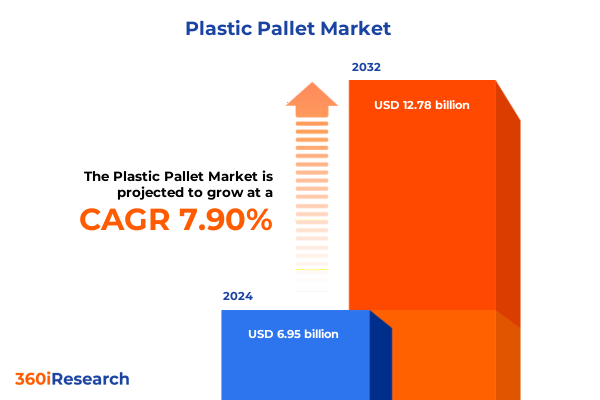

The Plastic Pallet Market size was estimated at USD 7.46 billion in 2025 and expected to reach USD 8.02 billion in 2026, at a CAGR of 7.99% to reach USD 12.78 billion by 2032.

Revolutionizing Supply Chains and Embracing Sustainability to Meet Evolving Demands and Uncertainties in the Plastic Pallet Market

Plastic pallets have emerged as a critical enabler of modern logistics operations serving as the backbone of increasingly complex supply chain networks. The rise of omnichannel retailing and rapid growth in online commerce have significantly elevated the demand for reliable material handling solutions capable of supporting high throughput and frequent turnover. As e-commerce giants set new standards for order fulfillment accuracy and speed warehouse operators are under intensified pressure to adopt pallets that offer both durability and consistency in performance. According to recent industry observations the exponential expansion of online retail has propelled investments in efficient reusable pallet systems that streamline goods movement and minimize product damage enhancing overall supply chain resilience

Navigating Market Disruption Through Digital Transformation Advanced Automation and Circular Economy Models in the Plastic Pallet Industry

In response to mounting cost and regulatory pressures plastic pallet manufacturers and users are charting a strategic course that blends digital transformation with circular economy principles. Automation and robotics integration is enabling advanced warehouses to achieve higher throughput and accuracy with artificial intelligence-driven systems assuming tasks from picking to sorting in real time. For example leading fulfillment centers are deploying autonomous mobile robots to complement human workers boosting throughput per associate by more than 1 000 percent in certain operations. At the same time sustainability initiatives are accelerating design innovations that facilitate full-life recycling and multiple reuse cycles which in turn support corporate environmental commitments and reduce end-of-life disposal costs. Transitioning from linear take-make-dispose models toward closed-loop solutions is no longer optional but a strategic imperative for capturing market share and meeting evolving regulatory standards.

Comprehensive Assessment of the Far-Reaching Consequences of New US Tariffs on Plastic Pallets and Upstream Resin Supply Chains

The introduction of sweeping tariffs on imported goods in early 2025 has created a new operating environment for plastic pallet stakeholders with implications spanning raw material sourcing to finished goods procurement. In March the baseline tariff on all imports rose to 20 percent for categories including plastic goods with base HTS rates of five to seven point five percent pushing total duty levels into the 50 percent range for certain resin products. Meanwhile the administration’s Section 301 actions have imposed surcharges of up to 54 percent on plastic pallets from China and upwards of 46 percent on resin exports from Vietnam elevating landed costs for in-bound pallet shipments by nearly half. These developments have prompted buyers to reassess sourcing strategies pivoting toward domestically produced solutions even as raw material prices swirl amid the reconfiguration of global resin trade flows.

