sustainable polymer formulations and recycled content programs, ensuring material innovations align with corporate net-zero objectives and evolving environmental regulations. By collaborating closely with resin producers to secure consistent supplies of post-consumer or post-industrial feedstock, organizations can mitigate raw material volatility and reinforce brand credibility among environmentally conscious end users.

Simultaneously, enhancing supply chain resilience through geographical diversification and digital logistics platforms can reduce exposure to tariff fluctuations and shipping disruptions. The integration of advanced analytics into inventory management and demand forecasting enables more accurate alignment of production schedules with regional consumption patterns, while the expansion of e-commerce and direct-to-installer channels can broaden market reach and foster customer loyalty.

Finally, engaging proactively with policymakers and industry consortia to shape future trade and standards frameworks will position organizations to anticipate regulatory shifts and advocate for material-neutral performance standards. Establishing cross-functional innovation teams that bring together R&D, commercial, and sustainability experts will accelerate time to market for differentiated piping solutions and solidify long-term competitive advantage.

Comprehensive Research Methodology Including Expert Interviews, Systematic Secondary Data Evaluation, and Data Triangulation for Robust Market Understanding

This research synthesis is grounded in a comprehensive methodology that integrates insights from primary and secondary sources. Expert interviews were conducted with executives across the value chain, including polymer compounders, extrusion specialists, system integrators, distributors, and end users in key end-use segments. These qualitative discussions furnished detailed perspectives on technological developments, regulatory impacts, and customer requirement shifts.

Complementing primary findings, secondary research drew upon publicly available technical standards, government publications on infrastructure and agricultural policy, industry association reports, and peer-reviewed journals focusing on polymer chemistry and fluid transport engineering. Company press releases, patent filings, and annual reports were systematically reviewed to track competitive strategies, product launches, and sustainability initiatives.

Data triangulation was employed to reconcile discrepancies between divergent sources and to validate core observations. Iterative workshop sessions with subject matter experts ensured rigorous testing of hypotheses and refined the interpretation of market trends. The resultant framework supports robust strategic decision-making by balancing qualitative depth with methodological transparency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Plastic Hot & Cold Pipe market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Plastic Hot & Cold Pipe Market, by Material Type

- Plastic Hot & Cold Pipe Market, by Size Range

- Plastic Hot & Cold Pipe Market, by Pressure Rating

- Plastic Hot & Cold Pipe Market, by Application

- Plastic Hot & Cold Pipe Market, by Distribution Channel

- Plastic Hot & Cold Pipe Market, by Region

- Plastic Hot & Cold Pipe Market, by Group

- Plastic Hot & Cold Pipe Market, by Country

- United States Plastic Hot & Cold Pipe Market

- China Plastic Hot & Cold Pipe Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding with Emphasis on Core Market Drivers, Emerging Opportunities, and Strategic Imperatives Shaping the Future of Plastic Hot & Cold Piping Solutions

In closing, the plastic hot and cold pipe sector stands at the confluence of material innovation, regulatory evolution, and digital transformation. Core drivers-ranging from water efficiency mandates and building code enforcement to environmental sustainability commitments-continue to reframe design priorities and competitive strategies across the value chain. Stakeholders who recognize these forces and adapt through targeted investments will be best positioned to influence emerging standards and capture growth opportunities.

The interplay of segmentation and regional factors further underscores the necessity of a granular approach to market engagement. By aligning material selection and product features with specific application requirements, distribution preferences, dimensional classifications, and pressure demands, organizations can achieve more precise value propositions. Likewise, tailoring strategies to regional imperatives-from the Americas’ renovation-driven dynamics to EMEA infrastructure modernization and Asia-Pacific’s urbanization surge-will be essential.

Ultimately, success will hinge on the integration of sustainable material practices, agile supply chain orchestration, and digital capabilities that elevate system intelligence. Through collaborative frameworks and proactive policy engagement, industry leaders can not only navigate current challenges but also shape the trajectory of plastic piping solutions for decades to come.

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to Access the Plastic Hot & Cold Pipe Market Report and Secure a Strategic Edge Today

Access to an in-depth market research report offers unparalleled visibility into the evolving dynamics of hot and cold plastic piping, equipping decision-makers with the actionable intelligence needed to navigate emerging trends and regulatory landscapes. Engineered for clarity and strategic relevance, this report compiles comprehensive analysis of transformative material innovations, application-specific growth drivers, distribution channel developments, regional market nuances, and competitive landscape shifts. It serves as a critical tool for executives, product strategists, and procurement leaders seeking to enhance operational agility and reinforce competitive positioning.

To obtain your copy of this essential resource and discover tailored insights for your organization, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His expertise in aligning research deliverables with strategic business objectives will ensure you gain immediate access to the comprehensive findings and recommendations presented in this report. Connect with him today to secure your strategic advantage in the plastic hot and cold pipe market.

- How big is the Plastic Hot & Cold Pipe Market?

- What is the Plastic Hot & Cold Pipe Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?