Uncovering Differentiated Insights Across Product Types Materials Capacities Sizes End Users Applications and Sales Channels

A nuanced understanding of market segments is critical for aligning product development and go-to-market approaches with specific customer requirements. Based on product type demand patterns vary markedly among custom engineered pallets designed to specialized dimensions accommodating unique payloads nestable units that offer space-saving storage in off-peak periods rackable options built for automated racking systems and stackable designs prized for straightforward manual handling. In parallel material type segmentation highlights how high-density polyethylene affords lightweight durability metal composites deliver enhanced load distribution polypropylene strikes a balance between cost and performance and polyvinyl chloride presents an alternative for chemically aggressive environments. Load capacity classification differentiates heavy duty platforms engineered for industrial loads medium duty versions suited to general warehousing and light duty systems optimized for retail and distribution tasks. Size distinctions among custom dimensions Euro (1200×800 mm) and standard 48×40 inch footprints furnish compatibility with global shipping and storage guidelines. End user segmentation identifies bespoke needs within automotive supply chains covering parts manufacturers and vehicle assemblers food and beverage operations spanning beverage producers dairy processors and frozen food packagers healthcare and pharmaceutical establishments including hospitals medical device firms and pharmaceutical companies and retail and logistics networks encompassing distribution centers and retail outlets. Application categories from export compliant solutions to static storage and dynamic transportation each carry distinct performance criteria while sales channel segmentation considers the nuances of direct manufacturer relationships distribution partnerships and the growing influence of digital marketplaces on purchasing behaviors.

This comprehensive research report categorizes the Plastic Pallet market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Load Capacity

- Size

- End User

- Application

- Sales Channel

Evaluating Regional Variations in Demand Policy Drivers and Manufacturing Strengths Across the Americas EMEA and Asia-Pacific

Market dynamics display pronounced regional divergence driven by differences in manufacturing capacity regulatory environments consumer behavior and distribution infrastructure. In the Americas the trend toward reshoring and nearshoring is underpinning investments in domestic pallet production with local recyclers expanding capacity to meet demand. Government incentives and infrastructure spending are reinforcing the United States and Canada as hubs for high-volume facilities while e-commerce growth in Latin America accelerates the shift toward reusable plastic platforms. Within Europe Middle East and Africa stringent sustainability mandates the EU’s Circular Economy Action Plan and ISPM-15 phytosanitary requirements are intensifying adoption of durable non-wood pallets and bolstering the emergence of multi-country pooling models. In parallel ongoing geopolitical considerations around supply chain security are driving localized sourcing strategies across the region. Across Asia-Pacific rising manufacturing output in Southeast Asia and India is creating a robust domestic pallet market while Australia and New Zealand emphasize food safety hygiene and export compliance driving demand for wash-down and chemical-resistant pallets. At the same time rapid expansion of e-commerce platforms in China Japan and South Korea is fueling investments in automated distribution centers where plastic pallets are preferred for their consistency and compatibility with robotics systems.

This comprehensive research report examines key regions that drive the evolution of the Plastic Pallet market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Detailing the Comprehensive Robust Research Framework Methodologies and Validation Techniques Underpinning This Market Analysis

Leading participants in the plastic pallet arena are executing diverse strategies to strengthen market positions through vertical integration digitalization and strategic collaborations. Global pooling specialists reported resurgence in domestic order volumes as import cost inflation spurred customers to reconsider long-term rental and exchange models. Major pallet rental operators and asset management firms have accelerated digitization initiatives incorporating RFID and blockchain-based tracking to enhance asset visibility and utilization metrics. Several manufacturers have announced joint ventures with chemical producers to secure upstream resin supplies while others established partnerships with recycling and remanufacturing entities to close the material loop. Recent financial disclosures from major global players indicate reinvestment of operating cash flows into automation of production lines and expansion of repair and recycling facilities to improve throughput and reduce unit costs. The convergence of these initiatives points to a strategic pivot toward fully integrated circular business models poised to deliver differentiated value propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Plastic Pallet market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allied Plastics Inc.

- Baroda Polyform Pvt. Ltd.

- Brambles Limited

- Cabka Group GmbH

- Cherry's Industrial Equipment Corp

- CRAEMER Holding GmbH

- Decade Products, LLC

- DIC Corporation

- Ergen Plastic Industries

- Inka Palet, SL

- Litco International, Inc.

- Loscam International Holdings Co., Limited

- Menasha Corporation

- Millwood, Inc.

- Monoflo International, Inc.

- Niagara Pallet

- Ongweoweh Corp.

- Perfect Pallets Inc.

- Premier Handling Solutions

- PURUS PLASTICS GmbH

- Rehrig Pacific Company

- Robinson Industries, Inc.

- Sangam Plastic Industries Private Limited

- Schoeller Packaging B.V.

- See Hau Global Sdn. Bhd.

- Snyder Industries, Inc.

- The Nelson Company

- The Supreme Industries Limited

- TMF Corporation

- Tosca Services, LLC

- TranPak Inc.

Implementing Actionable Operational Strategies to Drive Resilience Agility and Sustainable Growth in Plastic Pallet Operations

In light of the current volatility and transformative shifts industry leaders are encouraged to adopt a multi-pronged approach that balances operational resilience cost control and sustainability objectives. Strengthening domestic manufacturing capabilities through targeted investments in automated injection molding and thermoforming lines can mitigate exposure to tariff fluctuations and supply chain disruptions. Parallel strategies focused on developing standardized recycling streams and leveraging advanced materials identification technologies will enable closed-loop reuse and reduce costs associated with virgin resin procurement. Embracing digital asset management platforms will optimize pallet fleet utilization drive down inventory losses and provide real-time insights to support agile decision-making. Additionally establishing cross-sector partnerships spanning chemical suppliers logistics service providers and end users can unlock collaborative innovation in materials technology and service delivery. Finally continuous monitoring of trade policies and participation in industry advocacy efforts will help shape favorable regulatory outcomes and ensure proactive adaptation to evolving tariff regimes.

Detailing the Comprehensive Robust Research Framework Methodologies and Validation Techniques Underpinning This Market Analysis

This analysis draws upon a comprehensive research framework combining in-depth secondary research primary interviews and rigorous validation processes. Secondary sources included industry association reports government trade publications customs data and peer-reviewed journals to establish an empirical foundation for market dynamics and policy impacts. Primary research comprised structured interviews with senior executives procurement specialists and supply chain managers across multiple regions and end-use sectors to capture on-the-ground perspectives and emerging use-case scenarios. Quantitative data was triangulated through cross-referencing customs export figures resin pricing indices and import tariff schedules to ensure consistency and accuracy. A series of expert panel workshops provided additional vetting of assumptions and surfaced alternative viewpoints on key trends and potential disruptions. Scenario analysis was employed to model the impact of variable tariff rates supply chain shocks and technology adoption trajectories ensuring the robustness of strategic implications.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Plastic Pallet market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Plastic Pallet Market, by Product Type

- Plastic Pallet Market, by Material Type

- Plastic Pallet Market, by Load Capacity

- Plastic Pallet Market, by Size

- Plastic Pallet Market, by End User

- Plastic Pallet Market, by Application

- Plastic Pallet Market, by Sales Channel

- Plastic Pallet Market, by Region

- Plastic Pallet Market, by Group

- Plastic Pallet Market, by Country

- United States Plastic Pallet Market

- China Plastic Pallet Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Summarizing Key Market Dynamics Imperatives and Opportunities for Stakeholders in the Plastic Pallet Landscape

The plastic pallet market stands at a pivotal juncture characterized by convergence of cost pressures shifting trade policies technological advancement and heightened sustainability expectations. Stakeholders that effectively harness digital tools streamline asset management and integrate circular practices will be best positioned to capitalize on the expanding need for efficient reusable material handling solutions. At the same time vigilance around evolving tariff regimes and proactive supply chain diversification will be essential to maintain competitiveness and manage risk. For manufacturers and end users alike the path forward lies in balancing near-term operational resilience with long-term strategic investments that align with global decarbonization and resource-efficiency imperatives. By staying attuned to regional nuances leveraging partnerships and deploying innovative materials and business models industry participants can transform challenges into sustainable growth opportunities.

Connect with Our Sales Team to Secure the Comprehensive Plastic Pallet Market Research Report from Associate Director Ketan Rohom

To explore the full depth of trends opportunities and risk mitigation frameworks in this rapidly evolving industry reach out to Ketan Rohom Associate Director Sales & Marketing to secure your copy of the comprehensive plastic pallet market research report today

- How big is the Plastic Pallet Market?

- What is the Plastic Pallet Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?